It was another big year for Amazon in 2017, which continues to grow its revenue and valuation annually. For sellers, many of the site’s older, outdated features were retired, while new, more interactive ones were introduced, tested and officially launched.

Amazon itself made big moves, expanding into dozens of white-label brands and even influencer marketing. It was a whirlwind 12 months for the retail giant to say the least.

It’s difficult to believe Amazon’s growth won’t continue into 2018. With Prime Memberships rapidly increasing, we don’t really expect Amazon to slow down.

This year, we’re asking leading industry experts which trends they predict will shape the Amazon Marketplace in 2018.

Meet the Experts: The 2018 Amazon Roundtable

This year, we collected predictions from our own experts as well as industry professionals including:

- Pat Petriello, Head of Marketplace Strategy at CPC Strategy

- Bernie Thompson, Founder at Efficient Era

- Jordan Gisch, Marketplace Channel Analyst at CPC Strategy

- Karen Hopkins, Marketplace Channel Analyst at CPC Strategy

- Ashley Vanderveen, Project Manager, Creative Services at CPC Strategy

- Chad Rubin, CEO at Skubana

- Ryan Burgess, Marketplace Channel Analyst at CPC Strategy

- Jeremy Biron, Founder at Forecastly

- Trish Carey, Marketing Director at Seller Engine

- Jordan Berry, Marketplace Channel Analyst at CPC Strategy

- Ray Nolan, CEO of xSellco; creator of Hostelworld and Skyscanner chairman

If you would like to learn more about our featured experts, jump to their bios below.

20 Amazon Trends Predicted to Shape 2018:

1. Amazon Product Reviews System Update

I have to give a shout out to Casey Gauss at ViralLaunch for putting the idea in my head, but I think we might see a change in Amazon’s review system. Since Amazon prohibited incentivized reviews in October of 2016, we haven’t heard much in the way of updates on how Amazon treats reviews, but getting initial reviews is still a massive hurdle for brands introducing new products to the Marketplace.

I think it’s possible we see Amazon reconsider whether they need/allow unverified reviews at all anymore (it made sense when the review system was in its infancy), change the review system to only count a rolling 12 month period, and/or display reviews as “500+” or “1000+” to discourage Sellers from trying to stockpile unnatural reviews.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

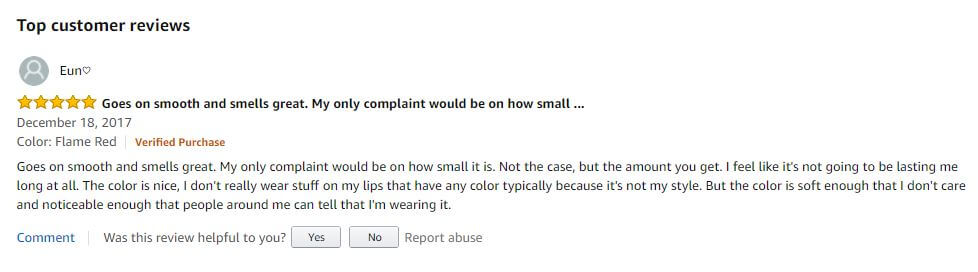

2. Introduction of Video Product Reviews

We have seen video become a bigger deal on Amazon over the past year or so as they continue to optimize the search and shopping experience to better enhance the customer’s experience.

Currently, Sellers can get “related video shorts” on detail pages by hosting a video on AWS and tagging it with related content to your product detail page, vendors can add a video as one of the secondary image placements on your detail page (and this is currently open as a beta for some 3P sellers via EBC), and in A++ content which is slowly being rolled out for vendors (for a hefty price) is more interactive and has some video components.

I would not be surprised at all if we start to see Amazon rolling out a “video product review” feature in 2018.

This will enable customers to leave more detailed reviews so that future shoppers can make more informed purchase decisions, reduce the number of product returns, and further separate high-quality products from poor-quality, knockoff items.

– Jordan Gisch, Marketplace Channel Analyst, CPC Strategy

3. Continued Functionality Parity Between 3P Sellers and Vendors

In 2018, Amazon will blur the lines between 1P and 3P, offering more hybridizations and common programs for brands. Control of listings and brand assets will become more unified. There’ll be more ways for Amazon to source goods from FBA at 3P pricing, and sell them 1P elsewhere.

