Linking Digital Media’s Impact to In-Store Purchases

Many brands struggle to quantify how their digital media marketing efforts impact physical sales (a.k.a. ‘closing the loop’). Online and in-store data usually live in separate silos, making it difficult for even the most sophisticated marketers to see how one impacts the other.

Poppi, a top-selling functional soda brand, advertises on Amazon Online Video, Instacart, and TikTok – platforms where measuring campaign impact is simple. However, understanding how these campaigns affect in-store sales is much more elusive. With 2022 bringing meteoric growth in both their online and retail sales, Poppi sought the ability to attribute digital campaign spend to point-of-sale impact in stores.

With multiple active campaigns and their products in more than 20,000 retailers and grocers, this would be no easy feat. They turned to Tinuiti, their digital agency of record, to help.

This level of data granularity is game-changing. With Tinuiti and Crisp together, we can dig into any specific region and immediately see which products and platforms consumers prefer – and what kind of impact those preferences have on all surrounding regions. It’s amazing. It lets us optimize our digital ad spend in ways I never thought possible.

Graham Goeppert

VP of Digital Commerce & Media, Poppi

more likely to purchase Poppi in-store after seeing Amazon Online Video ads

more likely to purchase Poppi in-store after seeing Instacart Search ads

more likely to purchase Poppi in-store after seeing TikTok ads

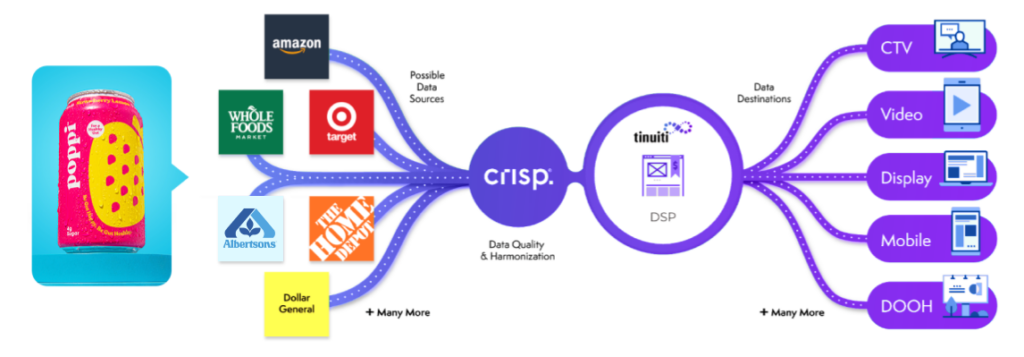

Tinuiti leveraged our partnership with Crisp, a powerful platform that collects, connects, and analyzes retailer sales data across disparate sources to provide brands with up-to-date, actionable insights. Crisp returns daily sales data at the ZIP-code level, allowing Tinuiti to assess the impact of media spend across all digital channels down to the neighborhood.

As a standalone tool, Crisp is surely powerful – but when combined with Tinuiti’s proprietary data modeling capabilities, it becomes an analytical tour de force. Tinuiti’s data models can measure impact across both direct and indirect retail sales, meaning we can track purchases in both a specified Designated Market Area (direct) and all consequent purchasing activity in neighboring DMAs (indirect).

For Poppi, this meant Tinuiti could pinpoint the most effective digital media campaign in a specific geographic region – including platform, flavors, and retailers – and extend that analysis to adjacent DMAs.

What we found was game-changing. Geographies that were served an Amazon Online Video ad were 15% more likely to purchase Poppi products in-store that week than areas that were not served an ad. Instacart Search ads were also effective, with a 10% higher likelihood of purchasing in-store. For social channels, we found immense value in TikTok, encouraging geographies at 80% higher rates to buy Poppi in-store.

Poppi had long assumed that digital ad spend affected retail sales, but now, they had quantitative proof. With this information, we adjusted Poppi’s media mix (for instance, investing more into TikTok due to its positive return across retailers) to maximize sales both online and in-store.

We were also able to help bolster logistical decisions and planning to boost revenue – like identifying pockets of geography that overwhelmingly love Poppi’s Cherry Limeade flavor, thus avoiding stock-outs.

As Tinuiti and Poppi further explore the value of this immense data resource, one thing’s for sure: More successes will continue to bubble up.