Media Update: TV Subscription Loss, TikTok Bill Awaiting Senate Action, YouTube CTV Enhancements

Sports viewership spiked YoY over last week as NCAA basketball rolled into Selection Sunday for the men’s and women’s tournaments, while news viewership remained elevated as election season heats up.

1. We’ve got another cord cutting update for you, and you can probably guess the punchline – the major pay-TV providers lost ~5m subscribers in 2023, an acceleration from the 4.6m net loss in 2022. Astute readers will note that the 2023 subscribers losses are not only larger in absolute terms; since they’re coming off a small base, the relative loss is even larger. 2022 saw the total subscriber base shrink by about 6%, and in 2023 that figure rose to 7.1%. In other words, even as the base continues to shrink, the rate of contraction is accelerating.

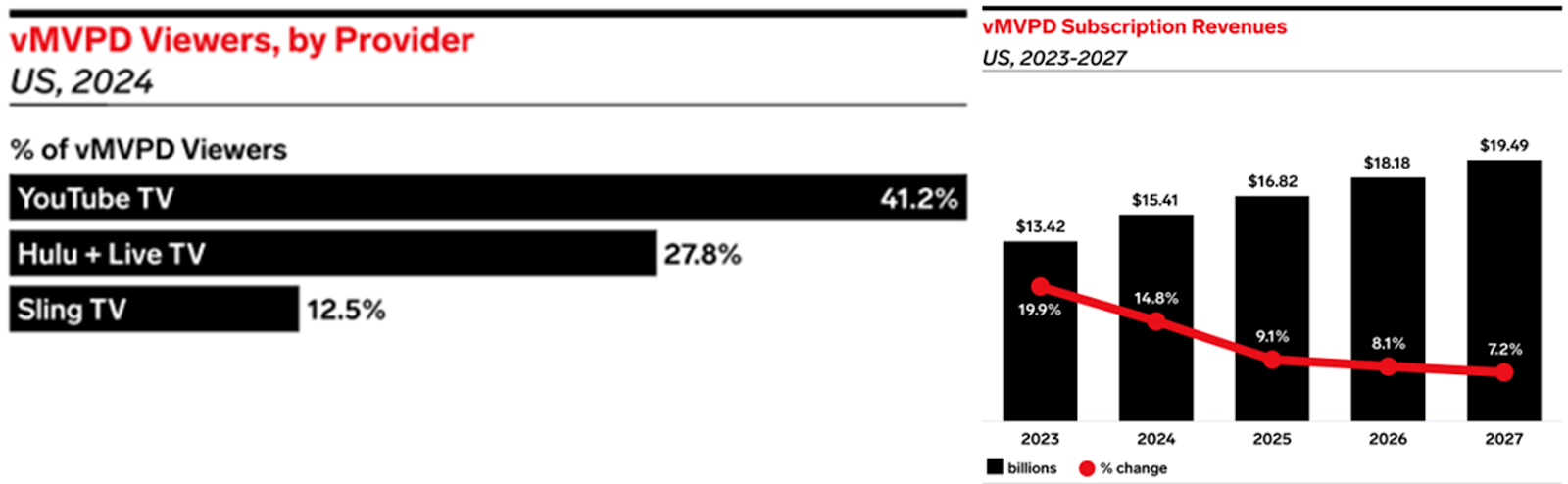

These figures would be even worse were it not for the rising popularity of the vMVPD’s (see story below), especially YouTube TV. YouTube’s cable offering attracted 1.9m net new subscribers last year, far outpacing all other platforms. In fact, the total vMVPD category grew by slightly less than YouTube alone, as Sling TV shed almost 300k subs. If one strips out the vMVPD’s, the remaining pay-TV providers shrunk by 12.5% last year.

