The 2016 Amazon Average CPC by Category Report

As Amazon continues to gain traction and dominate the shopping market against channels such as Google Shopping and retailers like Wal-Mart, reports indicate a reflected rise in Amazon’s average cost-per-click (CPC).

According to the latest data (below), Sponsored Products average CPC continues to get more expensive. Which should come as no surprise as more than 50% of consumers begin their product searches on Amazon.

As with any ecommerce channel, bid plays an important role in terms of gaining more exposure for your ads. But before we jump into the 2016 average Amazon CPCs by category – let’s review how CPC bids play a role in Amazon’s overall algorithm.

The cost-per-click bid is the maximum cost per click you are willing to pay when someone clicks your ad.

Amazon will never charge more than this maximum bid, and your cost per click may actually be lower than your cost-per-click bid. Of course, sellers should never bid more than they are willing to pay for a click.

The average CPC is the average cost per click paid for the click and the seller only pays $0.01 more than the next highest bid.

For example, you could bid $6 and only get charged $0.81 if the next highest bid was $0.80. In this case, the winning bid was $6 even if the seller was only charged $0.81.

For Sponsored Products the minimum cost-per-click bid is $0.02; however, Amazon recommends a minimum of $0.05 to be competitive.

But according to Pat Petriello, Senior Marketplace Strategist at CPC Strategy, Amazon sellers would be naive to base their bidding strategy on Amazon’s Estimated Page 1 Bids alone.

“We’ve suspected this, but the estimated page 1 bids Amazon communicates for keywords are not accurate,” he said.

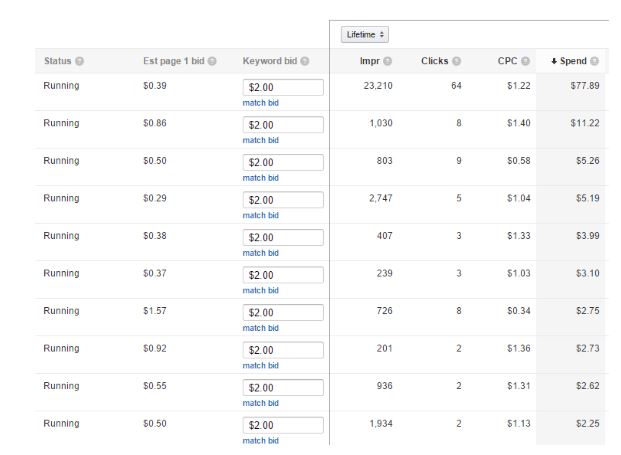

As you can see in the below example, the suggested bids by Amazon to rank on the Page 1 are significantly different than the actual CPCs.

“Sellers should take Amazon’s page one suggested bid with a grain a salt & use actual click and conversion data to make bid modification decisions. We often find that to get on page one of the SERP is a much higher bid than what Amazon is suggesting, and as long as you’re getting an acceptable ACoS, you can keep pushing up the bid to get more volume while remaining profitable.”

As with other online advertisement services, Amazon has a competitive advertising environment.

When a customer searches for a keyword you have targeted, Amazon displays the top ads that are relevant to that keyword. Amazon determines which ads to display using a variety of inputs, one of which is the cost-per-click bid.

To learn more about Amazon Sponsored Products’ algorithm, check out our recent guidebook: The 2016 Guide to Amazon Sponsored Products

https://tinuiti.com/blog/2016/08/utilizing-sponsored-products-on-amazon-in-q4/

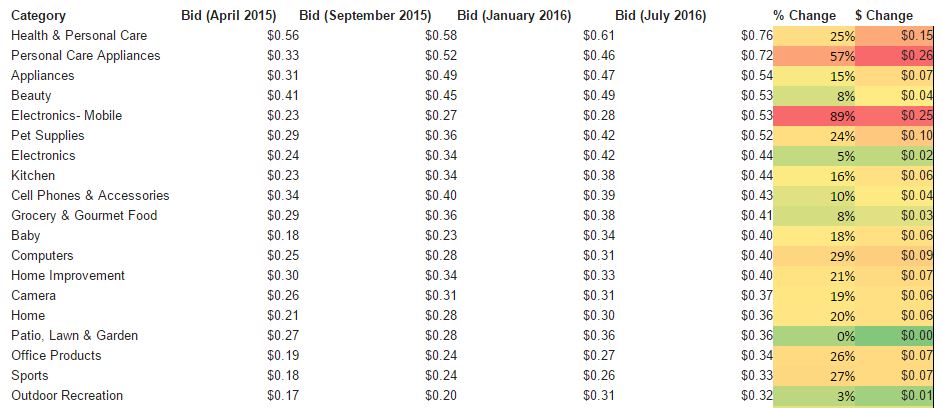

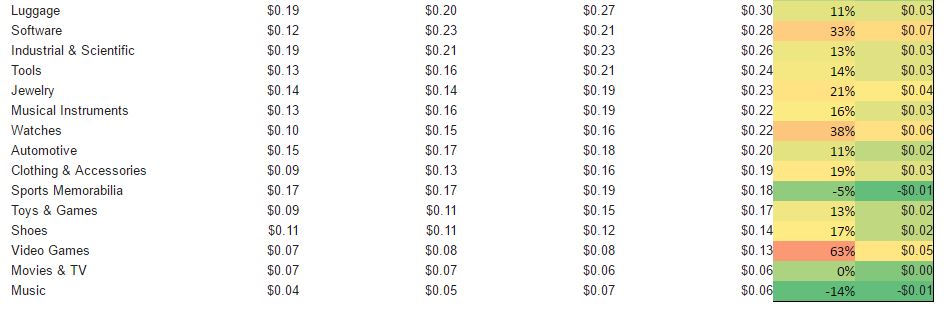

Below are the average winning CPC bids by category on Sponsored Products from April 2012 to July 2016:

The biggest takeaway is that CPC’s went up in all categories (with the exception of music & sports memorabilia) and the average winning CPC bid by category increased approximately 20% ($0.28 to $0.34) from Jan. 2016 to July 2016.

