Everything You Need to Know About Amazon Beauty

Amazon has made major inroads into the beauty industry over the last year by expanding its line of luxury brands and “indie” direct beauty brands, and most recently — their very own professional beauty store.

Consumer preferences for fast-shipping and low prices have analysts projecting that health and beauty will be Amazon’s third fastest-growing category this year, with sales totaling 44% of all online health and beauty ecommerce.

Here’s everything you need to know about Amazon beauty, the categories, competitive landscape, bestsellers, and insight from our Amazon experts.

Beauty has expanded far beyond just makeup for women — Amazon Beauty now includes everything from eyeliner to shampoo, to fragrances and even toothpaste.

Amazon’s Beauty includes the following subcategories:

Each of these beauty categories include several subcategories of their own.

Amazon also highlights featured categories across the top of the homepage, some of which are subcategories:

Luxury Beauty – Tools & Accessories – Men’s Grooming – Professional Beauty – Best Sellers – New Arrivals

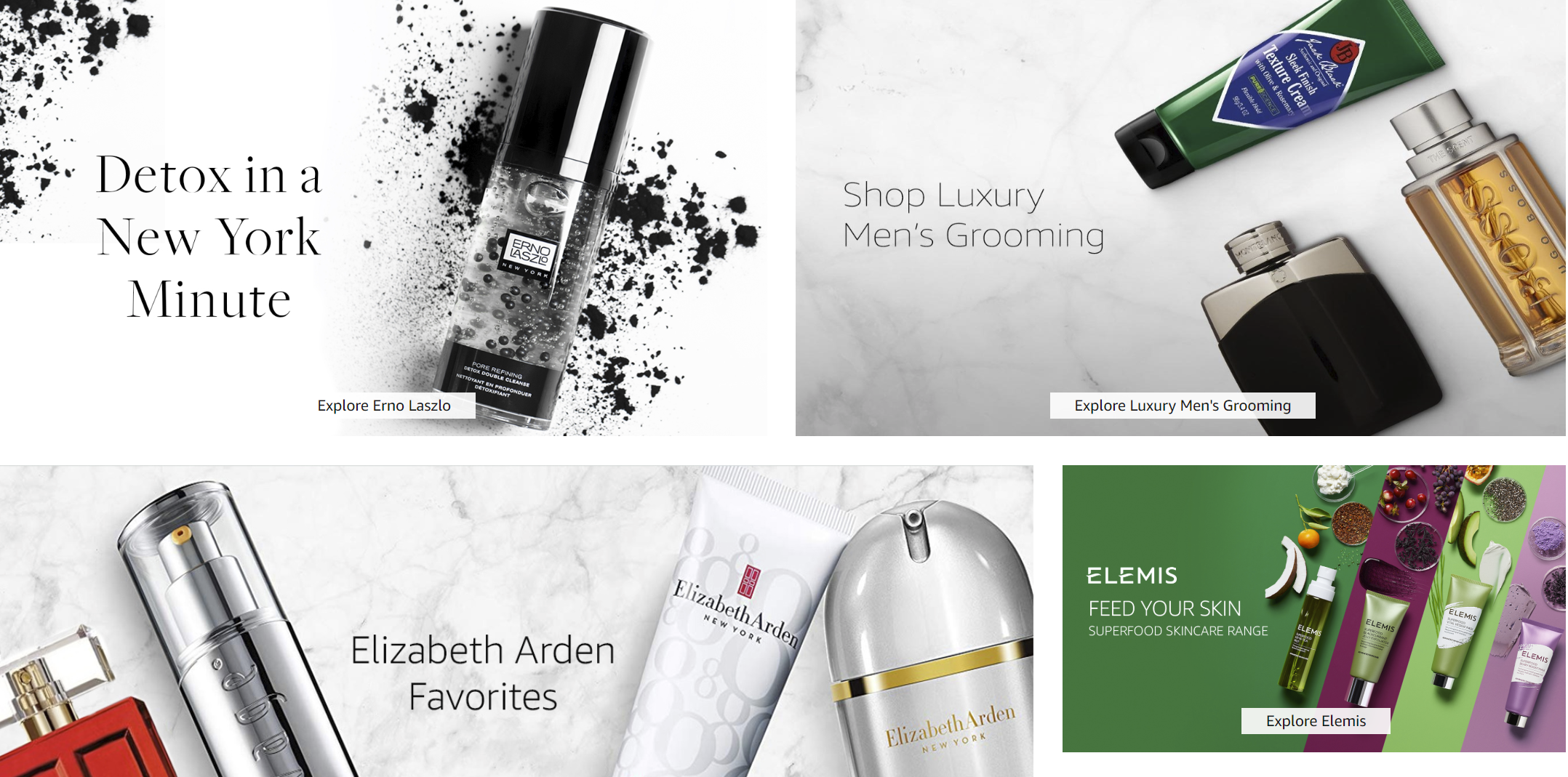

There’s also large real estate reserved for featured beauty brands, which highlights Amazon’s growing selection that includes everything from lux names to indie up & coming brands:

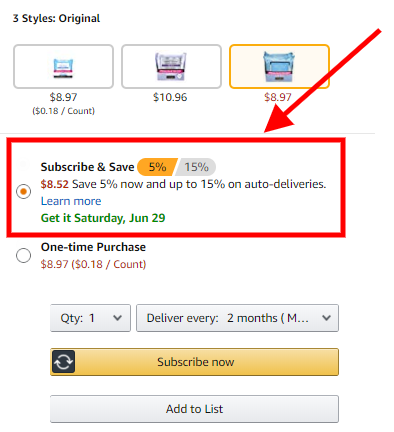

One feature that is particularly popular with Amazon Beauty is the Subscribe, which is great for beauty sellers because many of the products in this category are replenishable.

This feature allows shoppers to purchase the product on a repeating basis — saving money for the buyer while improving the lifetime value for the seller.

