How Buy Now, Pay Later Is Shaking Up Ecommerce Retail

Nothing is quite as enticing to the modern shopaholic as the idea of buying now and paying later. Luckily, this fantasy is now a reality.

Buy now, pay later (BNPL) — as the name implies — allows shoppers to make a purchase without forking over the cash at the time of purchase.

With the ability to increase impulse buys and drive additional ecommerce sales, it’s no wonder BNPL is the next big payment trend in the online retail world.

If you’re reading this and asking yourself, “What is the point of buy now, pay later when I already offer credit card payments?” you’re not alone. The BNPL model does indeed offer some striking similarities to credit cards.

With credit cards, buyers can also make a purchase and pay it off over time — but the purchasing psychology behind BNPL offers are perks with which credit cards can’t compete. One case study found that average order values increased by 33% solely due to the addition of a buy now, pay later option.

Here’s how the buy now, pay later transaction option is shaking up the ecommerce industry and how you can add BNPL options to your website.

The concept driving buy now, pay later is pretty simple: Customers complete an online transaction and, instead of paying the total amount up front, make installment payments over time.

Similar to how credit cards work and the layaway model — a popular shopping option around the holidays in which shoppers set aside items and pay them off over time — BNPL lets customers quite literally buy now and pay later.

Buy now, pay later makes it possible for retailers to move products quickly out of inventory.

Stores can offer their own financing, similar to the store-specific card days of yore, or go through a third party like Klarna or PayPal Credit. Regardless of payment method, buy now, pay later has been rising rapidly in popularity, with even the big banks, like Chase and Citi, rushing to get on board.

Using the buy now, pay later model, customers have the option to buy now and make payments later. In general, this works by entering customers into a contract that obligates them to make payments of both principal and interest in the future, much like a traditional loan.

Say your company offers a buy now, pay later option through a third party, like PayPal Credit. When a customer chooses this option, they’re agreeing to purchase a product without paying upfront but rather over time. Under these circumstances, your company still receives the proceeds of the sale upfront from PayPal, making this scenario generally equal to a credit card payment from the perspective of your business.

It’s no longer on you to chase down the money owed as a part of the “pay later” aspect of the transaction; that burden falls to the BNPL provider in the same way a credit card company would be responsible for receiving money from users with standard credit card payments.

Most third-party BNPL providers do a soft credit check to avoid giving money to people who have shown general disregard for repaying obligations, but this isn’t universal. Some BNPL solutions offer one consistent interest rate, while others base interest rates on things like purchase price. Usually, a buy now, pay later transaction includes the potential for something like late fees or prepayment fees, but how this applies can vary from one vendor to the next.

For companies who choose to use their BNPL financing to avoid paying third-party service fees, buy now, pay later is akin to providing a store credit card. The burden is then on the company offering financing to ensure all debts are paid.

This can add a layer of complication and the potential for lost revenue. But it may result in additional benefits for those in a position to manage their financing and thus avoid vendor fees.

Buy now, pay later is the hot new ecommerce trend, and most store owners understand that customers love it. But what is the overall benefit of offering BNPL to customers, and what does it offer you?

Your loyal customers will likely shop with you on an ongoing basis, regardless of the kinds of payment methods you have to offer, but how much they spend with you isn’t necessarily guaranteed. These customers will likely keep shopping for their favorites, but the availability of BNPL may influence the frequency or value of their purchases.

Think regular customers will shop with you regardless of the payment method without the risk of cart abandonment? Think again. Even people in a stable financial position can sometimes get to the checkout screen, realize they have an expensive cart and shy away from going through with a purchase.

However, buy now, pay later opportunities can increase the odds that customers will spend. Of customers surveyed who used BNPL, 31% said that they wouldn’t have purchased at all without the ability to pay later.

If you’ve ever loaded up your cart with goodies on your favorite ecommerce site only to get to the checkout and balk at the price, you’re not alone. Lots of customers are excited to buy new products until they’re confronted with exactly how much they’re going to have to pay — leading to cart abandonment.

Even though BNPL works in a way similar to credit cards with no real savings option, the psychology behind paying later for a single purchase makes buyers far more willing to pull the trigger.

