Media Update: Fractured Streaming Landscape, Meta AI, Apple Enhancements and Healthy Macro Trends

Just days away from Election Day 2024 and news viewership is… subdued. Audience sizes are roughly equal to those seen a year ago, across both broadcast and cable news. We can certainly expect an increase next week on the night of November 5th, but October simply hasn’t generated the interest that we saw around September’s debate or the tumultuous period in the summer. Meanwhile, pay attention to the entertainment tracking line below. By total audience, this remains the largest bucket of content, but the entire year has seen consistent declines amid steady cord-cutting.

1. On its face, Netflix’s most recent earnings report had a lot for analysts to like. Subscriber count grew to 283M while revenue jumped 15% year-over-year, beating analyst projections and leading to a jump in the stock price. However, beneath the surface, there have been a few recent signals that indicate a challenging position for the streaming giant. While subscriber counts are growing, the pace of additions has slowed year-over-year, and the company plans to stop reporting subscriber counts publicly in 2025.

In response to the slowing subscriber growth, the company is turning to price increases globally to power its strong financials, recently announcing subscription cost increases in Europe, Africa, the Middle East, and Asia. While the company has not indicated it will raise costs domestically – its $6.99 price tag for its cheapest tier coming in below competitors’ – its revenue goals for 2025 suggest that costs may rise absent continued subscriber growth. Meanwhile, the company has hit roadblocks recently, moving away from plans to launch a “triple A” video game and losing a bidding war for Margot Robbie’s “Wuthering Heights” to Warner Bros.

These efforts signal Netflix’s attempts at broader diversification, a natural outcome of the fractured entertainment and streaming landscapes. Netflix leadership seems well aware of the situation, with co-CEO Ted Sarandos noting in a recent interview, “I think the way that people consume [entertainment] has become disaggregated. I think people are doing it in a bunch of different ways, and they’re favoring things that favor the consumer, which I think does play into our strength as a company… Other companies have tried to migrate into what we do; they still have their roots in [the] old legacy-media model—not at your timetable, with narrow choices of things to watch. Netflix can be very broad and have a big variety of programming.” While Sarandos’ framing here is obviously bullish for Netflix, it acknowledges the diverse interests of streaming consumers – movies, original scripted programming, live sports, news, and more – and the challenge that presents to entertainment companies. With so many platforms and players servicing part of those desires, each competitor feels the strain and, inevitably, the need for consolidation. As we move further into “the great re-bundling”, we may see a more active market for partnerships and outright mergers as we head into 2025. Advertisers should stay tuned, as a consolidated landscape could mean a more simplified process to access audiences – and more pricing power for publishers. | WSJ, WSJ

2. October 28th was a “sports equinox” (a rare day when each of the NFL, NBA, MLB, and NHL had games), so it’s only fitting we check back in on the growth of the streaming sports landscape. We’re continuing to see rapid viewership growth for digital sports, with eMarketer estimating that digital audiences will eclipse traditional pay TV audiences this year by over 20%, a figure expected to grow to nearly 40% next year.

Sports have seen particularly strong audiences in recent weeks, with the WNBA season setting records for its digital audience, and the World Series on pace for its best audience since 2017 across linear and digital platforms. Meanwhile, the streamers continue to fight for greater access to this key source of inventory. Fubo announced the launch of standalone premium subscriptions without a base plan, with an initial focus on local sports options including FanDuel Sports Network (f.k.a. Bally Sports) and NBA League Pass. Peacock is taking a similar tack as well, making regional sports channels for Boston, Philadelphia, and Northern California available digitally through the platform. With sports audiences on the rebound and inventory readily accessible through digital channels, advertisers of all types should strongly consider including this content in their 2025 plans. | eMarketer

1. Big moves from Meta this week, as it works on a new AI-powered search engine designed to keep users more engaged across Facebook and Instagram. The update is aimed at meeting Gen Z and younger audiences where they are: looking for interactive AI, immediate answers, and in-app recommendations. Today, Meta AI search results are powered by Bing for context and provide a web link for the search query, like the below example:

Now, imagine a user looking for “holiday gift ideas”within their search bar on Facebook or Instagram—they’ll be able to ask Meta’s conversational AI for recommendations, allowing them to browse and discover products, content, or ads in real-time.

