Walmart vs. Amazon: The Race for Ecommerce Apparel Sales

In the race for ecommerce apparel, there are two standout contenders–and they’re not the ones you would have expected to see in this arena five years ago.

While Nordstrom and Kohls struggle to maintain traffic in a fizzling brick and mortar industry and Macy’s crumbles, Walmart and Amazon seem to only have eyes for each other.

Their strategies starkly contrast, but their goals are similar: To reach a young, increasingly affluent, online obsessed audience.

However, neither of them have historically seen strong online sales of apparel.

That’s about to change. Let’s explore who has the best shot.

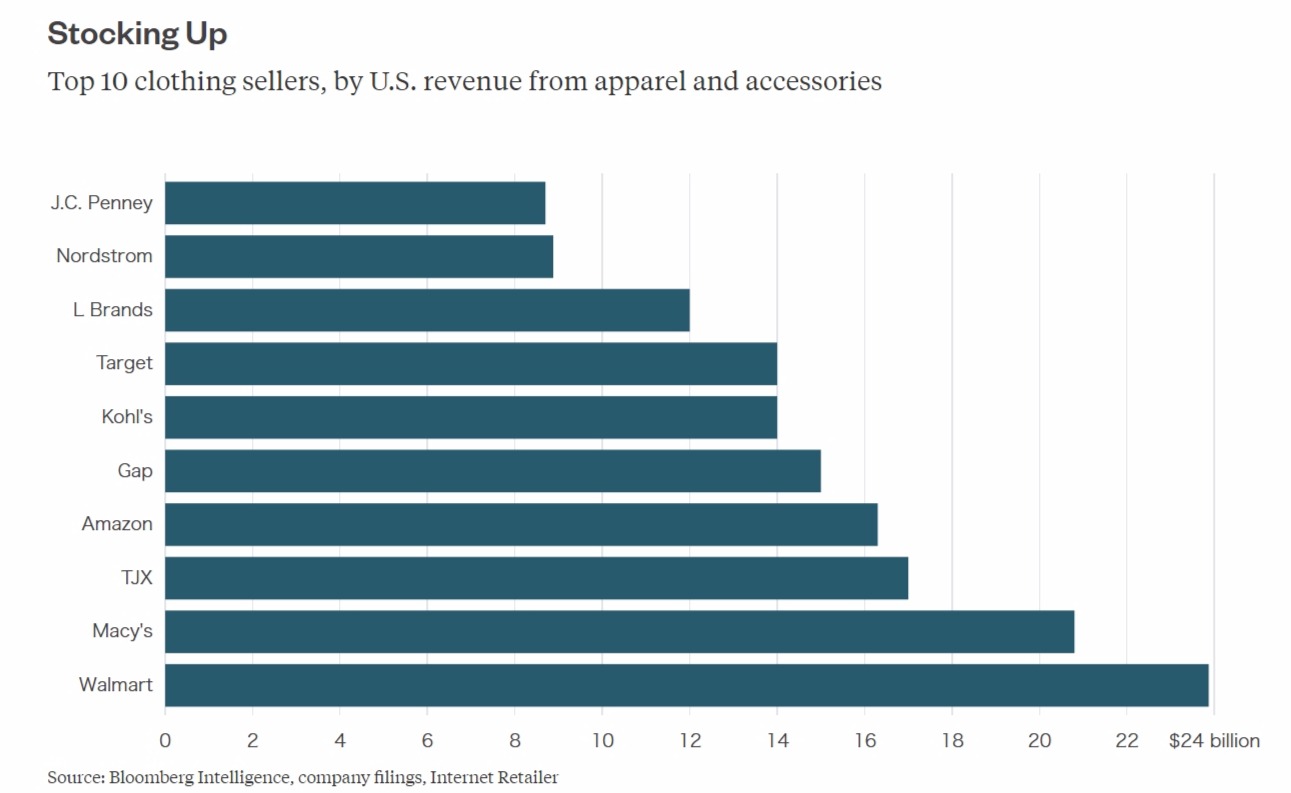

Walmart’s revenue from in-store apparel sales was over $23 billion, and its brick and mortars are the key to success in this arena. Can they push this success into the online arena?

