Google Clicks Declining, CPC Exploding for Many Retailers as US Reopens

The pandemic brought with it a surge in ecommerce demand, spilling over into overwhelming search interest for products and services that consumers may have otherwise sought out in-store. With the US steadily reopening and vaccination rates continuing to rise, there is a question of how consumers will respond to more freedom of movement and what that will mean for advertisers in search.

Over the past few weeks, many advertisers are starting to see year-over-year click declines, while CPC growth is soaring. Importantly, year-ago comparisons have recently been impacted by stimulus checks that happened last April as well as this March, and looking at trends relative to early-2021 performance is important in fully understanding these recent shifts, though doesn’t make the picture particularly rosy.

A third round of stimulus checks boosted consumer demand in March 2021, with many Americans receiving deposits on March 16 and 17. This payment occurred roughly a year after many advertisers pulled back in the early stages of the pandemic back in 2020, which was also a period when consumers’ search demand shifted away from some kinds of products, like apparel.

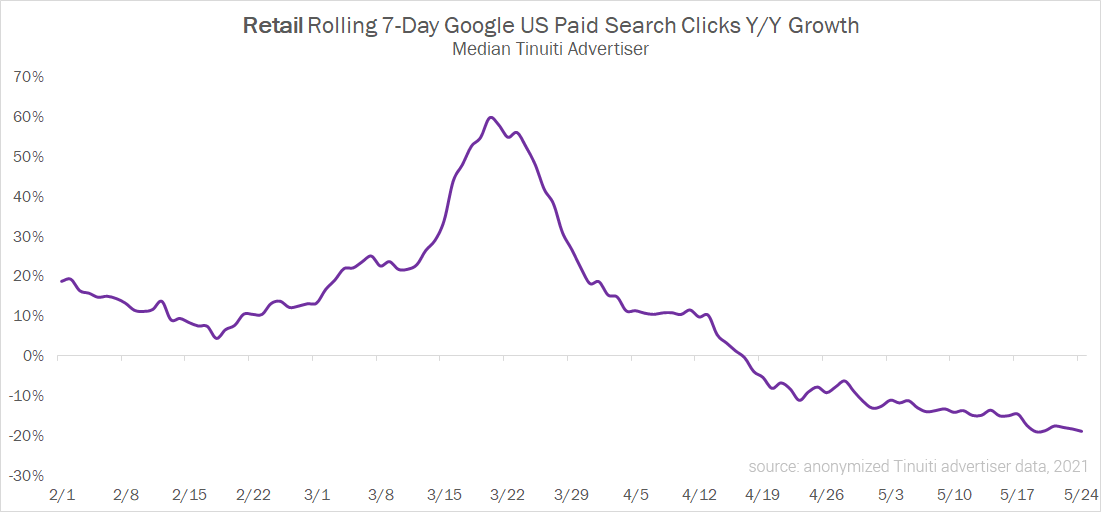

This resulted in many advertisers seeing outsized click growth year over year (Y/Y) with the introduction of March 2021 stimulus money. Across a collection of long-standing Tinuiti advertisers, rolling 7-day Y/Y Google click growth topped 50% for the median retailer (including ecommerce pure plays) in late March.

Click growth slowed to early-February levels in early April, though, and then really dropped for most brands in mid-April, as we lapped year-ago comparisons for when many Americans received stimulus checks in 2020.

This Y/Y decline in search ad clicks has continued for several weeks now, in part because the rollout for the first round of stimulus checks in 2020 was drawn out for many Americans, with yours truly not receiving a deposit until May 6 of last year.

