Last year, they coined Black Friday as “Couch Friday” when millions of holiday items were purchased via mobile, desktop and tablet devices.

This year, the trend of shopping from the comfort of home surrounded by friends and family continued to dominate.

Adobe Analytics announced that $6.22 billion was spent online by the end of Black Friday, an increase of 23.6% year over year.

2018 Amazon Black Friday & Cyber Monday Recap

Jump to the section below:

Top Selling Products

What the BF / CM Data Tells Us

Thanksgiving Weekend Data

Black Friday Data

Cyber Monday Data

Trends & Takeaways From the Experts

As expected, Amazon broke its own record on Cyber Monday, selling more products worldwide than any other day in its history. Amazon customers worldwide ordered more than 18 million toys and more than 13 million fashion items on Black Friday and Cyber Monday, combined.

It’s no surprise that Black Friday and Cyber Monday continue to serve as the biggest shopping days of the year. And by now, more than half the country depends on: deep discounts, free delivery, and 2-day shipping (or less!) thanks to Amazon Prime.

Top Selling Products

This year, top-selling products on Amazon.com (on Cyber Monday) included:

1. New Echo Dot

2. AncestryDNA: Genetic Testing Ethnicity

3. Bose QuietComfort 25 Acoustic Noise Canceling Headphones for Apple devices

4. Becoming by Michelle Obama

5. Jenga

6. Instant Pot DUO60 – 6 Quart

What the Black Friday / Cyber Monday data tells us:

While we can take a look at Amazon’s Black Friday and Cyber Monday trends from an overall perspective, we also wanted to dive into the numbers and see how they compared year-over-year (YoY) based on our own data.

Based on CPC Strategy’s CAPx AMS account data (11/1-11/22 daily average compared to 2018 Black Friday), this year:

- Impressions almost doubled compared to our daily average in November

- Average CPC increased but only by +7%

- In contrast, spend increased significantly by +77%

- Sales growth outpaced spending growth at +91% leading to a dip in ACOS of about 1.5 points (-7%)

- Best selling categories included luxury watches, electronics, and toys.

