Q3 Facebook Growth Strong as Instagram Continues to Lead the Way

While there have been several dust-ups in the news over the past couple of years surrounding Facebook, it remains the single most important paid social platform for many advertisers. Here we take a look at same-client samples of long-standing Tinuiti Facebook advertisers to show how ad spend on Facebook and its properties has been trending over the last few quarters and which segments are driving the change.

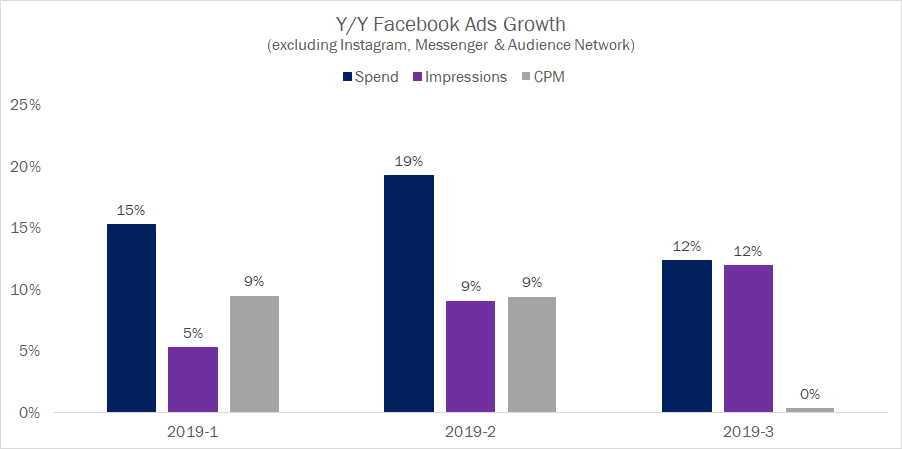

Looking at spend growth for Facebook proper (excluding Instagram, Messenger, and the Facebook Audience Network), spend grew 12% year-over-year (Y/Y) after growing 15% and 19% in Q1 and Q2, respectively.

Impression growth has started to tick up of late, with 12% Y/Y growth in Q3 more than double the 5% impression growth observed in Q1. CPM remained flat Y/Y in Q3 following two straight quarters of 9% increases.

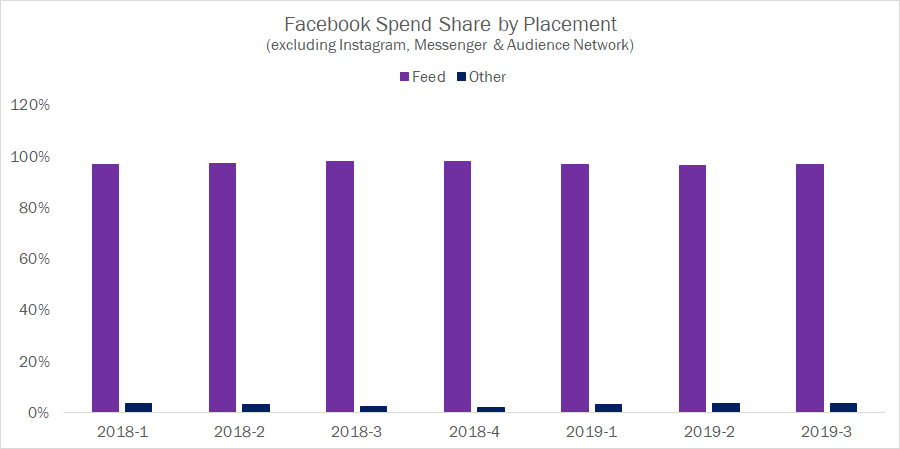

Breaking down Facebook spend share by placement, the feed has accounted for at least 96% of spend every quarter since the beginning of 2018.

