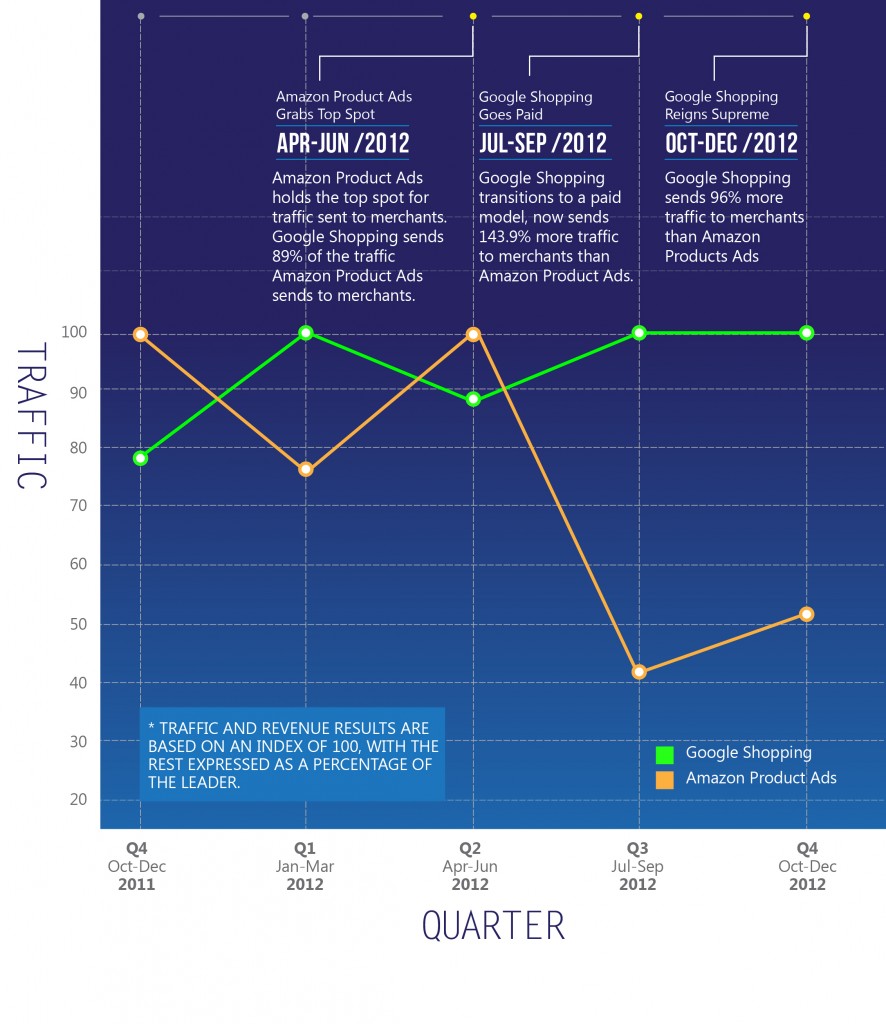

Google Shopping Sends Advertisers 120% More Traffic & Is 32.7% More Cost Effective Than Amazon Product Ads In Q3 And Q4

In Q3 and Q4 2012 Google Shopping officially transitioned to a new commercial shopping engine built on Google Product Listing Ads. After this switch, Google Shopping’s performance compared to rival shopping engine Amazon Product Ads changed dramatically. With a new incentive to show merchant products to consumers, Google sent more than twice as much traffic to merchants from Google Shopping in Q3 and Q4 2012 than it did in 2011.