By 2020, Amazon’s predicted to own over 18% of all apparel sales.

To put that in perspective, even just the 6.6% of apparel sales Amazon claimed in 2016 equated to $22B from direct clothing sales and commissions.

Walmart’s story is a little different.

While they’re the top leaders in overall apparel sales (see chart below), they’re lagging far behind most retailers in ecommerce apparel sales.

According to Fortune, “…ecommerce accounts for about 3% of Walmart sales, compared to 7.8% across retail”.

That takes us to our first disadvantage for Walmart: Their difficulty catching online shoppers.

Amazon was born on the internet.

Walmart was born in Rogers, Arkansas.

“Walmart already has a massive retail scale in terms of distribution and brick and mortar ownership, but they’re behind Amazon on ecommerce,” says Nii Ahene, COO of CPC Strategy.

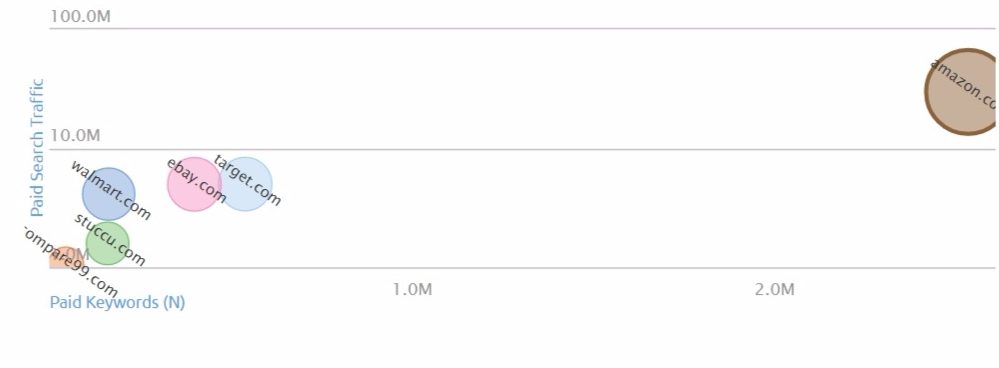

Just take a look at the general data below around paid search traffic for Amazon compared to competitors (taken May 11, 2017):

In general, Walmart’s inexperience in the ecommerce game will be a tough challenge to overcome. However, it’s not impossible. And as you’ll see in the next few sections, selling ecommerce apparel’s a whole new game for both companies.

Yep, that’s right–Walmart’s greatest asset happens to be the thorn in Amazon’s side for the apparel shopping experience–no bricks and mortar.

While customers will ready purchase their favorite K-Cups without seeing or holding them first, a pair of jeans is different.

Not only do a lot of people like trying on clothes before they buy, a lot of them also like to be able to return those items to the store, not the post office.