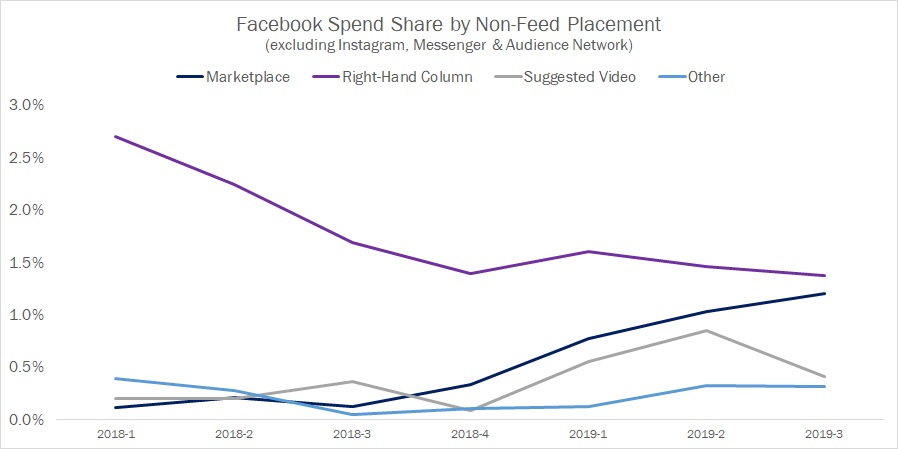

Dissecting the other placements where advertisers are spending money, the right-hand column has long been the second-largest in terms of Facebook spend, but has been trending downward for the last couple of years. The Facebook Marketplace has grown since the beginning of 2018, going from just 0.1% of spend in Q1 of that year to 1.2% in Q3 2019.

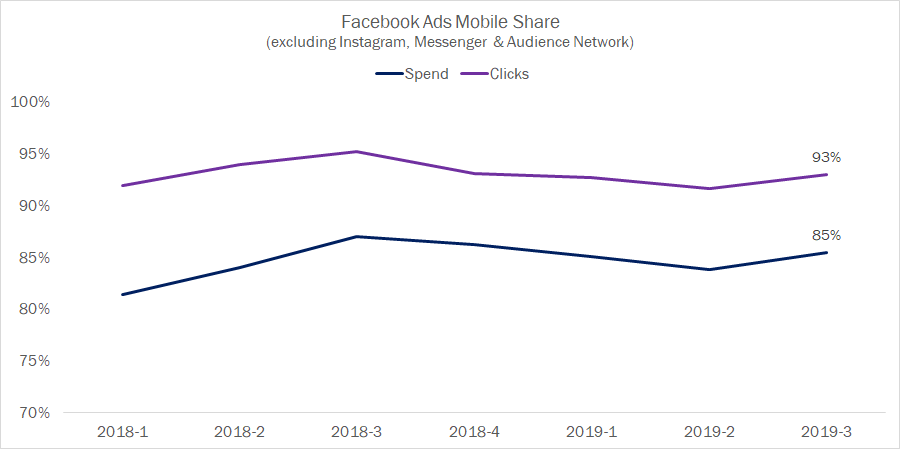

The decline in spend coming from the right-hand column is partially attributable to the growth over time in the share of spend coming from mobile devices, which don’t produce right-hand column ads. Mobile spend share went from 81% in Q1 2018 to 85% in Q3 2019, with click share above 90% every quarter over that time frame.