It is this dramatic and accelerating decline of traditional pay-TV that is forcing more extreme measures from legacy media companies, from the launch of a sports super-app to taking ESPN fully DTC, accepting the cannibalization of its one-time cash cow. | Leichtman Research

2. Apart from sports, awards shows are another area where linear TV maintains a meaningful foothold, and Hollywood’s Biggest Night got a bit bigger this year. Oscars viewership rose by ~1M viewers YoY to 19.5M, powered by the “Barbenheimer” cultural phenomenon and steady hosting from veteran Jimmy Kimmel. But while ABC can be pleased with the night’s performance, signals point in streaming’s favor – and not just with respect to winning awards. The SAG awards, a precursor to the Oscars, streamed on Netflix this year. Moreover, ABC’s night was a success only in relative terms – viewership trailed 2020’s pre-COVID broadcast (23.6M) and was just a fraction of the show’s former glory, when the Oscars drew over 40M viewers just a decade ago. With viewership on the decline and streamers primed to pick up the pieces, the future remains cloudy for linear’s hold on premier live events. | NYT, USA Today

3. With linear on the decline and streaming in the ascent, a middle space continues to gain relevance – Virtual Multichannel Video Programming Distributors (vMVPD). This unwieldy acronym refers to services that allow viewers to stream TV content for a subscription fee and includes providers such as YouTube TV, Hulu + Live TV, and Sling. vMVPD services are growing in usage, especially as they offer new ways to access live sports without need for a traditional cable package.

vMVPDs are putting effort into maintaining and accelerating that growth: YouTube is prioritizing a more interactive viewer experience for its TV app, including for YouTube TV, where it will be unveiling views that help subscribers stay abreast of other games’ scores while watching live sports. While the rise of vMVPD won’t kill linear on its own, its combined effect with streaming’s growing presence in live events looks likely to accelerate linear’s decline. | InsiderIntelligence, InsiderIntelligence

ESPN, Fox, and WBD are bringing in a heavy-hitter to take the managerial reins of their new sports streaming offering. The trio has hired Pete Distad as the JV’s new CEO; Distad is an ex-Apple executive who has spent the past decade leading business, operations, and global distribution for video, sports, and AppleTV+. He previously worked in senior leadership at Hulu. By bringing in a face with proven success in sports streaming – Distad led Apple’s $2.5B agreement with Major League Soccer in 2022 – the three networks are signaling commitment to the new JV and preparing a competitive campaign in one of the few remaining areas where traditional linear TV holds sway. | AdwWeek, WSJ

1. The big news of last week was the US government voting on a bill to ban TikTok. While the headlines are attention grabbing, the bill is not outwardly designed to ban TikTok. Instead, the bill is designed to force ByteDance, TikTok’s Chinese parent company, to divest its stake in TikTok over concerns that the Chinese government could have influence on TikTok’s US app. The bill passed in the House on March 13th and is now awaiting a vote in the Senate.

While a Senate vote has not yet been scheduled, numerous senators have said they plan to “pump the brakes” and will potentially require amendments on the existing bill before voting. Even once the bill passes, it would be a minimum of 6 months before any changes to the platform or its status take effect, so there is no short-term concern for advertisers at this time.

While a ban is unlikely, a forced sale is plausible. In this case, TikTok would continue operating and any long-term impacts would be contingent on who ultimately purchases the platform. We’re continuing to closely monitor the situation, and we recommend brands continue with business as usual until an official decision has been made, either by the government or by TikTok. | Adweek

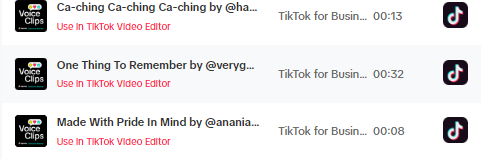

2. TikTok announced this week that Influencer Audio Clips are now part of its commercial sounds library. Sound is a core element of TikTok – 88% of users feel sound plays a critical part in their enjoyment of the app, and 73% say that sound makes them stop and examine video content more closely. Many musicians and content creators have been discovered through their sounds or audio going viral on the app.