Beyond discovery, brands would be able to lean into in-the-moment, intent-driven ad placements that let them reach users as they actively search for ideas. As Meta builds out this AI functionality, the potential for search-based, intent-driven ads is huge. Whether you’re focused on top-of-funnel awareness or closer-to-purchase campaigns, understanding how to leverage Meta’s new search capabilities could be a real advantage for brands looking to stay top-of-mind without users leaving the platform. | The Verge, SocialMediaToday, The Information, Meta AI

2. Reddit’s Q3 earnings results show substantial gains in both user activity and ad revenue — a clear signal that the platform’s community-centered approach is continuing to resonate with both users and brands. This rise, largely thanks to Reddit’s strengthened ad features and new brand partnerships, reflects growing user engagement where brands have more opportunities to reach dedicated, interest-specific communities.

For advertisers, Reddit’s momentum highlights a fresh avenue to connect with audiences authentically, and capitalize on high-intent discussions in dedicated communities on the platform. This presents a valuable opportunity for brands looking to capture attention in spaces where traditional ad approaches might not perform as well, and it’s one that many brands are seeing strong success with. | SocialMediaToday, Reddit

PAAPI (more formally known as the Protected Audience API) is not just a fun play on the former Red Sox first baseman’s name but also one of Google’s Privacy Sandbox technologies that is showing promising results for remarketing in a cookieless world.

A recent study conducted by researchers at Boston University’s Questrom School of Business found that when used for remarketing, PAAPI recovers almost half of the ad clicks (46.3%) and clickthrough conversions (43.5%) lost from cookie depreciation. This may not seem impressive on its own, but when you consider the low adoption rate and adjust for ad expenditure, PAAPI is comparable to third-party cookies, accounting for 86% of the clicks and 82% of the clickthrough conversions per dollar spent. While PAAPI won’t solve all the addressability issues, this may alleviate some of the angst around remarketing in a privacy-focused future.

So, how does PAAPI actually work? It’s all about the user’s browser. With PAAPI, the browser takes the lead by storing interest groups tied to the user. When it’s time for an ad auction, the browser handles everything right on the device, ensuring that user information stays private and isn’t shared with publishers or advertisers.

For example, let’s say a person visits a website that sells running sneakers, navigates to the women’s sneaker page but doesn’t convert. The sneaker website will ask the user’s browser to associate that user with a predefined interest group (defined by the sneaker brand). In this case, the interest group may be “women’s running sneakers.”

Later, our site visitor goes to a publisher’s website that serves ads. Before the ad renders, there is a three-step process that takes place:

This process allows users to receive relevant ads without having their information shared across multiple partners. While the results are promising, there are a few considerations:

Given the encouraging findings from the study, PAAPI is certainly an aspect of the Privacy Sandbox that advertisers should consider exploring. However, until Google formally announces its plans for cookie deprecation, we anticipate that adoption among publishers will remain limited, restricting opportunities for scaled usage. | AdExchanger, SSRN, Google Developers

Apple Intelligence was first announced back in June 2024 with teasers about product releases and enhancements coming in the fall. As of Oct. 28th Apple Intelligence is now available via a software update to iOS 18.1 on eligible devices. The software update will be a months-long rollout, and many of the enhancements are expected to contribute to evolutions in the way people go about searching for information.

Apple’s new integration with ChatGPT technology is coming in December, and will be optional to help power Apple’s voice assistant Siri. If enabled, Siri will be able to tap into ChatGPT’s expertise “when helpful” and reduce the need to jump between tools. Users will be able to access the ChatGPT integration capabilities for free without creating a dedicated account, and can rest assured that privacy protections are built in. Apple said, “IP addresses are obscured and OpenAI won’t store requests. For those who choose to connect their account, OpenAI’s data-use policies apply.”

Interestingly, the newly redesigned Siri is evolving beyond a voice assistant, and will soon be able to respond to typed requests as well. The ability to type to Siri could fundamentally change how users interact with the technology, moving away from spoken word and back toward searching via written text queries.

Some initial testers claim that the ChatGPT integration with Siri “worked best for Apple-specific questions,” such as answering questions about how to take a screen recording or share a Wi-Fi password. The testers were underwhelmed by the usefulness of information that Siri returned when using the typing functionality, claiming it was more helpful for “basic queries.” For example, when asked for a “recipe for espresso martini,” Siri powered by ChatGPT only surfaced basic ingredients but not proportions for the cocktail.