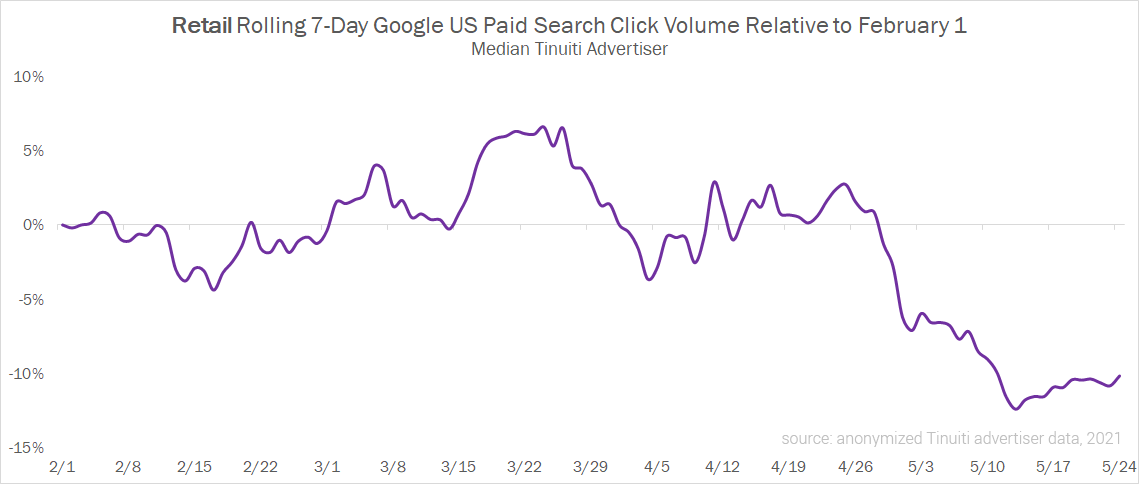

However, looking over at how click volume has fared relative to earlier in 2021, it’s clear that the continued decline in Y/Y growth hasn’t just been the result of strong year-ago comparisons, as click volume has begun to slide for many marketers even relative to the period before the March 2021 stimulus. Typically, ecommerce sales are 5-10% stronger in Q2 than in Q1, so seeing click volume fall like this is unusual.

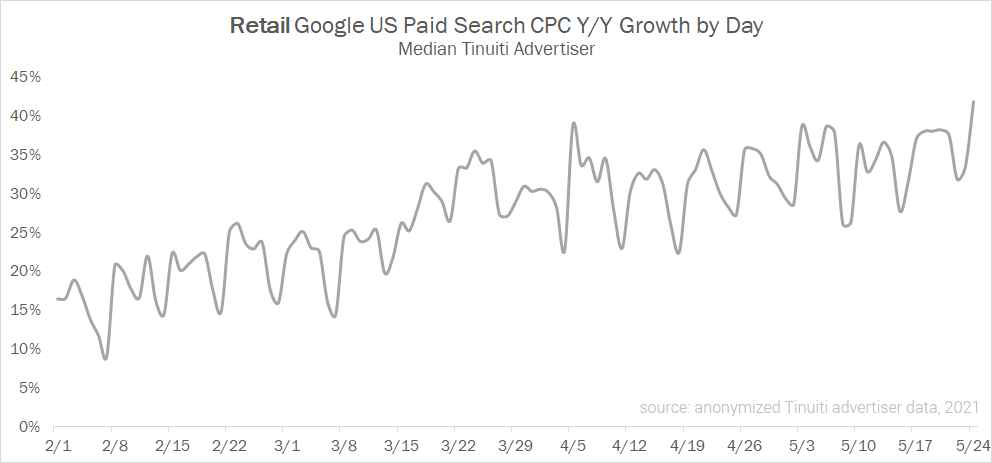

This isn’t the only big trend taking hold right now, though, as CPC growth is exploding for many brands and putting pressure on ad budgets, even as click volume has been weaker.

Average CPC declined a whopping 17% Y/Y across all Tinuiti advertisers in Q2 2020, so it’s no surprise that many advertisers are now starting to see massive Y/Y CPC increases in Q2 2021. For the median Tinuiti retailer, CPC growth is now rising above 40% Y/Y on some days.

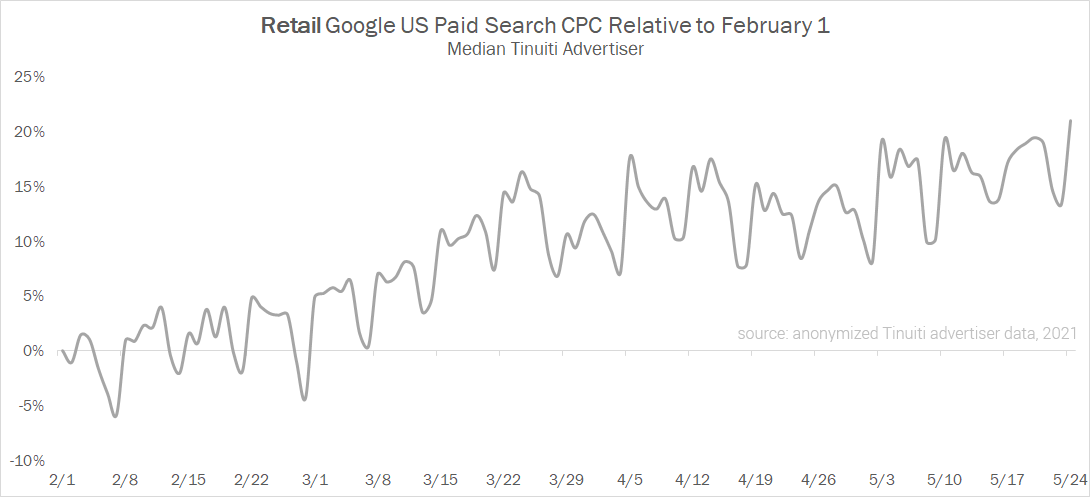

The upward trend is also clear when looking at CPC compared to earlier in the year.

