2019 Holiday Shopping Behaviors: The Complete Guide For Advertisers

The holiday shopping season is merchants’ biggest opportunity of the year to reach new audiences, build brand loyalty, and generate peak revenue — and it’ll be here before we know it!

To help merchants prepare their holiday strategies, Tinuiti surveyed over 2,000 U.S. consumers to learn more about their holiday shopping plans.

By understanding who’s shopping and how much they’ll spend on what, as well as when, where, and why, merchants can fine-tune ad spending and marketing campaigns, optimizing their investments and positioning themselves for holiday success.

Here are some of our key findings.

Holiday spending continues to rise year-over-year. The NRF reported that holiday sales spiked by 5.5% in 2017 and 2.9% in 2018.

Approximately 10% more shoppers than last year say they’ll spend at least $500 this holiday shopping season. And 1 in 10 consumers say they’ll spend over $1,000 — twice as many as in 2018.

Ecommerce accounts for a lot of that growth. According to Adobe, holiday ecommerce sales rose 14.7% in 2017 and 16.5% in 2018, and we can expect them to continue to increase this year.

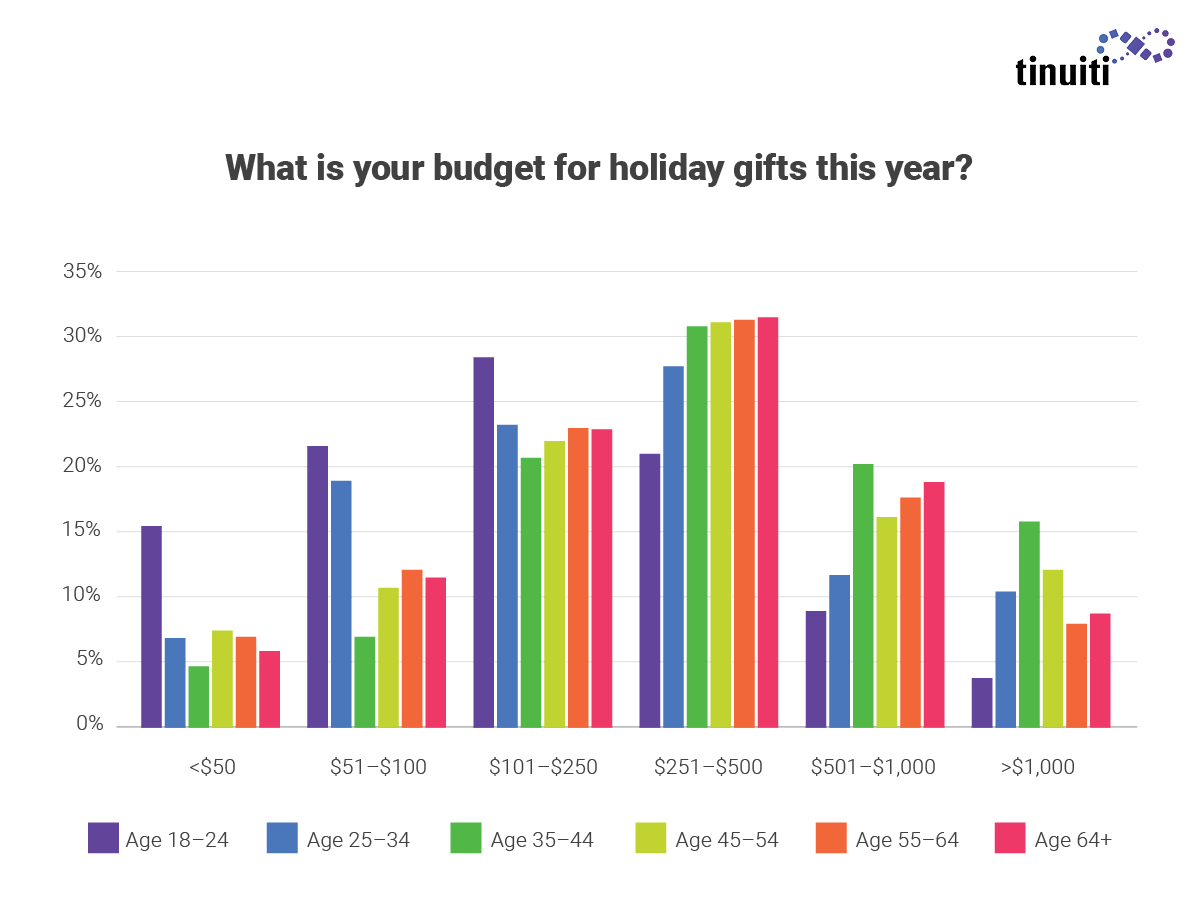

Age plays a big role here:

Tailor your marketing to your target audience’s demographics. If you want to sell to younger shoppers, a budget-conscious approach might work better than a focus on high-end gifts.

On the other hand, if your target market is made up of Gen X shoppers, they may respond better to a focus on quality and luxury.

Holiday shopping seems to start earlier and earlier each year. Thanksgiving falls later than usual this year (November 28), so don’t wait for Black Friday weekend to start targeting holiday shoppers.

The majority of consumers plan to start their holiday shopping before Thanksgiving, including 45% of shoppers who plan to spend $500 or more. That’s a big opportunity for merchants to engage shoppers early and often through promotions and marketing efforts. of the shopping holidays with sales and advertising efforts.

Shoppers who focus on bargains — like Millennials and Gen Z — are more likely to wait until the big discount days after Thanksgiving to start their shopping:

No matter who your target market is, Black Friday and Cyber Monday continue to dominate as the year’s biggest shopping days, with Thanksgiving coming in third. Sales for each of these discount days have grown every year, suggesting that no matter when consumers start their shopping, they’re still receptive to relevant offers.