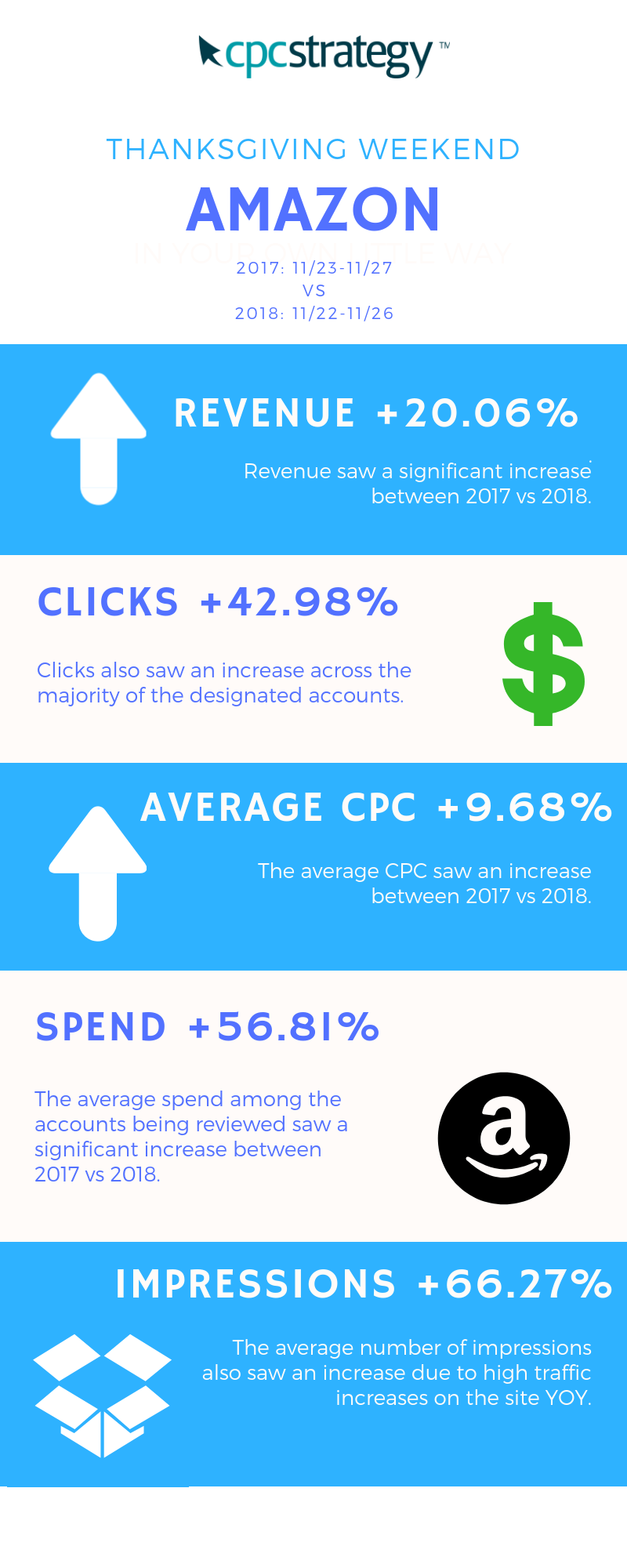

We also gathered data on CPC Strategy clients (combined AMS & Seller Central) that we managed between 2017 and 2018.

Thanksgiving Weekend (2017 vs 2018):

Note: We also saw an increase in ACoS of +30.61%.

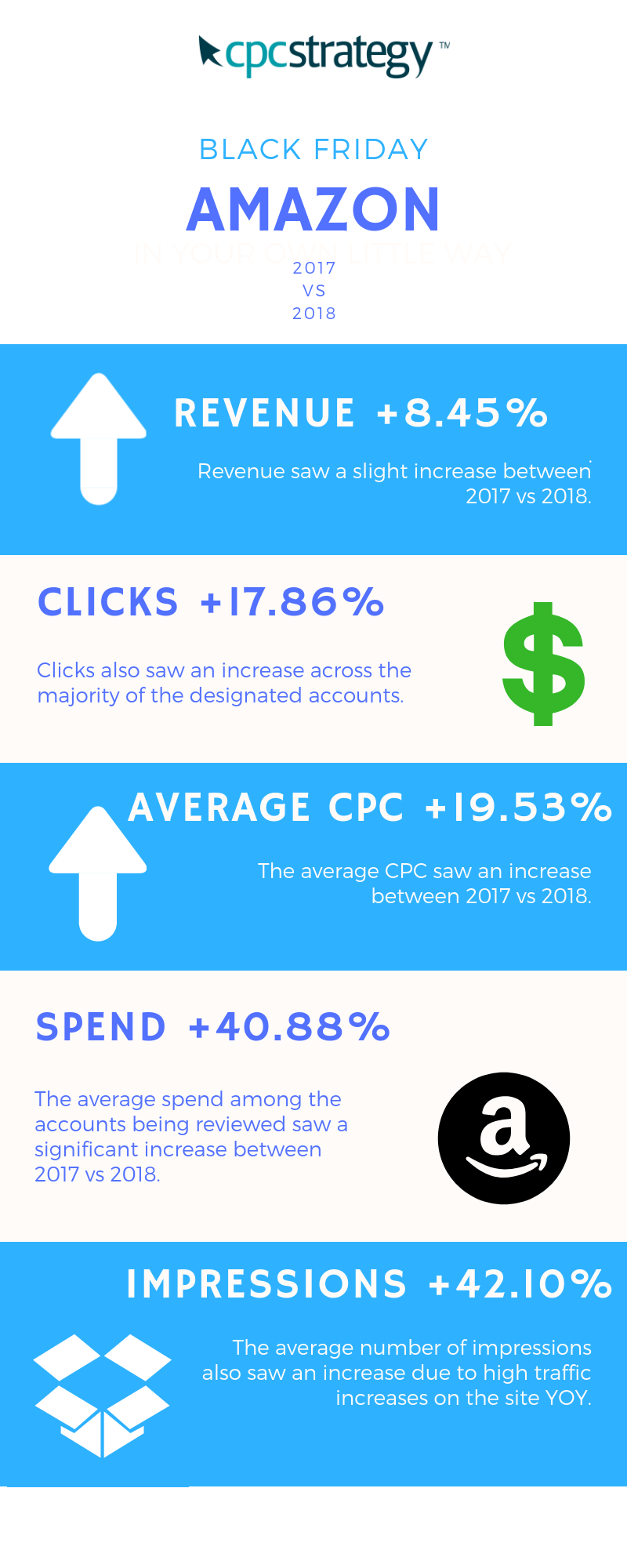

BLACK FRIDAY (2017 vs 2018):

Note: We also saw an increase in ACoS of +31.35%.

