The New Tariff Landscape: Predicted Impact on Retailers, Consumers & More

Global trade dynamics are shifting rapidly, with new tariffs and retaliatory measures emerging between the United States, China, Canada, and the European Union. This ongoing analysis tracks key developments and their potential impact on advertisers, consumers, and the broader economy—offering strategic insights to help brands navigate a complex and evolving landscape.

The 2025 tariffs could reshape supply chains, influence consumer pricing, and alter market demand—all of which affect how brands position themselves, allocate media budgets, and manage messaging across regions. So, we tapped our agency’s top experts to deliver you exclusive insights on the evolving tariff situation. Read on, or use the table of contents below to skip directly to your topic of interest:

The 90-day suspension offers a valuable window for brands to explore alternative sourcing options, renegotiate supplier contracts, or adjust pricing strategies to mitigate financial impacts. Brands should evaluate how the adjusted tariffs impact their supply chains and cost structures, particularly those relying on Chinese imports now subject to higher tariffs.

As we work through the impacts of these tariffs, we understand the circumstances of every partner are different. Below are some of the considerations our team at Tinuiti can help navigate.

Yale Budget Lab has crunched the numbers, finding that under the current configuration of trade tariffs:

The Budget Lab (TBL) estimated the effects all US tariffs and foreign retaliation implemented in 2025 through July 31, including the new list of “reciprocal” tariffs to take effect August 7. TBL analyzed the July 31 tariff rates as if they stayed in effect in perpetuity.

(Source: The Budget Lab)

President Trump is set to enact a new wave of significant tariffs on nearly 100 trading partners next week, fulfilling his long-held desire to dismantle and reshape the existing global trade system. These double-digit tariffs mark a dramatic departure from the post-World War II trading order, where the U.S. generally maintained low import taxes under the World Trade Organization (WTO). (Source: The New York Times)

Tariffs cause major uncertainty and negative impacts on the US retail and advertising markets. Retailers like Amazon, Walmart, and Best Buy are seeing disrupted supply chains and fears of higher prices, despite some temporary relief from reduced tariffs on Chinese goods.

The ad market is particularly vulnerable, with total US media ad spending projected to fall significantly under heavy tariffs. Companies like Temu and Shein have already drastically cut their ad spending. While retail media may see some growth, overall, the industry faces substantial financial and strategic challenges due to the unpredictable tariff environment.

(Investor’s Business Journal; Tinuiti Data)

New tariffs pose a significant threat to the growth of the US advertising market in 2025. According to an April 2025 forecast, total US media ad spending could plummet to $394 billion under a heavy tariff scenario, effectively erasing any projected gains for the year.

This downturn is already showing signs:

(Source: eMarketer; Tinuiti Data)

The Trump administration is developing a “Plan B” for imposing tariffs, as a recent court ruling deemed his use of emergency economic powers (IEEPA) to implement sweeping duties illegal. While a federal appeals court has temporarily allowed the existing tariffs to remain in effect during the appeal process, the administration is exploring alternative legal avenues to maintain its aggressive trade policy. (Source: The Wall Street Journal)

A federal trade court has struck down tariffs imposed by President Trump on nearly all U.S. trading partners, ruling that he exceeded his authority under the International Emergency Economic Powers Act of 1977 (IEEPA).

The decision, handed down by the Court of International Trade, stated that the IEEPA does not grant the President “unbounded authority” to impose such sweeping tariffs and that an “unlimited delegation of tariff authority would constitute an improper abdication of legislative power.” (Source: The Wall Street Journal)

Temu adds import charges of about 145% in response to President Trump’s tariffs, doubling the price of many items. Rival discount retailer Shein has also hiked prices on its site, but it doesn’t appear to be implementing import charges. (Source: CNBC)

As advertisers get buffeted by tariff-induced uncertainty and a precipitous drop in consumer confidence, Amazon appears to be emerging as an early beneficiary. Tinuti data found that spending on Prime Video rose 29% between fourth quarter 2024 and first quarter 2025, fueled by competitive CPMs and its large audience of ad-supported users.

Among endemic advertisers — brands also selling products on Amazon — the DSP accounts for 34% of Amazon investment among Tinuiti clients, up 2% from Q4. Investment on both search and the DSP grew.