On average, around two-thirds of shopping carts are abandoned, which equals a lot of lost sales for most ecommerce companies. However, stores that add BNPL options at the checkout are seeing a sharp drop in cart abandonment rates, leading to a boost in profits without any significant cost increases.

One survey found that 48% of consumers would allow BNPL availability to influence purchasing decisions, which means that nearly half of your prospective customers may be swayed one way or another by your payment option availability.

Why is it important to better your customer experience? Creating positive customer experiences builds loyalty and encourages repeat business.

More ways to shop, more ways to pay, and more products to choose from are all positive factors from a customer perspective. Offering customers the flexibility to shop and pay the way they want often means an increase in loyalty and, accordingly, sales.

An estimated 6% of carts are abandoned due to insufficient payment options, which says a lot about how much customers value a variety of ways to pay.

Which options you feature is ultimately up to you and your target demographic — for example, Millennials are far more likely to prefer mobile wallets than their Baby Boomer parents — but the more choices provided, the better.

Buy now, pay later is just one more option customers like to see. Leaning into this growing trend can provide the great customer experiences that build you a base of returning shoppers.

The numbers don’t lie: customers want the buy now, pay later option. With reductions in cart abandonment and increased spending, BNPL is benefiting everyone.

Before adopting BNPL, you need to ensure that the financing option is right for your business and audience.

Many BNPL providers have a price minimum for financing. There are financing solutions that have a $50 minimum, while others only offer financing for expensive goods.

When determining if BNPL is an option for your store consider the pricing of your products and if financing would even be an alternative. If you are wanting to move more expensive items out of inventory, verify that your BNPL solution can break payments down into smaller amounts your customers can afford.

Also, think about the cost of providing a BNPL option. Depending on the provider you select, there might be transaction fees or a flat rate.

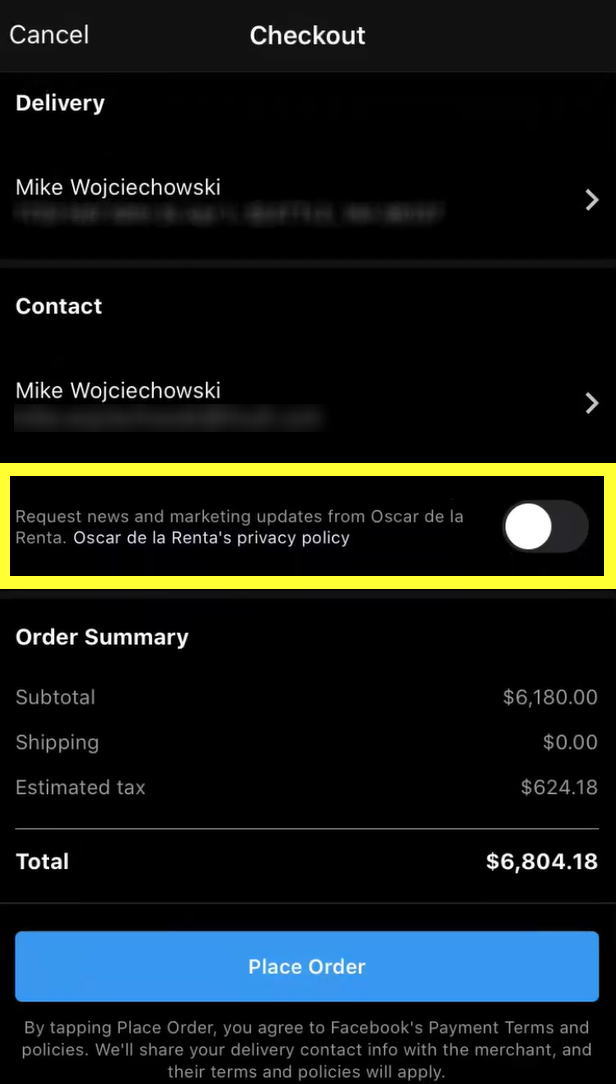

For your customers to be able to use the your selected BNPL solution, they will need to meet certain requirements.

In most cases, customers will be required to complete a credit check and have a score above 650. Customers must also not have any recent negative financial events, like bankruptcy or foreclosure.

As BNPL has evolved, several solutions have been created to meet customers’ needs. Adding these solutions to your ecommerce store is a fairly simple process if the providers are already integrated with your ecommerce platform. If you select a provider without an integration to your platform, then you will be editing code or needing to create a customized solution.

