Instacart Releases New-to-Brand Sales Metrics

While Instacart, the widely used online grocery platform, isn’t necessarily the new kid on the block these days, shoppers are still flooding the marketplace daily where they’re discovering new brands and new products.

Wish you had access to more data on these new-to-brand shoppers? You’re in luck.

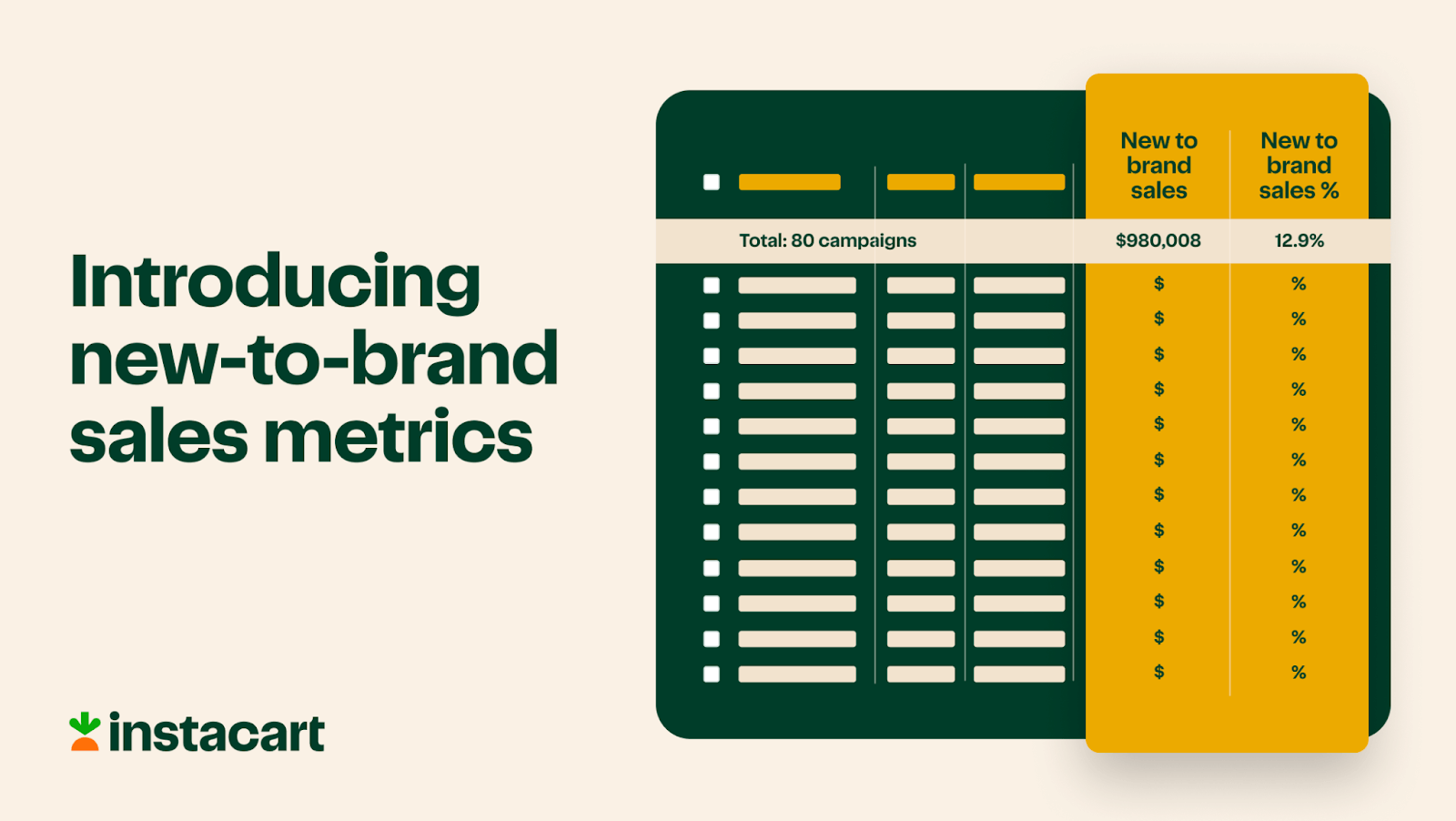

Instacart recently announced updated sales metrics to help you better understand consumers who might be new to your brand. These metrics help sellers dive deeper into the sales impact of new-to-brand customers. These insights are now available in Ads Manager and through Instacart’s API for sponsored product and display ads.

Ready to learn more about new-to-brand sales metrics from Instacart? In this article, we’ll cover why these metrics are important, how to leverage this data, and more.

New-to-brand is a set of new reporting metrics that have been released in Ads Manager and the API that’s available to all advertisers across the U.S. and Canada. New-to-brand is defined as either the percent or dollar sales amount of attributed sales from consumers who have not purchased any products from the overall CPG brand in the last 26 weeks.

As marketers, data drives every move we make. We follow performance to increase results and Instacart’s newest launch helps advertisers do just that. These new-to-brand reporting metrics provide deep insight into how successful your ads are at converting new consumers and retaining existing ones within the Instacart space.

This data is a great addition to existing metrics (ie: ROAS) so you can better determine the success of your ad campaigns, and so you can better understand customer acquisition for your various ad tactics.

“The new-to-brand metric is a valuable data point that helps us to create informed strategies for our brands on Instacart. It allows us to understand who is buying their products and the best use of budget in upper funnel tactics vs. lower funnel branded terms. Understanding which products have a higher NTB conversion rate allows brands to invest more which in turn grows their customer base and market share. Instacart understands the importance of incrementality for brands and they continue to invest in reporting capabilities.”

— Rachel Kwak, Retail Media Specialist, Marketplaces at Tinuiti

As highlighted in a recent blog post, a few of Instacart’s brand partners have already seen significant results…

“What excites us most is that over half of our Instacart sales from our ad campaigns in the first half of 2022 came from consumers who have never purchased our brand That’s it. on Instacart,” said Elizabeth Pigg, CMO of That’s it. “New-to-brand reporting has really helped That’s it. understand incremental customer acquisition online in a way that we typically don’t see from our other partners.”

“Visibility into new-to-brand metrics has allowed us to look at our business at a more granular level. We are able to get more focused on growing our consumer base and market share,” said Katie Bleuer, Omnichannel Development Lead at Catalina Snacks Inc., who had access to these new-to-brand metrics during a pilot phase. “We are excited for the opportunity to have these metrics at our fingertips within the Ads Manager portal on a regular basis.”

According to Instacart, users can view the new to brand reporting metrics in Ads Manager and/or through the API. The metrics are available for the following reporting breakdowns:

Keep in mind, there will be no other changes to existing reporting and optimizations as a result of this launch.

There’s no better time to leverage Instacart’s new-to-brand metrics to help your CPG brand continue to thrive on the platform. If you’re ready to see how new-to-brand data can boost your performance, learn how our Commerce team can help you make the most of retail data from Instacart and beyond.