Amazon will take more of the tax complexity burden off 3P sellers. These hybrid models will strengthen Amazon’s offerings and give sellers more cases where they get the “best of both worlds” between 1P and 3P.

– Bernie Thompson (Founder, Efficient Era)

I also expect we’ll continue to see Amazon close the functionality gap which has long existed between 3P Sellers and Vendors.

We’ve seen this already with EBC being introduced as the analog to A+ content and Headline Search Ads being made available through Seller Central.

I expect we’ll continue to see this, with Amazon likely to make Product Display Ads available through Seller Central and even considering opening up programs such as Vine to 3P Sellers.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

4. More opportunity in Amazon Sponsored Ads

Since the removal of the right rail ad placements this year, Amazon sponsored ads will soon be a place that’s no longer for the faint of heart. As Amazon’s algorithm becomes increasingly more sophisticated, I believe they will be rolling out measures to increase the flexibility of the sponsored ads space, with more opportunity for customer segmentation and more valuable insights from customer data such as keyword visibility.

We have already seen how Amazon has added more granular analytics in ad reports such as CTR and conversion rate, so in my opinion the opportunity with Amazon advertising is still very much in its infancy.

I would be very keen to see how the advertising space will evolve, because with more products being added to Amazon’s catalog every day, and product search becoming more competitive, advertising is an increasingly important asset for Amazon’s bottom line.

Empowering advertisers with more data is the only way that serious sellers will see it as an opportunity for significant investment, as with Adwords.

– Ray Nolan, CEO of xSellco; creator of Hostelworld and Skyscanner chairman

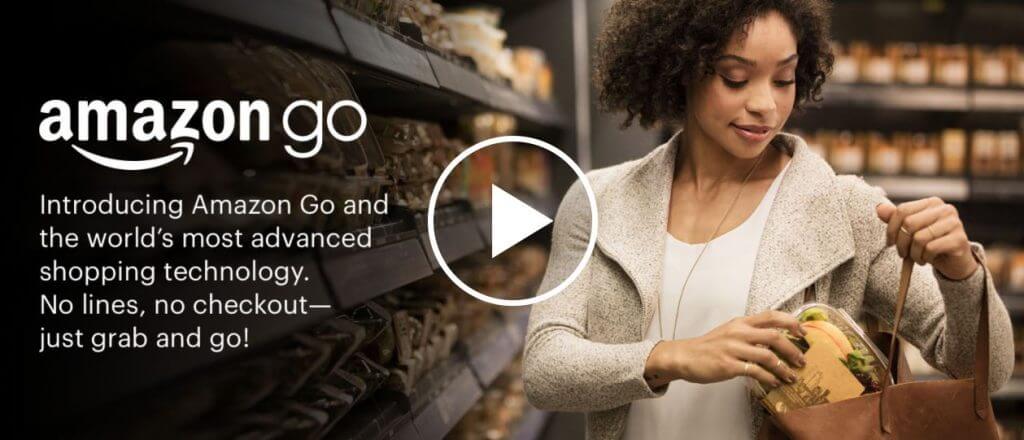

5. Increase development of “Amazon Go” and other grocery efforts

Amazon Go is the “no-lines” grocery store where you simply fill your basket and walk out, having your Amazon account charged for the items you took. There is currently only 1 location, in Seattle, and it’s closed to select Amazon employees.

With Amazon’s recent purchase of Whole Foods, I expect they’ll be using these new locations to collect data on retail customer shopping behavior to influence the future development of these “cashier-less” stores, possibly rolling them out in existing Whole Foods locations across the country.

– Ryan Burgess, Marketplace Channel Analyst at CPC Strategy

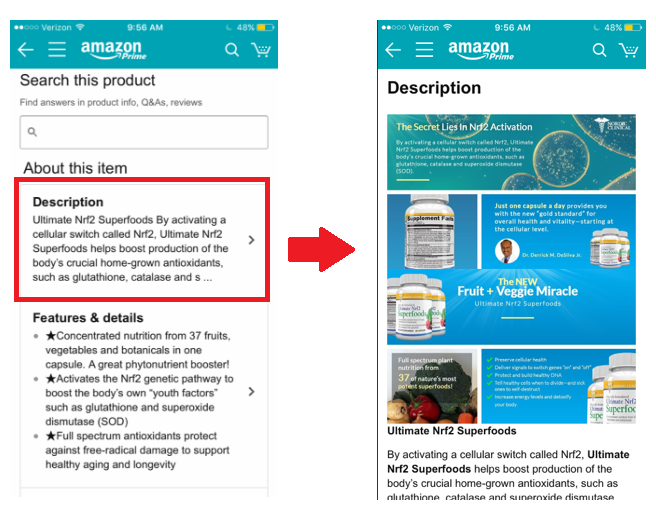

6. Optimizing Content for Mobile & Video

With the release of Enhanced Brand Content pre-set templates and the ability for custom templates, I see Sellers being able to optimize their Enhanced Content for mobile specifically.