These five BNPL solutions can help you introduce financing into your ecommerce store.

Affirm: Affirm is a payment gateway for all business sizes. Customers can select from payment plans that divide their payments across 3, 6, or 12 months.

Afterpay: Afterpay is available for U.S., Australia, and New Zealand stores. AfterPay gives shoppers the ability to break their payments up into four equal installments due every two weeks.

Klarna: Klarna offers very flexible financing options, including allowing customers to pay after the delivery of their orders.

PayPal Credit: PayPal provides financing for customers who make purchases that total to $99 or more, with no interest if paid in the first six months. Many people like PayPal credit because they have had positive experiences using the brand.

Bread: Bread is a flexible financing solution that lets you offer several payment plans to your customers. With Bread, you can make your payment process match your business needs.

If you’re not prepared to embrace buy now, pay later avenues for your ecommerce store, you’re going to find yourself at a competitive disadvantage.

These three brands have leveraged BNPL for extraordinary gain, setting themselves apart from the competition and gaining a loyal following for catering to the wants and needs of their consumers.

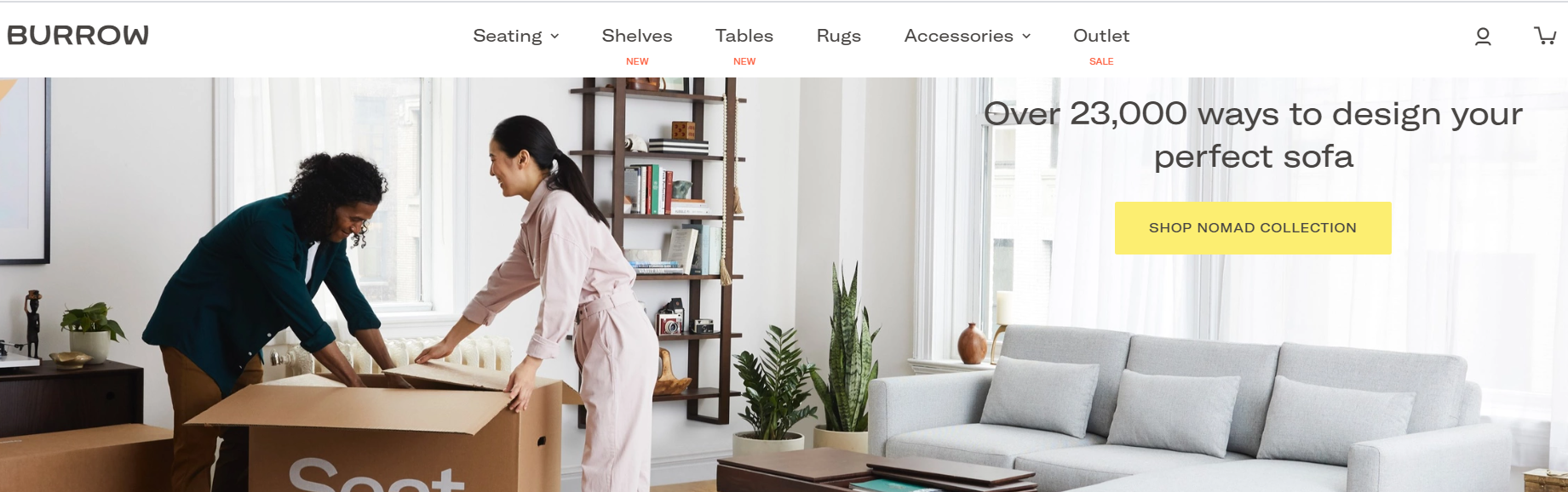

Burrow, an ecommerce furniture store selling high-quality products without the middleman, offers a buy now, pay later option — particularly useful for making big-ticket purchases like furniture.

Burrow uses third-party BNPL provider Affirm. Customers just need to enter some basic information to determine credit worthiness, then receive a near-instant credit decision. The subsequent payment plan is based on the purchase price and credit information.