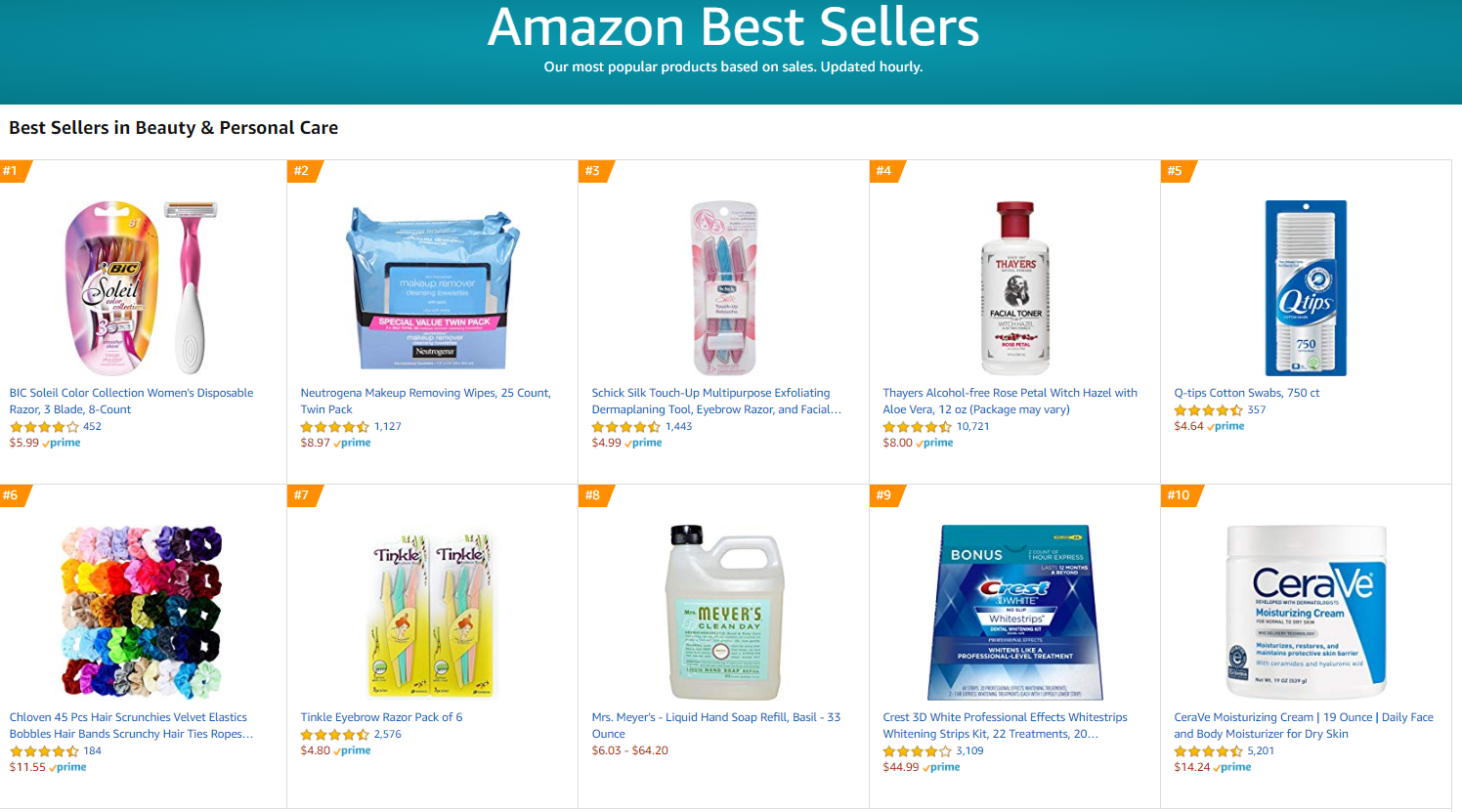

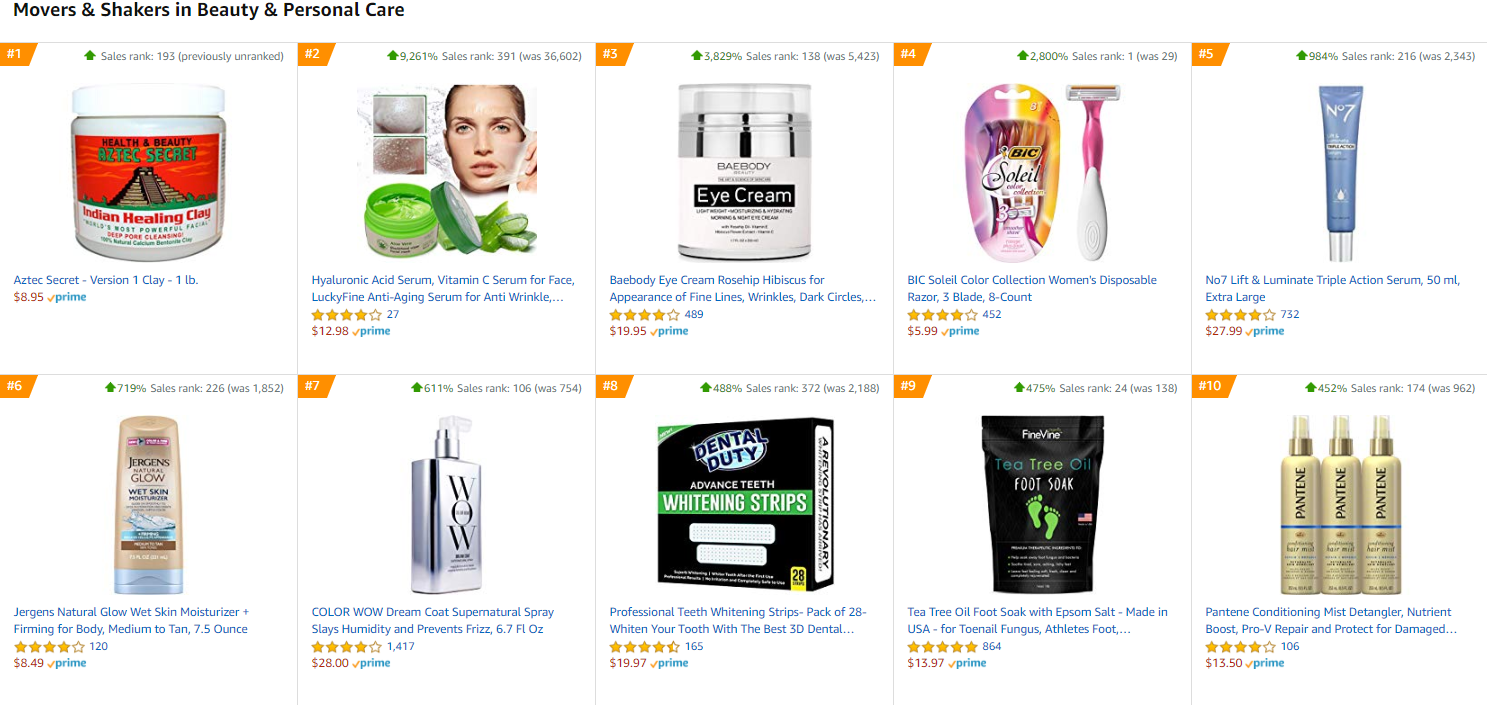

As of this writing, the top ten bestsellers of the beauty category include:

It’s worth noting, that with the exception of the Crest 3D Whitestrips, every product in the beauty bestsellers list is under the $15 price point.

