Is the Future of Retail "Brandless"?

Are brands in jeopardy? Is the future of retail “brandless”?

According to Scott Galloway, Clinical Professor of Marketing at the New York University Stern School of Business, the answer is yes.

In a presentation last month, Galloway talks about how Amazon has changed consumer shopping habits and the relationship between shareholders and investors.

The 24-minute talk touches on a variety of data and marketing concepts, but what really sparked some interest is Galloway’s prediction that brands will essentially cease to exist one day and that “voice-based technologies will take over the world”.

If you don’t have time to watch the full video, we’ve summarized a list of takeaways along with expert insight from our team.

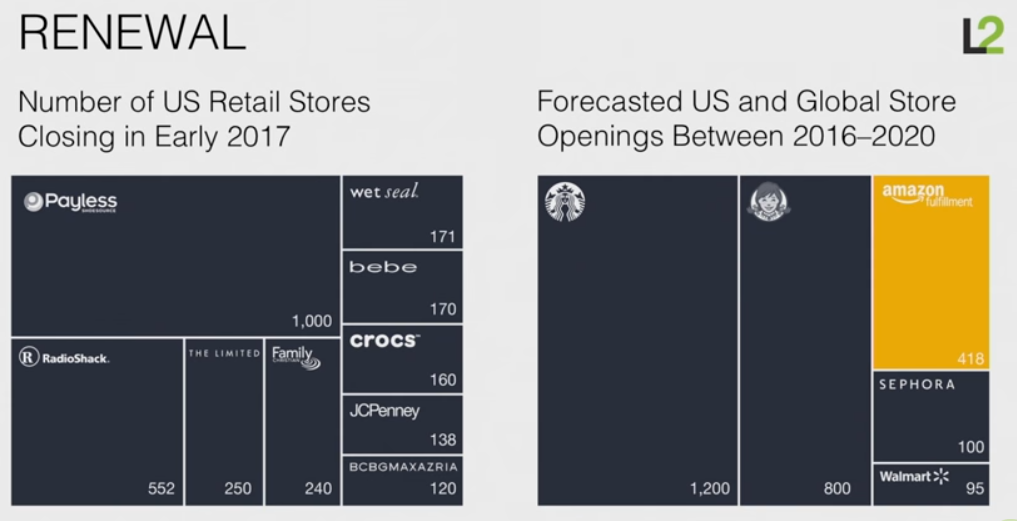

According to Galloway, Amazon is dismantling retail and brands are experiencing an incredibly challenging environment.

“It feels like the reckoning is finally here,” he said.

In Q1, 9 retail bankruptcies were reported (more than all of 2016 combine). Additionally, malls are crumbling (from 2010 to 2013 mall visits declined 50%).

“There are some [companies] breaking through in the face of competition (example: Starbucks, Walmart, & Sephora), but as you can see there’s a lot more that are closing.

In contrast, Amazon hit 64 billion in growth since 2010 and now, 52% households have Amazon Prime.

“Today, more people now have Amazon Prime than have a landline phone, just to give you a sense of how much technology has shifted in America.”

“You can get retail delivered within two days. This is the technology America has opted for over a landline phone,” he said.

Additional Amazon statistics:

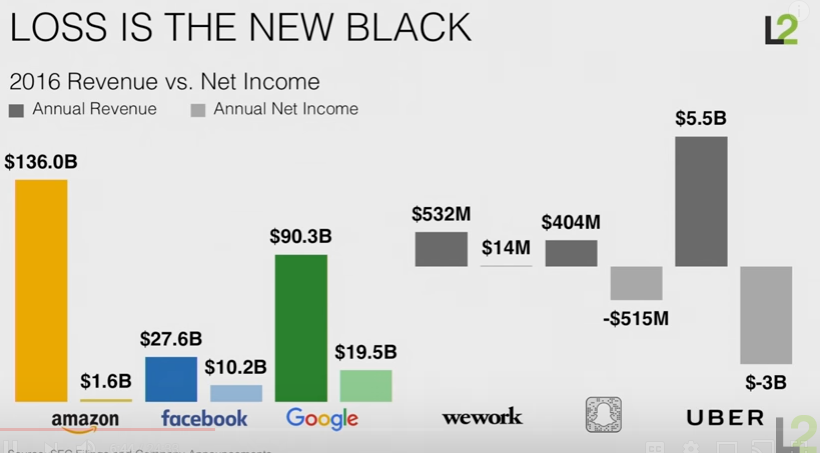

Amazon has essentially changed the relationship between companies and shareholders by replacing profits with vision and growth.