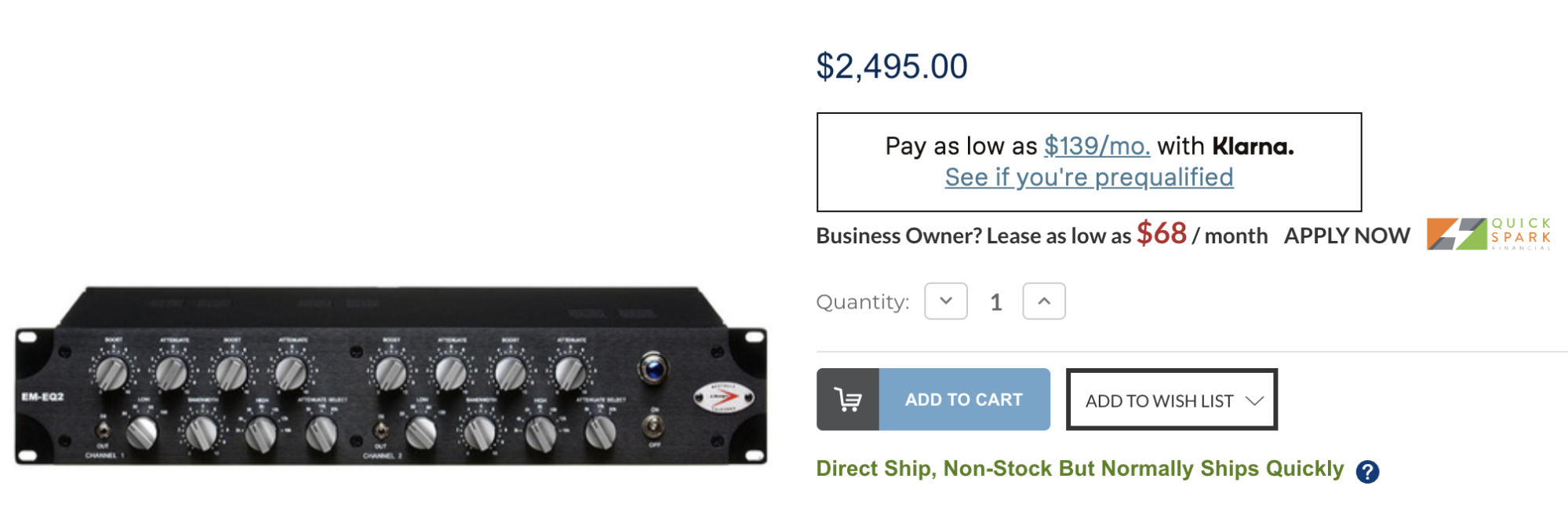

ZenPro Audio is a respected pro audio gear dealer, offering recording equipment primarily aimed at professional recording studios.

ZenPro uses Klarna, one of the most popular options for buy now, pay later.

Among the first to come to the U.S., Klarna is used by some of the biggest names on the ecommerce market, including Sephora, Asos, and Crocs. The BNPL provider allows virtually any purchase to be repaid over time based on the price of the purchased object.

Klarna provides flexible options, including:

Klarna charges retailers a flat $0.30 fee for each transaction in addition to a variable rate of anywhere from 3.29% to 5.99%.

As the world of ecommerce continues to grow and change, it’s not surprising that payment methods are included in this. Digital wallets have been on the rise for years, but the trends haven’t stopped there; today, more customers favor buy now, pay later than ever before.

While buy now, pay later concepts aren’t exactly new — credit cards and layaway have been viable purchase options for both online and brick and mortar purchasing for decades — the current incarnation is relatively recent.

Functioning in a way similar to short-term loans with flexible repayment options, customers on the fence about a purchase can find the motivation necessary to click “Buy” with the lure of low payments.

While there’s a cost to merchants — usually around 2%–5% of the purchase price — many options are completely free for customers to use, creating a winning situation that can erase any doubts about spending money on a must-have or an impulse buy.

If you want to attract young buyers and open the door to more purchases than ever before, BNPL needs to be part of your checkout process.

This article was authored by Leigh-Anne Truitt.

Leigh-Anne Truitt is a Search Engine Optimization Specialist at BigCommerce where she researches and discovers strategies to increase organic traffic. Prior to joining the ecommerce industry, Leigh-Anne perfected her marketing skills at The University of Texas at Austin and CanIRank.