Note: We also saw an increase in ACoS of +31.35%.

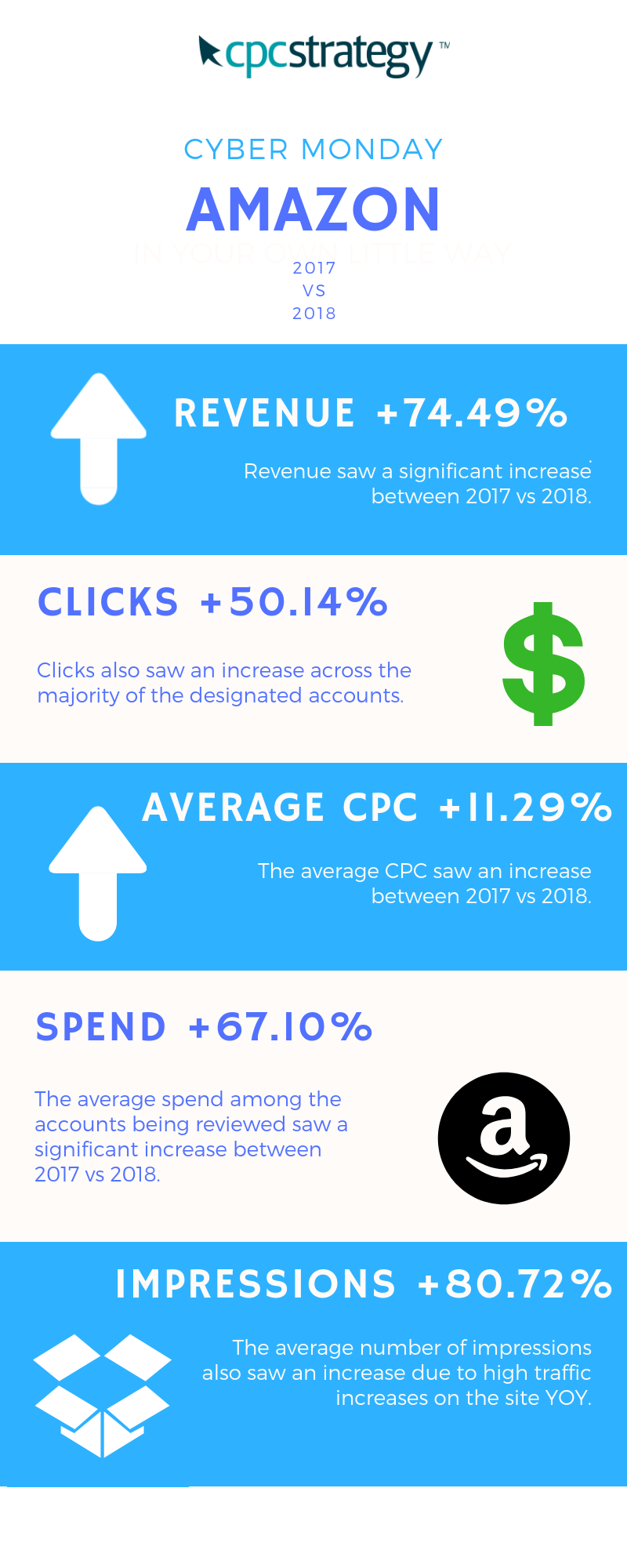

CYBER MONDAY (2017 vs 2018):

Note: We also saw an increase in ACoS of +10.73%.

Trends & takeaways from the experts:

We spoke with our Amazon Team at CPC Strategy to get their take on how the holiday weekend panned out:

1. Low conversions leading into shopping days

Leading up to Black Friday, conversion rates were down but this isn’t something new.

“We see this every year and I imagine this will continue. There is a panic among Amazon sellers leading up to Black Friday, because during this time sales are dropping and conversion rate is falling.”

“What we have to remind our clients is that most people are not buying any items Sunday through Wednesday of the week leading up to Thanksgiving,” Petriello said.

People will start to buy on Thanksgiving (a trend unique to ecommerce) largely because they can make online purchases from the comfort of their home while spending time with their family and friends.

