Amazon itself made big moves in 2018, expanding into dozens of white-label brands and even breaking their own Cyber Monday record [again]. It was a whirlwind 12 months for the retail giant to say the least.

Are you all caught up on the Amazon changes 2018 saw? If not, take a minute to fill yourself in.

1. Amazon Rebrands Advertising Features

In September, Amazon rebranded all of their AMG, AMS, & AAP features under a new name called, “Amazon Advertising”.

Taking a page out of Google’s book (who recently renamed Google AdWords to Google Ads), here’s what Amazon said in the announcement:

“We are excited to announce that from now on we are simply Amazon Advertising. With this, we are retiring the names Amazon Media Group (AMG), Amazon Marketing Services (AMS), and Amazon Advertising Platform (AAP). You’ll see this change on our website and in simplified product names that reflect this unified brand and the direction of our business.”

Amazon Advertising New Feature Names:

- Headline Search Ads will now be called ‘Sponsored Brands’

- Amazon Advertising Platform (AAP) will now be called ‘Amazon DSP’ (to more accurately represent the capabilities of this programmatic ad buying tool)

- Amazon Marketing Services (AMS) will now be called ‘Advertising Console’

Full Story: “Amazon Advertising | Rebranding Efforts For AMG, AMS, & AAP“

2. Introducing Amazon Attribution

For the first time, using Amazon Attribution, brands can measure the impact of display, search, and video channels based on how consumers discover, research, and buy their products on Amazon.

Amazon Attribution (announced in November) is a new beta measurement solution that provides brands that sell on Amazon with sales impact analysis across media channels off Amazon.

With on-demand reporting, Amazon attribution allows advertisers and brands to uncover the insights needed to optimize their media campaigns and grow product sales.

According to Amazon, this new feature also provides a comprehensive view of how each marketing tactic contributes to a brand’s shopping activity on Amazon.

Amazon Attribution allows brands to:

- Measure: Gain insight into advertising channel effectiveness through Amazon sales impact analysis

- Optimize: On-demand attribution reporting allows for in-flight optimization

- Plan: Review channel performance and relevant Amazon audience segment insights to help plan future marketing strategies that can maximize ROI

Full Story: “What is Amazon Attribution?“

3. New Product Targeting Options in Sponsored Products

As of December, Amazon advertisers have more control over the way they target customers with Sponsored Product Ads using product targeting. Advertisers are already pretty excited to implement this new feature and for good reason.

With product targeting, it’s easier to reach shoppers as they browse detail pages and filter search results for specific products similar to yours.

What is changing for Sponsored Products Targeting?

Introducing Product Targeting:

The first big change is that advertisers will be able to target customers by product (in a similar fashion as Product Display Ads). Advertisers will be able to target either specific ASINs or categories and apply refinements by price, brands or star rating.

Improvements for Auto-targeting:

The second new feature is an improvement to Sponsored Products’ auto-targeting. Now, negative targeting will allow advertisers to choose product auto-targeting or keyword auto-targeting.

Full Story: “Amazon Sponsored Products New Product Targeting Features“

4. Amazon Breaks “Cyber Monday” Record – Again!

Amazon broke its own record on Cyber Monday, selling more products worldwide than any other day in its history.

This year Amazon customers worldwide ordered more than 18 million toys and more than 13 million fashion items on Black Friday and Cyber Monday, combined.

According to David Weichel, VP, Product Development at CPC Strategy the data we compiled during the holiday implies several takeaways for Amazon sellers & advertisers:

- An increase in competition. The Amazon ad landscape is more competitive. Generating the same sales as 2016 or 2017 – now requires sophisticated advertising strategies (to get the same results or better) in 2018.

- In 2018, customers expected more long-term deals. Customer expectations are no longer hyped around gimmicky one-day sales. Customers expect deals & savings to be extended beyond the one-day shopping holidays of past years. Amazon has already started to shape customer expectations by extending their own Prime Day to 2 days.

- Omni-channel is still trending. Black Friday is becoming more of an “omni-channel” or ecommerce shopping holiday. As holiday retail strategy, in general, has become more “omnichannel”, the traditional Black Friday retail brick-and-mortar holiday is taking over ecommerce.

- Amazon is experiencing steady year over year growth. Overall, from Black Friday to end of Cyber Week, we’re seeing solid YoY growth. Online shopping is continuing to grow, and at rates that are profitable for Advertisers on Amazon.

Full Story: “CPC Strategy’s Amazon Black Friday Cyber Monday Recap [2018]“

5. Amazon Launches Born To Run Program

One of the biggest challenges for Vendors on Amazon is launching a brand new product with no sales velocity & convincing Amazon to purchase enough product orders to keep the item in stock.

Thanks to the introduction of Amazon’s latest program, “Born to Run” – select Vendors now have the opportunity to launch new products on Amazon at an accelerated rate rather than having to wait to ramp up sales & positive reviews.

