2024 Election: What Marketers Need to Know

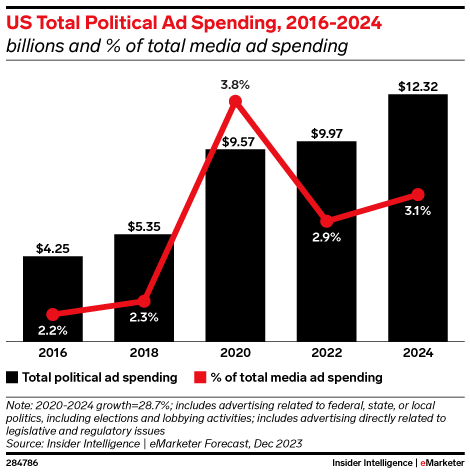

According to eMarketer, U.S. political ad spending will pass $12 billion in 2024—a new high—as compared to the $4.25 billion spent in 2016. So, as we quickly approach the 2024 Presidential Election, it makes complete sense that marketers are increasingly mindful of how this major event will impact their advertising strategies.

While the future remains uncertain, we’ve compiled key insights and recommendations to help you navigate the upcoming months across various advertising channels. We’ll give you a comprehensive look into how each channel might (or might not) be impacted including Paid Search and Commerce, Paid Social, TV, Audio & Display, Ecommerce, and more.

There’s no need to fear the unknown if you’re as prepared as possible and we’ll help get you there. Let’s dive into all things election.

“At this point, marketers have weathered multiple years of black swan events. While a macro-degree of distraction & uncertainty will persist until the election concludes, the reality is that this will be business as usual for the majority of American consumers & marketers alike.”

Simon Poulton EVP, Innovation & Growth at Tinuiti

Good news for digital marketers: paid search channels are likely to see little direct impact from the election. However, there are still important considerations to stay mindful of.

Looking at past search trends, we see that during election years like 2020, the spike in search activity doesn’t actually drop off—it just gets pushed back. Normally, this bump happens about 7 to 9 days after Election Day, whereas in non-election years, it’s usually 4 to 5 days earlier. For 2024, this means we might see a peak around November 13th to 15th. This timing is key because it’s about two weeks before Cyber Monday, a time when we usually see a big uptick in shopping activity.

Key actions for marketers/advertisers:

Political spending on social platforms is expected to jump about 53% to $605 million in 2024 compared to 2020. However, Meta is taking a different approach this election cycle. They’ve announced new restrictions for political advertisers, including stopping the recommendation of political content on Instagram and Threads unless users specifically seek it out. Meta has also scaled back political content in News Feed and banned targeting based on sensitive topics like political beliefs. These changes aim to improve user experience, enhance brand safety, and lower costs for non-political advertisers.

Keep in mind that Meta will be prohibiting any new ads in the week leading up to the election, so from 12:01 AM PT on October 29, 2024 through 11:59 PM PT on November 5, 2024 no new ads about social issues, elections or politics can be published in the U.S., and most edits will be prohibited.

Meanwhile, TikTok has poured over $2 billion into trust and safety this year, focusing on curbing misinformation, banning political ads, and increasing transparency with verified accounts for governments and political figures.

“Brands should not anticipate any major cost fluctuations on Meta or TikTok in response to election inventory, but we historically see CPMs begin to climb in the first week of November as advertisers scale up their holiday investment.”

Jack Johnston Senior Social Innovation Director at Tinuiti

And while brand activism was seen as essential in the last election, a recent survey shows that only 25% of consumers now think it’s important for brands to take a stand on social issues. This indicates a shift towards preferring brands that stay true to their products and are selective about the causes they engage with.

Key actions for marketers/advertisers:

While not directly impacted by political ads, ecommerce marketers should be aware that the election may distract customers and contribute to cautious spending behaviors. Amazon’s recent earnings report highlighted that the election is making Q3 predictions challenging, as it seems to be “distracting customers.” They also noted that this distraction might be contributing to consumers remaining cautious with their spending, opting for deals, and trading down.

“When watching the news, election coverage is always front and center especially with the changing candidate landscape, consumer price index and rate cuts are being watched closely and we seem to be walking a very fine tightrope in performance which is further fodder for the election. As a result we will see consumers watching what these candidates say in order to drive more confidence in spending decisions going into 2025 and beyond.”

Robert Avellino VP of Commerce Innovation and Growth at Tinuiti

According to eMarketer, election advertising spend for 2024 is expected to be about 30% higher than in the previous election cycle. With more advertisers vying for ad space, CPMs are likely to rise, particularly during peak times, in specific locations, and on channels directly related to politics.

