2021 Prime Day Wins [Experts Share Their Most Successful Marketing Campaigns]

Despite the date being a moving target up until the last minute, Amazon Prime Day 2021 generated record-breaking sales across all categories including electronics, baby care, home goods, and more.

According to Adobe Analytics data, total online retail sales in the United States during Amazon’s 48-hour Prime Day surpassed $11 billion — 6.1% higher than overall e-commerce transactions generated by the 2020 event. The self-made shopping holiday brought in nearly $5.6 billion on Monday and $5.4 billion on Tuesday, making Monday the biggest day for digital sales in 2021.

Historically, Prime Day is Amazon’s largest event of the year, with hundreds of deals on products including toys, personal care, and furniture. The event is equally exciting for brands who want to get their products in front of consumers by leveraging deep discounts, Lightning Deals, and Prime Day Deals to attract clicks and open wallets.

Since its launch in 2015, Prime Day has overtaken Black Friday and Cyber Monday as the biggest annual sales event on Amazon, with better deals on more products resulting in increased sales (and Prime memberships).

Amazon became a lifeline for consumers during the pandemic and subscriptions to its Prime membership club surged in 2020. Amazon now boasts more than 200 million Prime members worldwide. In the U.S., analysts estimate Prime membership in 2020 grew 25% to 147 million—more than half the nation’s adult population.

But that growth also raised key questions for brands and advertisers in 2021. Now that vaccinations are widespread and restrictions on work, leisure, and shopping are easing, will Prime membership and Prime Day still be appealing? Will the new buying habits that took hold while people were stuck at home persist as society reopens?

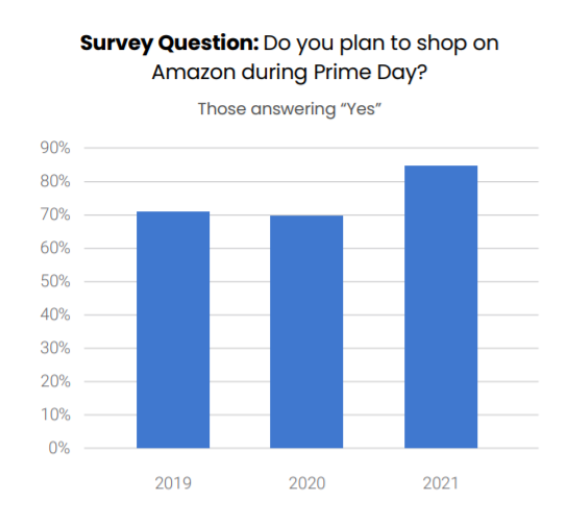

At Tinuiti, we expected (and prepared our clients) for the massive surge in 2021 Prime Day impressions and purchases. According to our 2021 Amazon Prime Member Study, released earlier this year, a record 84% of members said they planned to shop on Prime day—up from 69% in 2020 when the event was held in October.