2. Advanced advertising tactics required

Conversion rates matter more now than ever before. With the increase in traffic, although you’re likely to have a lot more people clicking on your product detail page – how many of those shoppers convert?

“Amazon sellers who made the decision earlier in the year to invest in things like Enhanced Brand Content (EBC) and A+ Content are the ones who won out this year,” Petriello said.

The Marketplace is more competitive than it has ever been and will continue to be competitive. Businesses who want to profit from Amazon will have to be extremely granular with their advertising strategy throughout the remainder of the holiday season and into 2019.

For example, are you the type of seller who tossed 100 of your products into one ad bucket or did you optimized each item in your catalog, providing it with the best opportunity to succeed? These are the things you should consider.

3. Big wins for Amazon DSP ASIN Retargeting

As we mentioned, having a sophisticated advertising approach was critical to capitalize on the biggest shopping days of the year.

In particular, we saw an enormous amount of success with Amazon DSP ASIN retargeting.

Here’s how Amazon DSP retargeting works:

As of September 2018, Amazon rebranded all of their AMG, AMS, & AAP features under a new name called, “Amazon Advertising”.

The Amazon Advertising Platform (AAP) is now called Amazon DSP.

One of the major perks of DSP advertising is the ability to leverage Amazon customer data to serve ads to past purchases and other shoppers likely to purchase your product(s) on Amazon-owned network sites.

“Once Amazon has collected consumer data on your customer (whether they be in-market or lifestyle), they can use this information to target the shopper whenever they are on any site that serves AMG ads and drive them back to your ecommerce site.”

– Nick Sandberg, Marketplace Program Development Manager at CPC Strategy

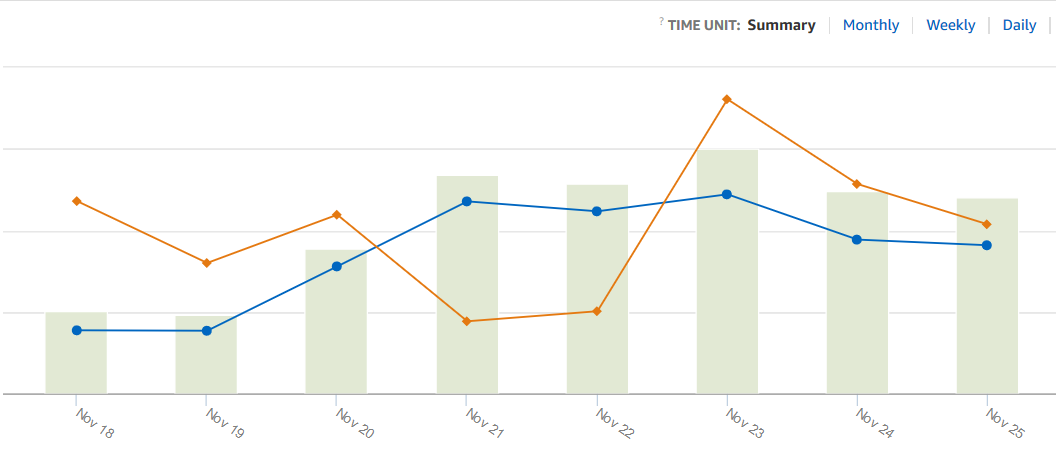

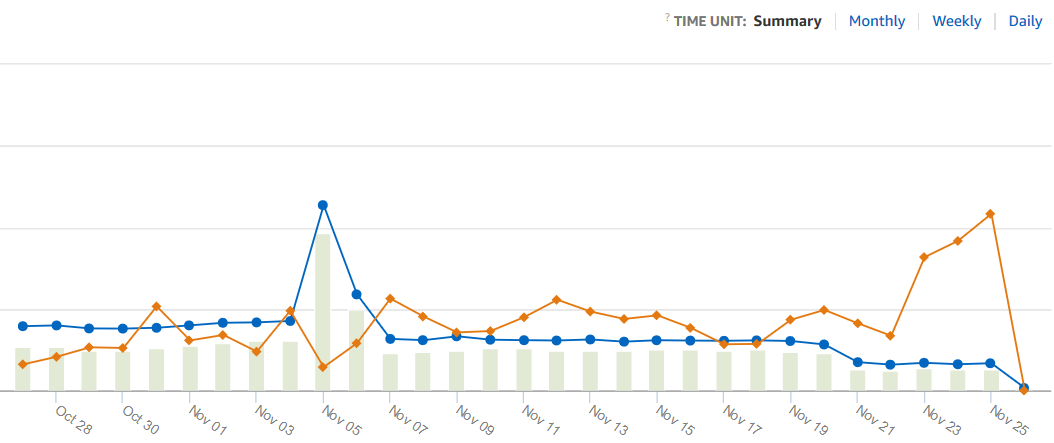

As you can see in the client data below, we saw a significant jump in ROAS for Amazon DSP retargeting campaigns on Black Friday.

- Orange Line – Represents ROAS

- Blue Line – Represents Spend

“It was important to the overall Amazon strategy to be running DSP ASIN retargeting during Black Friday and Cyber Monday. With the natural increase in clicks and impressions, we saw our retargeting pool grow.”

“The CPCs also became more competitive so even if a click did not convert into a sale, we do not view that as wasted spend but rather that click turns into a potential future customer.”

“Purchase intent is higher during this time of year and combining that with a strong advertising strategy, we were able to use retargeting to grow overall revenue.”

– Karen Hopkins, Marketplace Channel Analyst at CPC Strategy

“For our clients running off Amazon campaigns, specifically targeting customers who have reached the detail page of their products, we noticed a significant spike on Black Friday and Cyber Monday.”

“In some cases, purchases increased 4x to 5x on these particular days. It goes to show that once advertising is controlled on Amazon, having a solid off Amazon strategy is key to capturing all potential customers.”

– Evan Walsh, Senior Marketplace Channel Analyst at CPC Strategy

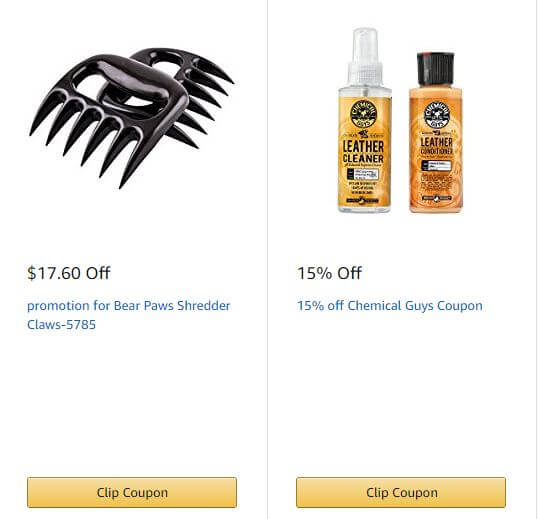

“The purpose of running Awareness campaigns is to literally drive awareness of your brand which enables you to generate demand for your products on Amazon.”

“With DSP, you are exposed to audiences on and off of Amazon.com, so leveraging these types of campaigns during Black Friday and Cyber Monday expands your reach during the highest traffic period of the year. Layering in coupons adds another level of engagement and can drive consumers to purchase.”

– Jen Acosta, Sr. Marketplace Channel Analyst at CPC Strategy

Pro-tip: Amazon Coupons are not only a powerful promotion tool, but they also allow vendors to gain awareness and increase sales directly to their products during Amazon Prime Day when shoppers are likely to make a purchase.

Customers want to save, and promotions provide an incentive to make a buying purchase sooner rather than later. You can learn more about Amazon Coupons and other promotions here.

4. New Sponsored Products Targeting (Early Testing)

As of now, Amazon advertisers have more control on the way they target customers with Sponsored Product Ads using product targeting. Advertisers are already pretty excited to implement this new feature and for good reason.

With product targeting, it’s easier to reach shoppers as they browse detail pages and filter search results for specific products similar to yours.

Recently, Sponsored Products has expanded to include several new keyword and product targeting capabilities including:

- Enhanced Auto Targeting, only available in auto SP campaigns

- Product Attributes Targeting, only available in manual SP campaigns

Now there are 4 different default targeting options within auto campaigns including:

- Loose Match / Close Match: This option allows your ad to be shown in the search results if your ad product closely or loosely matches searches results from shoppers.

- Substitutes / Complements: This option shows your ad on the detail pages of products that are substitutes or complements of your ad products.

Although we are still in the early stages of testing these new features, we did receive some early feedback from our team regarding the recent holiday performance.

In one example, a coffee machine brand tested a small sample size (two campaigns) with bids on each of the 4 groups mentioned above being equal. The results? The ‘substitutes’ group has seen the most traffic so far.