Key actions for marketers/advertisers:

With record-breaking spending anticipated, the landscape is evolving as traditional and digital channels vie for a share of the political pie. Let’s take a deeper look at some top trends…

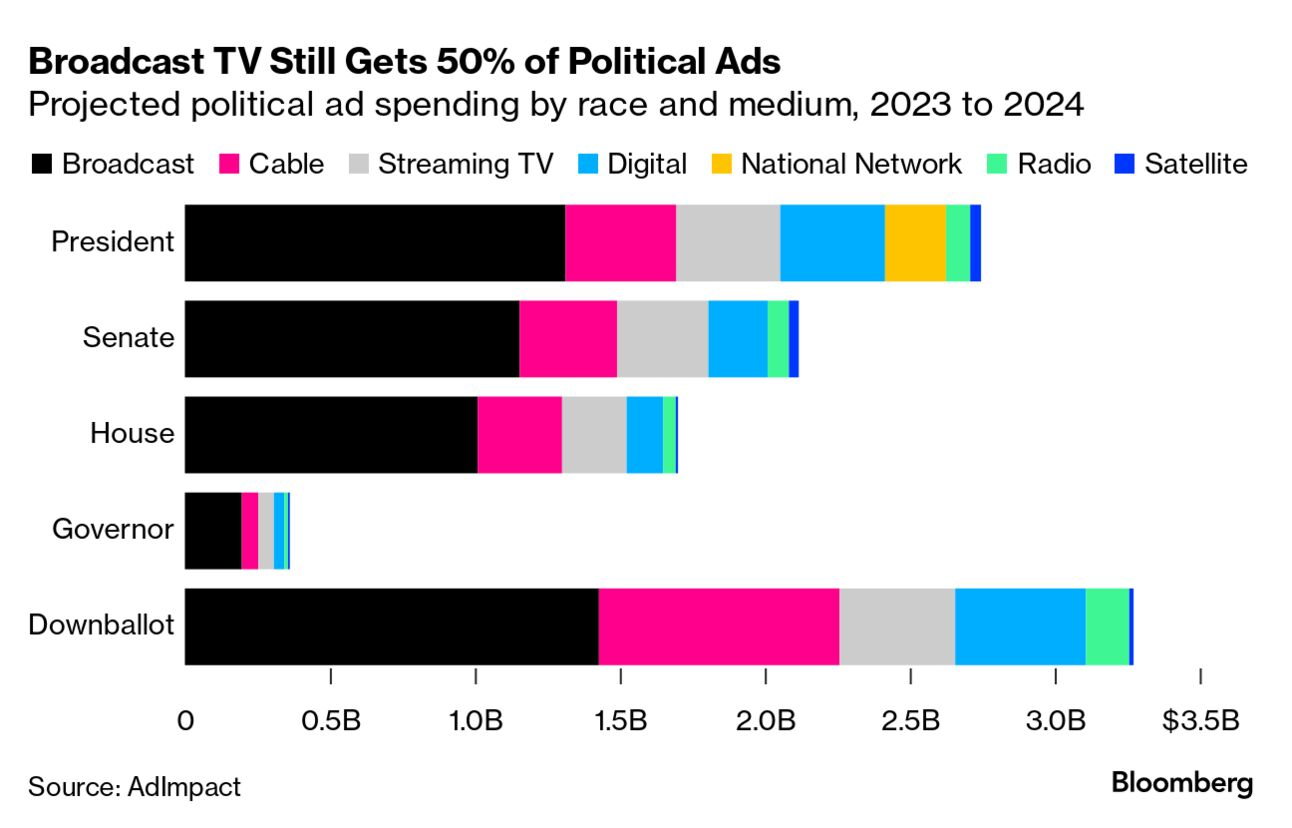

Political spending for the 2024 election cycle is ramping up significantly and is projected to surpass $10 billion, exceeding the 2020 cycle by over $1 billion. Over half of this total will be invested in broadcast television, with a heavy concentration in local markets and key states.

Cable TV is seeing a decreasing share of this spend, while digital ads on platforms like Facebook and Google are expected to remain relatively steady. Streaming TV is anticipated to see notable growth, although it will still lag far behind broadcast TV in terms of overall spending.

