Amazon is well-known for featuring some of the lowest price points across every product category, making the Marketplace a huge draw for online shoppers.

After all, low prices are the number one factor influencing purchase decisions for a majority of shoppers (over 41%) on the Marketplace.

But what do hyper-competitive pricing and the proliferation of gray market products mean for luxury brands that want to sell high-priced items on Amazon?

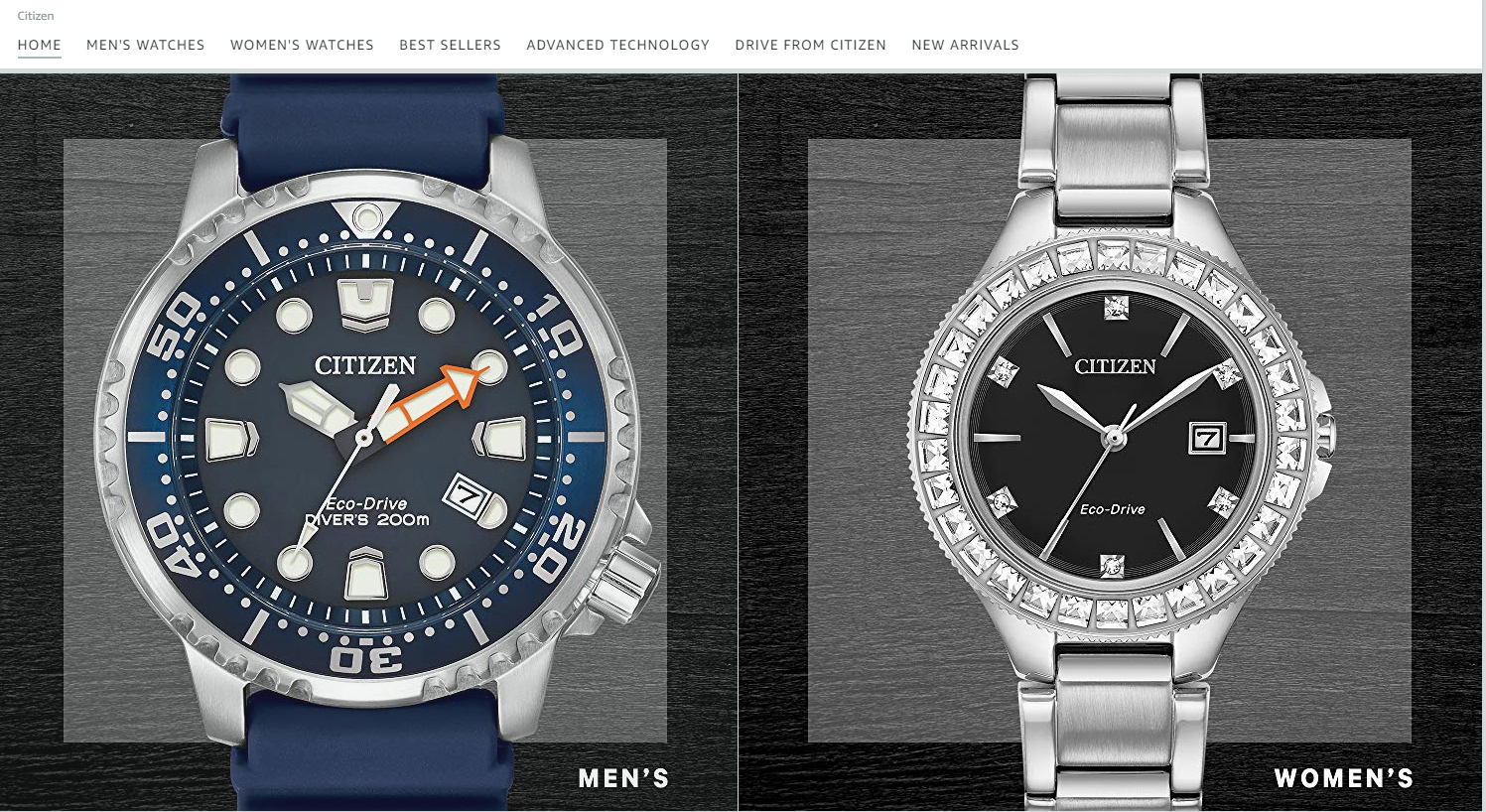

At this year’s AdNYC event, Citizen Watches discussed how they’ve successfully navigated price erosion, knockoff brands, and more to grow their business on Amazon without sacrificing luxury brand equity.