But for an electronic accessories brand, performance was a little different. Across 6 campaigns utilizes all of the new features listed above, ‘loose match’ actually turned out to have the most impressions on 3 campaigns.

While it might be too early to report on definitive results, we will continue testing Amazon’s new product targeting features. You can look for ongoing updates in our recent post, “Introducing Amazon Sponsored Products New Product Targeting Features“

“Sponsored Products targeting has all the benefits of PDA targeting plus additional targeting features. PDA’s have been somewhat of a black box when it comes to identifying what is and isn’t working about your ad, which makes it difficult as advertisers to justify allocating much spend behind them,” Dylan Verburgt, Senior Marketplace Channel Analyst at CPC Strategy said.

“With ASIN level performance, you can optimize your ad to only target products that are converting. Having the ability to target products based on a price range or star rating will allow advertisers to more easily provide a sophisticated and accurate targeting approach by offering enticing deals rather than hand selecting products or using a blanketed approach via expanded targeting.”

5. Inventory issues continue to damage sales

We see it every year – sellers hurt by inventory stockouts.

“If I were head of marketing for a brand, inventory preparation would be something that I would invest a tremendous amount of energy into,” Petriello said.

“The truth is, even if you do all your advertising efforts up front including Enhance Brand Content, building out a granular list of keywords, and running FBA – if you stock out on high volume shopping days you have essentially devalued all of your investment. I would view this as an area that a lot of businesses still get wrong.”

What a lot of sellers and vendors don’t realize is that although they are operating through FBA, Amazon, in general, can take a lot longer to process your inventory (compared to say Target) because you may have to individually label all of your items.

So even as a vendor if you hit a huge spike (in Product Orders) and it’s bigger than expected on a busy shopping day, you might stock out and not be able to get those shipments into FBA quickly enough to satisfy demand.

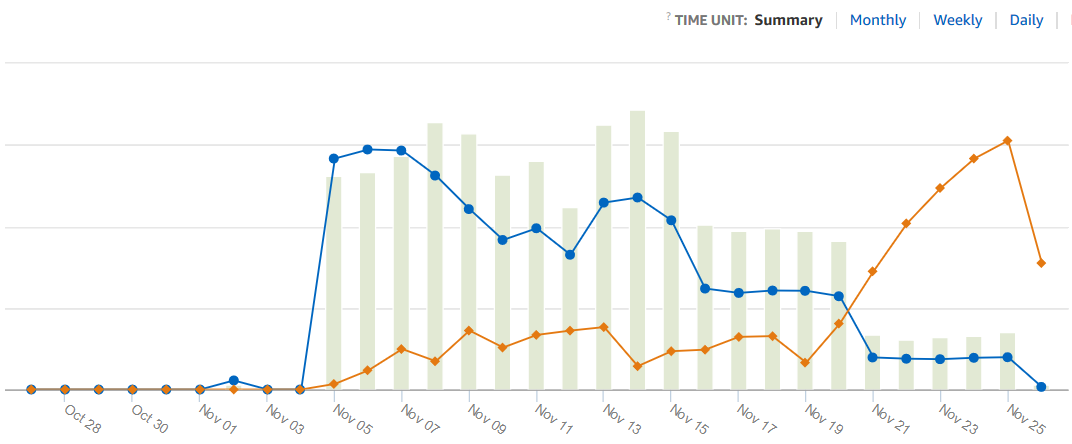

6. “Deals of The Day” dominate

Deals of the Day are a single item or small set of closely related items discounted for one day only. Keep in mind, Deal of the Day are available to Vendors ONLY.

Products that are featured in Amazon’s “Deal of the Day” space (especially on Amazon Prime Day, Black Friday, & Cyber Monday) typically enjoy a bump in sales throughout the duration of the deal.

This year was no different.