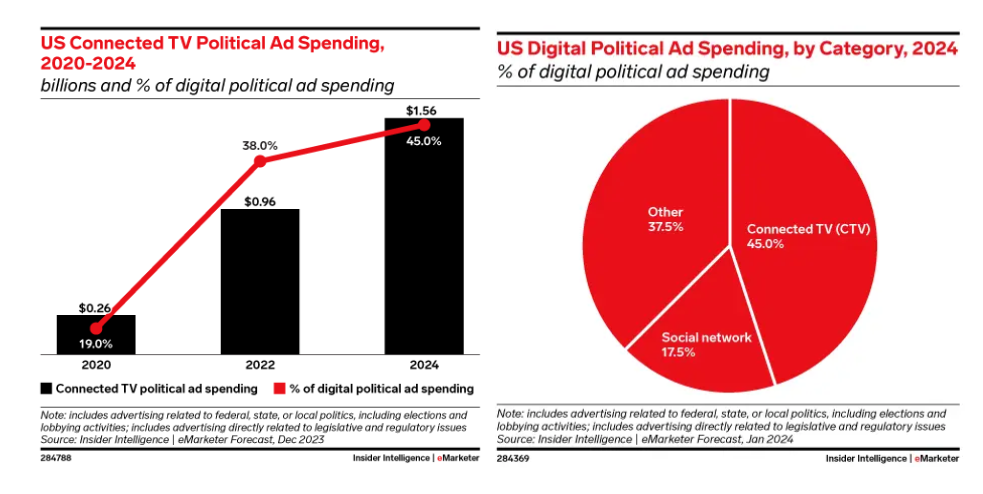

As audiences continue to cut the cord and embrace streaming, political ad dollars are making a similar shift. While traditional TV still captures the majority of political spending, Connected TV (CTV) is poised for a massive leap in 2024, with political ad spend projected to skyrocket by 500% compared to 2020. This surge will account for nearly half of all digital political investment and over 5% of total CTV ad spend.

Podcasts are also emerging as a new frontier for political ads. Recent surveys indicate that listeners are increasingly open to political content in their favorite podcasts. Notably, Spotify, which had removed political ads in 2020, has since reinstated them, reflecting this growing acceptance.

“There has been a distinct influx of youth-oriented messaging with a focus on both current and future generations of voters. While social media is a natural place to reach that audience, streaming TV and digital audio also boast large cohorts of modern media consumers and will play a vital role in this and all future election cycles.”

Shasta Cafarelli SVP, Media Investment at Tinuiti

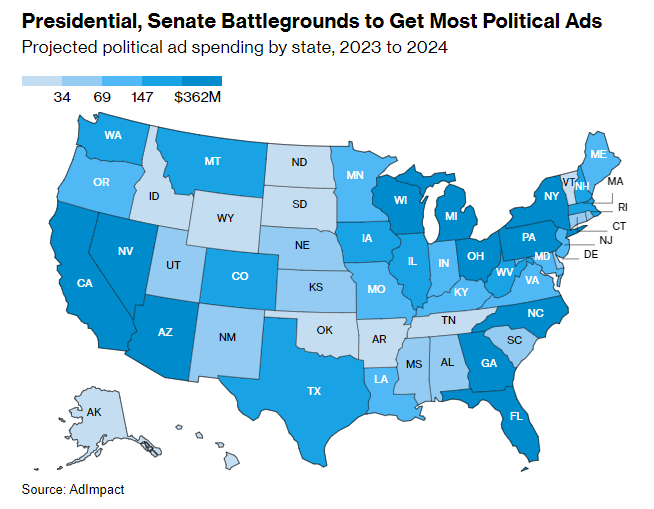

Political ad spend is heavily concentrated in swing states like Pennsylvania and Michigan, with significant investments also flowing into Arizona, Georgia, Wisconsin, North Carolina, and Nevada. Advertisers running local campaigns, particularly on linear TV, should brace for substantial CPM premiums in these key states through November.

Emerging technologies from DSPs like Nexxen are enabling more precise targeting by political district, extending the local focus from linear TV to CTV. According to AdImpact, the projected ad spend for the 2024 election is substantial: $2.7 billion for the presidential race, $2.1 billion for Senate races, $1.7 billion for House races, $361 million for gubernatorial races, and $3.3 billion for other down-ballot elections.

The surge in spending from both candidates and political action committees is significantly impacting the media marketplace, disrupting traditional supply and demand dynamics. As political activity ramps up, inventory tightens, costs rise, and non-political advertisers may need to adjust their media strategies. There are a few factors to keep in mind…

National video and audio campaigns will feel some effects, especially in news and sports content, but the impact will be less pronounced compared to local broadcast linear TV campaigns. In swing states, costs and demand for local TV ad placements could soar by as much as 75%.

Expect the peak in digital and television ad spending to hit around six weeks before Election Day (approximately September 24th), though this increase may begin earlier depending on the channel and market. For instance:

As we approach a period with heightened political ad activity, here’s a quick guide to managing your media campaigns through both national and local lenses.

National Campaigns:

Local and Geo-Targeted Campaigns:

The 2024 election will undoubtedly create a unique advertising landscape. By staying informed, remaining flexible, and planning ahead, marketers can successfully navigate this period and position themselves for a strong year ahead. Remember to keep a close eye on performance metrics and be ready to adapt your strategies as the political climate evolves.

Have questions? Our team of experts are ready to help. Contact us today for more information.