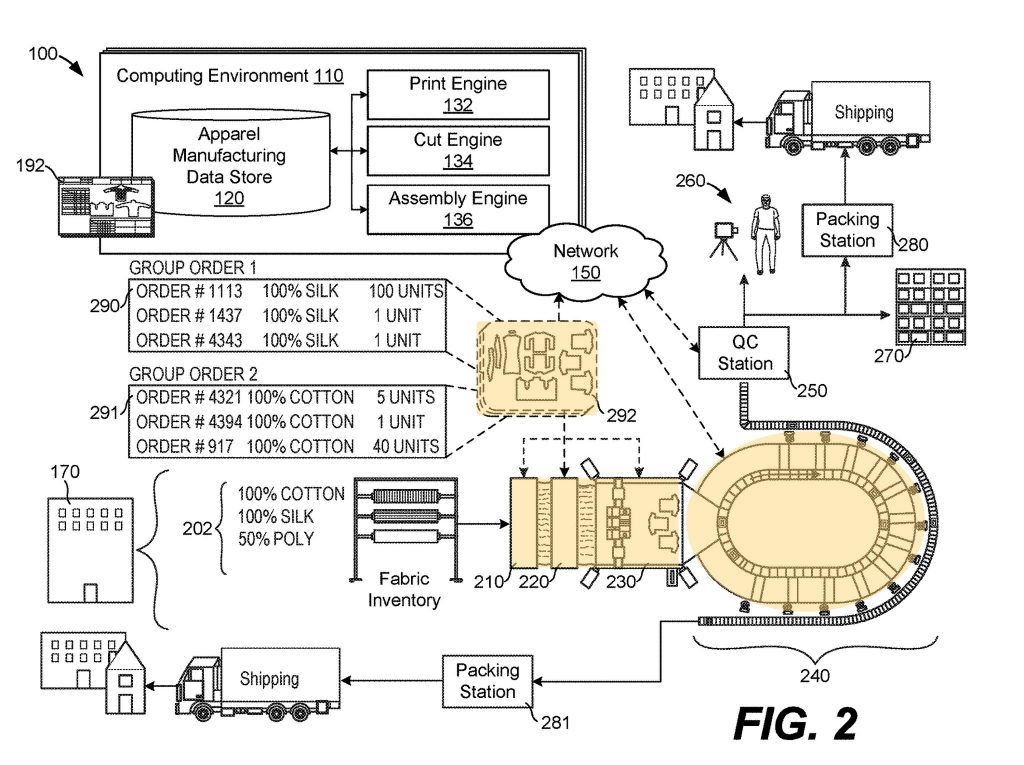

This may be part of the reason why Amazon’s exploring custom-made clothing. Check out one of the images from their patent filing below:

If your clothes are guaranteed to fit you, you might be more confident about buying online.

Incidentally, this technology could also help Amazon save money.

“Custom clothing could result in costs savings in the form of reduced customer returns,” explains Pat Petriello, Senior Marketplace Analyst at CPC Strategy. “I believe apparel averages a 30% return rate on Amazon, and if they can ensure proper sizing, they could potentially reduce that number.”

Walmart hasn’t exactly been ahead of the curve on site design or UX.

If trends continue, Walmart’s always going to trail Amazon in their site experience and design.

