What Happened on Google Shopping Over Black Friday Weekend?

Considered the biggest shopping days of the year, Thanksgiving Day through Cyber Monday was predicted to drive a total of $11 billion in online sales, 15 percent more than 2014, according to Adobe.

Based on CPC Strategy’s data, we saw over a 24 percent growth in sales on the major shopping days, outpacing the average predicted sales increase by 5 percent.

But, the success of Black Friday weekend really depends on who you are talking to.

For example, in an interview with the Financial Times as reported by the Financial Review, Andrew House, president and global chief executive of Sony, said that Black Friday 2015 was “the most successful” in company history. He added that Sony is trying to “benchmark against the success” of the PlayStation 2, and if possible, “exceed it.”

But according to Time.com, while the term “Black Friday” is used more than ever, the traditional Black Friday experience—going shopping in physical stores on the day after Thanksgiving—has essentially become meaningless and it was reported that sales on Black Friday 2015 were down roughly $1 billion this year.

As holiday shopping continues to evolve, we’ve compiled a list of what major trends stood out to marketers on Google Shopping during Black Friday / Cyber Monday 2015.

Thanks to higher CPCs, bigger name brands with budgets to spend were able to push out many smaller retailers and claim prime advertising real estate.

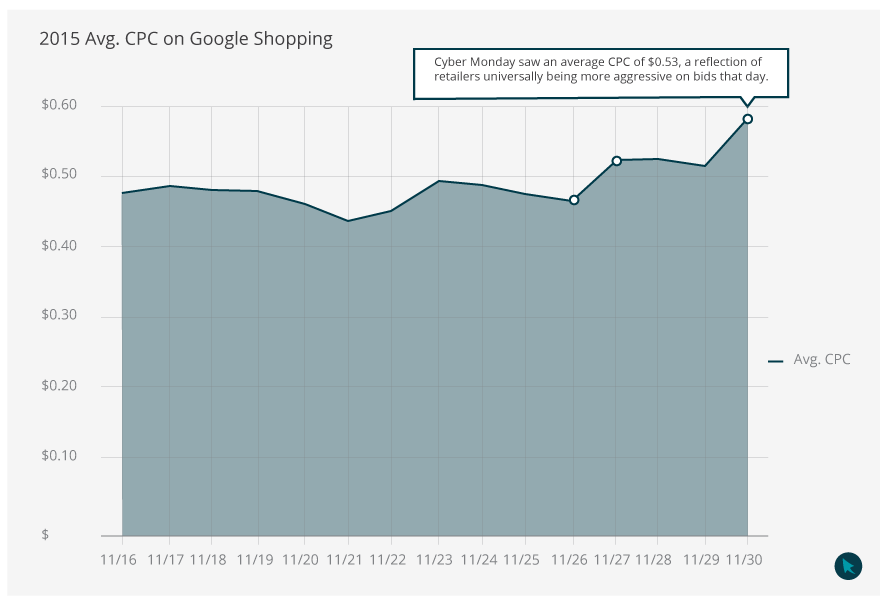

For our client base, we saw an average CPC of $0.53, a reflection of retailers universally being more aggressive on bids that day.

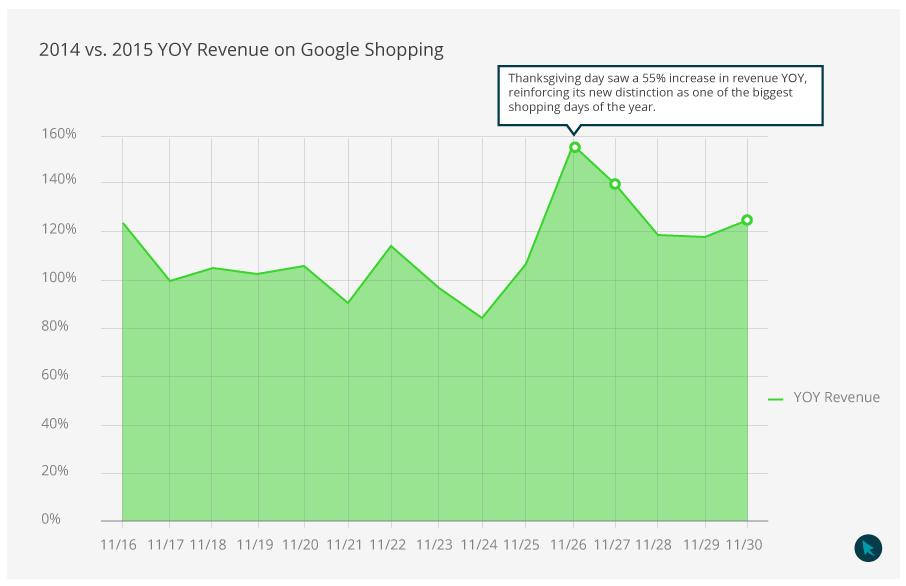

According to CPC Strategy, Thanksgiving day saw a pretty significant jump with a 55% increase in revenue YOY, reinforcing its new distinction as one of the biggest shopping days of the year.