With the new modules roughly based on some A+ Content modules, your content will be able to stack and have a sense of mobile responsiveness. A++ will hopefully continue to become more available to vendors and keep enhancing the overall consumer experience.

Enhanced Brand Content Video was rolled out in 2017. Video plays a huge role in Amazon Stores and I think will continue to become something that you include on your product listings just like an image.

The ability to showcase your product in a 360-view and explain specific features may help decrease the risk of returns and empower the consumer to make the purchase decision with the additional information provided.

– Ashley Vanderveen, Project Manager, Creative Services at CPC Strategy

7. Brands / Brick & Mortars Flee to Amazon

Bigger brands are coming to Amazon in 2018 looking to expand into non-branded and branded traffic (which could potentially saturate the market) so it is important to get dialed in and protect your space.

Additionally, brick and mortar stores are expanding into online marketplaces to compete (largely because Amazon is already in 50% of households, thanks to Amazon Prime memberships).

– Karen Hopkins, Marketplace Channel Analyst at CPC Strategy

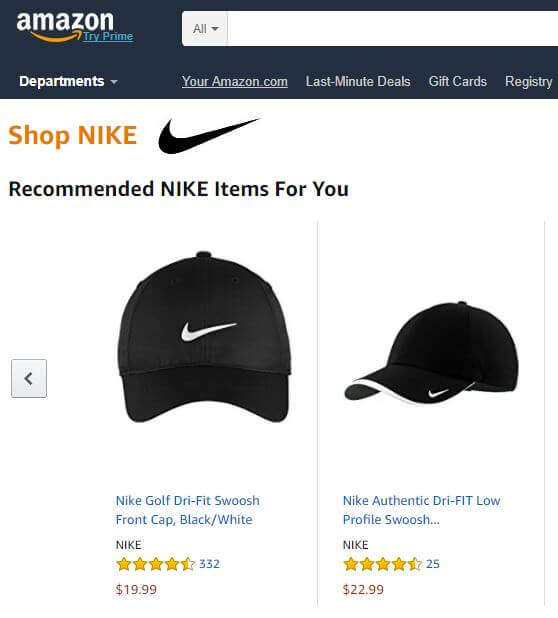

8. Bigger Brands > More Competition > Higher CPCs

Again, this isn’t novel, but the competition on Amazon will continue to get more fierce, especially with premium brands entering the Marketplace at an increasing rate. Calvin Klein, Levi’s, and Nike are just a few examples of major players which have entered the space with premium brand equity and deep pockets.

As the Amazon advertising space continues to get more competitive, especially with household players, CPCs will increase across all categories and advertisers will have to invest more simply to maintain market share, let alone increase it.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

9. Better Ad Targeting & Reporting

I expect we will see more advanced ad targeting in the new year. Amazon is behind the curve when it comes to ads being able to target specific shoppers – I imagine in 2018 they will follow suite like Facebook and Google and roll out more advanced targeting for Sponsored Product ads.

Amazon Retail Analytics Premium (ARAP) was just revamped for Vendors but I think that better reporting will soon be available for third party sellers.

– Jordan Berry, Marketplace Channel Analyst at CPC Strategy

Amazon will continue to follow in the path of AdWords and add more functionality to their advertising suite. I would expect we will see options such as mobile bid differentiation, geotargeting, and dayparting made available to Amazon advertisers in the not too distant future.

From a data standpoint, I could also see Amazon release data on performance by placement for Sponsored Products so advertisers know what the opportunity is for getting from the second placement to the top placement, for example.

All of these features empower advertisers to more accurately target their ads, which in turn creates a more relevant experience for Amazon shoppers and drives more advertising dollars for Amazon.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

I predict Amazon will start to track external traffic with Pixels, providing more visibility so that Amazon merchants spend more to drive to their listings and track where their traffic sources are coming from.