“What is the right approach where you can protect your luxury brand integrity, and still capture that wallet share and be in the right place at the right time?”

Dorné: What is your relationship and approach to Amazon as a luxury brand?

Selling and working directly with Amazon has been really a great opportunity for us as a brand to build our relationship with Amazon themselves, both from the merchant and the marketing side.

We started working with the Amazon because whether we liked it or not, our product was showing up there.

A big problem in the luxury watch category, and many other categories, in general, is the presence of a gray market. Working with, rather than against Amazon, enabled us to control the brand experience.

Dorné: The role of a luxury brand is important in driving consumer inventive to pay more for a product that they could otherwise purchase from non-luxury competitors.

How are you developing that equity and building that presence on Amazon?

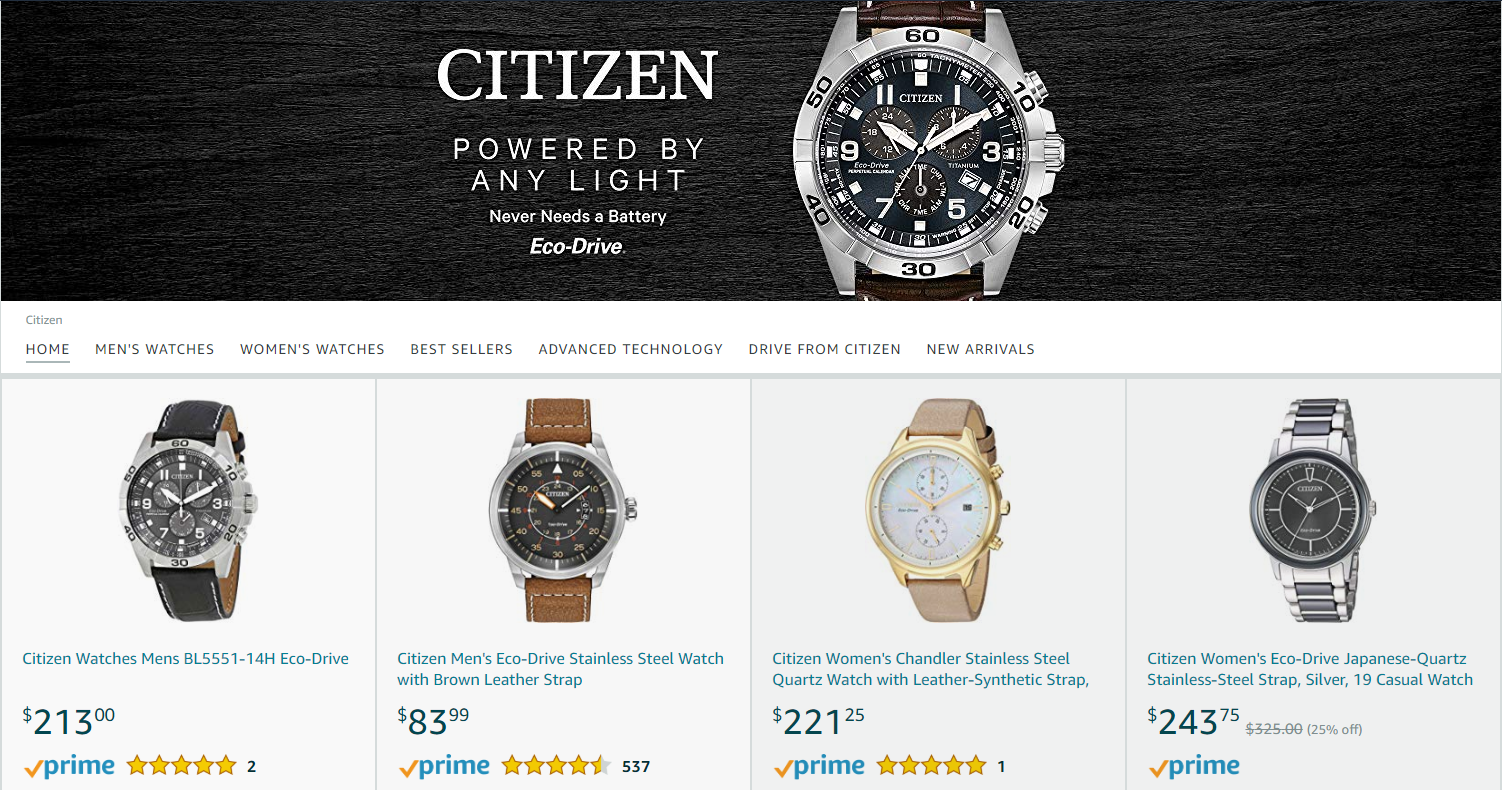

You know, it’s all about content. I think that’s kind of what defines the brand and in luxury.