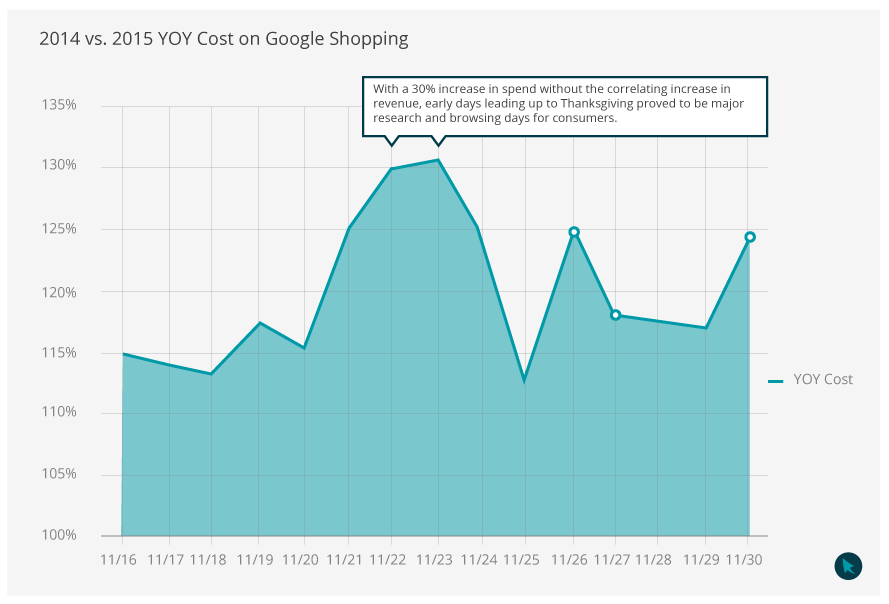

We also determined a 30% increase in spend (without the correlating increase in revenue), throughout the early days leading up to Thanksgiving.

What this indicates is that the days leading up to Thanksgiving were considered research and browsing days fo r consumers, who most likely wanted to figure out which products they would purchase on Thanksgiving or on Black Friday / Cyber Monday.

r consumers, who most likely wanted to figure out which products they would purchase on Thanksgiving or on Black Friday / Cyber Monday.

“People on Google Shopping and Amazon were browsing in early November. We saw more clicks, CPCs rose but not an increase in conversions until a shift around November 15th,” Nick Sandberg, Marketplace Channel Analyst at CPC Strategy said.

As more big box brands, such as Walmart and Target move into the Google Shopping space – it has made it much more difficult for smaller retailers to compete.

For example, a furniture retailer with a high impression share in November 2014, was beat out by Wayfair, Kohl’s and Target – with an overall 50% drop in performance this year.

“Smaller retailers like that can’t compete – realistically they get pushed out,” Jostin Munar, Senior Retail Search Manager at CPC Strategy said.

“Smaller retailers like that can’t compete – realistically they get pushed out,” Jostin Munar, Senior Retail Search Manager at CPC Strategy said.

One specific strategy we did test out this year and found to be successful when competing against big name brands is to aggressively bid only a select number of items.

Since most retailers don’t have access to the large scale budgets of big name brands, it’s better to focus on your top products and raise bids appropriately, rather than across the entire catalog.

“When we came around to Q4, we got aggressive on those key 25 SKUs,” he said. As a result, some of our clients experienced significant success in 2015 using this strategy to beat out big names such as Walmart on certain products.

Retailers who waited too long to submit their Google Promotions likely experienced problems during Black Friday weekend. If retailers submit a promotion too late, the feed could get rejected. At that point, retailers are forced to remap and assign a new ID. By the time the process is approved, you could run the risk of missing out on Black Friday traffic completely.

So, why do promotions get rejected?

“If the promotion is not active on the site, Google is not going to display it,” Munar said.

The turnaround for approval or disapproval is usually a couple hours, but it’s recommended retailers have these types of promos ready in advance to avoid any mishaps during Black Friday or Cyber Monday.

“We started collecting promotions from our clients back in October,” he said.

Thanks to Facebook advertising, one of our clients experienced it’s highest product sales to date for the “Jellycat Fuddlewuddle Puppy Plush” on Cyber Monday.

Sometimes this social push is intentional – but it’s important for retailers to stay on their toes when it comes to running social ads during Black Friday and Cyber Monday. You never know what items could take off and go viral in a matter of hours (which could max out your budget & inventory faster than you anticipated).

Another example is hoverboards – which most retailers classified as a “hot pick” for holiday shoppers in 2015. Hoverboards gathered a lot of attention thanks to social shares, videos and paid advertising. Most of our clients selling hoverboards completely sold out of this product by the end of Cyber week as well.

According to Roman Fitch, Retail Search Manager at CPC Strategy, the categories that benefited the most from Black Friday / Cyber Monday advertising efforts included:

According to Roman Fitch, Retail Search Manager at CPC Strategy, the categories that benefited the most from Black Friday / Cyber Monday advertising efforts included:

Surprising, wetsuits also did extremely well. A retailer averaging $3,000 in sales per week, sold almost 17,000 in wetsuits on Black Friday alone.

