ESPN+ Raises Prices, Makes the Bundle More Attractive

Over the past few months we’ve highlighted the impressive, yet relatively quiet, growth of ESPN+ in recent times. Following its launch in the spring of 2018, the service accumulated just 6.6m subscribers by the end of 2019; contrast this with the November 2019 launch of Disney+, which tallied over 10m subscribers on its first day. This sluggishness out of the gates was largely a product of channel conflict: ESPN didn’t want people to cancel their highly lucrative cable subscriptions to sign up for the new streaming service. ESPN collects about $7.64 per month from every single cable subscriber, even those who don’t care about ESPN (the magic of bundling!), plus the ad revenue stream; meanwhile, as of late 2019 ESPN+ generated $4.44 per month, inclusive of ad revenue, only from users who care enough to sign up for ESPN+. Thus, all of the most sought-after content stayed on ESPN’s linear channel and ESPN+ was the home for the long tail.

And yet, the logic of internet distribution cannot be resisted indefinitely. ESPN’s linear distribution was 76 million households at the end of last year, a 10% YoY decline and down ¼ from its peak over 100m roughly a decade ago. Alive to these long-term trends, ESPN has been bulking up on expensive digital rights deals, such as the F1 rights renewal at a 1,500% premium we told you about a couple of weeks ago. With rights costs escalating, and Disney’s DTC streaming business losing almost a billion dollars per quarter, it is inevitable that consumers will face higher costs, and indeed Disney announced last week that the price of ESPN+ will rise in August from $6.99 to $9.99/month.

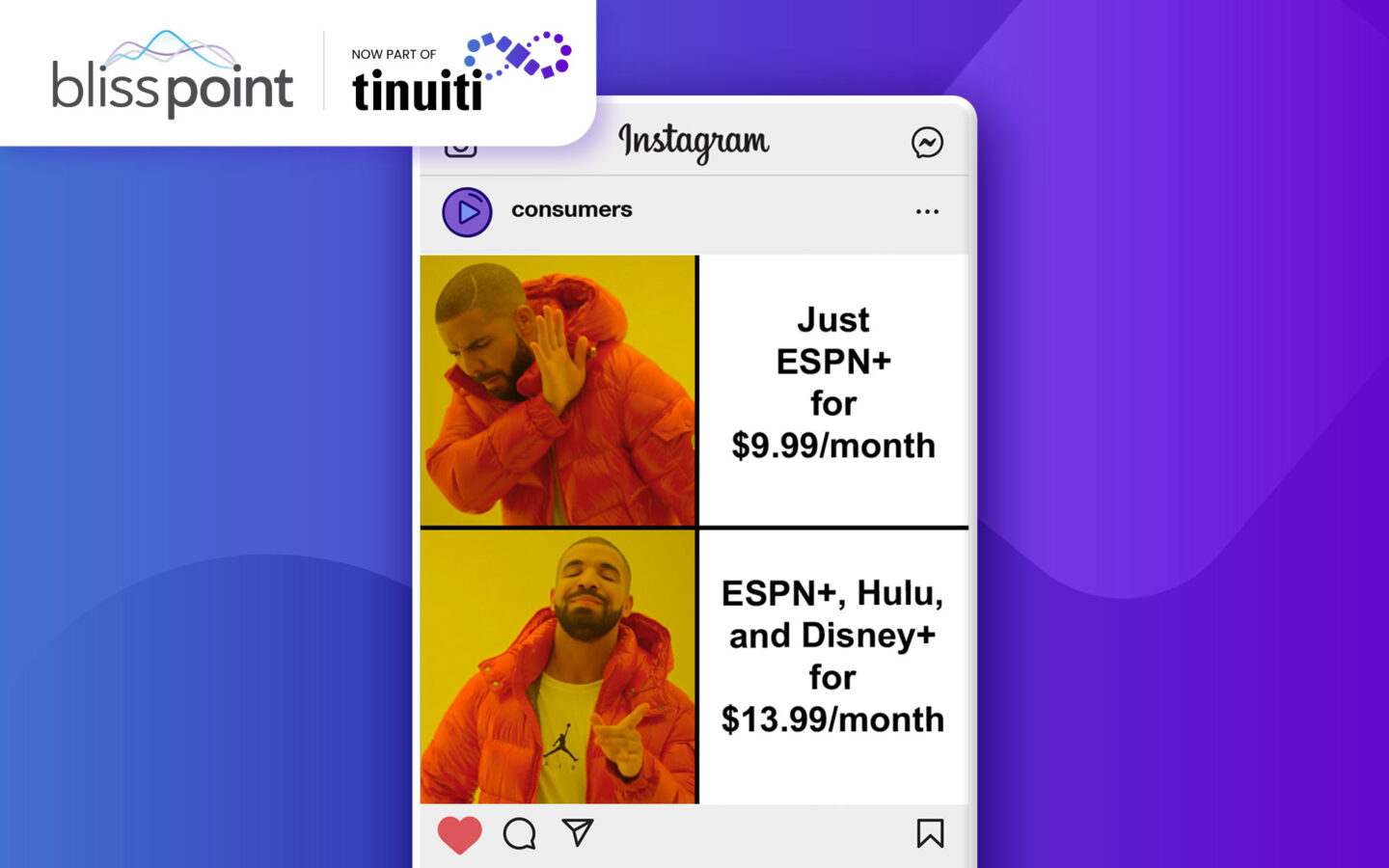

One way this pricing move can be viewed is as strengthening the incentive for consumers to opt into the bundle of Disney+, Hulu, and ESPN+, which will be a mere $4 more than ESPN+ alone. Bundle dynamics can be highly advantageous to content producers and distributors (without being harmful to consumers) given the largely fixed costs of content production and the churn-mitigating features of a diversified content slate (if you’re a fan of both The Mandalorian and UFC, you’ll be less likely to cancel the bundle once The Mandalorian season is over than if you subscribed to Disney+ alone). Of course, ESPN’s pricing move is not without risk – Netflix’s price hike earlier this year is widely seen as having contributed to its industry-shaking subscriber losses, and consumers are already reeling from widespread inflation. Ultimately, it is consumer interest, abetted by ever-improving distribution technology, that is driving the increase in rights costs – networks are just the middlemen – and those consumers will express their willingness to pay in the end. | Bloomberg