It’s super important that you take advantage of every opportunity that Amazon gives you. Whether that’s beefing up the content on your A+ detail pages to really educate the consumer on the brand or using your Amazon storefront and making sure that that’s the landing page for all of the marketing that you’re doing.

Use that content as a springboard for the customer to learn more about the brand, discover collections within the brand that way.

It’s important to leverage that premium content to showcase the unique selling proposition of your brand across everything that you’re doing marketing-wise. It’ll ultimately be what sets you apart.

Dorné: Amazon is such a different platform when compared to other digital channels.

How are you navigating the landscape to drive success on the Marketplace?

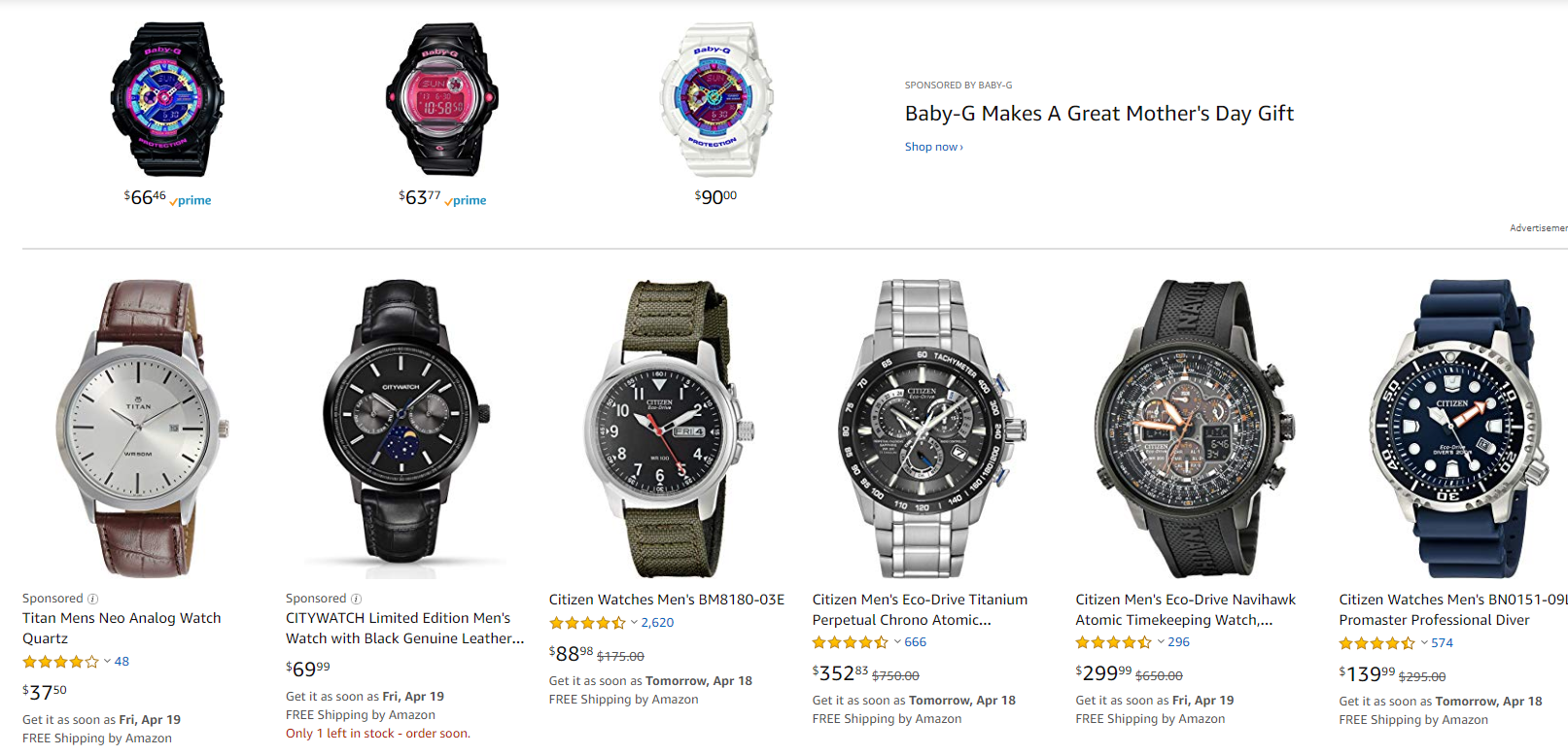

First of all, you have to define and redefine who your competition is on Amazon because it’s most likely is not who you sit next to in brick and mortar retail. It certainly isn’t that way for Citizen.