Another search-related feature that’s coming soon is Apple’s new visual intelligence tool called “Camera Control,” which sounds an awful lot like Apple’s version of Google Lens. This new technology will be able to have ChatGPT analyze images taken by the phone’s camera, or can tap into Google Image search to find similar results online. Previously, Siri was able to look up basic visual information such as plants or landmarks, but this evolution is taking Apple’s visual search capabilities to the next level. An early tester, Allison Johnson from The Verge, said this new Camera Control technology is “pretty good – mostly,” and cautioned, “as long as you treat the answer as a starting point, AI is pretty handy for these kinds of low stakes questions,” such as coming up with a list of cocktails to make based on a photo of her home bar.

With more advanced AI-chatbot powered voice and text search, as well as enhanced visual search functionality coming soon to phones that comprise more than half of the market share in the US, we’ll be paying close attention to how search behaviors continue to evolve. We’ll also be curious to see if Google’s total share of the Search landscape continues to decline, with more and more queries powered by chatbot-esque technologies. | Apple [Oct. ‘24], PC Mag, The Verge, Tech Radar, Apple [Jun. ‘24]

As we’re in the midst of a flurry of earnings reports, we’ll round up the major players’ releases for what they tell us about the state of the advertising market.

Taken together, these results suggest the digital advertising economy is in rude health, with double-digit growth across the board. They also suggest that the larger platforms continue to pull away – even from much higher bases, they continue to grow faster than the subscale platforms like Snap.

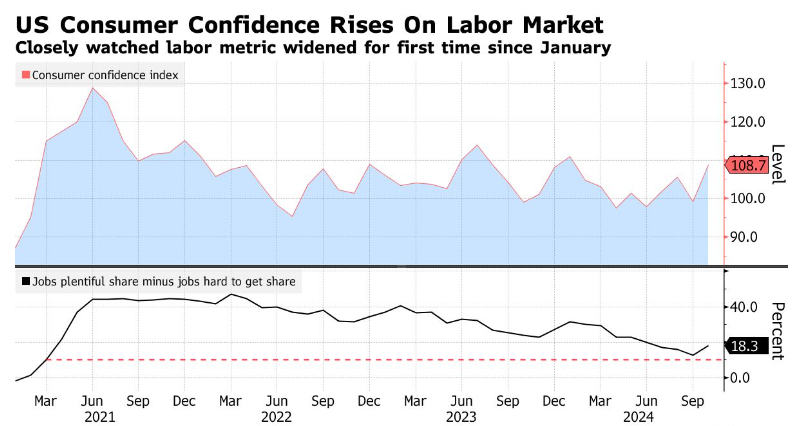

1. We noted last time that consumer sentiment unexpectedly declined in early October and remains stuck well below pre-pandemic levels. More recent data from the Conference Board show consumer confidence increased in October by the most since March 2021, on optimism about the broader economy and the labor market.

As we’ve noted in the past, one should be careful of over-interpreting individual observations in high-frequency data with significant measurement error. As you can see in the chart above, over the past year it’s been up, down, up, down, defying any obvious temporal trends. The one thing we can say unambiguously is that confidence remains well below its pre-pandemic level.

A standout finding in this most recent report is the share of respondents anticipating their financial situation to improve in the next six months, which rose to the highest in data back more than two years. | Bloomberg

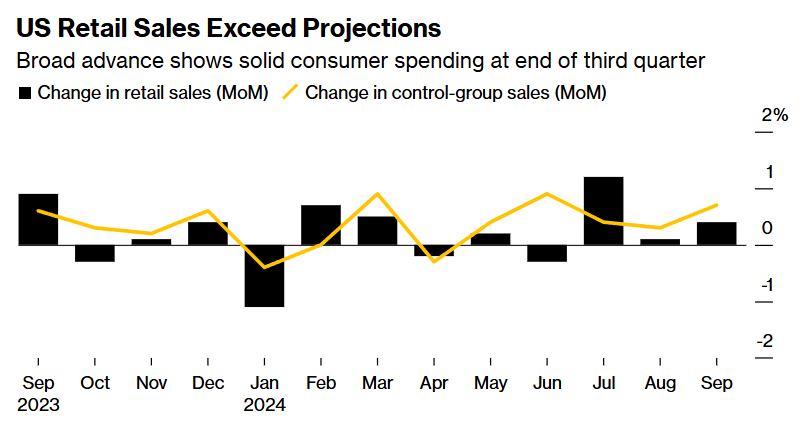

2. More confident consumers ought to mean increased willingness to spend, and that’s exactly what last month’s figures show – retail sales accelerated to 0.4% MoM growth in September, one of the strongest readings so far this year. Excluding gasoline, where prices have fallen recently, spending increased by 0.7% MoM.

