Back to School Ads: How Advertisers Can Prepare For An Unpredictable School Year

The 2021 back-to-school shopping season will present fresh challenges and opportunities for families and the marketers who hope to engage them. Brands need to begin preparing their strategies and plans immediately to launch campaigns with enough lead time before students go back to school.

To help retailers and brands stay ahead of evolving conditions, Tinuiti surveyed more than 2,000 families with children in K-12 schools to discover their attitudes and concerns as they plan for the coming academic year.

Here are some of our key findings and what they mean for advertisers planning back-to-school campaigns.

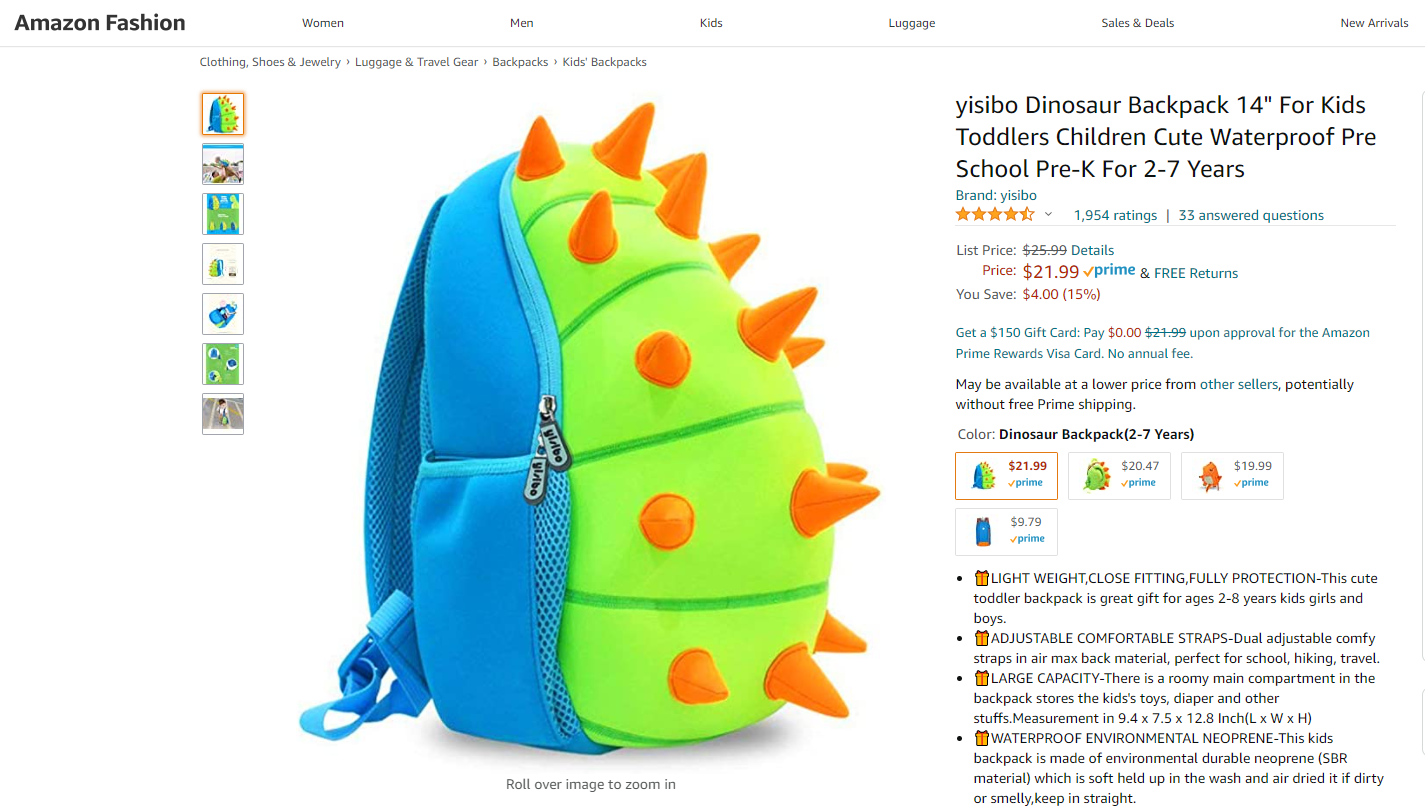

When buying basic school supplies, like pencils and backpacks, families with K-12 students turn first to big-box stores like Walmart and Target. Amazon is a close second, with more than half of respondents planning to make back-to-school purchases from Amazon.

How families plan to shop often aligns with whether or not students plan to attend school in person. Families of in-person learners are more likely to buy supplies in person, while those with remote students are heavy online shoppers. Meanwhile, those with hybrid learners are more likely to shop both online and in person.

Even among online-only shoppers, big-box stores maintain a slim lead over Amazon.