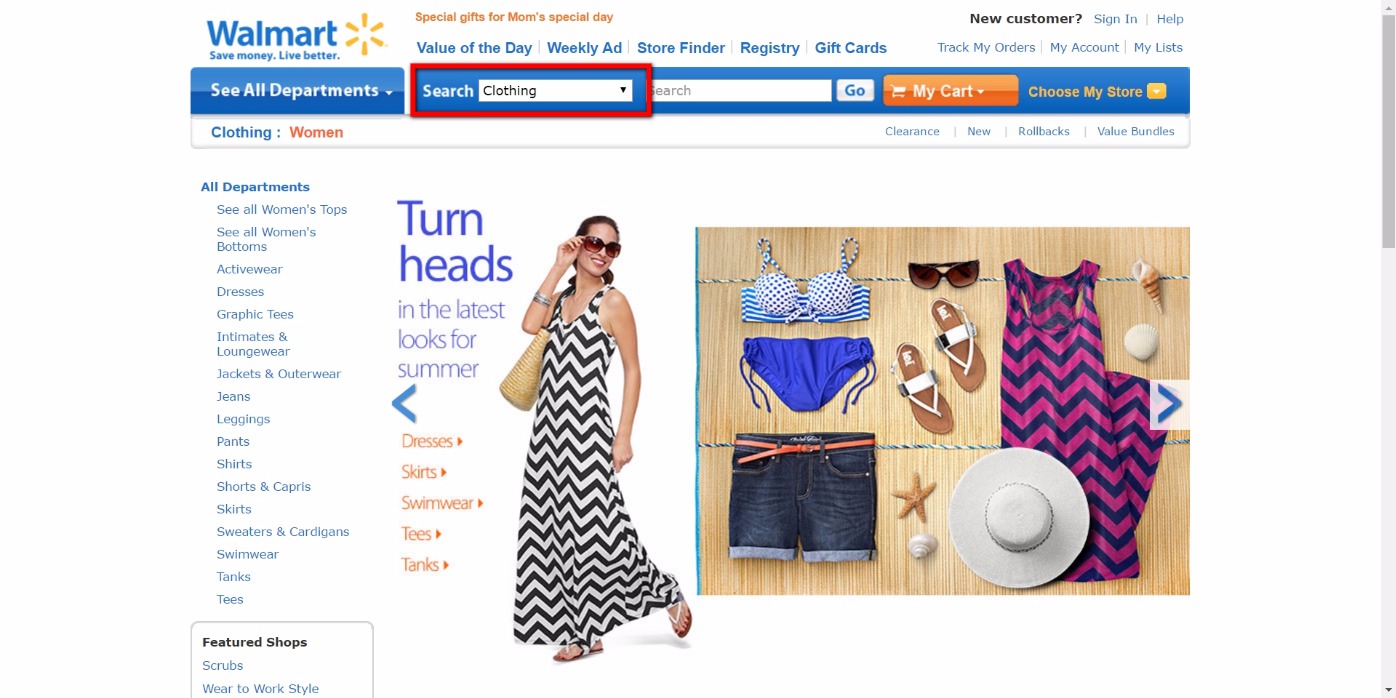

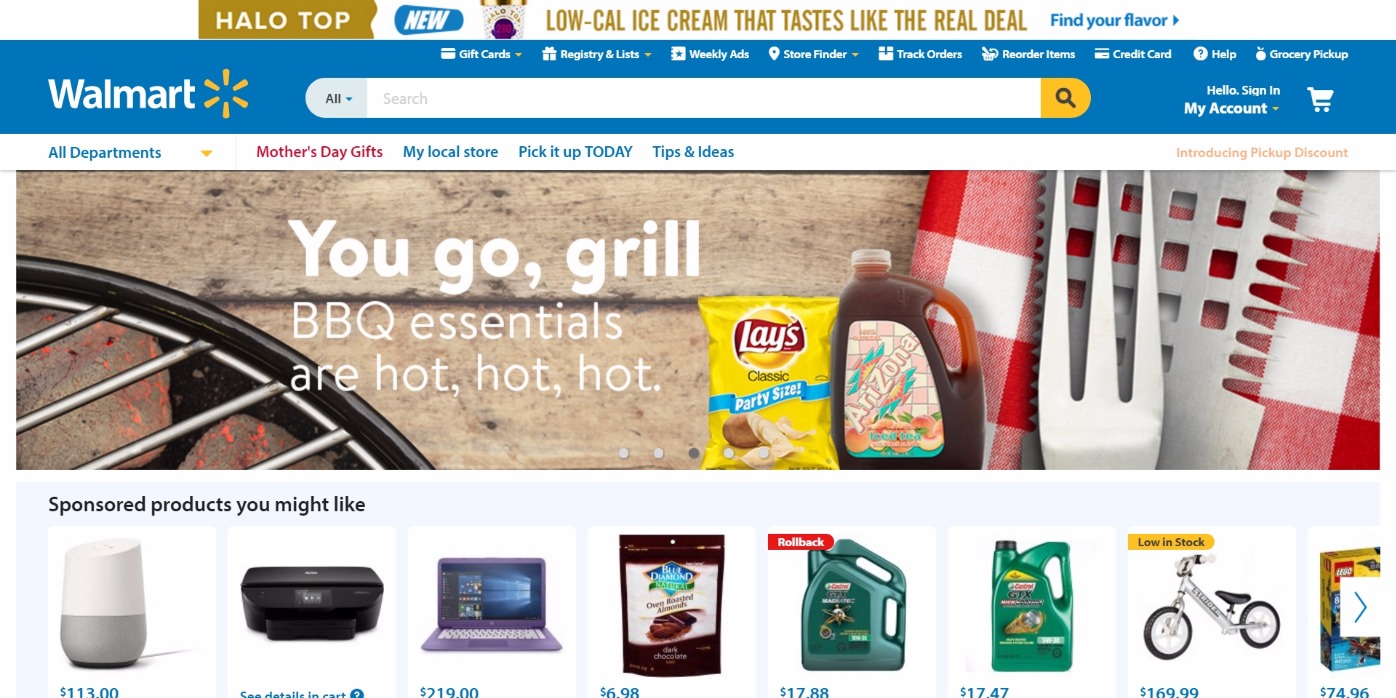

Take a look at the screenshots Wayback Machine revealed. (And we all know Wayback Machine doesn’t lie.)

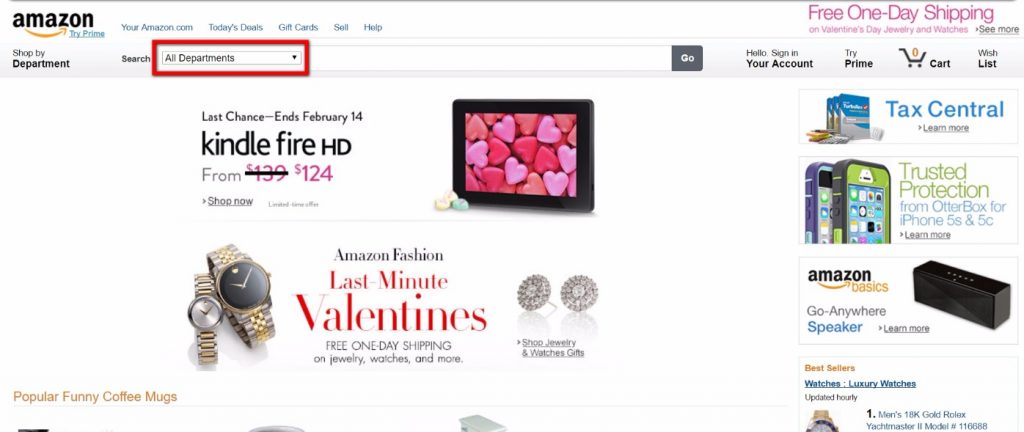

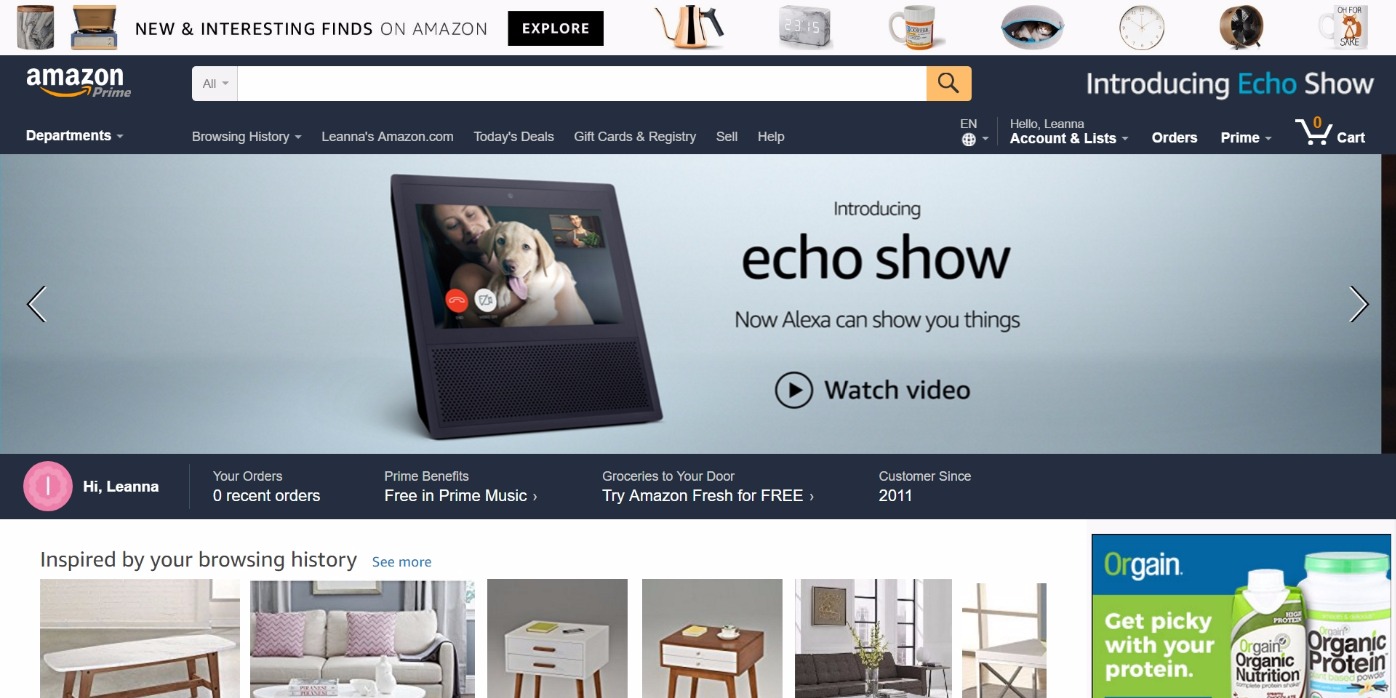

In 2014, this was Amazon’s home page:

And this was Walmart’s home page:

Fast forward to 2017, and it looks like Walmart has yet to break free of mimicking Amazon’s design:

“If Walmart put 50 million dollars into improving the site experience and it improved conversion rates by .5%, then it would have a huge positive impact on Walmart in the short term,” says George Anastopoulos, Account Executive at CPC Strategy.

To be fair, we did say both Walmart and Amazon need to improve their fashion shopping experience.

If you search for jeans on Amazon’s women’s clothing section, the first thing you’ll see is brand logos above the fold. There are brands everywhere–even the jean product images overlaid with them.

Considering the recognizability of specific jeans brands compared to, say, t-shirts–this does make some sense.

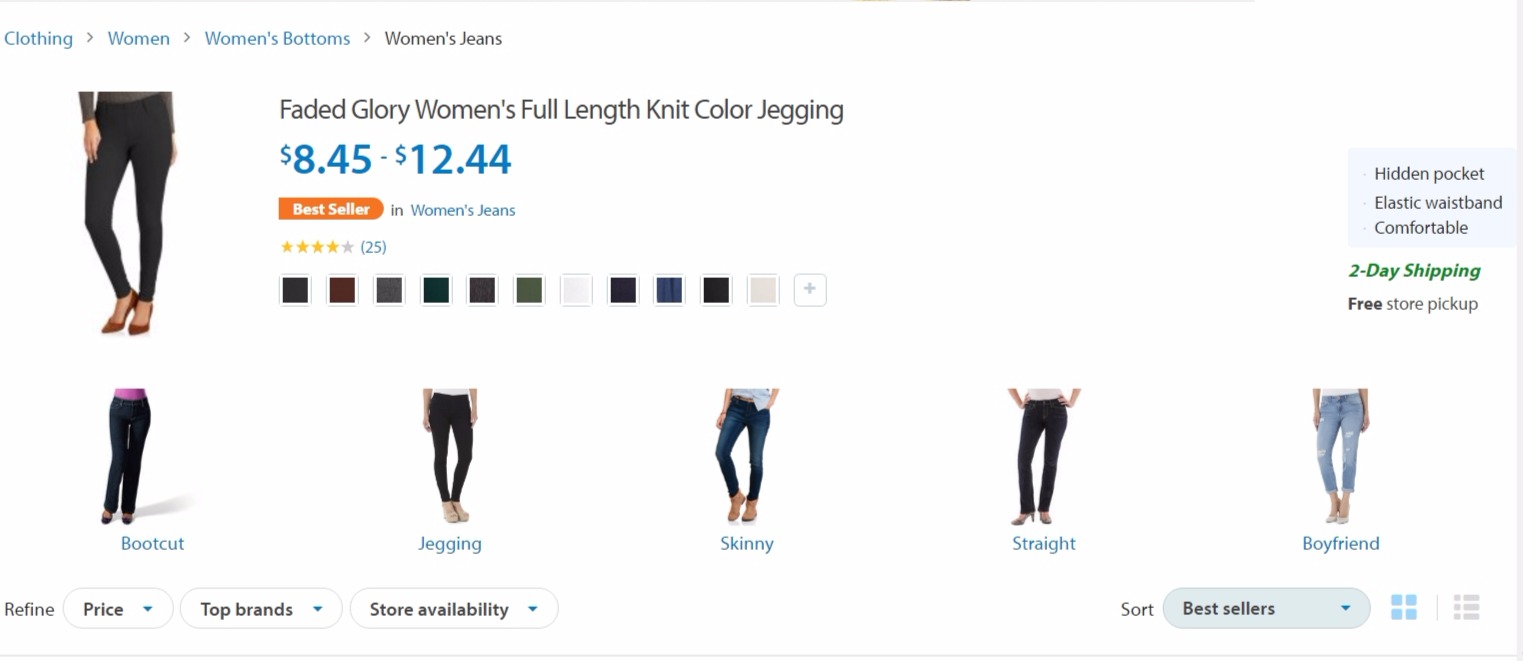

A bunch of logos isn’t exactly enticing, but still more upscale than Walmart’s page, which emphasizes price above all else:

If Walmart’s goal is to compete with Amazon for the same customers based on price, they don’t understand what really drives an Amazon customer: Value, not just low prices.

The advantages for both companies might sound like the inverse of their challenges, but it’s more complex than that.

While Amazon’s challenge is related to a lack of B&M stores and the experiences those bring, their ability to overcome that challenge doesn’t hinge on the power of their advantages. It hinges on their ability to leverage technology and understand new ways to meet their customer’s needs.

And although Walmart’s powerful B&M presence does pose a threat to Amazon in some ways, it may not be enough to draw customers away from the platform.

Out of all online retailers in 2016, Amazon sold the most apparel to U.S. shoppers aged 18 to 34.

This is one thing Walmart still doesn’t seem to understand.

Think about it this way: If a shopper’s able to get a pair of J-Brands at a decent price with fast shipping on Amazon, they’re going to be more excited than they would if they purchased a cheap pair of lower quality jeggings from Walmart.

Again, Amazon customers shop on the platform for the value it provides, not just for the low prices.

(Our 2017 Amazon Consumer Survey has more data on what motivates Amazon customers to buy.)

First, there’s the obvious advantage to Walmart’s extensive network of brick and mortars–customers can actually try products on and return them in-store.

Another way Amazon’s been leveraging their network of B&Ms to cater to an online audience has been via in-store pickup.

This is a pretty effective way to get increased foot traffic from the convenience of online browsing. and there’s an added bonus to this strategy. According to some sources, 50% of your online shoppers who come into your store to pick up will also buy something else.

However, in-store pickup isn’t perfect–and of the 43% of consumers who didn’t pick up an online order in 2016, 82% say it’s because rather have the item shipped to their doorstep.

But that doesn’t make Walmart’s B&M’s as archaic. There’s another strategy they could employ that could make Amazon break out into a (light) sweat.

Lightning-fast shipping straight from Walmart B&Ms.

Ahene explains:

“You’re probably closer to a Walmart than an Amazon distribution center. If Walmart could figure out a way to mesh their convenient locations with fast deliveries using Uber or another type of crowdsourced delivery–they could have the advantage. Not just over Amazon, but also over convenience stores.

There is a percentage of items consumers buy that they are willing to wait for–cell phones, video games, etc.–depending on your vertical, that’s maybe 40-50% of your purchases. But there are also a lot of discretionary items–cereal, rubbing alcohol, toilet paper–that share of wallet is still owned by convenience stores and stores such as Walgreens and Target. This is an area where Walmart is better positioned to dominate. The question is how will they leverage their resources?”

Walmart has made great strides in matching Amazon’s shipping policies (and at one point, even beating Amazon’s shipping policy for non-Prime members).

If they start to put the focus on fast + free shipping, it could potentially erode Amazon’s CPG verticals.

We’ve seen Walmart and Amazon a lot in the news lately for acquisitions, while other retailers and brands are in the news for not-so-great reasons (read: Macy’s slow implosion and tales of struggling Target).