Across age groups, the top 3 gift categories are:

If you don’t currently offer gift cards, now is the perfect time to start! Gift cards appeal to nearly every age group and shopping segment. Promote your gift cards throughout the season and across touchpoints, especially as the holidays get closer; online gift cards make great last-minute gifts. For the best customer experience, make sure that you outline clear redemption policies and delivery methods on your store.

Email remains the number one promotional channel to reach holiday shoppers, beating out social media. Use email to target early shoppers and top spenders, and social media to connect with younger consumers. Here’s some advice on how to make the most of email promotions this year:

“It’s not your imagination – the holiday promotional period does creep a little earlier every year, with some brands even running ‘Black Friday in October.’ While it’s difficult to maintain strong sales momentum for months at a time, there are opportunities to capture early revenue pre-Cyber Week.

Single’s Day (11.11) is now the top shopping day globally, and running an email promotion for this event can jump-start your holiday sales weeks before Black Friday, capturing a larger share of wallet from early holiday shoppers. Our clients have also seen success offering early access for major Cyber Week sales to their email database or a subset of VIP subscribers. Giving your subscribers a sense of exclusivity builds loyalty and drives revenue – win, win!”

– Mandi Moshay, Associate Director, Email & CRM

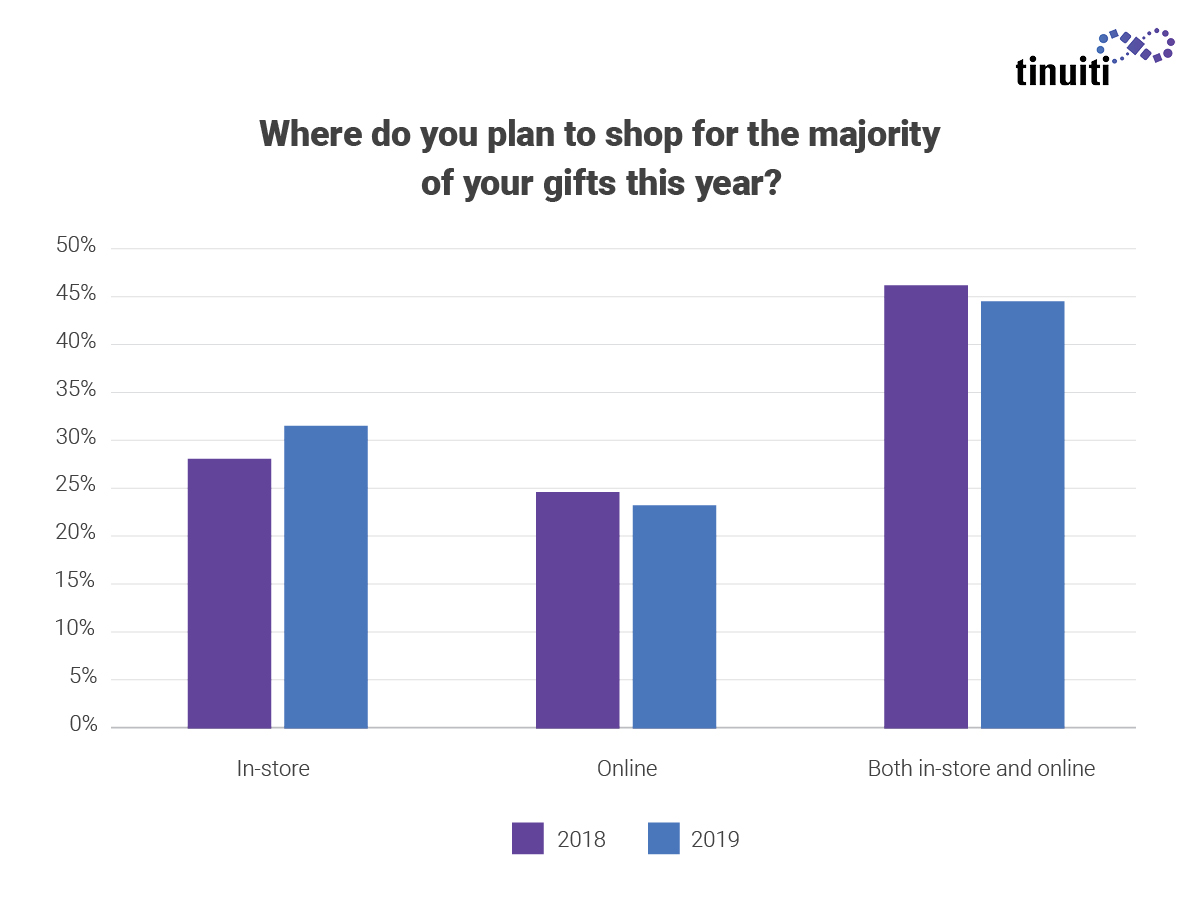

The short answer: both.

Brick-and-mortar stores are becoming more popular with every age group. Shoppers now expect omnichannel shopping experiences, with more than 40% saying they plan to use buy online, pickup in-store services this year.

That said, nearly three-quarters of shoppers begin their search for gifts online. For 28.3% of consumers, that means starting on Amazon — and Amazon outranks all other ecommerce sites when it comes to gift buying.

If you sell on Amazon, make sure you have a coherent marketplace strategy, paid placements, and consistent messaging and creative across the platform.

Whether you sell online, in-store, or both, returns are a big part of the holiday shopping experience. 40% of shoppers returned at least one gift they bought or received in 2018. That’s why three-quarters of shoppers say that a hassle-free, clearly-stated return policy has an impact on purchase decisions.

Returns and exchanges can also represent a post-holiday opportunity to re-engage shoppers in-store and online.

For even more actionable takeaways, [download the full guide here.]