As we know, shoppers want the best deal possible, but what about quality? Are shoppers willing to sacrifice on quality in order to get a better price? As far as we have seen – yes.

According to Jason Bell at CPC Strategy, “Shoppers are looking for a gift, not a product for themselves – so they may opt for the cheaper item.”

We saw similar results across text ads as well.

As we mentioned, with more big box retailers joining Google Shopping – the competition has increase. According to Bell, now more than ever marketers and retailers are savvy on Google’s platform and know how to bid aggressively – as a result we’ve seen an increase in short tail keywords, less aggressive bidding on negative keywords, and the use of RLSA, Auction Insights and countdown features.

“I knew it was going to be more aggressive this year and more expensive. Overall, we were able to outpace and gain more orders BUT we had to pay for it,” he said.

According to Bell as retailers finish out the holiday season it is important to:

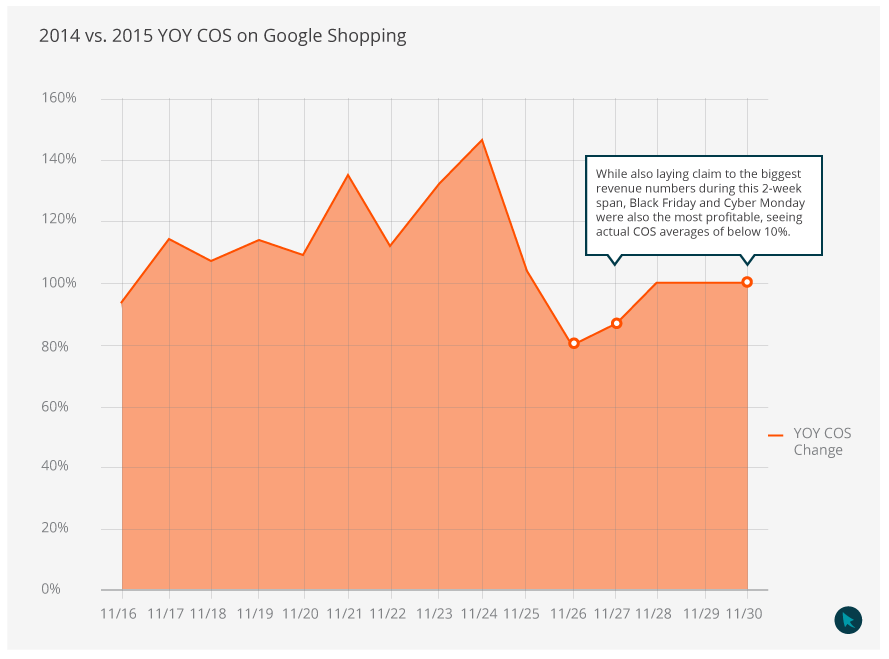

We took a look at over 200 of our clients for which we managed Shopping during Black Friday weekend both last year and this year. These same-store sales trends paint the picture of a Google Shopping that has become much more competitive year-over-year (YOY). With more advertisers and more Big Box retailers allocating budget to the channel, the overall cost to participate has scaled up.

Our analysis aggregates over 200 same-store retailers and compares average Google Shopping performance data on specific days in 2014 to 2015. The comparable dates in 2014 are 11/16/14 to 12/1/2014 while the dates analyzed this year are 11/17/2015 to 11/30/2015, starting 2 weeks before Cyber Monday and ending on Cyber Monday.

This graph shows 2015 cost (ad spend on Shopping campaigns) as a percentage of last year’s cost on correlating days. For example, if our clients spent $115 total on Shopping on 11/16/2015, they spent $100 on Shopping on 11/17/2014 (ie. a 15% increase YOY). This graph is the most telling of the shift we’ve seen with Google Shopping to a more mature and competitive pay-to-play model since each day in this 2-week span increased YOY.

This graph shows 2015 revenue (conversion value from Shopping campaigns) as a percentage of last year’s revenue on correlating days. When you look at this in comparison to our Cost graph, the major increases in spend on the days leading up to Thanksgiving didn’t necessarily translate into a correlating increase in revenue. Perhaps a takeaway for next year is to be more cautious with spend during these prime research days and ramp up on bids on days when that research finally pays off into purchases.

The major days – Thanksgiving, Black Friday, and Cyber Monday – all saw large increases in overall revenue, resulting in a 55%, 38%, and 24% increases in conversion value YOY, respectively.

This graph shows 2015 cost of sale (COS) data (spend / revenue = COS) as a percentage of last year’s cost of sale data on correlating days. An interesting trend here is that while the raw numbers for both spend and revenue on Black Friday and Cyber Monday were the highest during this 2-week span for both 2014 and 2015, both days still saw the best COS percentages. Year over year, these days have proven to be the most profitable for our clients, showing that the intent to buy is consistently the highest on Black Friday and Cyber Monday.

This graph shows the actual average cost per click (CPC) on Google Shopping across all of the examined clients for 2015. Compared to last year’s CPC data, CPC’s have only risen about 12% across the board during this 2-week span – a percentage we expected to be higher given the more competitive market.