Which Amazon Beauty products are growing the fastest in terms of sales?

Here are the top ten products in terms of sales rank growth as of this writing:

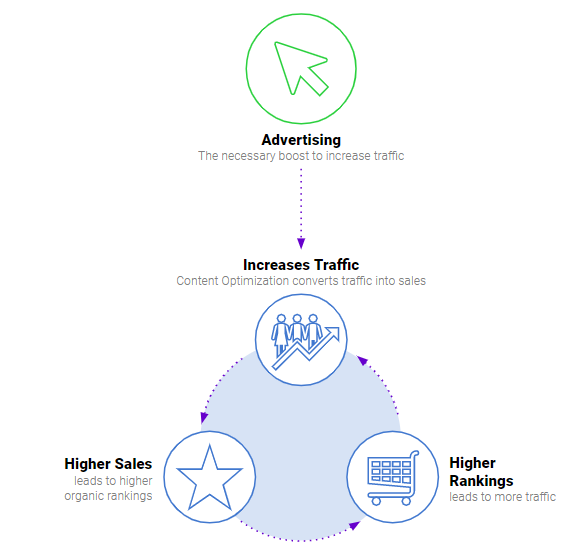

Landing your product on the first page of any category, let alone beauty, is no easy task.

These brands, however, all accomplished this using a similar strategy that Tinuiti implements for our Amazon clients.