Approximately 68% of online back-to-school shoppers say they’ll order from big-box retailer websites and apps, compared with 65% who will buy from Amazon. This opens up a significant ad opportunity on ecommerce marketplaces for advertisers targeting back-to-school shoppers.

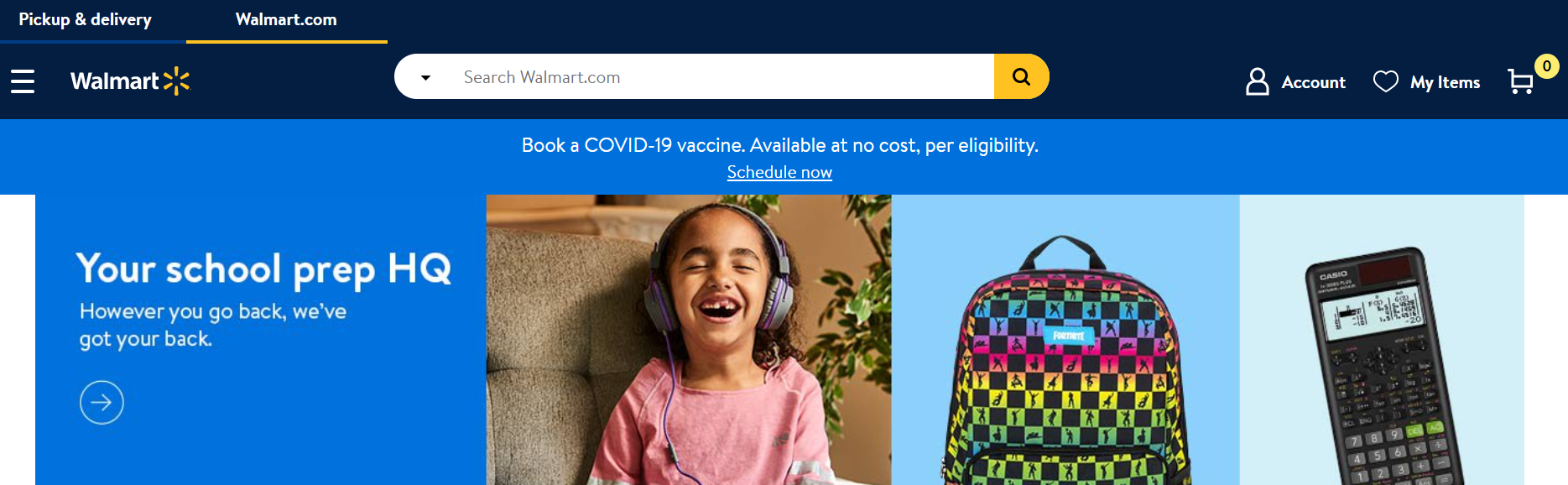

With big-box stores being the most popular choice for back-to-school shopping, retail media ad opportunities on ecommerce marketplace platforms like Walmart are worthwhile investments. Advertisers should consider establishing product feeds and paid campaigns across a variety of marketplace platforms, starting with Walmart and Amazon.

Walmart recently combined its digital offerings across Walmart.com, Online Pickup and Delivery, and the Walmart App to create a more holistic digital shopping experience. Historically, advertising across these offerings has been separate. But as of March, Walmart Connect has combined these offerings to produce more inventory and optimization levers for sellers.

“Walmart has always connected customers and the great brands they love, and now we have the ability to offer an easy-to-use platform to enhance those connections at scale. We’ve built a substantial business that can serve clients in a way no one else can – as a closed-loop omnichannel media company. By expanding our offerings we’re creating measurable value for our partners and customers alike in our ecosystem and beyond.”

– Janey Whiteside, Chief Customer Officer, Walmart

This change means that advertisers can get their messaging in front of shoppers right when they’re making purchasing decisions about back-to-school shopping.

“With the consolidation of OPD and .com, it’s increasingly important for sellers to keep a close eye on KPI volatility considering the fact that all swim lane changes occurred behind the scenes. These changes are likely to bring an increase in impressions and clicks so sellers will want to ensure that that increase is also positively influencing sales, conversion rate and return on investment.”

– Stuart Clay, Associate Director, Marketplace Strategic Services at Tinuiti

Many shoppers are uncertain about whether vaccine availability will make them feel safer in stores. For advertisers looking to increase in-person shopping, messaging about in-store safety protocols may encourage shoppers using pickup services to venture indoors.

Finally, when it comes to regional promotions and ad buys, marketers should factor in the prevalence of in-person versus remote schooling choices, as they tend to align with shopping habits across regions.

This year more than ever, timing matters. In-person and hybrid-schooling families plan to start back-to-school shopping earlier than average, while online-only learners’ families will likely begin shopping later.

But how many K-12 students plan to return to in-person learning?