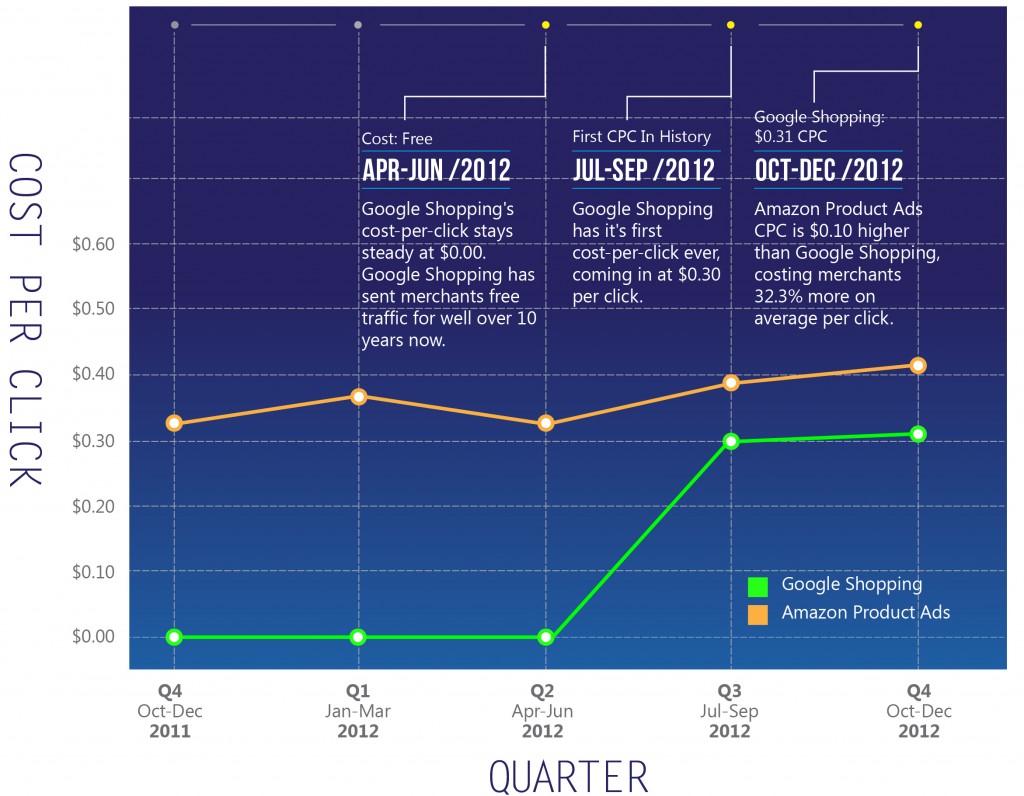

Google Shopping recorded the first cost per click in the program’s 10+ year history in Q3 2012, coming in at $0.30 cents per click on average. During Q4, Amazon Product Ads had an average CPC of $0.41 vs. Google Shopping which had an average CPC of $0.31. Google Shopping was 32.5% cheaper per click than Amazon Product Ads during this period.

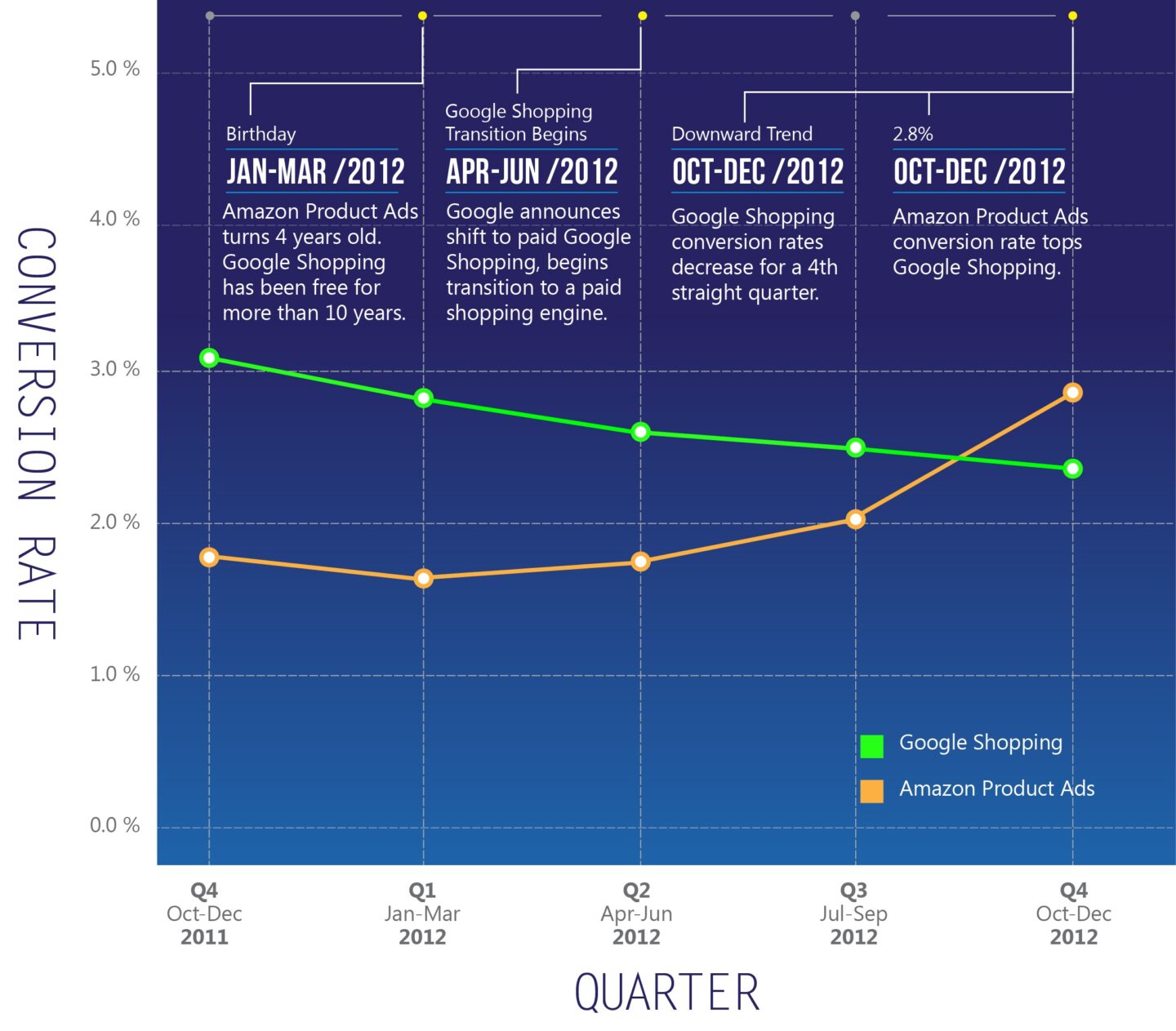

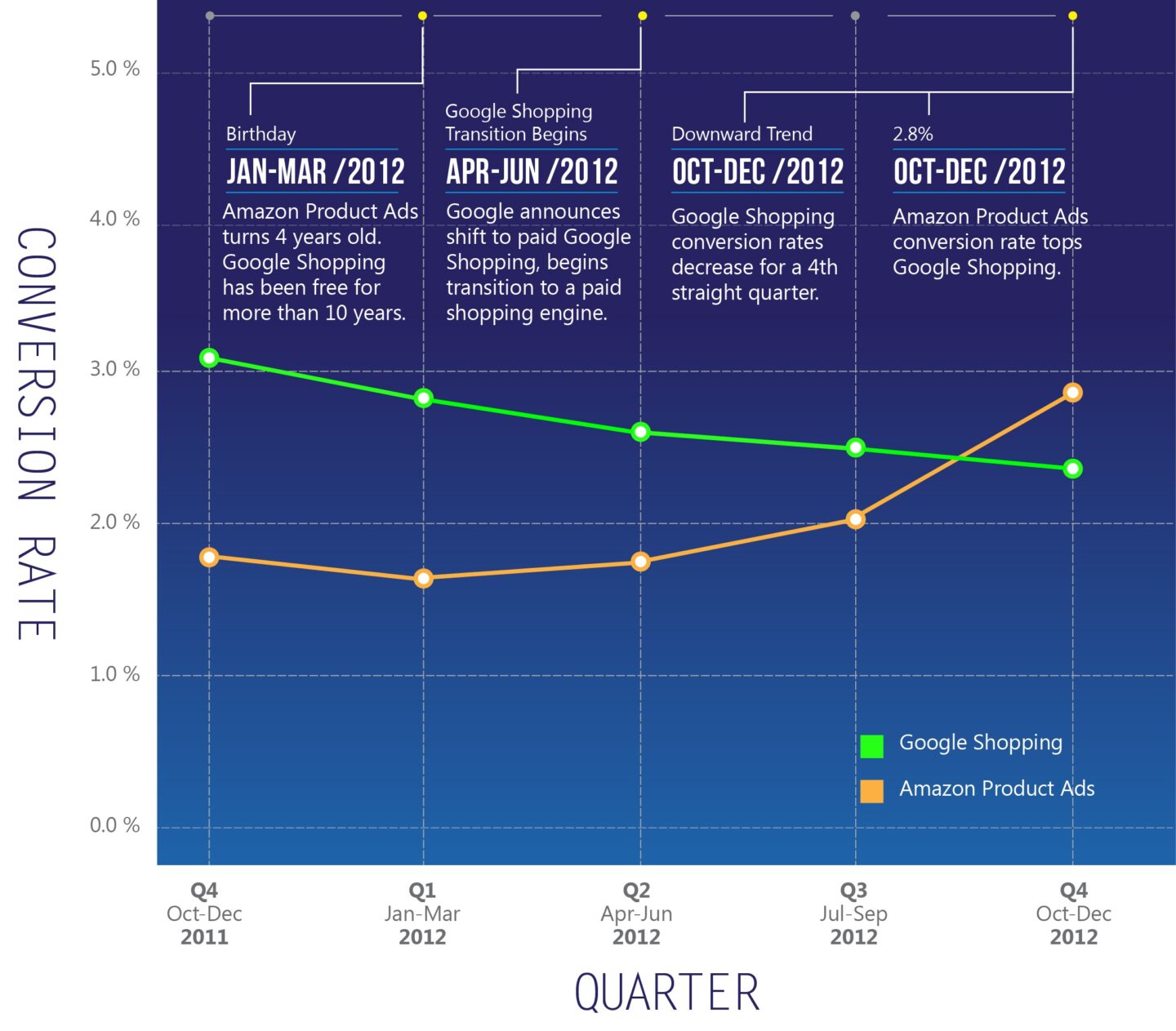

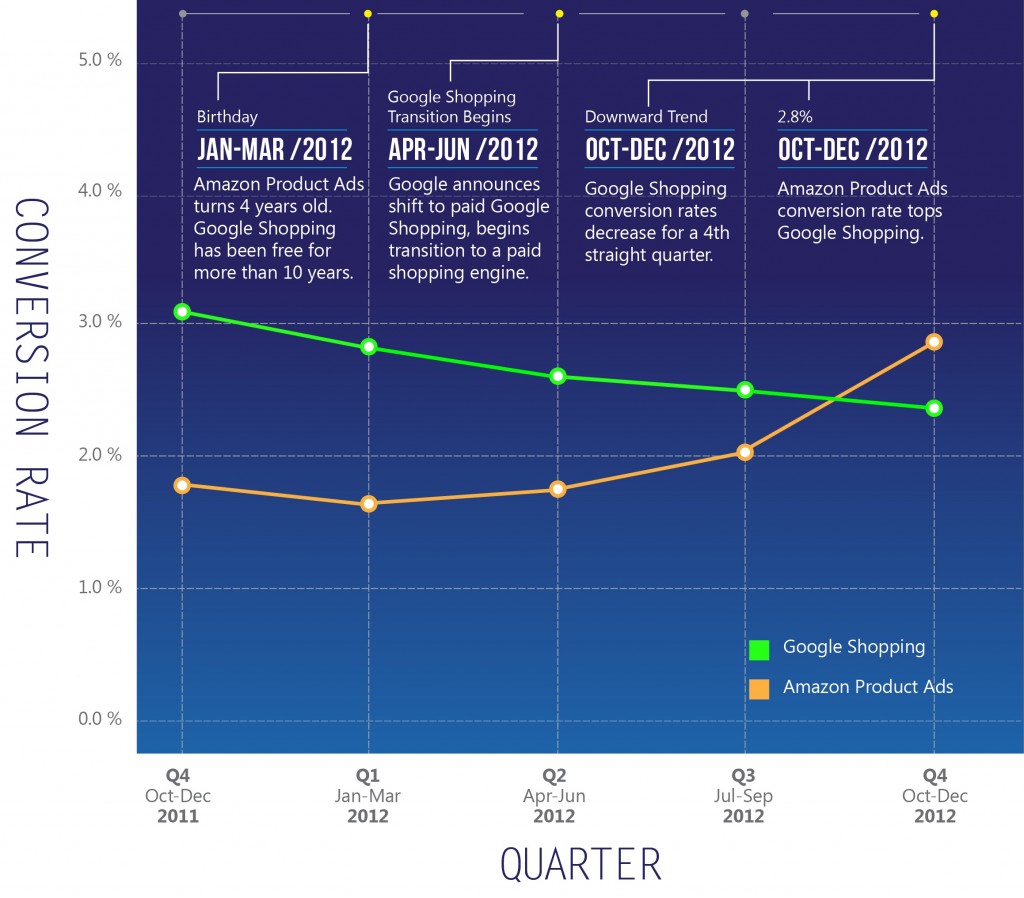

In Q4 2011, Google Shopping had a conversion rate of 3.1%. In Q4 2012 that dropped to 2.4%, a decrease of 22.35% in a year. Amazon Product Ads, on the other hand, saw the opposite. In Q4 2011 Amazon Product Ads had a conversion rate of 1.8%. In Q4 2012 it increased to 2.8%, an increase of 57.5% in a year.

Implementing a major change to the Google Shopping algorithm by making a merchant’s bid play a role in the ad-service process is one take on why conversions dropped consistently throughout Q4 2012, a month where conversion rates traditionally increase.

Amazon Product Ads conversion rate was boosted by Amazon’s continued efforts to establish itself as the most trusted company in the U.S.