“That has changed the entire ecosystem. Investors are no longer satisfied with steadily growing profits; instead they seek fast growth and strong vision – even at the expense of profitability,” Galloway says.

What might be surprising to some of our readers is that Amazon essentially breaks even, but the retail giant doesn’t need to be profitable to convince investors to stick with them.

Amazon has established a reputation as the “innovator” and growth and vision (over the cost of profit) is a model that investors today love.

A growing trend is the use of voice search. As a performance ad agency, we’re already thinking about what advertising will look like on voice-first devices and it’s no surprise to see shopping channels like Google investing in their own voice-activated products (Google Home), after the success of Amazon Echo.

So, what are people using Echo for? Right now, mostly to find information or as an audio speaker. But shopping and purchase intent via voice-device is expected to rise.

According to Galloway, Amazon is likely to leverage Alexa to create a friction-less way of ordering products.

He predicts in 2 to 3 years, Amazon will launch a Prime feature (using a consumer’s credit and buying history) to send two boxes twice a week automatically to their house with items that they might need (including food, toiletries and more.)

If you decide you don’t like or need any of the items included, you can send them back and Amazon will adjust to make better purchasing decisions for you in the next shipment.

Basically, Amazon will have the ability and predictive technology to anticipate your shopping needs.

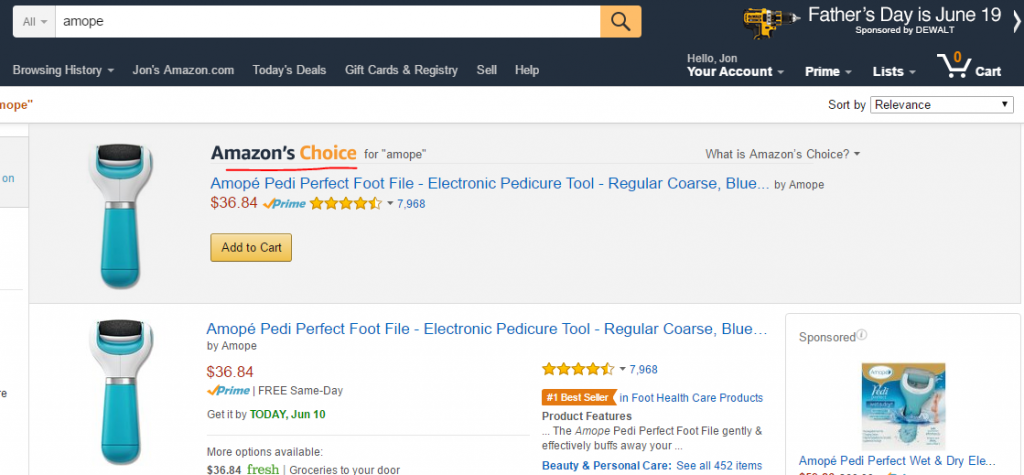

So, how does the retail giant intend on getting households to adopt Alexa for shopping? One major driving component is price.

Right now, Amazon is already providing voice search customers with discounts and benefits for ordering their products through Alexa.

Amazon’s Choice is a label applied to products that can be directly purchased from Amazon Echo by voice command. In the past, Amazon Echo could only reorder items that a customer had already purchased. Now, Prime members can place voice orders via Echo for music and “tens of millions” of Prime-eligible products.

But the biggest controversy to stem from Galloway’s presentation is whether “brand” value is actually diminishing as a result of Amazon’s growth.

If Galloway’s theory is accurate, then it’s safe to assume consumers don’t value the brand connection to the products they purchase.

But according to some of our experts, it might be a little too soon to write off brand value completely.

“Brands aren’t dead and people still identify with brands that have stories they connect with, Pat Petriello, Head of Marketplace at CPC Strategy said.

“That being said, old retail is dead and with it the brands that make the choice to not adapt.”

Galloway also makes an assumption that the markup a brand might charge is purely to feed a marketing flywheel and ignores a brand’s role in innovation & product development.

“It might be easy to replicate a popular product at a cheaper price, but a successful brand can continue to innovate and bring value to the market with product improvements or new ideas altogether,” Jeff Coleman, VP, Marketplace Channels at CPC Strategy said.

“It might be easy to replicate a popular product at a cheaper price, but a successful brand can continue to innovate and bring value to the market with product improvements or new ideas altogether,” Jeff Coleman, VP, Marketplace Channels at CPC Strategy said.

We’re interested to hear what our readers think: Is the death of the brand inevitable or do you think brands have a place in the future?