Other takeaways include:

![]()

![]()

![]()

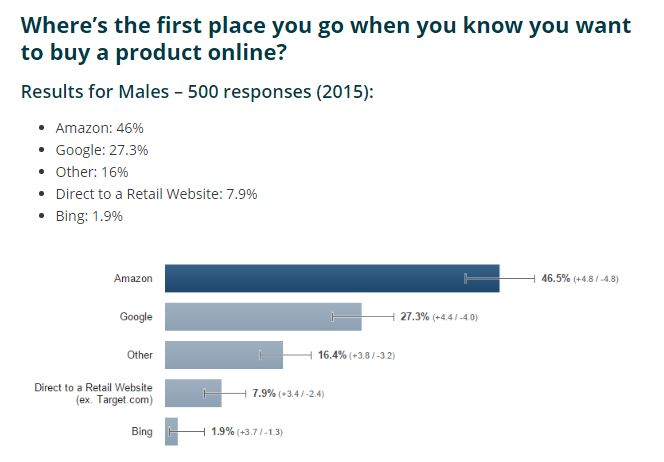

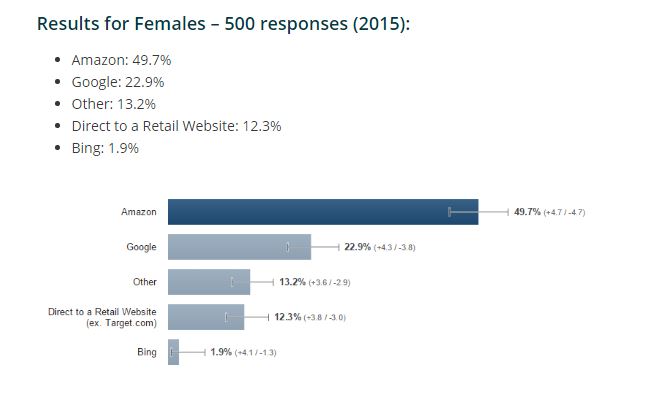

CPC Strategy first reported the shift in Amazon product searches in November 2015, after we conducted a survey of 500 males and 500 females ages 18 to 65+ across the US to find out which channels they would use to buy products online (see below):

According to Bloomberg’s report in late September, the shift to Amazon as the number one shopping destination is growing:

“Fifty-five percent of those surveyed go to Amazon first when searching for products, an increase from 44 percent a year earlier, according to a Labor Day weekend poll of 2,000 people released by the Internet marketing firm BloomReach Inc.”

“The second annual survey showed search engines, such as Google and Yahoo, and retailers losing ground to Amazon. Search engines were the starting point for 28 percent of those surveyed, declining from 34 percent a year earlier. Specific retailers were the starting point for 16 percent, down from 21 percent.”

Morgan Stanley research shows that more than 50 percent of Amazon’s mobile traffic growth is coming from its app.

app.

“It wasn’t so long ago that web users were faced with a slate of options to find information online – Yahoo, Altavista, Excite, Lycos – just to name a few,” Nii A. Ahene, COO at CPC Strategy said.

“Google grew to dominate the space, due to their ability to serve the most relevant results for browsers consistently and as a result the word Google evolved from a noun into a verb. If Amazon’s dominance around product-focused searches continues to grow I don’t think it’s farfetched to see a similar semantic evolution occur around happen in retail search: ‘Amazoning it’.

https://tinuiti.com/blog/2015/11/online-shopping-destination-2015/

It’s nearly impossible to have a discussion about Amazon’s growth without mentioning their recent spike in Prime memberships & overall Prime Day success.

Referred to as the “biggest day in the history of Amazon”, Amazon Prime Day on July 12th increased customer orders more than 60 percent worldwide compared to the event last year.

In the U.S. alone – Amazon saw a 50 percent increase in customer orders and was named “the biggest day ever” for Amazon devices sold globally.

According to additional reports, aside from Amazon products other top selling items included mostly electronics (ex: TVs (90,000+), Lenovo laptops (14,000+), iRobot vacuums (23,000+ ), headphones (200,000+), and more).

The growing demand in electronics is directly reflected in the 89% jump in average winning CPCs from January to July of this year.

CNBC experts estimate that Prime Day added between “$500 million and $600 million in incremental sales to the retailer’s topline”.

“While a boon to retailers on the platform, it was also a reminder of the influence that Amazon has on the broader e-commerce ecosystem. The retail giant is unmatched in its ability to essentially create a new holiday with the intent of growing their Prime membership base ahead of Q4,” Petriello said.

“What this means for retailers going forward is that they must continue to get more sophisticated and optimize their approach to FBA inventory allocation to ensure their products are best positioned in front of an ever growing body of Prime members.”

Study Reveals Top Online Shopping Destination for 2015