What are Walmart and Amazon trying to do? Well, two very different things, as it turns out.

We all heard about Walmart’s acquisition of Jet.com. But there are a few more that might surprise you.

Since 2016, Walmart has acquired all of the following apparel companies:

These are diverse selections ranging from women’s clothing (Modcloth) to outdoor apparel (Moosejaw). And it’s not a mistake–there are two key advantages to these choices.

First, several of these companies are retailers, and retailers can potentially offer a bigger bang for your buck because they offer access to a slew of desirable brands.

“When a company acquires a retailer, the strategy is to acquire the same manufacturer relationships that their acquisition has,” points out Jon Gregoire, Director of Marketing at CPC Strategy. “That was part of Walmart’s strategy in acquiring Moosejaw, to build out their brand partners in the outdoor category.”

The second advantage is that many of these companies have clout with a millennial audience.

“By buying hip millennial companies [such as Bonobos and Jet.com], Walmart can grow their ecommerce data stack,” says Ahene. “This is especially valuable because millennials have traditionally been less likely to go to Walmart than other generations.”

While Walmart does have their own clothing brands, they aren’t sought after by a desirable millennial audience.

So rather than attempting to create a “cool” brand and turn around their status as your great-Aunt-from-Tennessee’s favorite store, Walmart’s aiming to swallow up cool brands so they, too, can have that power.

“Amazon and Walmart are going head to head on video games, blankets, and a ton of other products,” says Ahene. “But there’s a concerted effort from Walmart around competing asymmetrically with Amazon, hence the acquisition of vertical-specific retailers.”

Amazon has made recent acquisitions of their own–ShopBop, MyHabit, Zappos, and EastDane come to mind–and again, they’re aiming for both retailers and brands.

However, Amazon’s larger strategy has been private labeling for apparel.

…and we’ve heard rumors about an athletic apparel line.

Ahene expands more on this move towards private labeling, and why it fits with Amazon’s values:

“Amazon’s all about three things: Selection, convenience, and value. They have selection via the 3p marketplace, they have a convenience factor via Prime memberships, and private labeling is an opportunity to provide value by driving down prices and cutting out the middle man.”

So why the sneaky brand names for their private labels?

Amazon couldn’t just start making clothing with an “AmazonBasics” label–they knew millennials probably wouldn’t go for that unless it was for essentials such as underwear.

Simply put: Nobody’s trying to make a statement with batteries, so they don’t care about the “cool” factor.

So instead of attempting to force the Basics brand to fit a new more complex market of apparel shoppers, Amazon cleverly created those private label apparel brands that don’t seem associated with Amazon at all.

Petriello expands:

“Amazon’s brand isn’t aspirational in the way that Apple’s or Nike’s is. Their brand is about service, reliability, convenience, and trustworthiness. I think that’s the reason that batteries and wireless mice are included in the AmazonBasics brand but apparel products (which are lifestyle products) are not. Most customers won’t even know that the Buttoned Down brand is Amazon’s. If you look at a Buttoned Down detail page, there’s nothing indicating it’s an Amazon-owned brand.”

Another way Amazon’s making their private labels more desirable is by making nine of them shoppable for Prime customers only.

Smart move considering Prime members don’t just spend more than non-Prime members, but also because Prime members now outnumber non-Primers.

We predicted the growth of Amazon’s private labels in 2017, and boy were we right. But we didn’t quite expect to see this many private labels in apparel.

Right now, Amazon is clearly the stronger player in ecommerce apparel.

A survey of 2,500 U.S. consumers showed that Amazon grew their army of apparel shoppers by 27% over the past two years, while Walmart’s number dipped 2.1%.

But Walmart’s made great strides from 2016-2017.

They’re working on gathering more data to understand a brand new audience, and part of the way they’re accelerating the process is by making purchases of brands that have built in millennial equity.

At the end of the day, both companies will need to strengthen their existing advantages, cope with challenges, and figure out inventive ways to engage millennials in order to succeed.