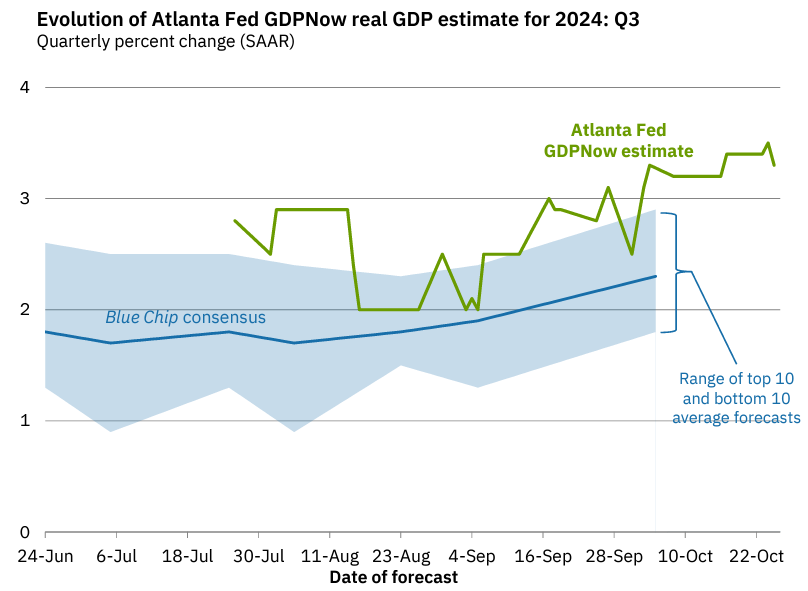

Resilient consumer spending is, necessarily, underpinned by a strong labor market – and indeed, recent data from the BEA showed wages and salaries increased 0.5% in August, the fastest rate in three months. These recent data points paint a rosy picture of overall GDP growth in Q3, as is visible in the GDPNow forecast from the Atlanta Fed, which is clocking 3.3% growth for the quarter:

On a sector-specific basis, spending at restaurants and bars increased by 1% last month, the most in nearly a year. | Bloomberg

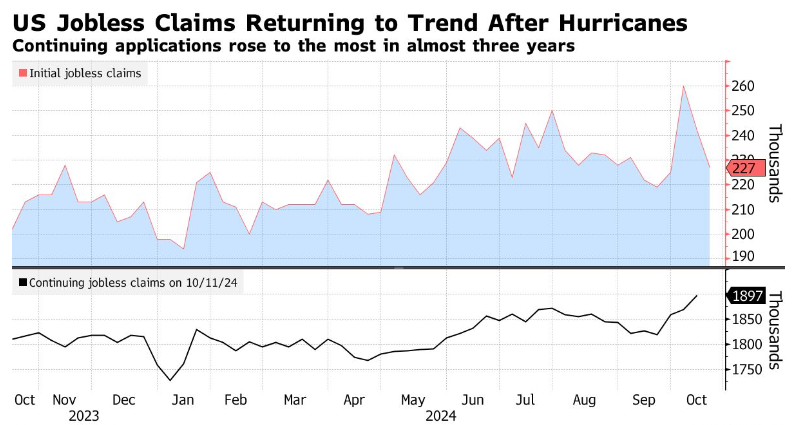

3. As noted above, resilient consumer spending has been underpinned by a very healthy labor market – the unemployment rate is currently 4.1%, and it has been under 5% for 37 consecutive months. Prior to the shock of the pandemic, another 42-month string of sub-5% unemployment. If one is willing to append those two streaks (reasoning that the pandemic was an act of god, and not a malfunctioning of the labor market), it’s the longest such run since data has been collected going back to 1948.

Recent data points underscore this picture of health. October’s initial jobless claims fell back to pre-hurricane levels, allaying fears that the devastation could metastasize into regional economic problems. Ongoing claims rose to the highest level in almost three years, though the recent data likely reflect the impact from the two storms and a weeks-long strike at Boeing that has led to furloughs at idle suppliers.

This picture is consistent with the robust levels of new job creation we detailed last time. | Bloomberg