– Chad Rubin (CEO at Skubana)

10. New Amazon Devices

With the popularity of the Echo line of devices, as well as the Amazon Kindle and Kindle Fire tablets, I expect to see Amazon continue innovating in new consumer electronics devices.

Not only do these devices prove to be exceptionally popular amongst consumers, they also loop the customer into Amazon’s ecosystem, as most owners of Amazon devices are Prime members.

Amazon has experimented with creating a flagship smartphone in the past, rather unsuccessfully, but I wouldn’t be surprised to see them try again in 2018 with a much-improved design.

– Ryan Burgess, Marketplace Channel Analyst at CPC Strategy

11. Growth of Voice Search & Home Assistants

I’d say voice search and home assistants will continue to play a big part for Amazon’s development in 2018. Both Alexa and Google Home are available in some models of newer cars (Ford, BMW & Mercedes).

US consumers are quickly purchasing speaker based home assistants, with Amazon dominating the market (70% according to TechCrunch vs 23% for Google home).

The next step will be how quickly Amazon can keep improving Alexa’s interface and AI to meet customers rising demands.

– Trish Carey (Marketing Director at Seller Engine)

12. Increased Seller Penalties

Amazon puts customer experience and satisfaction above all else. The Amazon search algorithm is designed to maximize customer satisfaction. Sellers that take actions to intentionally deceive the algorithm in an effort to boost sales are negating what Amazon is trying to achieve.

In 2018, Amazon will continue to improve the detection of seller actions that are in violation of its Terms of Service.

– Jeremy Biron (Founder at Forecastly)

13. Encouraging Driving Off-Amazon Traffic to Amazon

This exists to an extent with Amazon’s Amazon Media Group (AMG) suite, but I expect we’ll see Amazon continue to look for ways to empower brands and advertisers to send traffic from Google and social platforms (Facebook, Instagram) back to their Amazon detail pages.

I believe the introduction of Amazon Stores is part of this evolution since it provides a mobile-optimized landing page for off-Amazon traffic, but I think we’ll see Amazon make this easier for Sellers/Vendors by providing more rich data to track the performance of that traffic and even a way to quantify attribution for off-Amazon traffic sources.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

14. Expansion of Amazon Private Label Brands

In 2017 Amazon achieved massive growth of its private label brands like Amazon Elements and Amazon Basics. The company is now starting to hit its stride with launching products under these private brands.

They’ve made significant investments in air and sea transportation to make it easier to import these types of products and quickly bring new products to market. We’ll see growth of these private label brands in 2018 that will far surpass the impressive growth we already saw in 2017.

– Jeremy Biron (Founder at Forecastly)

15. Same-day Delivery Expansion

It’s no secret that Amazon wants to get orders to its customers as fast as possible and is working on efforts to make order turnaround as fast as possible. Fast shipping is one of Amazon’s strategic advantages and same-day delivery will expand into many new markets in 2018.

In the fulfillment centers where Amazon will now offer same-day delivery, it’ll improve its local delivery fleet and increase the breadth of products regularly stocked.

– Jeremy Biron (Founder at Forecastly)

16. Amazon Owning the “Last Mile” of Logistics

While UPS and FedEx have long been integral partners in Amazon’s fulfillment chain, I expect we’ll see Amazon increasingly compete against those carriers by way of rolling out their own fleet of vehicles and owning the last mile of the customer experience.

Amazon operated delivery trucks (drones?) wouldn’t have to share space with deliveries from other sites the way a UPS truck does, and they could use data to optimize routes and make delivery times even shorter. The better the delivery experience, the more satisfied the customer, the more loyal they stay to the Marketplace.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

17. Increased Focus on Search Marketing

It’s no news that SEO is important if you want to get your products found on Amazon’s increasingly competitive SERPs, but I definitely see a big focus on more sophisticated ranking factors over the next few years. As we’ve seen with Google’s evolution over the years, the current weight on exact match keywords is something that’s not sustainable as the product catalog grows.

Current ranking factors such as customer experience, time on page and conversion rate will likely be given more weight and thorough on-page optimization will be essential. With Amazon now a starting point over Google for the majority of product searches, it makes sense that the search algorithm will get smarter.

