Google Shopping Trends: Preparing for Q4

Q4 is, without question, the most demanding time of the year for the digital retail industry – particularly on the Google Shopping front. Advertisers are besieged with holiday shoppers making their way through Christmas lists, taking advantage of Black Friday and Cyber Monday deals, and otherwise finding reason to splurge during such a sales-driven season.

With such an influx in shopping traffic, retailers looking to revamp their advertising approaches in the closing months of 2016 should look to the past to see how to adjust for the future. Taking a look at Google Shopping trends from 2015 can be instrumental in garnering as much return as possible in Q4 of this year.

In anticipation of the coming months, we turned to client performance from last year to distinguish what patterns and insights we might be able to use in formulating expectations for 2016.

Unsurprisingly, Thanksgiving, Black Friday, and Cyber Monday amassed the highest revenue jumps in Google Shopping – each coming in with a 55%, 38%, and 24% year over year increase (2014 vs. 2015).

These increases are expected, and maybe even a little obvious – especially during the holiday season. But surveying how Google Shopping trends continue to shift can be critical to your approach in Q4.

The biggest, and perhaps most noticeable, of Google Shopping trends we have seen is one most popular marketplaces come to expect at one point or another: a rise in competition.

Shopping, often seen as a viable tool for a large majority of retailers, has become populated with sellers trying to take advantage of the exposure offered from the Google platform – particularly among big box retailers, such as Macy’s and Target.

Considering the top 10 most searched retail companies are established, household names, it’s no surprise their presence within the ecommerce industry has been so emphatic.

However, most retailers can’t all be the Best Buys and Nordstroms of the world – which makes it difficult for smaller brands and businesses to compete and get as much visibility on the SERP.

Ad spend behaviors are becoming a recurring theme among Google Shopping trends. During this time of the year, evaluating how spend is being distributed by the industry’s leading brands should be indicative of how small business advertisers combat stiff competition.

The Search Monitor conducted a private study analyzing the top-spending advertisers on AdWords and compared their spend in October 2015 to spend in November 2015.

The results were staggering, as they displayed a significant swell in AdWords investment. Over the course of the two-month span, these advertisers had increased ad spend by 316%.

“We have certainly seen the presence of big box retailers having a much larger impact on Google Shopping.” said Jostin Munar, Retail Search Manager at CPC Strategy.

“We’ve definitely started to see a rise in CPCs because these bigger brands are trying to go through and dominate impression shares.”

“As a result, this has started to push out a lot of smaller retailers who are having trouble competing.”

It’s clear big box retailers are looking to amplify their position within the marketplace. This sort of attention has transitioned from being one of many Google Shopping trends, to becoming a perpetual constant. Smaller retailers looking to maintain relevancy will need to restructure their strategies.

Understanding what your budget is and how to best maximize the potential return from it is where many retailers should consider starting.

The concept is simple. Big brands have more money. They have the ability to place higher, ambiguous bids across the board. Smaller retailers, however, often do not have the splendors of flexibility when it comes to meddling with their budgets.

How spend is allocated needs to be calculated and methodical to increase the likelihood of garnering higher returns – especially in the Shopping marketplace. Analyzing and understanding what your highest performing SKUs are can be pivotal in combating big box retailers.

If you’re currently placing bids across your entire product line, consider refining your bid strategies and scaling it down. Take the most popular and highest performing SKUs and bid up on those distinct products.

Your entire line may not see as much exposure, but the products you want to sell most – the products proven to be wanted most by shoppers in the past – will have a better chance selling amongst unwieldy competition.

“Making sure you stay visible on your best performing items is key. Additionally, making sure you’re able to identify items that have really good margins is another approach retailers should consider.”

“You can leverage these high-margin items to act as “introducers” to customers. A customer may click on your introducer item, but end up converting on something else.”

“Really taking this type of data into account when you’re bidding is thoroughly important.”

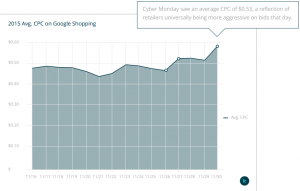

Cost spikes are an inherent part of competitive shopping days, particularly those that fall within Q4. An increase in CPCs falls under the Google Shopping trends we’ve seen in the past.

In reviewing internal data, CPCs have risen roughly 12% year-over-year during the two weeks leading up to Cyber Monday (11/16/15 to 11/30/15).

It’s important to note that there is a fairly sizable difference between CPCs depending on the ad type. The Search Monitor reported the average CPC of text ads were anywhere from 2-4x that of PLAs.

Higher CPCs will make it difficult to reach established ROI/ROAS goals, which means retailers should have contingency plans lined up to help counter lost return due to fluctuating ad spend costs.

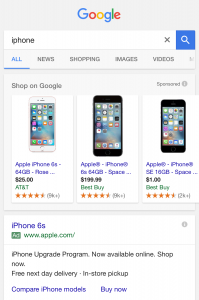

Competitive auctions are often a big component of why advertisers pay higher CPCs. A product with a high search volume, such as “iPhone”, will have an abundance of sellers. Naturally, bids will increase as each seller is vying for the top spot.

Product Feed Optimization should be highly valued when dealing with search terms that are heavily populated. Optimized product content allows your items to qualify for auctions that aren’t as aggressive.

Incorporating additional key words (i.e. iPhone vs. Space Gray iPhone 6s) addresses longtail searches that competing retailers may not have taken into consideration. And while the implementation of enhanced product data feeds can be a small change, they can go a long way.

“Make sure your data feed is optimized. Make sure you have all of the appropriate MPNs and UPCs or GTINs. Make sure your titles and landing pages are optimized.”

“You don’t want to drive traffic to a landing page that doesn’t match what someone is looking for. The thing here is, you want to ensure that everything is as concise as possible all the way through.”

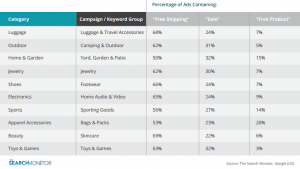

It’s no surprise that customers like getting a good deal. Even less of a surprise, ads with special offers tend to perform better than those without.

In a previously released case study, Google presented data showing the impacts of Merchant Promotions – also known as special offers. Venus, one of the largest direct marketers of women’s fashion and swimwear, increased CTRs by 7% and decreased CPCs by 11% through the use of such promotions.

Many retailers have, naturally, followed suit. Attracting more prospective customers and incentivizing them with additional offers has become a major constituent of an ad’s effectiveness. This held especially true in text ads last year, becoming one of many Google Shopping trends.

While the approval process is fairly straight forward, it’s important to make sure you have everything in order when submitting your feed.

“From time to time, we’ve seen people trying to apply a certain promotion on a particular subset of items, but will accidentally apply it to everything, and it would get rejected.”

“If it’s rejected, you’ll have to start over. You’ll have to go through and remap your feed. Resubmit everything for approval through Google, and end up having to go through the entire process all over again. Which can be detrimental on such important shopping days.”

With the introduction of Google’s new Expanded Text Ads, it’s important to be aware of ad copy and the role it’s going to play in your advertising.

The increased character limits within text ads has had profound impacts on ad display for users. Previously, if all structured snippets and ad extensions were being utilized, an ad could take up 5 or 6 lines of the SERP.

Now, on mobile phones, it’s entirely possible that organic listings may not even appear as PLAs and text ads consume the majority of the screen.

While the ad format is still relatively new, understanding how they can impact your approach in Q4 shouldn’t be overlooked.

“It seems like Google has started to serve expanded text ads (ETAs) much, much more. We anticipated a soft rollout of the ad format initially, but it’s been pretty full force so far.”

“For us, they’ve been performing as well, if not better, than standard text ads right now. So understanding how to structure these appropriately will have a big impact on their efficiency.”

“Make sure that the language being used is geared towards really knowing your audience. Speak to them appropriately when it comes to what your specials are and making sure that all of your site links and ad extensions are up to date. All of this is key for the effectiveness of your ETAs.”

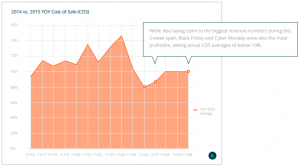

Leading up to high volume shopping days, like Black Friday and Cyber Monday, a lot of ads are going to be clicked on that won’t end up converting right away.

Consumers often dedicate a portion of their efforts toward doing product research, seeking out the best deals, and otherwise doing general browsing before committing to a purchase.

In looking at these particular Google Shopping trends, we were able to look at the cost of sale (spend / revenue = COS) of correlating days between 2014 and 2015.

And while those click-throughs may not immediately convert, there is still value that can be utilized.

“I’d suggest going through and creating new remarketing lists for that specific month. That’s who you’re really going to want to retarget over the next 30 days as people move into Christmas and other holidays.”

“Social is going to play a huge part as well. Especially with Facebook product ads and how well they tie into everything.”

“If you’re going through and searching for something on Google, on the same browser being used for Facebook, you’re going to see a dynamic ad on your Facebook feed.”

“You want to stay top of mind. Especially during this time of the year.”

“Some things to really think about is making sure you have your budgets and fulfillment in place. The worst thing that can happen is running some really great promotions and not being able to fulfill those orders.”

“You’re going to get dinged. There might be a backlash of reviews, Google may deem your site unsafe for purchasing, and that can all really lower your backend quality score with Google and Shopping.”

“This year, it’s going to be big. Amazon’s Prime Day squashed last years. If that says anything of the shift that’s gone from traditional shopping at brick-and-mortars to online shopping, that should be a huge indicator we’re going to see ecommerce really boom this year.”

“It’s always been big. But this year is probably going to be one of the biggest we’ve seen in the Shopping marketplace.”

For more information on Google Shopping Trends, please contact [email protected]

Additional Resources:

The State of Google Shopping: Key Takeaways for 2016

10 Google Shopping Mistakes Draining Your Budget

How to Drive Google Shopping Results via Product Feed Optimization