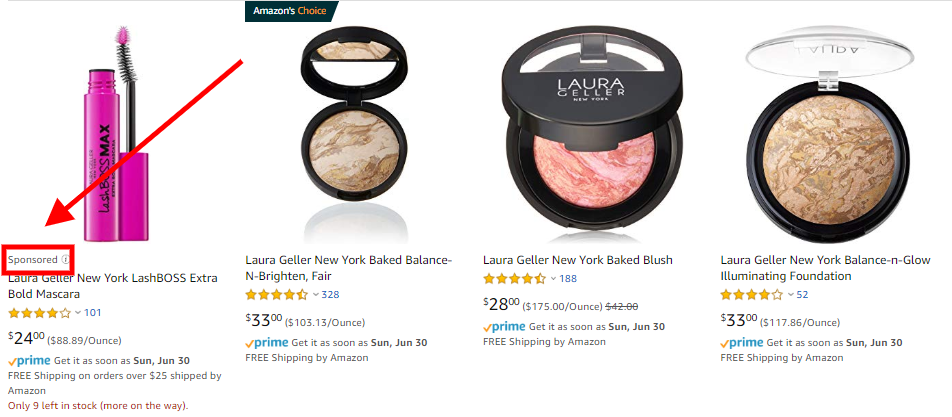

It’s an approach that includes building out compelling premium content to increase conversion rates, and then driving traffic to these optimized product listings using sponsored ads, which in turn generates sales velocity and moves organic rank.