For brands wanting to jump on trending audio, this has historically presented a challenge in securing usage rights. TikTok’s rollout of pre-licensed Influencer Audio Clips will hopefully lower this barrier and allow advertisers to more easily tap into trends by partnering with recognizable creator voices in the brand’s organic and paid content on the platform.

Right out of the gate, there are 18 voice clips from six different popular creators available for use. All of the clips are pre-recorded, which may limit an advertiser’s ability to use it in a cohesive way, but more clips and creators will likely hit the platform if the program is successful. For any brands wondering how to utilize the current audio clips, take a listen, and see if your product or content style aligns with any of the voiceovers. And if one of the creators has a viral video, this creates another good opportunity to leverage a recognizable voice in your content. | SocialMediaToday

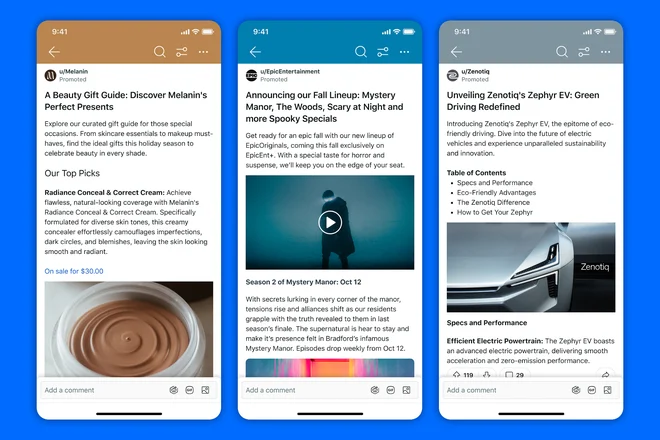

3. Reddit is expanding its ad unit catalog to include more native-looking ad content and allow brands to more easily lean into traditional Reddit syntax. Historically, advertisers who are not intimately familiar with “speaking Reddit” have had to lean on Reddit’s KarmaLabs creative team for support with copywriting and developing creative that feels authentic and native to the platform. The rollout of this new ad unit will allow advertisers to engage with the platform in much the same way users do. This includes the ability to combine multiple media types, suh as image, video, and text.

Previously, this was limited to one media format per ad. The idea is that ads, or Sponsored Posts as Reddit calls them on the platform, will become a one-stop-shop for users who are looking to engage with brands and learn more about their product(s). With a user base that comes to the platform in a discover-first mindset, and heavily seeks peer feedback and recommendations, this could be a powerful capability for advertisers to be able to tap into. Early results are showing the free-form ads driving a 28% stronger CTR and more engagements compared to other ad types. | AdWeek, MediaPost

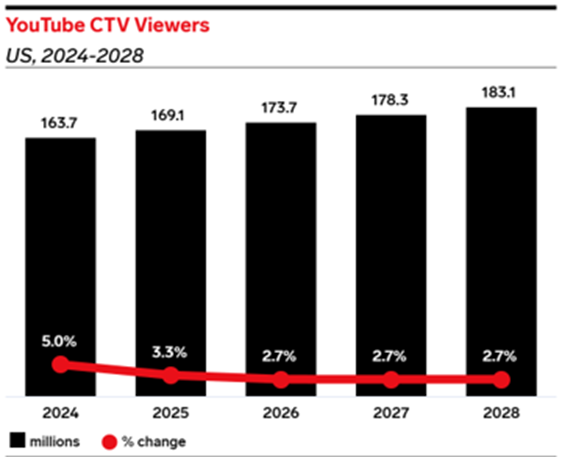

1. YouTube viewership continues to rise on the largest screen in the house with over 1 billion hours per day watched globally on the TV screen. In the U.S. alone, an estimated 164M viewers (+5% YoY) are turning to their TV screens to watch their favorite YouTube content. As viewership continues to grow, the YouTube team has set out to develop an experience that is “uniquely YouTube and that gives viewers the opportunity to engage with the content they’re watching, even on the big screen.”