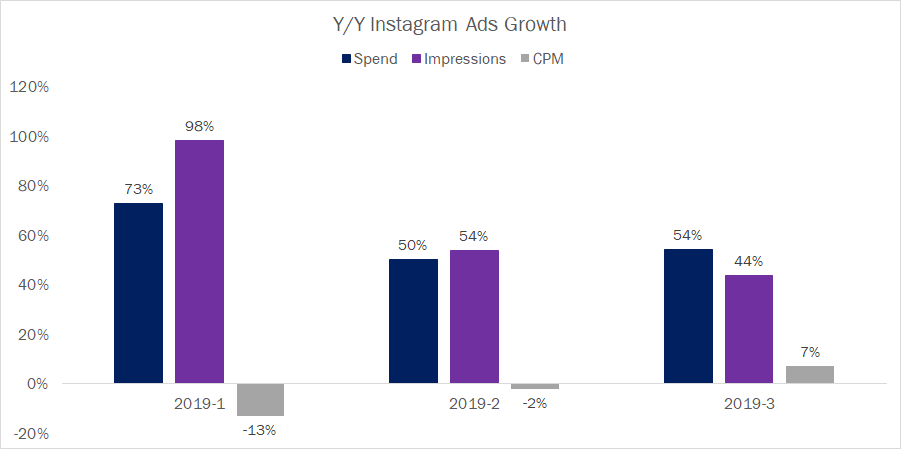

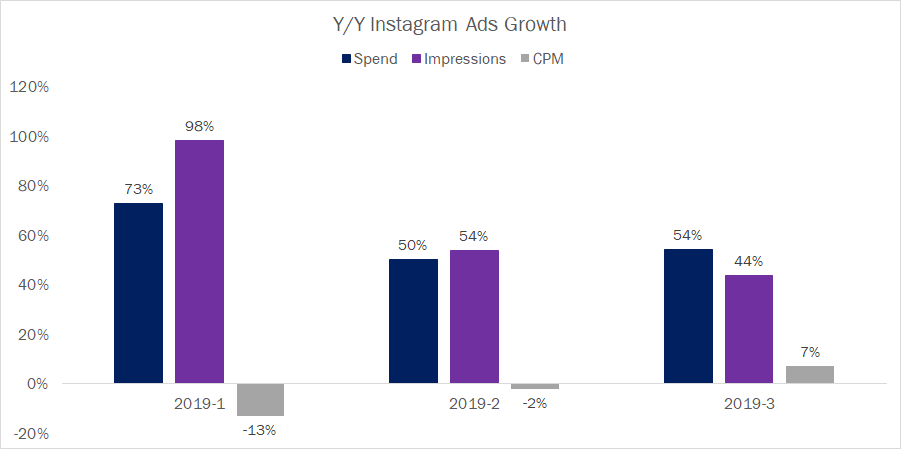

Of course, Facebook proper is the most mature of Facebook’s owned properties, and Instagram continues to far outpace it in terms of Y/Y growth.

Instagram spend was up 54% Y/Y in Q3, following 73% growth in Q1 and 50% in Q2.

In contrast to Facebook proper, Instagram impression growth has been decelerating throughout 2019, though still grew at a robust 44% in Q3. CPM growth went from declines in each of the first two quarters of the year to a 7% increase in Q3, as competition continues to heat up in the space.

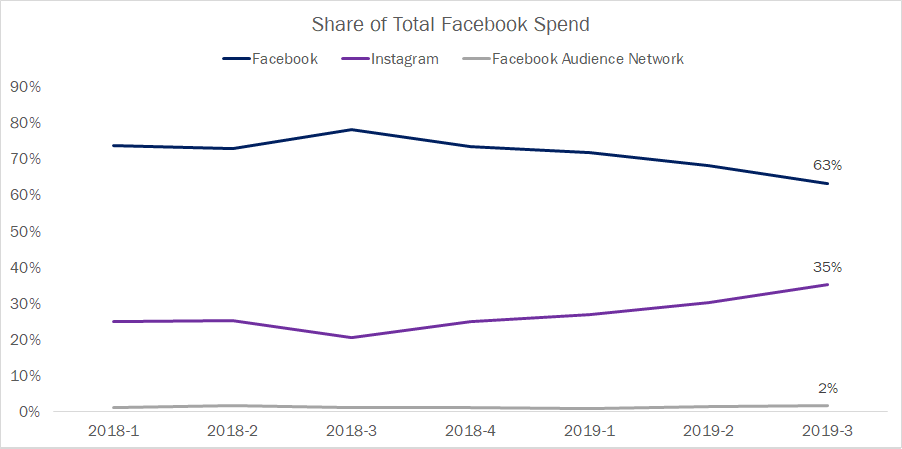

The stronger growth rate of Instagram has meant its share of total investment in Facebook properties has risen over the past couple of years, and now accounts for more than a third of all spend.

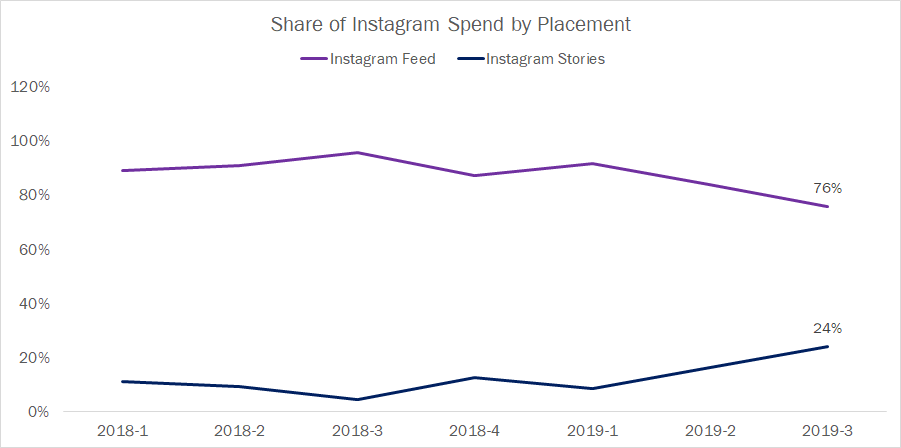

A quickly growing segment of Instagram spend is Stories ads, which have seen increased adoption over the last few quarters and now account for nearly a quarter of all Instagram spend.

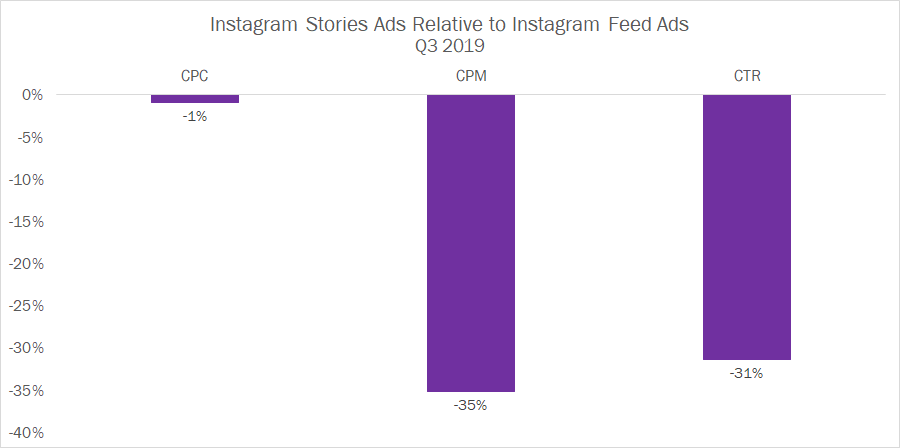

In terms of CPC, Stories ads were nearly identical to those featured in the Instagram feed in Q3 2019, but CPM and click-through-rate (CTR) were both more than 30% lower for Stories ads than ads featured in the feed.

While growth on Facebook proper has steadily slowed over the past couple of years, there’s still significant opportunity to grow existing programs in Q4 and during the holiday season. Though still very small in the big scheme of things, the Facebook Marketplace in particular is picking up over time.

Instagram will almost certainly continue to far outpace Facebook in terms of growth in the coming quarter, and advertisers should consider optimizing campaigns around Instagram specifically to ensure they’re fully taking advantage of the platform. In particular, Stories ads are becoming an increasingly important part of growing on Instagram, and advertisers not targeting these placements may want to reconsider.

Additionally, Instagram growth will likely receive a Q4 boost from ads featured in the Explore tab, which were announced in June this year and have been getting rolled out to advertisers over the last few months. While these accounted for <1% of Instagram spend by the end of Q3, that share promises to head up in Q4.

Moving forward, we’ll be checking in and updating these trends periodically throughout Q4 and beyond to help you stay on top of all of the most important shifts taking shape across Facebook and its properties.