Overall, the bulk of back-to-school shopping is set to occur in July and August, with 72% of families saying they’ll start preparing for school then. To stay ahead of this busy shopping season, advertisers should begin preparing back-to-school campaigns and promotions as soon as possible.

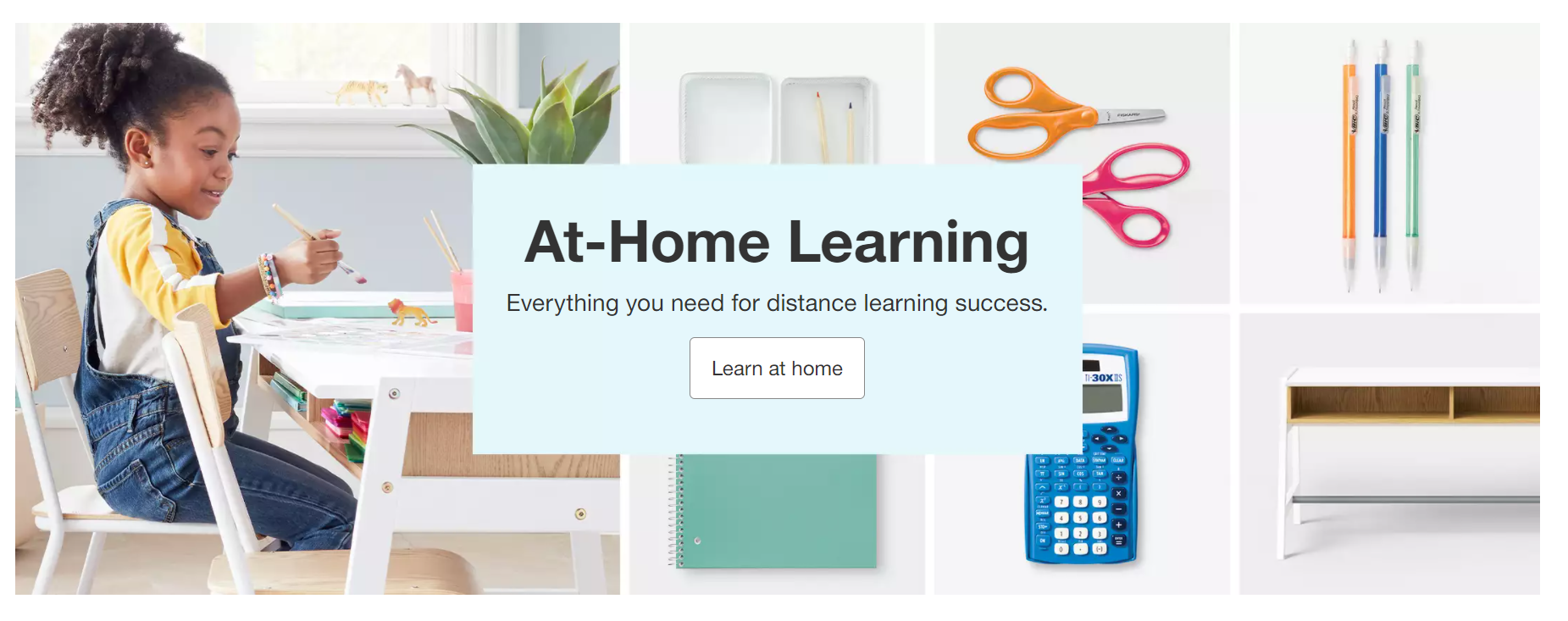

Due to calendar upheavals, online learning, and safety concerns, back-to-school spending in 2021 will highlight new priorities.

This year, traditional and digital school supplies top consumers’ back-to-school shopping lists. Apparel, which is typically the most popular back-to-school shopping category, will be the lowest-ranked priority for 2021.

Here’s how shoppers ranked their top product categories:

In response to these shifting priorities, marketers should consider bundling product categories in new ways. For example, in-person learners may need PPE alongside traditional school supplies, while remote learners may need multiple sets of headphones.

Marketers should also pay close attention to the 36% of families with children doing e-learning at places outside the home. This valuable group is forecast to spend slightly more than respondents overall in 2021, and mobile ad placements can reach these on-the-go shoppers. Advertisers can target this audience with relevant products and promotions that encourage purchasing items in multiples, so every remote learning location is well-equipped.

All in all, as retailers and brands prepare their 2021 back-to-school ads, they must keep their audience’s schooling and shopping preferences and regional variations top of mind. With a flexible approach, retailers can develop creative offerings and messaging that reflect customers’ current needs, earn sales, and build trust.

The findings in the Back-to-School Shopping Report are illuminating for marketers strategizing for an unpredictable back-to-school season. Click here to download the full report: “Back-to-School Shopping Report: How the Hybrid World Changed Consumer Habit“