You can learn more on comprehensive Amazon strategy by checking out Amazon Strategy 2019: 3 Steps to Marketplace Success.

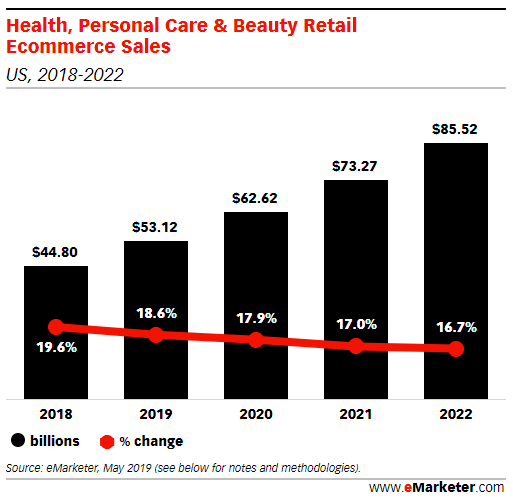

The beauty industry, valued at more than $93 billion in North America alone, has seen rampant innovation and disruption in recent years.

eMarketer forecasts that the “sales of health, personal care and beauty products will surpass $53 billion this year,” becoming the second-fastest category in terms of growth.

The advent of online and mobile commerce, the influence of social media, and broader consumer trends combined to open the door to a wealth of upstart beauty brands and new business models that are driving the growth of online beauty.

This growth has contributed to an increasing number of sellers on Amazon.

So while there’s a 1,000 additional pages of products to choose from, when you search for a keyword like “anti-aging serum” the majority of shoppers still won’t search for products beyond the first page.

“In the category of Beauty, Amazon saw 192% growth in Beauty(as a whole) and 57% growth in Luxury Beauty growth (YoY). Which is just incredible to think about considering Luxe Beauty started with only 24 Vendors a couple of years ago.”

– Nancy-Lee McLaughlin, Marketplace Channel Manager at Tinuiti

This increase in competition means there’s an increase in the number of businesses going after the same keywords & ad space, which in turn has increased ad spend across the board for beauty retailers.

In our 2019 U.S. Forecast on Beauty Shopper Trends, we identified the following trends that are impacting beauty shopper behavior:

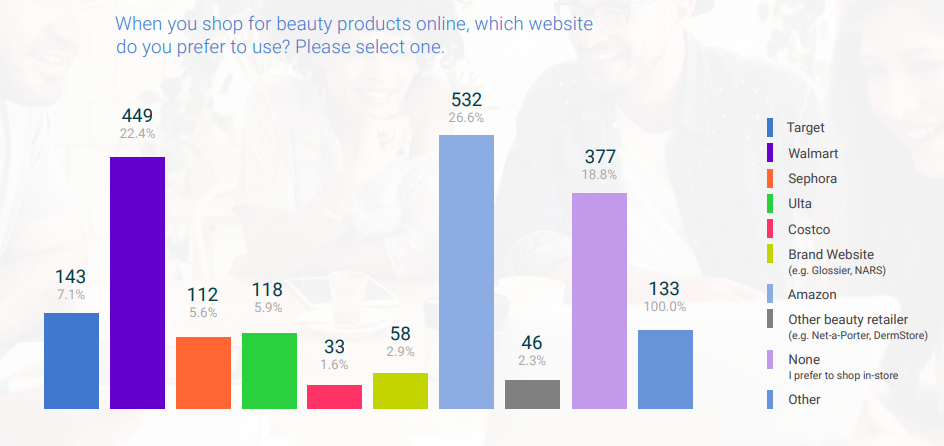

Amazon now ranks alongside Walmart as a top destination for beauty.

Competitive prices, fast shipping, and a plethora of brands have attracted all age groups to the Amazon.

Men represent the fastest-growing demographic of beauty shoppers; they now buy more frequently than women (really).

Men’s grooming is going big, with some estimates forecasting growth of 8.9% through 2025 in the U.S. as younger shoppers defy gender stereotypes.