As competition grows, focusing on customer experience and feedback is more important now than ever, so developing an efficient feedback strategy that focuses on targeting the right customers, at the right time, is key to getting more reviews and ranking higher.

Getting feedback on Amazon shouldn’t be a shot-in-the-dark approach with mass email blasts—enhancing the customer experience with the targeted communication at every stage of the buyer’s journey is what customers will respond to and be happy to talk about.

– Ray Nolan, CEO of xSellco; creator of Hostelworld and Skyscanner chairman

18. Increased Focus on Amazon Prime Music

The most popular music streaming services today are Spotify and Apple Music. It’s been predicted by many analysts that neither company is profitable by charging the monthly subscription fee alone.

Amazon has shown it can be a real player in the Video Streaming industry, competing directly with Netflix/Hulu all at no additional cost to Prime Members. I wouldn’t be surprised to see Amazon release updates/dedicate a push towards promoting Amazon Prime Music to directly compete with rivals Spotify and Apple Music in 2018.

– Ryan Burgess, Marketplace Channel Analyst at CPC Strategy

19. More A++ Content

We’ve only seen A++ (we’re not sure if this is the official Amazon name for them yet) detail pages for lead brands such as Dove, Degree, and Samsung, but I expect this is a glimpse into the future of the Amazon detail page experience.

Amazon is a conversion engine optimizing towards turning traffic into orders, and A++ allows brands more options to highlight the unique value proposition of their products and recreate the in-store shopping experience on a two-dimensional screen.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

20. Amazon Purchasing Control

Amazon will remove the ability for customers to choose who they buy from.

Amazon will algorithmically place who wins the buy box and consumers will lose the ability to choose. In the end, this gives the best experience to the consumer but will hurt resellers competing for visibility and the coveted buy box. The buy box will become the black box.

– Chad Rubin (CEO at Skubana)

21. More “Online Shopping” Holidays

I expect to see that Holidays are turning into opportunities for businesses to capitalize on coupons and run deals on Amazon that are typically not considered “online shopping” days.

– Karen Hopkins, Marketplace Channel Analyst at CPC Strategy

22. Market Consolidation

As the Marketplace continues to mature, it continues to require professional business acumen and a channel dedicated strategy to be successful. Long gone are the days of throwing up a product data feed and hoping for success.

Amazon is a ruthless marketplace, and Sellers/Vendors without a competitive value proposition, quality products, a dialed in strategy, and effective implementation across advertising, content, inventory, service, and branding will not be able to survive.

– Pat Petriello, Head of Marketplace Strategy at CPC Strategy

23. Continued growth of Amazon Australia

With a population of over 24 million, and 2017 e-commerce sales forecast at $32 billion according to eMarketer, Australia is one of the top 10 global markets—and Amazon’s recent launch there is a growing opportunity for sellers worldwide.

The marketplace already has over 3,000 active sellers within two weeks of launch, so those that have the ability to get there early will be able to snag top ranking positions and build their reputation in the market as it grows.

Until now, eBay has dominated the Australian marketplace space, so it’s set to receive some heavy competition with Amazon swooping in for a piece of the pie. If you already sell on eBay Australia, Amazon’s launch presents a great opportunity for increased multichannel revenue.

– Ray Nolan, CEO of xSellco; creator of Hostelworld and Skyscanner chairman

Expert Bios:

Pat Petriello, Head of Marketplace Strategy at CPC Strategy

Pat is a former professional seller on Amazon.com, Amazon.co.uk, eBay, Buy.com and former member of Amazon Seller Service Team. As a Head of Marketplace Strategy for CPC, he’s responsible for keeping his team on the cutting edge of Amazon trends and insights.

Pat is a thought leader in the industry, speaking at a variety of events and often quoted in the industry press. He’s passionate about understanding Amazon as a channel and helping brands utilize its full potential.

Bernie Thompson (Founder, Efficient Era)

Bernie Thompson owns an 8-figure private label electronics brand, selling internationally on Amazon since 2009.

He has not only experienced skyrocketing growth on the Amazon platform, but has also witnessed frustrating listing suspensions, seen the rise of AmazonBasics and experienced undercutting by 1P sellers. Bernie is the founder of Efficient Era that helps hundreds of Amazon Sellers with automation tools to build their brand and protect their brand on Amazon.

Jordan Gisch, Marketplace Channel Analyst at CPC Strategy

Jordan is an expert Marketplace Channel Analyst at CPC Strategy. He analyzes key metrics and implements data-driven strategy across marketing campaigns, inventory management, pricing, fulfillment strategy, product management, content management, feedback solicitation/maintenance, and CRM.

Jordan was born and raised in Orange County, CA until he moved down south to attend the University of San Diego where he graduated cum laude with a bachelor’s degree in Marketing. When he’s not working, you can find Jordan at the beach, fishing, bird watching, or cheering on the Green Bay Packers and Chicago Cubs.

Trish Carey (Marketing Director at Seller Engine)

Trish Carey is the Marketing Director at SellerEngine Software. Prior to that, she was the Assistant Director of Digital Strategies for Portland State University’s Center for Executive and Professional Education, and Marketing Manager at GTS Services, a software company located in Portland, OR.

She has over 19 years of experience in a variety of digital marketing specialties and industries. She enjoys project launch, social media, and analytics. Trish serves on the board of SEMpdx as Partnership Director, the Education Committee of SEMPO, and sits on the Communications Committee at the Multnomah Athletic Club.

Karen Hopkins, Marketplace Channel Analyst at CPC Strategy

Karen is an expert Marketplace Channel Analyst at CPC Strategy. She analyzes key metrics and implements data-driven strategy across marketing campaigns, inventory management, pricing, fulfillment strategy, product management, content management, feedback solicitation/maintenance, and CRM.

Karen is a San Diego native and graduated from California State University San Marcos. She’s always had an interest in digital marketing and is excited to take on the role of a Marketplace Channel Analyst at CPC Strategy. She enjoys spending her free time traveling, exploring new restaurants/areas or hanging out at the beach in her hood, PB.

Chad Rubin (CEO at Skubana)

Having worked in corporate finance covering internet stocks, Chad Rubin decided in 2008 to set up an e-commerce storefront, CrucialVacuum.com, and later an e-commerce acceleration platform, Skubana.

Skubana is an enterprise-grade, all-in-one cloud portal that solves the most serious problems of order processing and inventory management. It is scalable enough to accommodate small, medium AND enterprise e-commerce companies, all for a fraction of the cost.

Ryan Burgess, Marketplace Channel Analyst at CPC Strategy

Starting out as an Amazon reseller during high school and college, then migrating into an eCommerce consultative role, Ryan is new to CPC Strategy, but not new to Amazon.

Ryan attended Utah Valley University, where he was anxious to leave the cold and come back to his hometown of San Diego. Outside of the office, you’ll find him rockin’ out on his guitar, spearfishing, or practicing his downhill mountain-biking skills.

Jeremy Biron (Founder at Forecastly)

Jeremy Biron is the founder of Forecastly and Honest Office. Started in 2008, Honest Brands works with brand owners to refine their presence on the Amazon marketplace and maximize their profit from the channel.

Always one for business optimization and process improvements, Jeremy recently launched Forecastly to help Amazon sellers optimize their inventory that is fulfilled using Fulfillment by Amazon.

Ashley Vanderveen, Project Manager, Creative Services at CPC Strategy

Ashley, a San Diego native, spent her college years in northern California at California State University, Chico. She graduated with a Marketing degree and has accumulated 5 years of marketing experience since then. On her off time, you can find her practicing Pilates, trying new restaurants or taking her French Bulldog Oliver for a stroll.

Ray Nolan, CEO of xSellco; creator of Hostelworld and Skyscanner chairman

Ray Nolan is the founder and CEO of xSellco, a suite of SaaS tools for online sellers: the only customer service help desk built for e-commerce, an Amazon repricer and intelligent feedback software. Reclaiming his seat as CEO in 2016, Ray is passionate about helping online sellers achieve their full potential, keeping his ear close to the ground for trends that are likely to impact the e-commerce space.

Jordan Berry, Marketplace Channel Analyst at CPC Strategy

Jordan is an expert Marketplace Channel Analyst at CPC Strategy. She analyzes key metrics and implements data-driven strategy across marketing campaigns, inventory management, pricing, fulfillment strategy, product management, content management, feedback solicitation/maintenance, and CRM.

Jordan graduated from the University of Tulsa in 2012. Originally from Houston, Texas, she now lives in California and loves trying new restaurants.

You Might Be Interested In