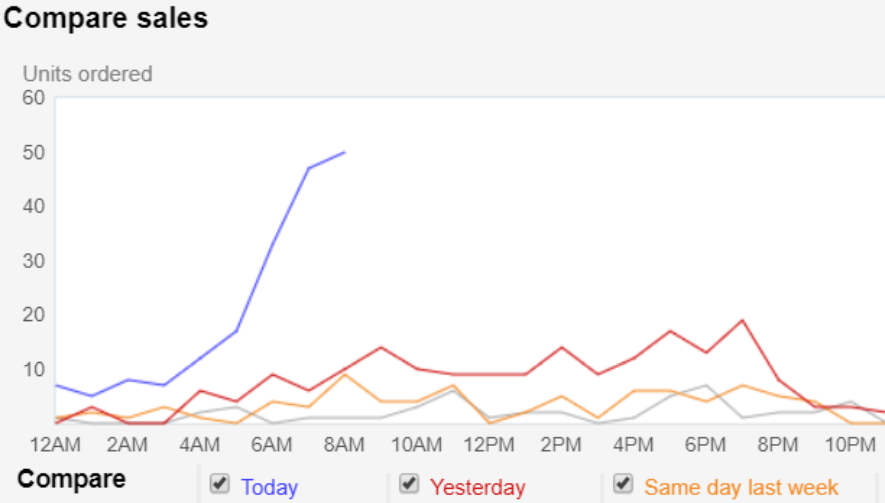

As you can see in the data below, a brand item featured as the “Deal of the Day” led to an extreme jump in units ordered on Cyber Monday (compared to the day prior “red line”, and the week prior “yellow line”):

7. Spike in International Marketplace sales

Another interesting takeaway was the noticeable spike in international sales.

CPC Strategy’s account managers saw considerable bumps in sales for clients selling in:

- Italy

- Germany

- Spain

- Amazon Canada

Amazon international expansion poses a vast opportunity for sellers to expose their products to new markets and increase sales.

However, with opportunity comes risks and costs that need to be calculated before rushing into foreign marketplaces. You can learn more about Amazon International expansion below:

- The Seller’s Strategy for Amazon International Expansion

- Amazon Global Selling, the Top U.S. International Marketplace

- Global Retail: The Biggest Challenges to Overcome When Selling Internationally

Final Takeway

According to David Weichel, VP, Product Development at CPC Strategy the data above implies several takeaways for Amazon sellers & advertisers:

1. There’s an increase in competition. The Amazon ad landscape is more competitive. Generating the same sales as 2016 or 2017 – now requires sophisticated advertising strategies (to get the same results or better) in 2018.

2. Today, customers expect more long-term deals. Customer expectations are no longer hyped around gimmicky one-day sales. Customers expect deals & savings to be extended beyond the one-day shopping holidays of past years. Amazon has already started to shape customer expectations by extending their own Prime Day to 2 days.

3. Omni-channel is still trending. Black Friday is becoming more of an “omni-channel” or ecommerce shopping holiday. As holiday retail strategy, in general, has become more “omnichannel”, the traditional Black Friday retail brick-and-mortar holiday is taking over ecommerce.

Cyber Monday used to be the online Black Friday equivalent, but now it’s possible that consumers are waking up on Black Friday with shopping apps on their phones, more Black Friday promo emails in their inbox and the traditionally physical store sale are now mostly online, which diminishes the impact we see on Cyber Monday.

Amazon is experiencing steady year over year growth. Overall, from Black Friday to end of Cyber Week, we’re seeing solid YoY growth. Online shopping is continuing to grow, and at rates that are profitable for Advertisers on Amazon.

Q1 Preparation & Strategy

Don’t take your foot off the gas just yet.

As we’ve said many times in our webinars, having a sophisticated advertising strategy in preparation of Q4 is absolutely essential to a seller’s success.

“Q4 is essentially a springboard for 2019,” Petriello said.

In many ways, your holiday advertising strategy will feed into your Prime Day success and so on and so on.

“It’s an ongoing process of gathering reviews, sales velocity, and ranking against keywords. If you continue with that momentum it will help set you up for the next big shopping day and the next after that,” he said.

“Whereas if you manage your campaign strategy poorly (in Q4) with stockouts and bad reviews, then you’re likely to spend most of the following promotional period licking your wounds and trying to heal rather than accelerating.”

Another misconception we see among sellers is the desire to prematurely dial back their advertising budgets in January, but Q1 represents an enormous opportunity for revenue due to returns, gift cards, and cash in hand.

“We expect a big apparel push in January, building off of the ‘new year, new you”‘ campaigns,” Petriello said.

In general, apparel has a high instance of returns due to the wrong size, color or fit so we expect there will be an influx of shoppers either returning items in exchange for something else or shopping for themselves.

For more information on Amazon Black Friday / Cyber Monday sales, email [email protected]

You Might Be Interested In