According to our experts, this program is a huge deal & could potentially solve one of the largest problems Vendors face today.

Aside from sounding like a Bruce Springsteen hit record, “Born to Run” is a program that allows vendors to successfully launch new products faster.

Vendors can choose their initial 10 week inventory position (also referred to as the “Launch Buy Quantity” or LBQ) for a new product launch in exchange for:

- Full return rights on all unsold products from the Launch Buy Quantity, &

- AMS support on the launch ASIN worth 10% of the Launch Buy Quantity’s cost.

For example, if an Amazon Vendor is about to launch a new Bluetooth speaker and they are confident the product is going to sell well on Amazon, they might want to apply for “Born to Run” to jump-start the Amazon flywheel.

Full Story: “What is the Amazon Born To Run Program?“

6. Amazon’s Accelerator Program Opens

Amazon is leveraging a new feature called the Amazon Accelerator Program to expand their “exclusive product offerings” and “help create more brands to be sold exclusively on the website”.

If you purchase from Amazon often, chances are you’re not just using Amazon’s distribution and shipping channels anymore.

With dozens upon dozens of private label brands to its name, you’re likely buying Amazon-manufactured products, too—and you might not even know it.

If it sounds like an exaggeration, data shows that Amazon private label brands are growing rapidly. According to SunTrust Robinson Humphrey, Amazon’s private label business is on pace to generate $25 billion in sales by 2022.

Last year, Amazon’s batteries, for example, saw 93% year-over-year growth and now account for 94% of all batteries sold on Amazon.com.

Another example is Baby wipes—sold under the Amazon Elements line— which grew 266% (in 2017) sitting just behind big-name brands like Huggies and Pampers.

Our Brands is a collection of Amazon private brands and a curated selection of brands sold exclusively on Amazon.

According to the announcement from Amazon:

“With Our Brands, we are bringing high-quality products at great prices to our global network of customers both directly (B2C) and commercially (B2B).

Full Story: What is the Amazon Accelerator Program?

7. Amazon Experts Gather at “AdDiego 2018”

Over 150+ experts representing retail brands and CPC Strategy gathered at the beautiful Alexandria campus in sunny San Diego last week for our annual AdDiego conference.

This year featured a full day of expert discussions around innovative Amazon strategies to drive growth in Q4 and beyond.

The event was packed with seasoned Amazon experts, successful retail brands like Franklin Sports, Nixon, and Guthy|Renker, insightful conversations, and delicious food and drinks.

“Amazon’s ecosystem is rapidly changing,” said Rick Backus, CPC Strategy’s CEO, setting the tone for the day’s presentations in his opening speech.

“Brands that want to win in an Amazon-dominated landscape need to understand the way that Amazon operates.”

You need to be agile, sophisticated, data-driven, and ready to act quickly on Amazon’s moves. It’s more important than ever to have working, innovative strategies that drive real growth in today’s competitive marketplace.

-Rick Backus, Co-founder and CEO of CPC Strategy

Here’s a brief recap of each of the presentations held throughout the all-day event in chronological order.

Full Story: “AdDiego 2018: A Day of Networking & Learning Amazon Q4 Strategy“

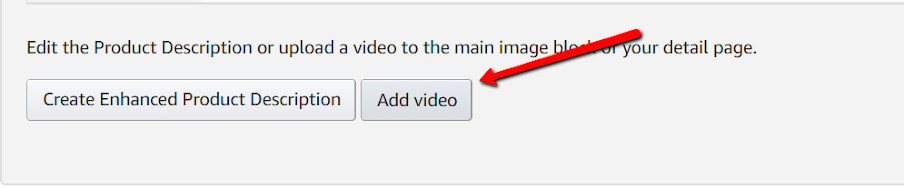

8. Video Opens To Brand Registered Amazon Sellers

As of August, brand registered 3P sellers have the option to “Add Video” to their product detail pages.

Before this was only available in Beta for some 3P sellers or specific categories.

Benefits of Video for Brand Registered Sellers:

- Video can increase your product conversion rate.

- Video is a great opportunity to share the value adds of your product, how to use, info on the brand, and what makes your product stand out.

- Video can also help negate negative reviews by clearly stating what the product does and doesn’t offer.