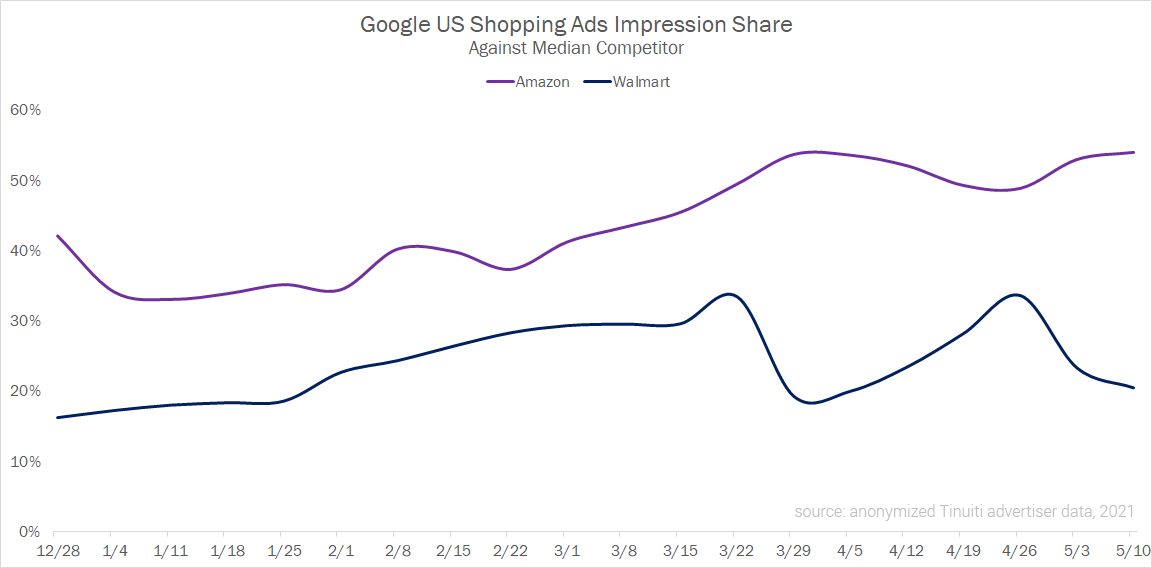

The competitive landscape can certainly play a role in how fast CPC grows at any time given performance and budget constraints. While it’s difficult to quantify the totality of competitive forces impacting Tinuiti advertisers, two key players that surged in Google Shopping presence in Q1 2021, Walmart and Amazon, have held roughly steady in the US since the end of the quarter outside of some week-to-week rockiness.

(This isn’t the case in all countries, however, as we recently reported that Amazon paused Google Shopping ads in Canada.)

While these two behemoths may not have meaningfully increased their presence in paid search in just the last few weeks, Amazon was not present in Google auctions at all at this point in 2020 and both have been relatively aggressive in bidding to start the year.

Clearly search auctions are highly competitive, in general, given the continued rise in ad pricing. It’s also important to note that many brands use digital to generate offline sales and offline sales are poised to grow faster than ecommerce sales for the first time in the history of ecommerce. Taken together with slower online click growth, many retailers are finding tough performance comparisons as we move further into 2021.

Last year brought with it a surge in ecommerce, vaulting online purchasing years ahead of the historical trend. Combined with brands like Amazon pulling out of ad auctions in the early-goings of the pandemic, many brands saw roaring performance from their digital marketing efforts, particularly in paid search.

We’re now coming to a point where these brands are not only lapping year-ago comparisons, but also dealing with new potential disruptions in consumer demand as the US reopens. Ecommerce sales are now maybe only a year or two ahead of the pre-pandemic trend, as customers return to brick-and-mortar stores.

Will shoppers continue to revert back to in-store shopping en masse? Will a roaring economy help keep retail strong both online and offline? Will everyone just be spending all of their money on plane tickets and bar tabs!?

There are a lot of unknowns, but paid search advertisers should stick to the best practices that would be crucial in 2021 even without the recent shifts. These include: