The 2018 Internet Trends Report is here, offering a macro overview of the biggest trends and power shifts shaking up today’s tech and consumer landscape.

Highly acclaimed by both Silicone Valley and Wall Street, the report’s data points can also guide marketers to where the future of ecommerce and digital marketing is headed.

Here are this year’s 10 biggest takeaways for ecommerce and marketers.

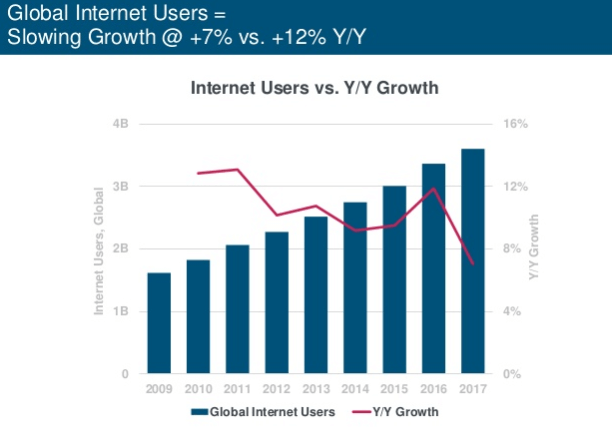

#1. Half of the world population is now online

This year internet penetration hits a historic milestone.

3.6 billion people, or half of the world population, is now connected to the internet.

The developing world now has more access to the internet than ever, thanks to the proliferation of wifi networks and cheaper mobile phones.

However, net new internet user growth has slowed from 12% to 7% Y/Y.

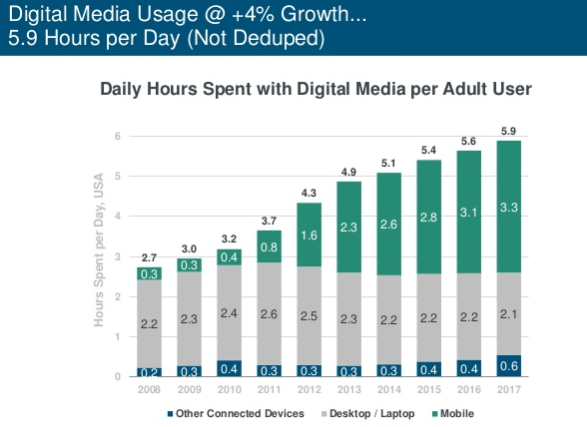

Despite slowing new user growth, time spent online continues to soar, nearly doubling from 3 hours in 2009 to 5.9 hours in 2017.

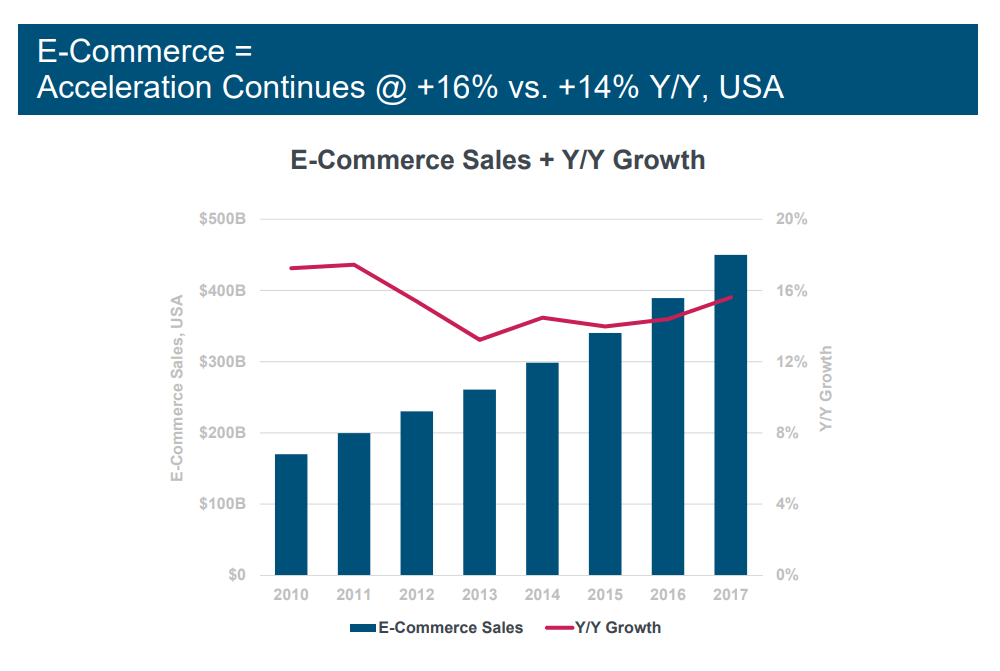

#2. Ecommerce retail continues to grow, with Amazon leading the way

Online retail growth continues to accelerate as physical retail declines.

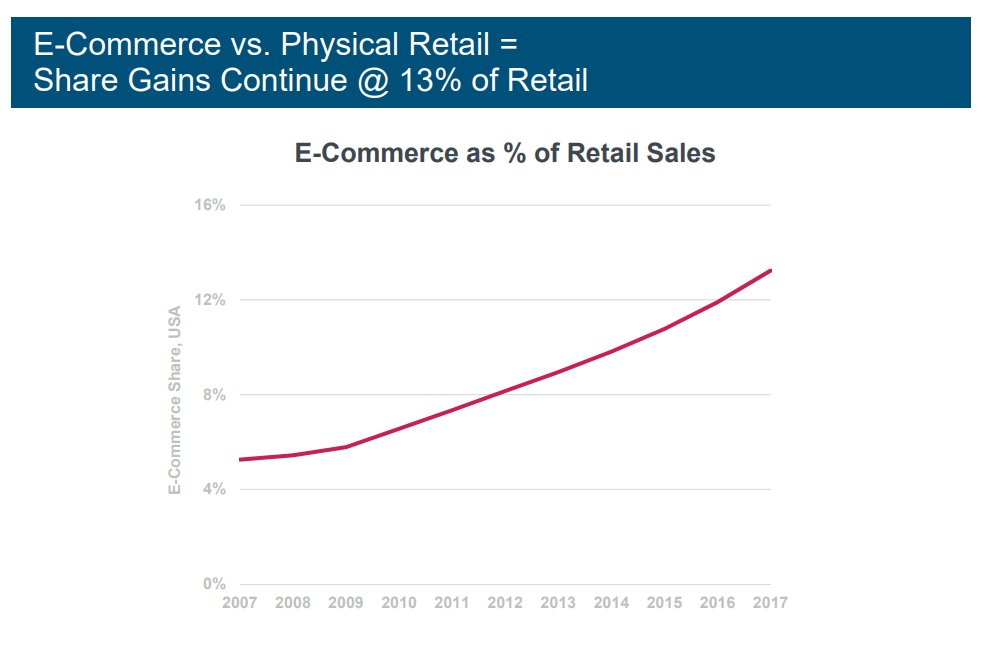

Ecommerce sales have accelerated from 15% Y/Y in 2016 to 16% in 2017, with over $450b in sales.

As a percentage of all retail, ecommerce has nearly tripled since 2009, reaching 13%.

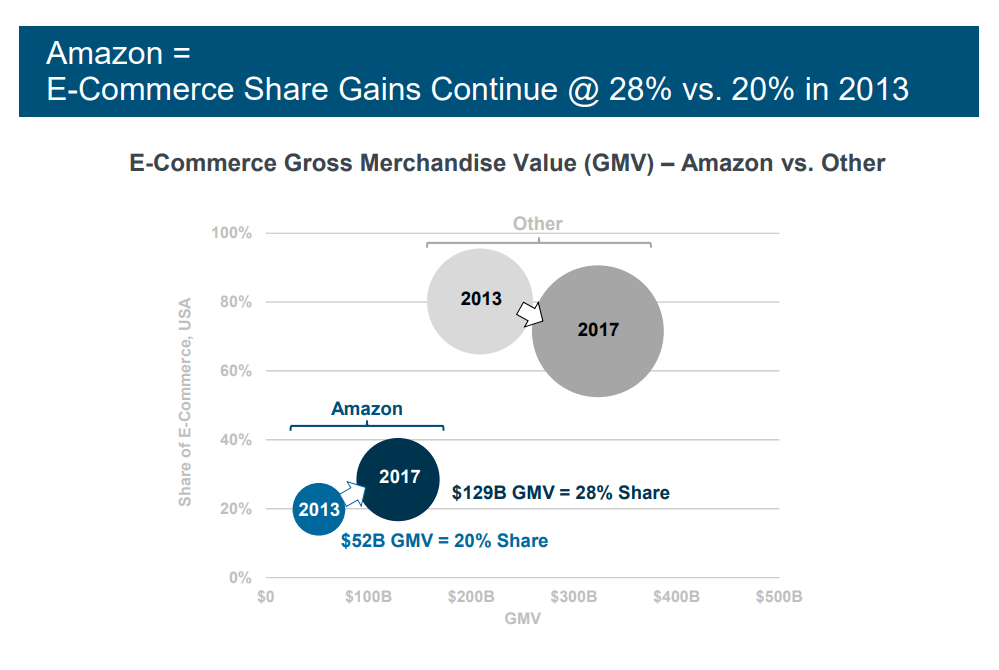

Amazon continues to increase its share of overall ecommerce, growing from 20%in 2013 to 28% in 2017 at $129b.

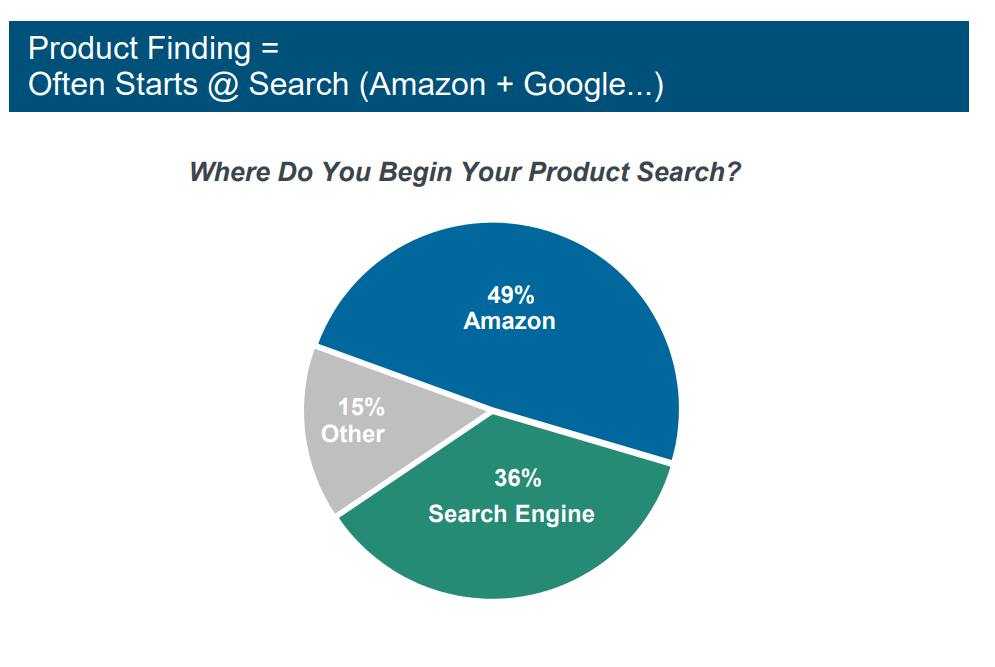

Amazon dominates the search-to-fulfillment process for many verticals. Users who search for products on Google end up having their purchase fulfilled by other competitors (like Amazon).

It is now more important than ever to have a comprehensive Amazon strategy, such as driving traffic to your Amazon store and making use of high-converting creative and enhanced branded content (EBC) on the marketplace.

#3. Social media driving discovery, purchase decisions

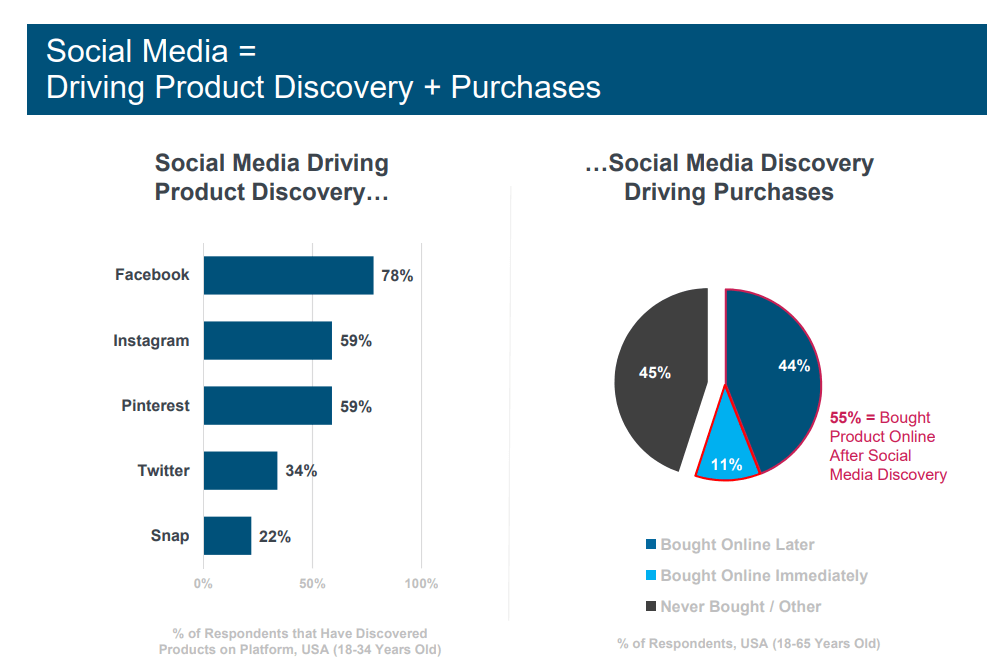

Consumers are discovering products on social media more than ever, and these platforms influence purchase decisions.

55% of people purchased a product online after discovering it on social media.

Facebook, followed by Instagram and Pinterest, is the biggest social media platforms driving product discovery.

As consumers shift toward Facebook and Instagram for finding their new favorite products, it’s imperative to leverage social media channels and tools such as influencer marketing, Power Editor, Facebook Ads Manager, and more.

#4. Customer lifetime value more important as acquisition costs rise

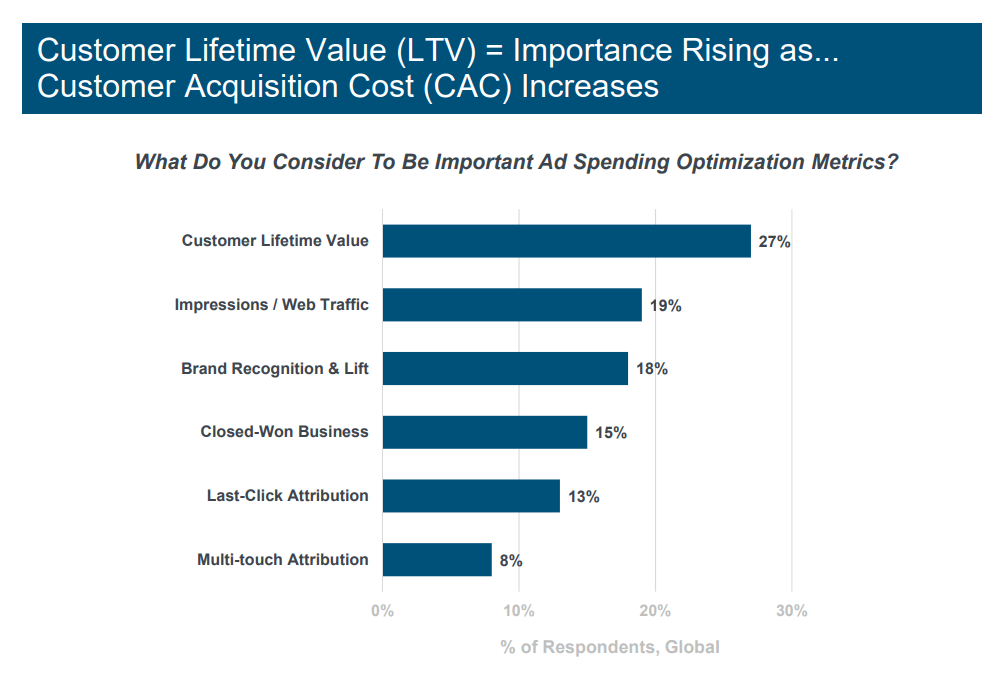

The majority of businesses now rate customer lifetime value as the most important metric for ad spend. This is in part due to rising competition for new customers, causing Customer Acquisition Costs (CAC) to rise.

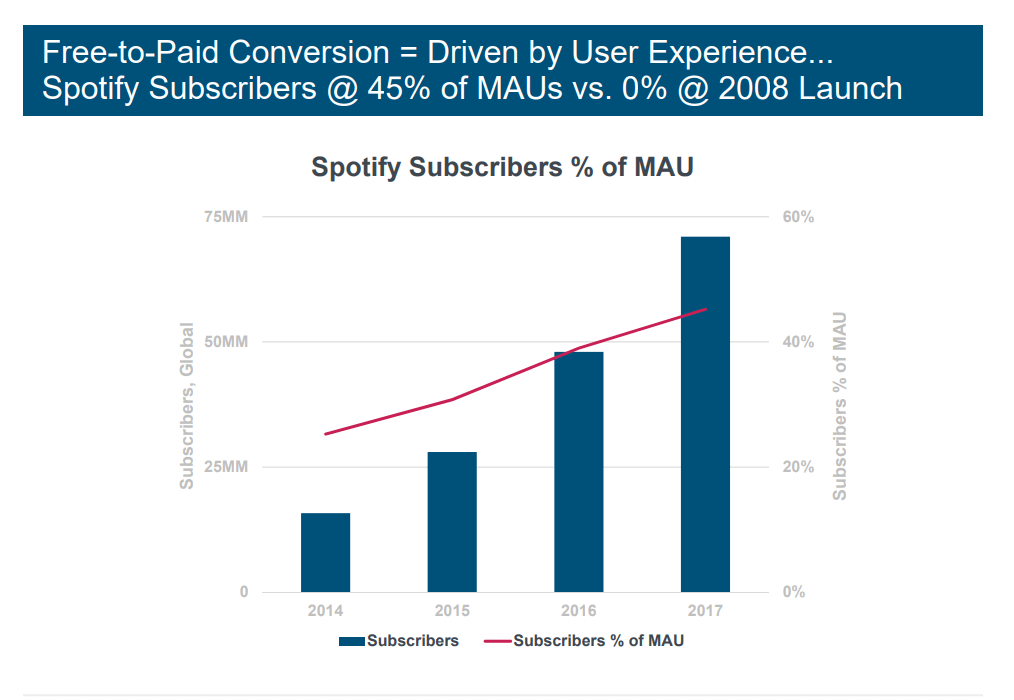

#5. The rise of subscription, “freemium” business models

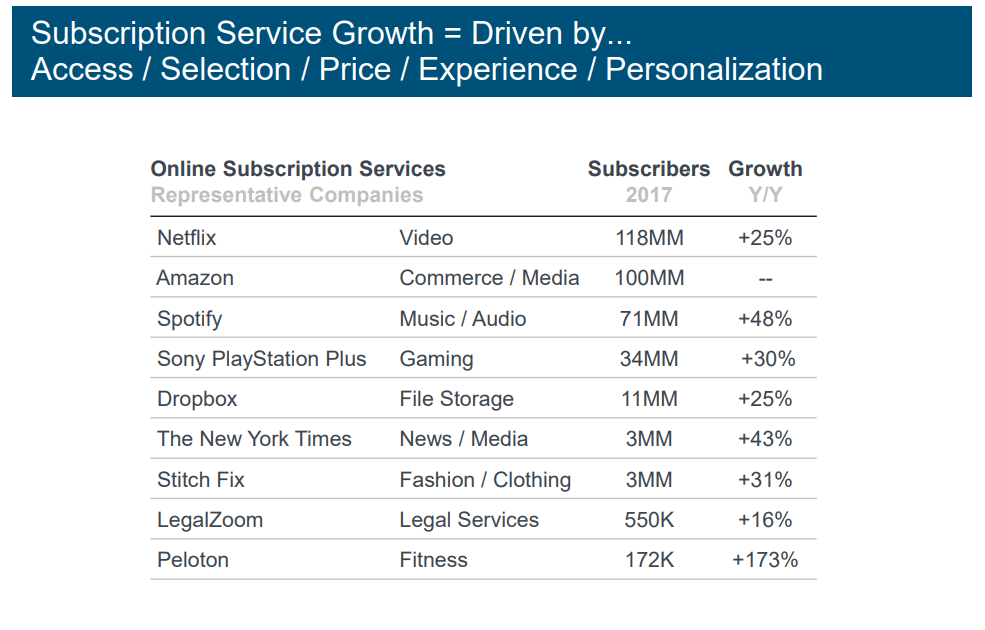

Growth for subscription media platforms continues to soar with double-digit Y/Y growth.

Free, ad-supported subscription models, like Spotify, accelerate subscriber adoption.

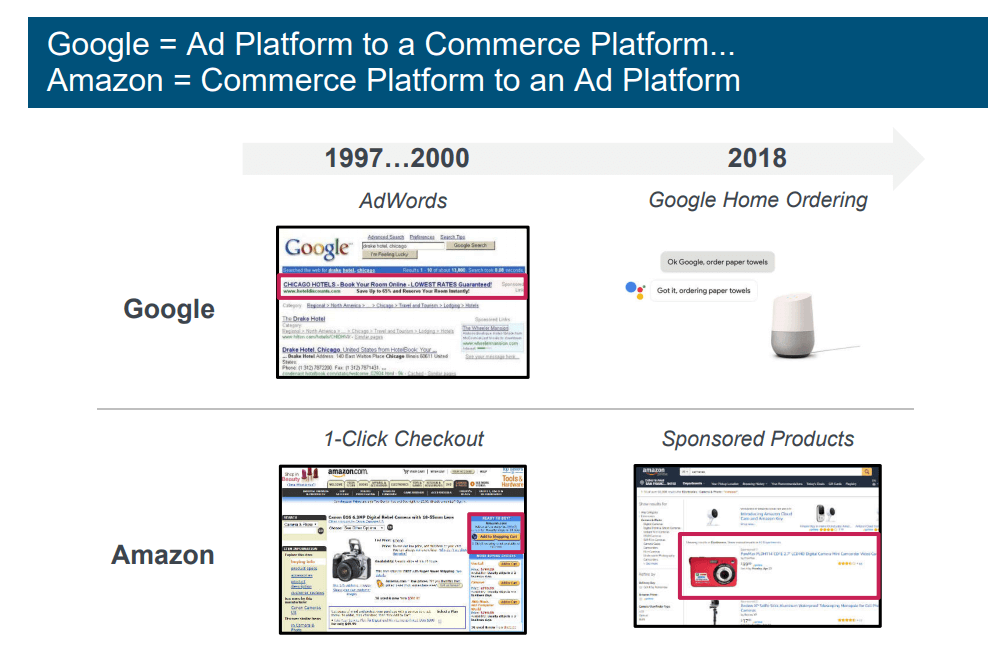

#6. Google and Amazon trying to emulate each others’ strengths

The report also shows that Google and Amazon are in a race to emulate each other’s advertising and ecommerce platforms.

Google is ramping up its ecommerce platform to be more like Amazon’s, whereas Amazon is ramping up its advertising platform to be more like Google’s.

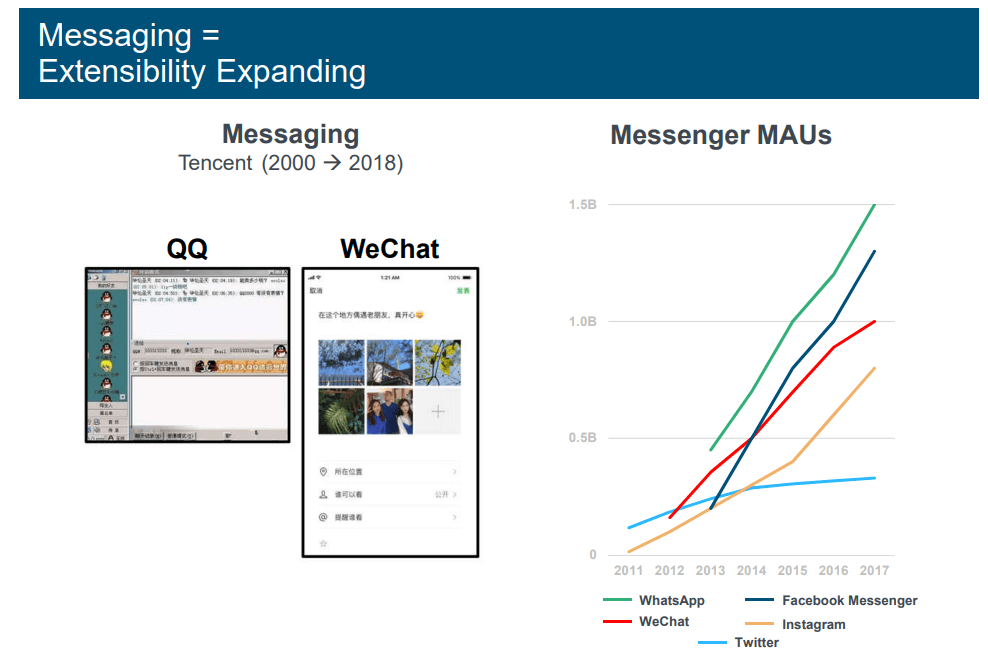

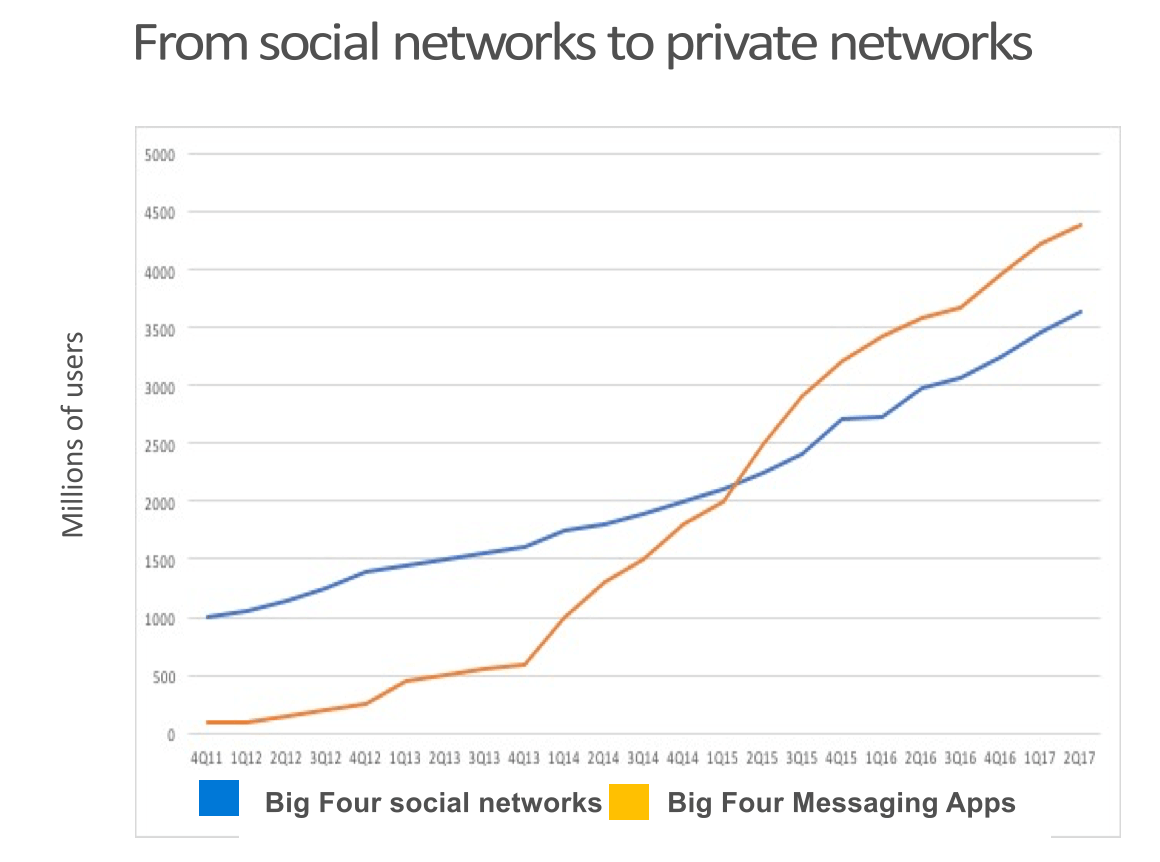

#7. The rise of private messenger apps

Total active users for messenger platforms has skyrocketed in the last 5 years, with Whatsapp and Messenger (both owned by Facebook) totaling over 1 billion users each.

The shift from public social networks to private messenger networks was highlighted late last year by Mark Schaefer.

Businesses that want to scale will want to look beyond social networks to private message services to reach consumers.

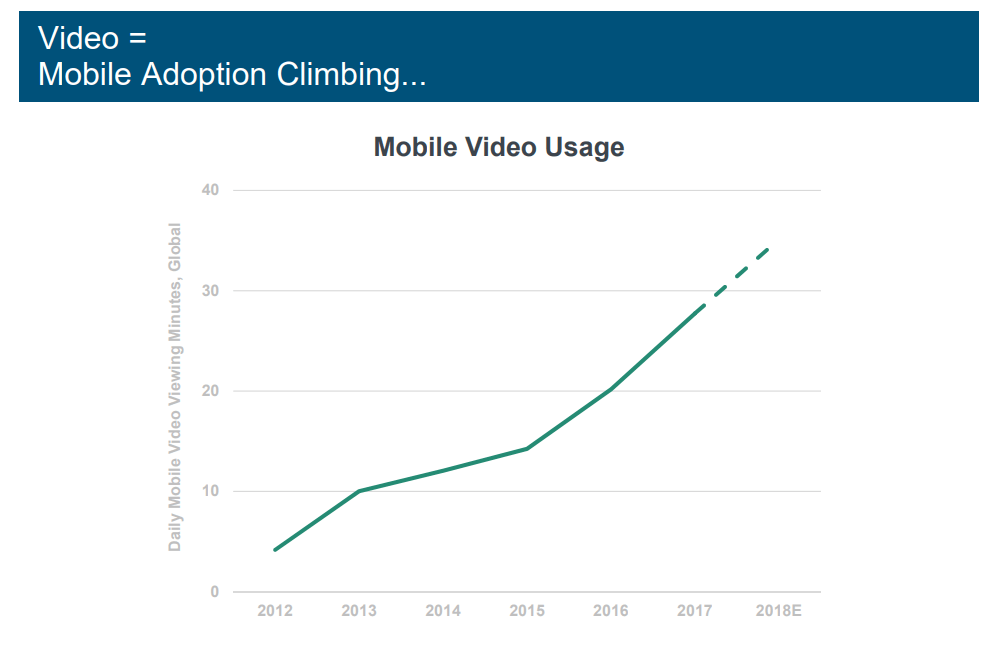

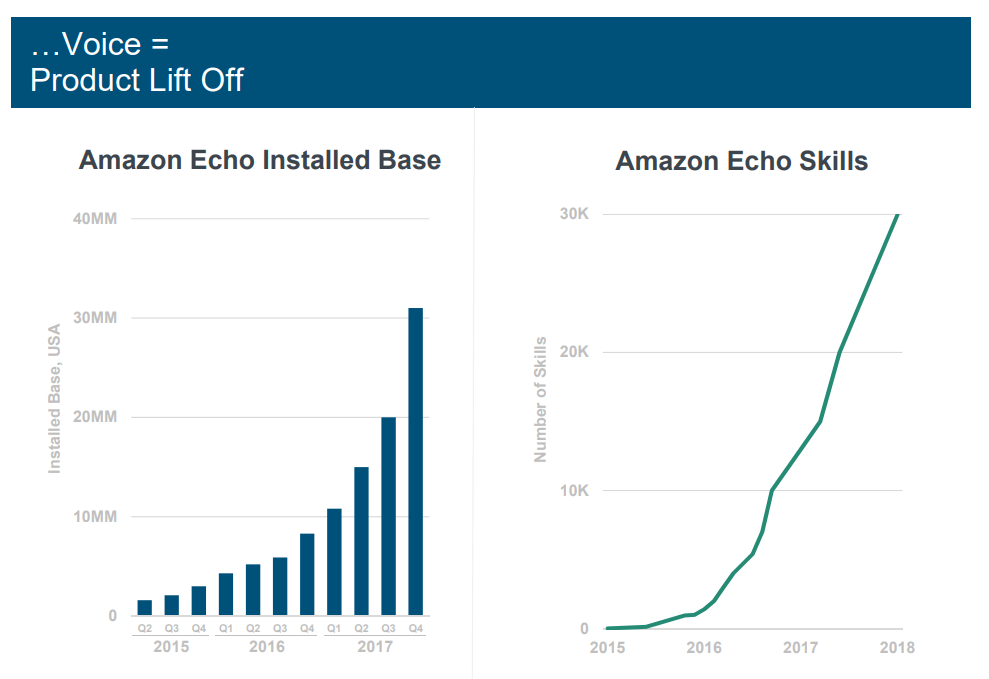

#8. Soaring demand for mobile video and AI-powered voice systems

As time spent on mobile devices increase, so does the demand for mobile video.

As AI-powered voice systems have improved, consumer demand has skyrocketed.

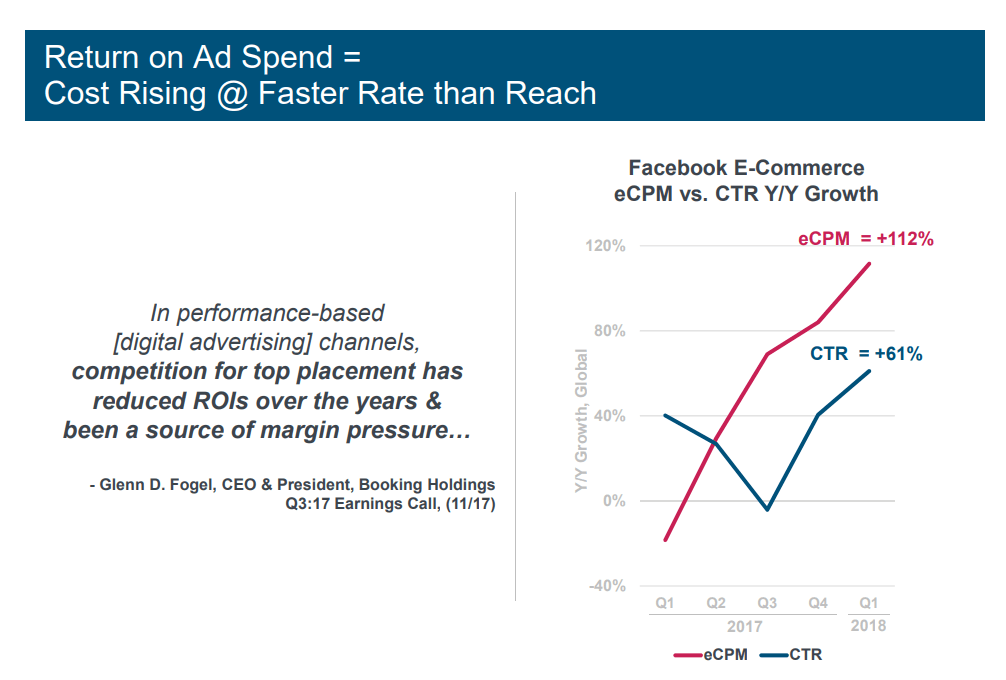

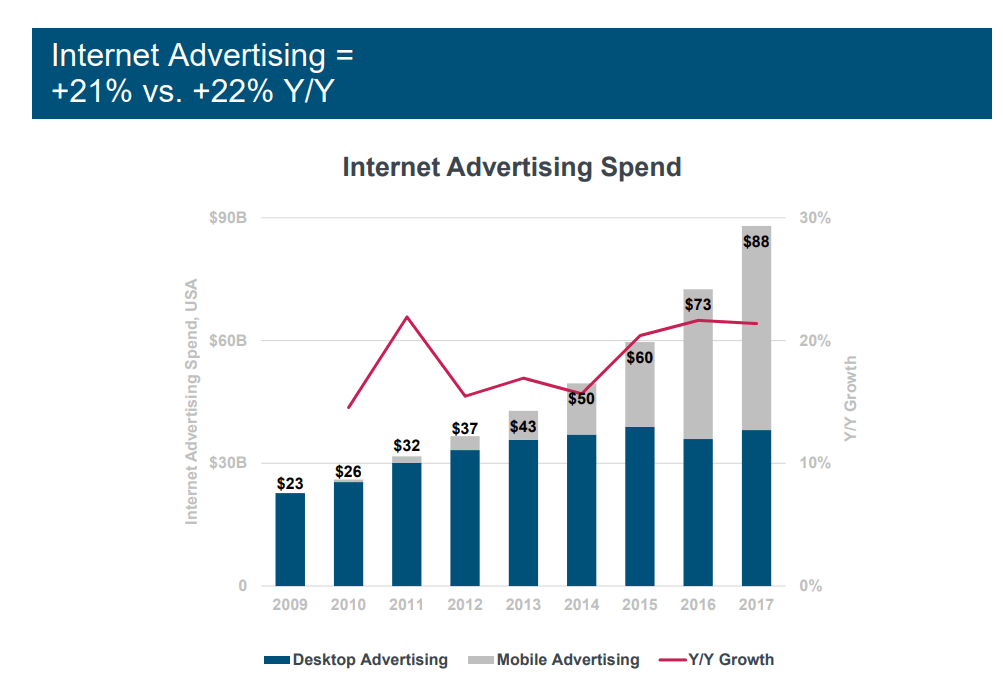

#9. Internet advertising spend increasing…

Internet advertising spend continues to accelerate, jumping from 21% last year to 22% this year. Mobile advertising now surpasses desktop advertising for the second year in a row.

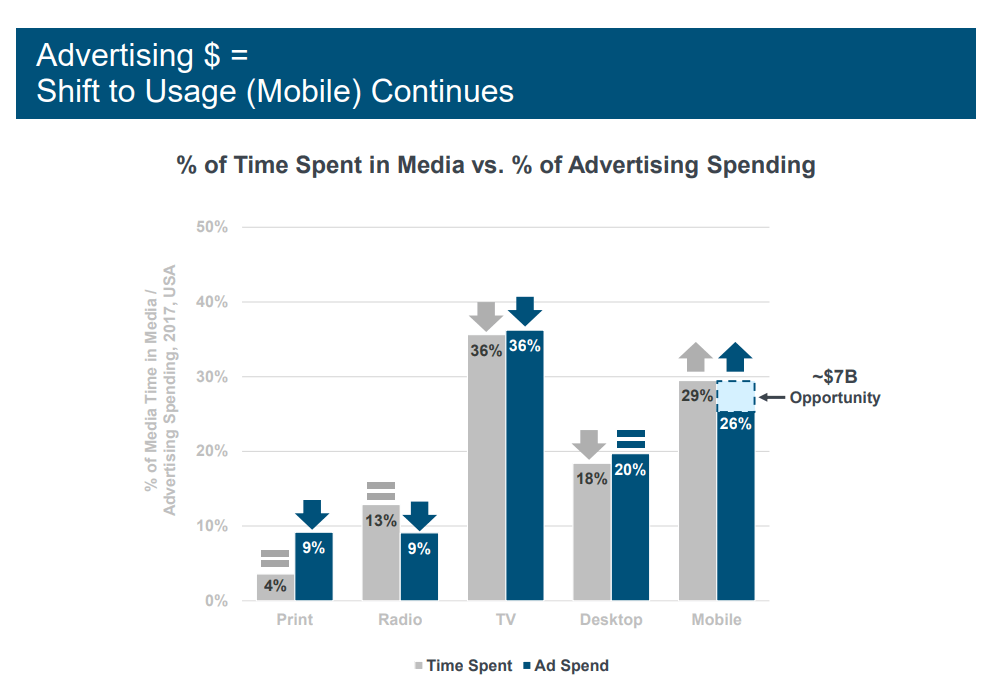

#10. …but not fast enough to keep up with mobile demand

Despite the increases in mobile advertising, there still isn’t enough mobile advertising to cover consumer time spent on mobile. This represents a $7b opportunity for marketers to close the gap and optimize reach on mobile.

Final Takeaway

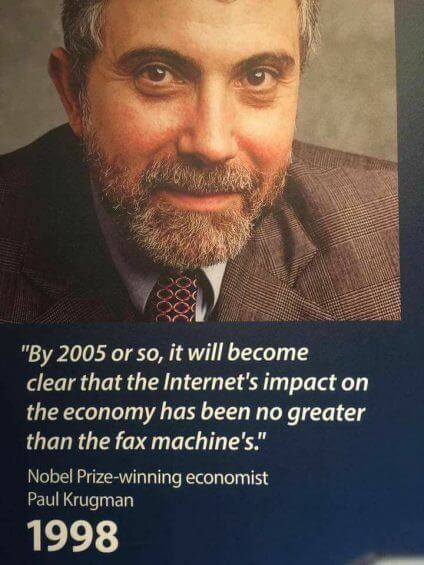

Surprise, surprise: the internet continues to grow and impact the retail landscape at every touch point.

Ecommerce retail continues to accelerate as consumers shift away from checkout lines to personalized, consumer-centric experiences online.

Successful brands and businesses will need to continue being agile in today’s rapidly changing landscape.

That means scaling your advertising into social media, messenger apps, mobile video, subscription platforms, and more — with an emphasis on the customer experience and lifetime value as acquiring new ones becomes more competitive and costly.

You Might Be Interested In