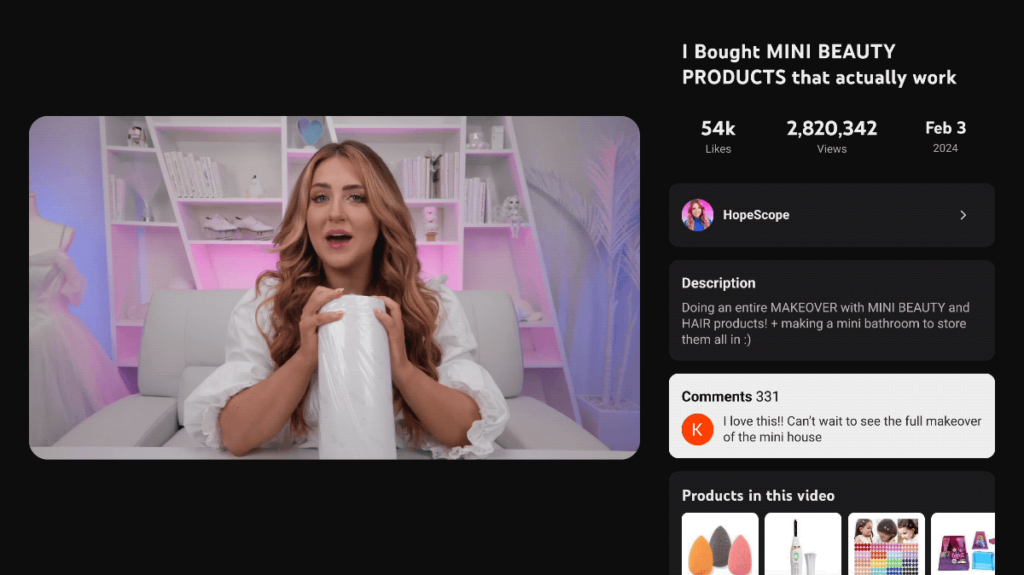

Within the new experience, the main video will remain front-and-center, but will be smaller, allowing viewers to easily read through video descriptions and comments while also engaging with other features such as chapters, key plays and most notably, shopping.

While T-Commerce is not new and streaming services have rolled out advertising products in an effort to link the TV screen engagement to purchases, the YouTube shopping feature is something we are keeping a close eye on particularly due to the influence YouTube creators have on the consumer journey. | YouTube Blog, Medium

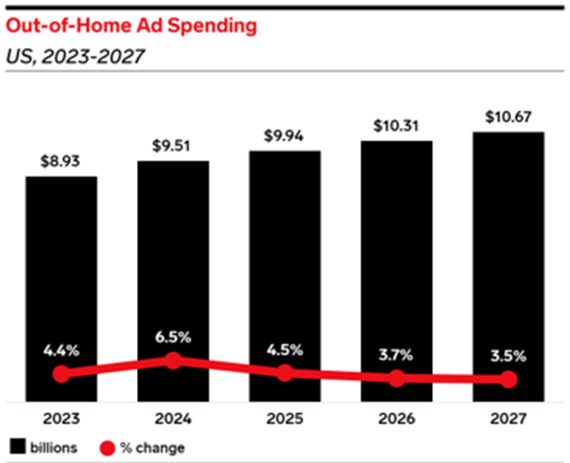

2. Out-of-Home (OOH) advertising continues its resurgence, accounting for ~$9B in total advertiser spend in 2023, surpassing pre-pandemic levels. This trend is expected to continue, with eMarketer estimating OOH spend will exceed $10B by 2026. And while traditional static ad units still reign supreme, making up 68% of the OOH investment, the future of OOH is quickly becoming digital.

Digital Out-of-Home (DOOH) investment rose 10% in 2023, due in part to the growing number of digital units available and the flexibility in buying digitally. Programmatic buying will be the next driving force of DOOH growth as more inventory owners enable their screens for programmatic buying. Just this week, the New York MTA announced they have enabled 3,800 screens across their network for purchase via the programmatic open auction. Leaning into Programmatic DOOH can be advantageous for certain advertisers as it provides easy access to large, high-impact formats that drive brand results. The ease of activating on the days and in locations that matter most without long-term commitments, coupled with the targeting capabilities found in traditional programmatic display campaigns, such as mobile retargeting to DOOH viewers, provides brands an opportunity to engage with consumers beyond their usual screens. | eMarketer, PR Newswire, AdExchanger

1. Fair warning – this is a pretty deep-in-the-weeds ad tech piece, so feel free to move on if your eyes glaze over at the thought. But it does have meaningful implications for the programmatic web as cookie loss accelerates, so we’ll do our best to unpack it for you.

The issue is a conflict between buy-side (DSPs) and sell-side (SSPs and publishers) over allegedly deceptive practices related to user identity in OpenRTB environments in recent IAB Tech Lab conversations. Let’s start with unpacking just that sentence:

The underlying cause here is signal loss – Safari and Firefox have of course been cookieless for several years now, and in January Chrome deprecated cookies on 1% of its browser traffic in preparation for full deprecation later this year. The issue for publishers is that cookieless traffic monetizes far worse than cookied traffic, with common benchmarks at about 30 cents to the dollar. This has placed a lot of pressure on publishers, and it is alleged that starting in February some publishers and SSPs have been engaging in deceptive practices – some calling it outright ad fraud – to mitigate the signal loss.

These allegedly deceptive practices revolve around presenting probabilistic or transitory identifiers as deterministic, reasonably persistent identifiers in the bid stream. One example of this is the practice of ID bridging, wherein a supplier will attempt to infer a cookieless user’s identity based on having observed their IP address in a cookied environment. Privacy concerns aside, this wouldn’t be so bad if it were reliable; but buyers have looked into this by comparing the cookie ID presented in the bid request with the ID attached to the resulting ad, and match rates have been as low as 36%. In such cases, buyers are truly not getting what they’re paying for, which is why some feel this constitutes outright ad fraud.

The consequences for advertisers include frequency mismanagement, shoddy ad targeting, and compromised measurement. In other words, it’s serious. The good news is (i) buyers are on to the issue, and won’t continue directing demand to suppliers engaging in such practices, which reduces the incentive to engage in such practices; and (ii) there are perfectly good ways to represent probabilistic identifiers in the oRTB spec, so publishers can continue to use them, they just need to be more clearly positioned as what they really are. Expect more drama along these lines as 3PCD lurches forward. | Adweek, Marketecture

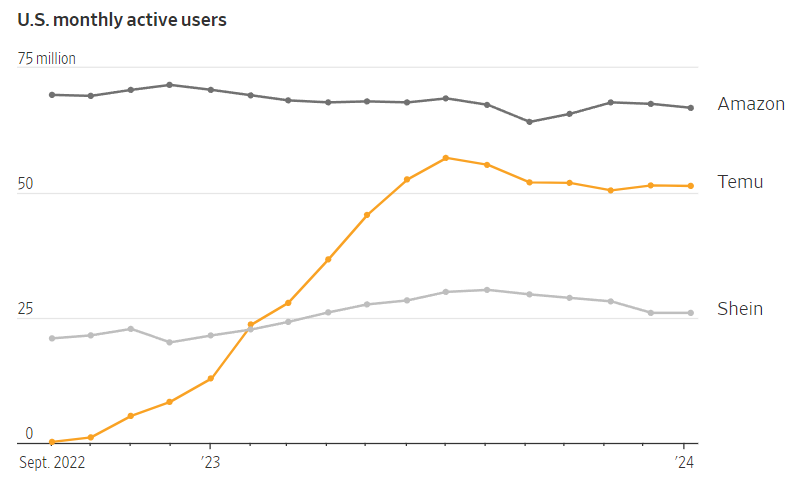

2. Back in December we discussed the sizable impact of Temu and Shein, two upstart e-commerce giants based in China, on Black Friday/Cyber Monday sales and ad spend totals. Since then, Temu in particular has continued its aggressive ad investment, notably with five Super Bowl spots at a cool $7m per. Now it’s emerged that Temu was Meta Platforms’ top advertiser by revenue in 2023, with almost $2b in total investment; Temu also became a top-five advertiser for Google.

This level of investment is reordering significant parts of American e-commerce and advertising (reminder: all Meta and Google properties are banned in China, so Chinese companies’ spending on these platforms is overwhelmingly about reaching American consumers). Meta’s China revenue doubled last year to over $13b, which is remarkable considering it is banned in the country. On the shipping side of the industry, Temu and Shein account for 70% of the 10,000 tons of goods shipped by air each day from China, contributing to an overall uptick in shipping & logistics industry forecasts. And in e-commerce, Amazon has serious competition on its hands:

For vendors who are seeing upside from such aggressive investment, there is a sense that the good times may not last. Goldman Sachs estimated that Temu’s marketing spending contributed to an average loss of $7 an order in 2023. There are echoes of Wish, another e-commerce merchant with a similar business model, which was once valued at $14b and spent billions on advertising at its peak but was recently sold for $173m. A similar outcome for Temu or Shein certainly would not devastate the ad businesses of Meta or Google given their size and diversification, but a significant pullback from either or both would have meaningful ramifications for other participants (i.e. growth marketers) in the major digital ad auctions. | WSJ

Update: As American politicians and regulators are putting extreme pressure on TikTok, Temu is taking note of the political risk and aiming to lessen its reliance on American shoppers. The U.S. accounted for 60% of its total sales last year, but the company is now hoping to reduce that percentage to as low as 30% by next year. To the extent this implies moderation of spending on marketing, it could ease some of the pressure other brands have come under in trying to compete with Temu in digital ad auctions. | The Information

1. The Labor Department released its latest jobs report earlier this month, and it’s been received as “the definition of a soft landing.” U.S. businesses added 275k jobs in February, up from 229k in January; however, that January figure is a substantial downward revision to the original estimate for the month of 353k, which had sparked fears of labor market overheating.

The unemployment rate did tick up to 3.9% in February, up slightly from prior months but still extraordinarily low by historical standards. This rise in unemployment appears to be due in part to new people entering the labor force and failing to find work immediately.

Perhaps the most notable data point from February’s numbers was wage growth, which came in at 0.1% MoM, a significant slowdown from January’s 0.5%. Many analysts focus on wage growth as an indicator of underlying inflation, and have taken the February data point as a positive sign that overall inflation will continue to moderate.

A contrasting signal came from the Labor Department’s latest inflation data, which showed inflation coming in slightly higher than expected at 3.2% YoY in February.

The jobs report is the last before the Fed’s March 19-20 meetings, where changes to interest rate policy are decided. Interest rate futures markets currently imply a probability of about 50% for an interest rate cut in March. | WSJ, Bloomberg, WSJ

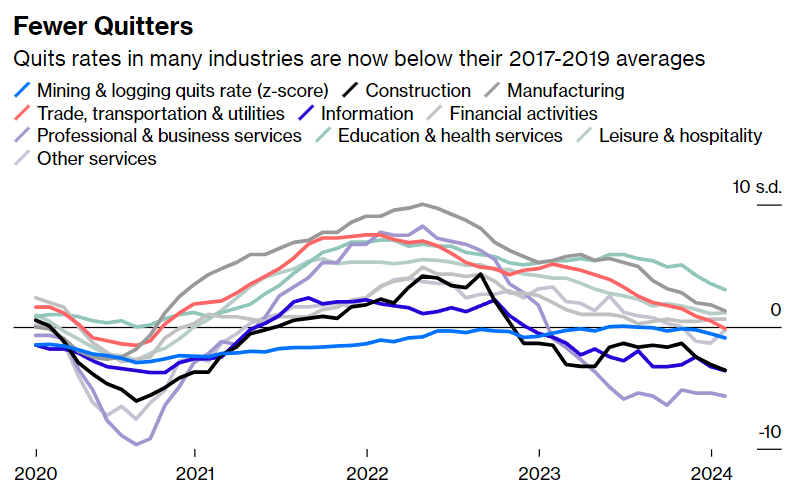

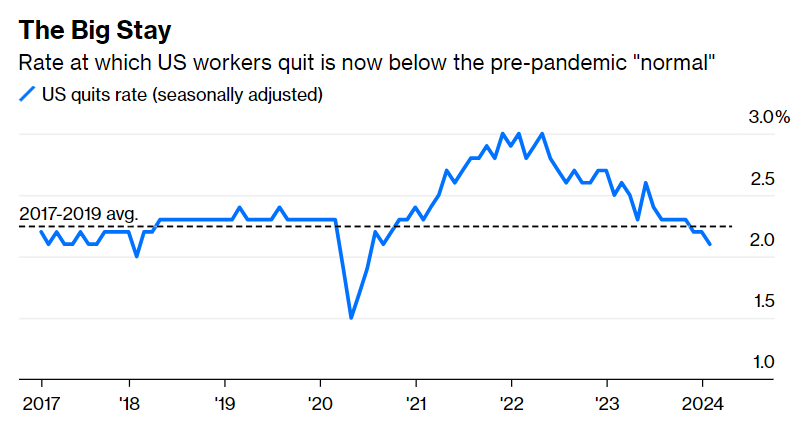

2. Sticking with the labor market, new data from the BLS paints a picture of the Great Resignation having fully abated, with monthly quit rates now below their pre-pandemic baselines. The January figure was 2.1% of workers having voluntarily left their jobs in the month, a continuation of a concerted downward trend since a peak in April of 2022.

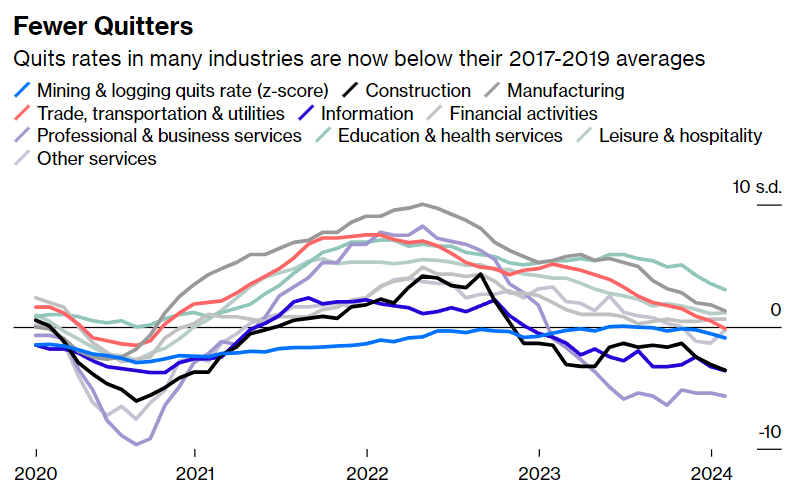

What is particularly interesting is how this is playing out across industries. While virtually all industries show the same general pattern, it is particularly pronounced in white-collar industries, represented below by the Professional & business services’ series.

There are multiple valid interpretations of these data. The glass-half-full story is that, after record inflation caused disequilibrium in the labor market, inducing many businesses and workers to reshuffle employment arrangements, most workers are now seeing the wage growth they want at their current jobs and have fewer reasons to shop around. The glass-half-empty story is that the labor market is not actually as strong as it appears on the surface, that workers grasp this on some level, and they’re clinging to their current roles for fear of being unable to find another.

While the truth is probably somewhere in between, achievement of a macroeconomic ‘soft landing’ this year would be unambiguously positive for businesses and workers alike. | Bloomberg