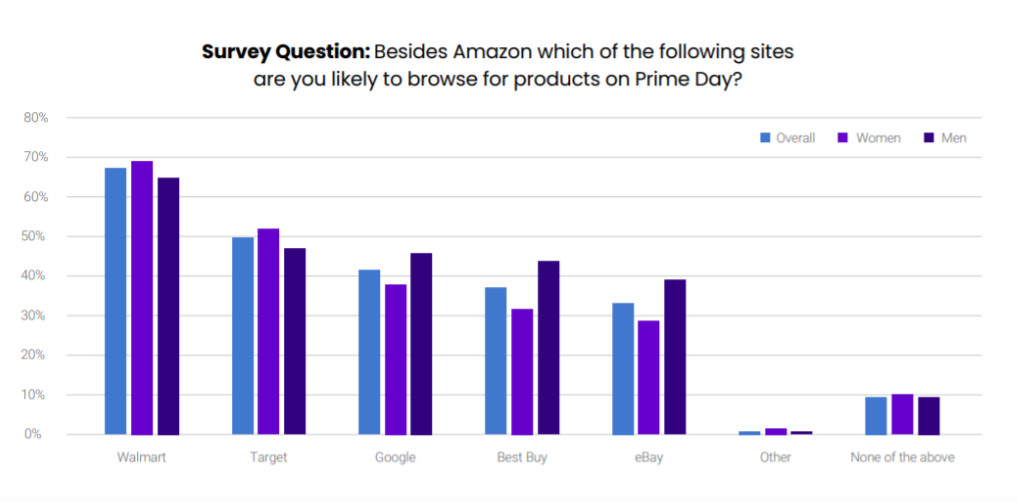

And although the majority of Prime members are extremely loyal, with 57% saying they don’t plan to cancel their memberships in the coming year, they do have a wandering eye. According to our study, almost 90% of Prime members said they would comparison shop on sites such as Walmart and Target on Prime Day.

Regardless of your product or business, this year it was absolutely vital for brands to have a sophisticated Prime Day advertising strategy on and off Amazon’s platform. And for those who did their homework – the payout was worth it.

In an interview with Forbes, Tinuiti’s Sr. Director of Search and Enterprise, Nancy McLaughlin emphasized the importance of using existing data around customer engagement, advising brands to “create a strategy that is built for their consumer with their advertising data collection and their brand growth goals in mind”.

From powerful data to early promotion and sophisticated creative, here’s a look at the most successful advertising strategies and tactics our experts implemented on Prime Day 2021.

The early bird gets the worm. The same goes for advertisers who invested early in promotion leading up to Prime Day. At Tinuiti, we typically recommend brands increase their budgets and bids in advance of the event to ensure they are building consideration for products as consumers conduct their research and save items to cart.

On Monday, a retro kitchen and home goods brand leveraged Amazon’s Demand-Side Platform (DSP) to raise product awareness with early browsers. The result? A massive 180 return on ad spend (ROAS).

“The month leading up to Prime Day, we expanded our upper funnel efforts, targeting people in relevant Amazon categories that aligned with the products we knew we’d be promoting. We wanted to educate customers on our products weeks leading up to Prime Day knowing that customers were doing extensive research as they prepared their cart. As a result, after the first day of Prime Day, we were at 170% of forecasted units.”

– J. Cole, Specialist, Marketplace Programmatic at Tinuiti

Pro-tip: Advertising to the audiences available within the Amazon Demand-Side Platform (DSP) can help increase your brand awareness both on and off Amazon. Through Amazon’s DSP, you can keep your brand messaging consistent with a full-funnel strategy. To learn more, check out “The Amazon Demand Side Platform (DSP): Everything You Need to Know”

Pro-tip: Using Search and Display together to form your Prime Day tactics allows you to not only capture the demand of those who are actively searching on Amazon but also to generate demand by layering in mid and upper-funnel strategies such as competitor conquesting and In-Market or Lifestyle audience targeting on top of Amazon Search ad units.

Even during a sales event created by Amazon solely for Prime subscribers, members are willing to check out the competition. As we mentioned, nearly 90% of shoppers check at least one other website for deals on Prime Day.

With its own free-shipping offering for members and a sprawling third-party marketplace, Walmart is the most popular alternative for Prime Day deals. According to our research, two-thirds of those who shop on Prime Day will also check Walmart for deals. Target is in second place, followed by Google, Best Buy, and eBay.

Our research also indicates women strongly prefer Target as a number two choice, at 52%, while among men, Google (46%) and Best Buy (44%) are almost as popular as Target (47%) as the second-favorite Prime Day alternative. Fully 39% of male Prime Day shoppers will also check eBay, 35% more than women.

At Tinuiti, we embrace a holistic, full-funnel approach to advertising. Simply put, we want brands to be on the channels and marketplaces where their customers are shopping.

On Prime Day, we found that brands who played smart invested in ad placements beyond Amazon (including Walmart and Target) combined with a paid strategy on Google to drive awareness and traffic. Specifically for CPG brands, Instacart played a vital role as Prime shoppers increasingly use Amazon for grocery purchases.