Full Story: “Video Now Available To Brand Registered Amazon Sellers“

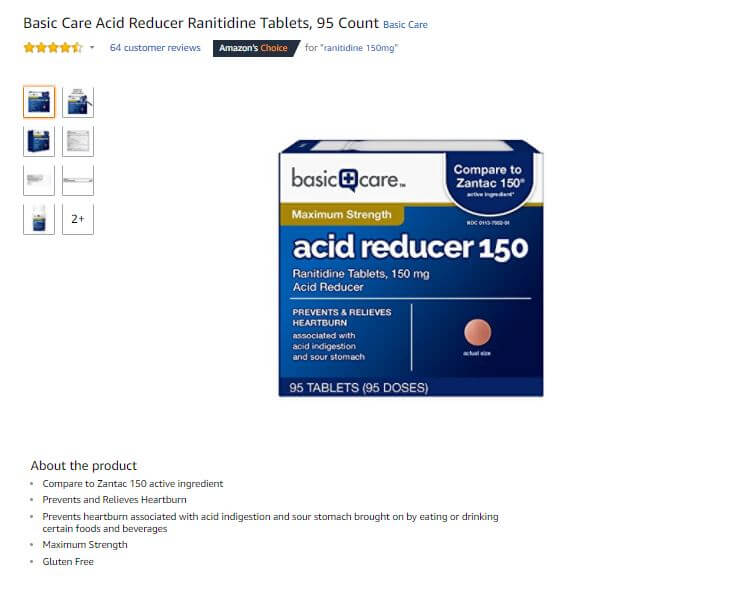

9. Amazon Basic Care Targets Drugstores like CVS and Walgreens

In March, Amazon expanded its brand, looking to take on CVS, Rite Aid, Walgreens and other drugstores with its latest Basic Care line of products.

In partnership with Perrigo OTC, Basic Care includes a variety of branded over-the-counter medications, like painkillers, cold medicines and even nicotine gum.

Currently, the line includes about 60 products, serving a variety of needs from basic health care to hair regrowth.

The line was quietly launched back in August and could hurt already-struggling drugstore chains across the nation – particularly those that rely on foot traffic and impulse buys.

Basic Care is essentially Amazon’s over the counter medicine e-commerce solution.

It offers the most commonly used and purchased health care, cold, cough and sleep medications, though they’re not the name brands you’re used to seeing in store.

Think of it like Target’s Up & Up and Walmart’s Equate brands – a minimalistic, white-labeled line that’s primarily there to offer lower prices than name-brand items can.

Basic Care categories include allergy/cold/cough, children’s, digestive, feminine hygiene, hair growth, pain and smoking cessation, and the product line runs the gamut, offering everything from ibuprofen, stomach acid reducers, allergy medicine and children’s cough syrup.

Full Story: “Will Amazon Basic Care Wipe Out Drugstores like CVS and Walgreens?“

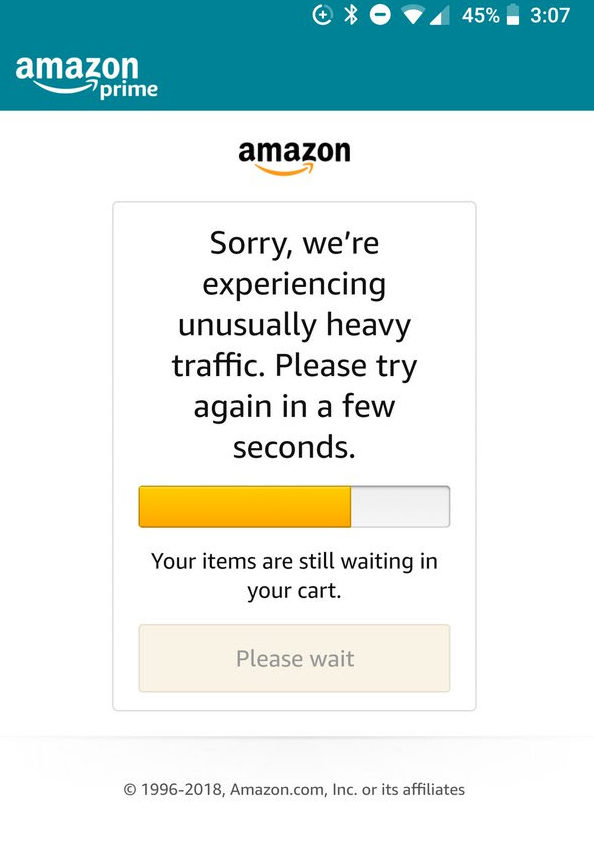

10. Prime Day Breaks Record – regardless of website glitch

It should come as no surprise that Amazon Prime members enjoyed the biggest global shopping event in Amazon history on Prime Day 2018.

According to Amazon’s official press release, on Prime Day small and medium-sized businesses worldwide have exceeded more than $1 billion in sales on Amazon.

Unfortunately, due to a website glitch, the launch of Amazon Prime Day 2018 did not go as smoothly as planned.

In the following article, we take a closer look at what actually happened to Amazon’s website on Monday.

In the following article, we take a closer look at what actually happened to Amazon’s website on Monday.

We also spoke with our own in-house experts to find out how they were able to successfully increase sales – regardless of the temporary website difficulties.

Full Story: “The 2018 Amazon Prime Day Recap: Sales, Success Stories, & Server Issues“

For more information on Amazon advertising in 2018, email [email protected]

You Might Be Interested In