Tinuiti clients spent 12% more year-on-year on Amazon’s DSP, and 11% more on its search ads during the same period. “It’s a recurring theme with the brands we work with [that the] DSP has been the faster growing part of the Amazon ecosystem. That said, we do continue to see the search part of the business continue to grow as well,” said Andy Taylor, VP of Research at Tinuiti. (Source: Tinuiti Data; Digiday)

As we predicted in March, the anticipated cooling ad market due to tariff uncertainty is now a reality as the U.S. re-imposed tariffs on Chinese imports, impacting cost structures and consumer behavior. Brands in electronics, auto, and CPG are acknowledging economic hardship in their ads, echoing pandemic-era messaging. Tinuiti data revealed that Temu, a significant Super Bowl advertiser in 2024, has drastically cut ad spending following the tariffs and de minimis policy changes, with their U.S. Google Shopping ad impressions falling from 19% to 0% in a short period.

According to a new eMarketer analysis, social media, linear TV & gaming media are poised to absorb the greatest impact from diminished budgets. Performance-oriented digital channels might be more resilient due to measurable results, though all platforms could see pressure as brands prioritize loyalty programs and organic strategies. Ad buyers are revising 2025 forecasts, focusing on lower-funnel tactics for quicker results.

Despite cooling inflation and modest consumer sentiment, retaliatory tariffs and supply chain issues create a cautious marketing environment. Unlike gradual monetary policy changes, trade actions have swift, significant effects. Agility is crucial for performance marketers in this era of fluid budgets and rapid re-forecasting. Brands aligning with finance, using flexible buying, and focusing on conversion will fare best short-term. Those absorbing tariff costs and maintaining brand awareness may gain a strong long-term advantage.

Temu’s share of impressions in Google auctions has fallen to 0% in the past week. As of March 31, 19% of U.S. Google Shopping ad impressions were bought by Temu. By April 12, that figure had dropped to zero, a strong signal that Temu is no longer aggressively bidding for visibility in the space. (Source: Tinuiti Data; Reuters; Adweek; CNBC)

China responded to President Trump’s tariffs on Friday, raising its own tariffs on American goods to 125 percent, as the world’s two biggest economies extended a fast-moving tit-for-tat that has seen the cost of trade soar and fueled concerns over a global recession. (Source: NYT)

President Trump on Wednesday (4/9) announced – by executive fiat, with no involvement from Congress – a 90-day pause on the “reciprocal” tariffs he’d announced on April 2nd, applying to all trading partners apart from China. That means the currently-in-force tariff schedule (and this can change at any moment) is:

Foreign nations have not sat by impassively while the United States has threatened tariffs at a level not seen in a century (though economists would argue they should!). Retaliatory tariffs have been imposed along the following lines:

So where we’ve netted out is with higher taxes on American importers, higher taxes on the customers of American exporters, and a potential end to one of the most significant bilateral trading relationships in human history.

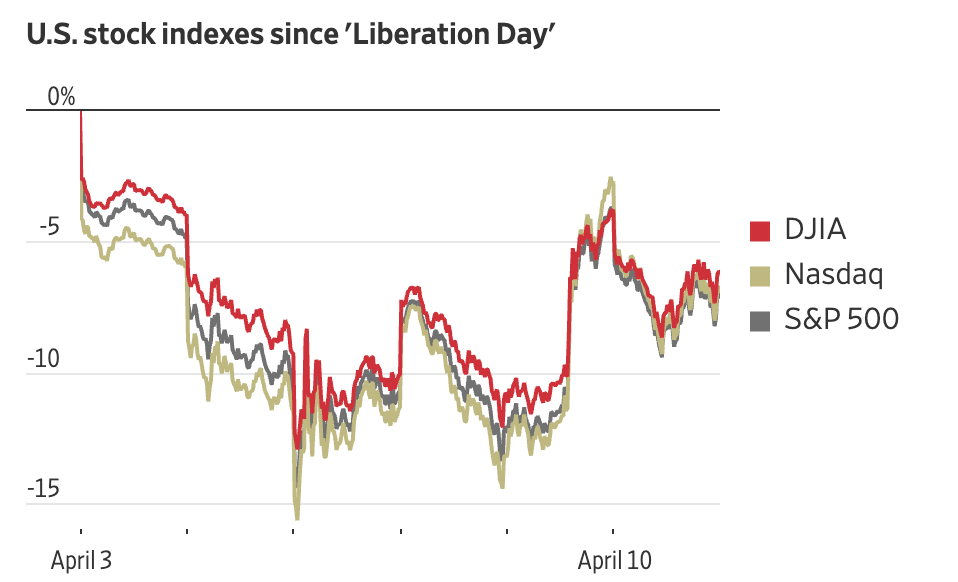

Market Reaction: The market unambiguously dislikes tariffs. Immediately following the President’s “Liberation Day” announcement on April 2nd, equity markets plunged; when he announced a pause of the reciprocal tariffs on the 9th, equities soared. Markets sank again on the 10th, possibly because expectations of further pullbacks from the universal tariffs were not forthcoming.