They’re exploring skin care and cosmetics and new business models, such as subscription boxes, that connect consumers with brands they haven’t previously considered.

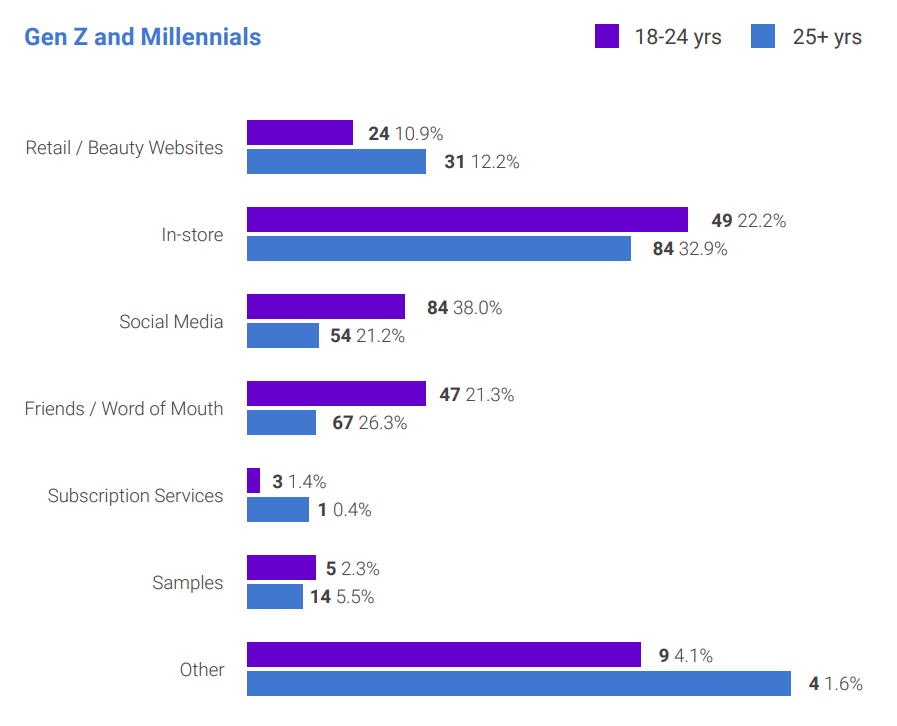

Friends, social media, and physical stores are the leading source of beauty ideas for Gen Z, according to our latest report.

This trend is perhaps unsurprising given that members of Gen Z are college age and apt to be heavier social media users overall; they’re also mobile natives, which means that mobile-first, product-centric social apps like Instagram are at the the forefront of their digital lives.

Close to 45% of Gen Z’ers also say their purchases have been impacted by digital influencers.

Laura Geller has developed and marketed dozens of high-quality, luxury makeup products that are found in major beauty retail stores worldwide, and now directly to consumers via Amazon.

We originally looked at the opportunity to sell on Amazon Luxury Beauty for brand gating because we knew there was demand there and we also wanted to use brand gating to remove unauthorized sellers and control our own brand experience.

Pamela Hemzi, VP of Ecommerce and Digital at Laura Geller

In 2017, Hemzi launched Laura Geller’s luxury beauty operation on Amazon because there were already sales being made by third-party sellers using Laura Geller’s name.

“Amazon UK actually approached our brand in 2016 and said, ‘Do you know that Laura Geller products are making an X amount of dollars on Amazon UK?’ Of course, I wasn’t aware of other distributors making that many sales off of our products on Amazon at the time. So our team did their due diligence and decided that we wanted to launch on Amazon UK in January 2017 first.”

Hemzi notes that after seeing rapid success on Amazon UK, they decided to expand to meet shopper demand in the North American market.

Of course, breaking into any beauty market on Amazon is no easy task. Hemzi knew that to cut through the noise and show up for top placements for important search terms, Laura Geller would need to implement a sponsored ads strategy.

“After we launched on Amazon UK, we launched on Amazon US six months later. It was led by one person, self-taught, spending about $3,000 on AMS over a seven-month period.”