Note: Amazon Product Ads did not decrease in traffic during Q3, Google Shopping just sent more than twice as much traffic to advertisers, and in comparison, Amazon Product Ads looks smaller. Amazon Product Ads also saw a larger drop than most other shopping engines after Google’s switch to a paid model, because they’re not actively advertising on Google Shopping themselves, like some other shopping engines are doing.

Note: Amazon Product Ads did not decrease in traffic during Q3, Google Shopping just sent more than twice as much traffic to advertisers, and in comparison, Amazon Product Ads looks smaller. Amazon Product Ads also saw a larger drop than most other shopping engines after Google’s switch to a paid model, because they’re not actively advertising on Google Shopping themselves, like some other shopping engines are doing.

Google Shopping sent 96% more traffic to sellers compared to Amazon Product Ads in Q4 of 2012. It was an abrupt reversal from the Q4 2011 when Google Shopping sent less traffic to merchants than Amazon Product Ads.

Google Shopping’s new paid model and aggressive merchant adoption of the new program encouraged Google to show more Google Shopping ads than ever before. In Q3 2012, when the transition to a commercial Google Shopping took place, Google sent merchants 144% more traffic than Amazon Product Ads, a huge shift from the previous quarter, an average of 120% more for the second half of the year.

The above chart represents the cost per sale merchants pay on average for each conversion through the two shopping engines. For example, a 11.3% cost per sale means that on average, an advertiser is paying $11.30 for every $100 in sales.

Google Shopping was on average 32.77% more cost-effective for advertisers during Q3 & Q4 2012 than Amazon Product Ads. With no minimum CPC bid and powerful search campaign management tools Google Shopping merchants were able to hold onto profits at a higher rate in 2012.

Resources on Amazon Marketing Services: