The Importance of Reaching Apple Device Users this Holiday Season

It’s no secret that Apple’s updates to address consumers’ privacy concerns have sent ripples throughout the digital marketing industry. Targeting iOS devices with ads and measuring return on ad spend has become more complicated for users who opt out of tracking when presented with the App Tracking Transparency (ATT) prompt, particularly for social and display advertising. Additionally, metrics like email opens will also become obscured for Apple Mail users with the rollout of iOS 15, and users will also be able to produce ‘burner’ emails through “Hide My Email” to avoid providing true email addresses to businesses.

Even so, marketers need to make sure they’re getting in front of this highly valuable cohort in order to make the most of what promises to be the biggest holiday shopping season ever, and not just because iOS currently accounts for 57% of all mobile operating system use in the US, according to Statcounter. Results from our recently released 2021 Holiday Consumer Spending Trends study comparing respondents who answered on iOS devices to those who answered on Android devices help to show why.

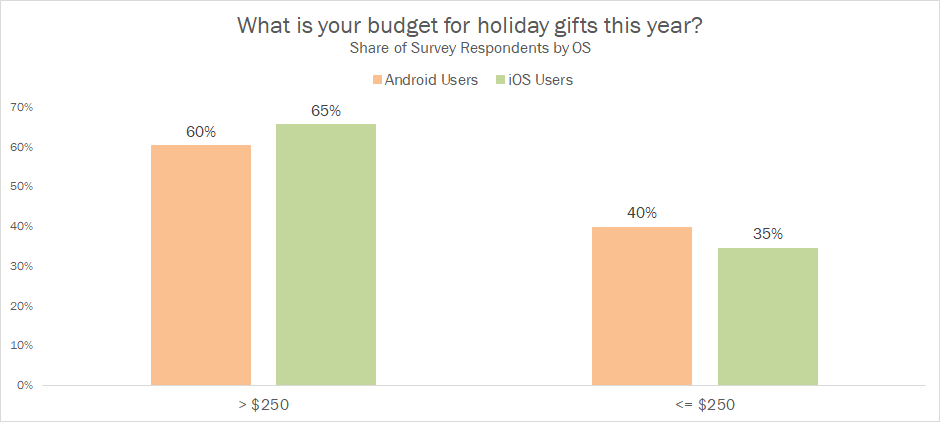

Taking a look at the percentage of survey respondents who intend to spend more than $250 this holiday shopping season, 65% of iOS users expected to do so compared to only 60% of Android users.

Further, looking at the share of respondents with holiday shopping budgets over $1,000, 13% of iOS users expected to have a budget this large in 2021, compared to only 9% of Android users. These findings are consistent with many studies showing that Apple device users tend to be more affluent, and thus more valuable to marketers, than Android users.

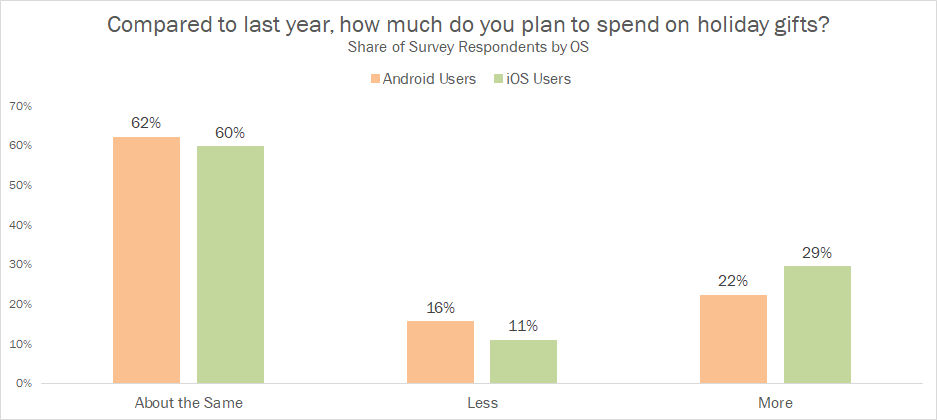

iOS users are also more likely to up their 2021 holiday budgets relative to last year.

A majority of both Android and iOS users intend to spend a similar amount on holiday shopping in 2021 as they did in 2020. However, zooming in on the share of respondents who expect to spend more this year than last year, 29% of iOS users expect to do so, a share that’s more than 30% greater than the 22% of Android users who expect to do the same.

Additionally, only 11% of iOS users expect to spend less on holiday gifts this year compared to last year, while 16% of Android users plan to spend less.

So, Apple device users are more likely to say they expect to spend big this holiday shopping season, and also to say that they’ll increase their shopping budget relative to last year. Getting in front of this group digitally, then, should be a key part of holiday strategy, particularly given that iOS users are also more likely to shop online.

Over half of all survey respondents expect to do at least a majority of their holiday shopping online in 2021, with 15% planning to shop exclusively online. Breaking down the share of respondents who expected to do a majority or all of their holiday shopping online by operating system, 59% of iOS users expected to do so. 54% of Android users planned to do the same.

With so many iOS users ready to turn to online channels for their holiday shopping needs, brands have to overcome any challenges created by Apple’s privacy moves to ensure marketing efforts are reaching iOS users. This is especially true when taken together with the share of iOS survey respondents that expect to spend big this year and who expect to spend even more than last year.

If you’re looking for more details on how to stay in front of Apple users and effectively measure performance in the wake of Apple’s changes, make sure you’re staying tuned in to the regularly updated Tinuiti Future of the Web hub, which features expert tips across a variety of channels and platforms.

Additionally, the Tinuiti 2021 Holiday Consumer Spending Trends report unpacks these and other key insights based on responses from over 2,000 US shoppers on how they intend to behave this Q4. Download the full report and go into the holiday shopping season with a better understanding of how your customers intend to shop in a year that is once again like no other.