You really have to deep dive and understand that a lot of these competitive brands are Amazon native brands, and they’re doing things that are successful on the platform. You have to study them to see what they’re doing that already works.

Take their brand terms and throw those into your own search campaigns to make sure that you’re conquesting some of that market share as well.

Secondary to that, when I think about the Amazon business for our brand and our category in general, one big difference in a positive way is that we’ve found more of a year-round business there.

Traditionally, the watches and jewelry category is really the majority of our sales is around the holiday season. But on Amazon, there’s been an opportunity to release and sell beyond gifting holidays.

There’s been an opportunity to take an evergreen strategy with advertising with DSP throughout the year.

What we found is that we are not only purchasing impressions a lot more cheaply throughout these downtimes throughout the year, but we’re capturing people who are in-market when some of the competition isn’t investing there.

The other benefit to that is that we just are continuously building and refreshing our retargeting pool so that when it does come time for those key gifting moments, we are locked and loaded. Um, and we’re not missing a sale.

Dorné: There’s a lot of conversation around the data limitations with Amazon compared to some of the other, older platforms.

Tell us about how you’re leveraging the data in Amazon to drive your programs.

From a marketing standpoint, we really have a window into post-campaign when we see the results from our advertising.

That reporting shares demographic information on purchasers as well as in-market information. Um, which has been really interesting for us.

A great example of this would be, when we ran holiday campaigns and where we had creative that featured a women’s watch. We could see performance over defined target audiences. In addition to that, Amazon provides a look back to see what other segments these purchasers fall under, just for future campaign purposes.

There’s always something interesting to be found in the reporting. And for this campaign, in particular, it was that the women’s creative performed really well among men.

We found that men that had been browsing and purchasing products from Amazon Garage. So we got this really clear picture of a “dude shopping war,” you know, where men were shopping for car parts online and then were seeing our ad and saying, “Oh, that’d be a great gift for my wife or girlfriend,” and then adding it to the cart.

So we were able to action that by adding that as a target audience, believe it or not, on our Valentine’s Day campaign. And it became one of the top performing segments.

When speaking about Google and Facebook, I think it’s interesting because Google and Facebook give you tons of information and a lot of it has to do with user behavior who this person is.

But Amazon has the information of what this person buys, which I think has more meaning in terms of ROI. So we’ve actually had a lot of successful campaigns and received a great return on ad spend using Amazon advertising.

Dorné: In the luxury category, you’re trying to ensure a consistent brand experience across the spectrum of the buying process.

When you think about the unauthorized sellers on Amazon, how are you guys dealing with that challenge?

It’s difficult; the gray market is a huge problem for the watch category on and off of Amazon. By working directly with these Amazon, we were able to overcome these challenges slightly.

However, there are some gray market brands that are so entrenched that it’s difficult to work around them. It’s been a complaint that some of our other retail partners outside of Amazon have had for a long time because it contributes to price erosion.

We have customers that are walking into a Macy’s or a Kay Jewelers and comparing prices that they see from gray market on Amazon to what they see in store.

And it’s the same watch for as much as a hundred dollars less. So it’s been a huge problem. One thing that we’ve tried to do to sort of appease our retail partners is a segmented assortment strategy with Amazon where we have things that are Amazon exclusives.

We have items maybe that were best sellers for years that we take out of the marketplace and give exclusively to Amazon, products that are tested and true. We put the most fuel behind those styles. So that’s what’s most visible on Amazon.

That’s a way that we combat it in a roundabout way. But unfortunately, it continues to be a problem.

Want to learn more?

What is Amazon Demand Side Platform? [2019]

ONE Brands Sweet Selling Success on Amazon

[Webinar] How to Improve Your Amazon Operations to Grow Purchase Orders & Profitability

You Might Be Interested In