In advance of Prime Day, many brands will have the opportunity to apply or be selected to participate in a Lightning Deal or Prime Day Deal. An Amazon Lightning Deal is a promotion with a limited number of discount offers on an item for a short period of time. These premium deals can be found throughout Amazon.com, and are available one per customer, until either the promotional period (typically 4-hour blocks) for the deal expires or all the available promotional discounts are claimed.

Products that are featured in Amazon’s Lightning Deal spaces (especially on Amazon Prime Day) typically enjoy a bump in sales throughout the duration of the deal. Of course, Amazon wants to entice customers with the best possible deals and requires brands to discount items by at least 20%. For the brands who are willing to invest – the exposure (and increase in purchases) as a result of a Prime Day or Lightning deal badge are typically worth it.

Below are some examples where deep discounts combined with coveted deal badges, clearly paid off:

“Thanks to a Prime Day Deal feature including a 40% discount, along with a bump in ad spend, one of our premium beauty brands had their best Prime Day yet. The featured ASIN skyrocketed to the #1 position for the term “facial masks”. We typically sell about 800 units of this item per week but on Monday alone we sold almost 200,000!”

– Brittany Levine, Specialist, Amazon & Marketplace Channels at Tinuiti

“A dinnerware client brand more than doubled daily ad sales on Monday compared to every other day this month thanks to a Lightning deal feature. On Monday, the ASIN jumped from #10 to #1 in Dinnerware Sets under best sellers. Their overall sales of this Prime Day were up +103.7% compared to last year’s event.”

– Ken Magner, Senior Specialist, Marketplaces at Tinuiti

Pro-tip: We also saw success with brands who dedicated a Prime Day landing page in their Store to feature Prime Day deals and discounts. By creating a subcategory page on their “Store” page, many brands were able to point users to a specific landing page making it easier for them to convert into customers. Some brands were also able to use their subcategory page as a landing page for ads off Amazon, like Google or Facebook (supporting the cross-channel selling strategy we mentioned earlier).

There are still a number of ways to put your own Prime Day data to good use in Q4. Here’s how we recommend using your Prime Day data to prep for Black Friday, Cyber Monday and overall holiday sales (just around the corner):

Reflect on the data: The first thing you want to do is analyze what worked and what did not. Take a look at your data to identify strong and weak performing items including products, campaigns, ad groups, specific keywords, and bids. That way you can see what performed efficiently and use this data moving forward to make optimizations in Q4.

Monitor returns and customer feedback: It’s possible you experienced a successful Prime Day but now you’re noticing an influx of returns with negative feedback flooding in. Although nobody enjoys reading through painful feedback, this is another learning lesson: Optimize your product copy/images and take a closer look to determine where content is not clear.

Get your inventory ready now: Post-Prime Day is also a good time to figure out how effective your inventory launch process is and if it needs refinement or sophistication. For example, did you overstock, and now you’re facing those unwanted long-term FBA storage fees? Or maybe you ran out of inventory too quickly? Either way, these are signals that you need to advance your inventory planning strategy prior to the holiday shopping season.

Think beyond Amazon: Brands (including Amazon) are leveraging external media like TikTok and Instagram to drive deals to Amazon. Merchants can capitalize on the opportunity in the short term with targeted placements on and off the Amazon platform, as well as through email and social campaigns promoting specials to subscribers and followers.

Pro-tip: You can generally expect Prime Day numbers to fall in line with Black Friday and Cyber Monday, so if you have data from those sales events, use it to determine your inventory strategy for the remainder of Q4.

Keep in mind, now is not the time to take your foot off the gas as we head into the holiday shopping season. Following Prime Day, many major retailers including Walmart and Best Buy are rolling out Black Friday-like deals (well ahead of the traditional holiday shopping season).

Wait! There’s more. Be on the lookout for Tinuiti’s Amazon Prime Day data recap and formal analysis next week.