Trump’s 10% minimum tariff on nearly all countries and territories takes effect.

China announces plans to impose a 34 percent tariff on imports of all U.S. products beginning April 10, matching Trump’s new “reciprocal” tariff on Chinese goods, as part of a flurry of retaliatory measures.

Trump’s previously-announced auto tariffs begin. Prime Minister Mark Carney says that Canada will match the 25 percent levies with a tariff on vehicles imported from the U.S.

According to our most recent Digital Ads Benchmark Report, ad spend growth accelerated across Google paid search, Meta, Amazon Sponsored Products, and YouTube in the second quarter, in line with expectations as many platforms saw softer year-ago comparisons in Q2 than in Q1.

While tariffs are directly impacting the spend of some advertisers, in aggregate they have not significantly influenced ad investment to this point. Many brands have taken other measures such as renegotiating contracts and shifting production where possible to protect margin while maintaining ad budgets.

At least part of the reason ad spend has held up is the rollback of the most severe tariffs, with the once 145% rate on Chinese goods reduced to 30% in May, which clearly had a meaningful impact on China-based brands like Shein and Temu. Both Shein and Temu appeared to pause Google shopping ads entirely in mid-April, seemingly as a result of the end of the de minimis exemption. Shein reactivated a little over a month later once the tariff rate was revised to 30%, and Temu started to reappear sparingly in Google shopping Auction Insights reports at the end of June.

There remains significant uncertainty surrounding the ultimate shape of US tariffs and whether any rates established will be more than temporary given the administrations rapidly shifting policies over the last several months.

According to The Advertising Research Foundation: Seven empirical studies analyzed the effect of firm advertising on sales or market share. A review of these empirical studies suggest that there is strong and consistent evidence that cutting back on advertising during a recession can hurt sales during and after the recession, without generating any substantial increase in profits. Such cutbacks can result in a loss in capitalization. On the other hand, not cutting back on advertising during a recession could increase sales during and after the recession. Moreover, firms that increased advertising during a recession experienced higher sales, market share, or earnings during or after the recession. Most of the studies consistently showed that the strategy adopted for advertising during a recession had effects that persisted for several years after the recession.

Certain ecommerce merchants have been particularly alarmed by the prospect of new duties on Chinese goods because of their reliance on the so-called de minimis exemption. The De Minimis Tax Exemption is a law passed by Congress that allows shipments bound for the US and valued under $800 to enter the country free of duty and taxes. The Trump Administration’s executive order will end the de minimis exemption.

This matters because the de minimis exemption has been crucial to the business model of hugely important China-based ecommerce players like Shein and Temu. Both platforms ship customer orders directly from China under the de minimis provision, allowing them to keep prices extremely low (indeed, both are famous for their ultra-low prices). The new rules would end the exemption and raise the costs of getting these goods to the United States, eroding the price advantage of Shein and Temu, which will likely end up in higher prices faced by American consumers.

Temu, which infamously bought five Super Bowl spots back in 2024, has massively curtailed ad spend. Adweek (in partnership with the Research & Analysis team) notes that while 19% of U.S. Google Shopping ad impressions were bought by Temu as recently as March 31, this has since declined to 0% as of April 12th.

American businesses and consumers are now dealing with 10% universal tariffs, 145% tariffs on Chinese goods, and a huge amount of uncertainty over what tariff rates might be tomorrow.

That is not the only concern facing those who wish to conduct commerce across political borders. The US Trade Representative announced back in February, and is now revising, plans to impose steep port fees on Chinese-built vessels. The original plan was to impose fees between $500k – $1.5m for each port call, though the revisions are aimed at lessening the impact on American consumers.

One impact of higher port fees would be for shippers to only dock at the largest ports, skipping all the second- and third-tier ports. This would obviously not be helpful to the industries and jobs built up around those ports.

A second impact, related to the first, would be greater congestion and longer product landing times at the largest ports (Los Angeles, Houston, New York), similar to what we saw during the pandemic.

A third impact would be, of course, higher final prices to consumers.

There is not, unfortunately, ready American capacity that can take over this kind of cargo shipping.

This sobering reality is downstream of the Merchant Marine Act of 1920, better known as the Jones Act, which for over a century now has restricted water transportation of cargo between U.S. ports to ships that are U.S.-owned, U.S.-crewed, U.S.-registered, and U.S.-built. The result has been a domestic shipbuilding industry that has withered almost to nothing; there might be a lesson here for advocates of protective policies in the name of reinvigorating targeted industries.