Media Update: Streaming Struggles for WBD & Paramount, Meta’s Algorithm Overhaul, and Walmart’s Ad Sales Surge

While it was another successful Olympics for the red, white, and blue – leading all nations with 126 medals and tying China for the most golds – the biggest winner may have been NBC. Enormous audiences caught the second week of the broadcast, with over 30M viewers tuning in across platforms on the final Saturday of the games, including 22.7M who caught the US men’s basketball team top France for gold, the best gold medal game mark since 1996. Overall viewership was up 82% vs. the Tokyo games, giving NBC a huge boost and setting the stage for further growth when the Olympics return to home soil in four years.

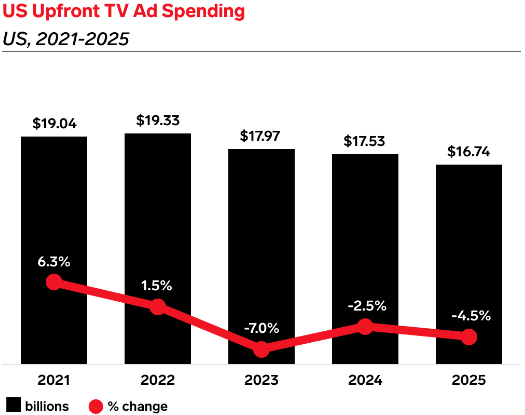

1. It has been a momentous few weeks in the TV world as pressure mounts on legacy publishers, particularly among the sub-scale platforms fighting to keep up with Netflix, Amazon, and YouTube. We begin with Paramount: as the go-shop period for its merger with Skydance nears its end, Paramount announced a $500M cost-savings plan, including a 15% layoff to take place over the coming weeks and months (joining a long list of media layoffs this year). These reductions come on the heels of an initial cut back in February and amid the announced shutdown of Paramount Television Studios and a $6B write-down of Paramount’s cable networks. These developments make plain the immense pressures the publisher is facing across all mediums as linear cord-cutting accelerates and its Paramount+ streaming platform fails to make up ground against more successful players. Paramount is not alone, however, as WarnerBros Discovery took an even larger $9B impairment charge to its cable networks. Overall, these write-downs come in the context of an ever more difficult linear landscape, with viewership and advertiser investment both declining.

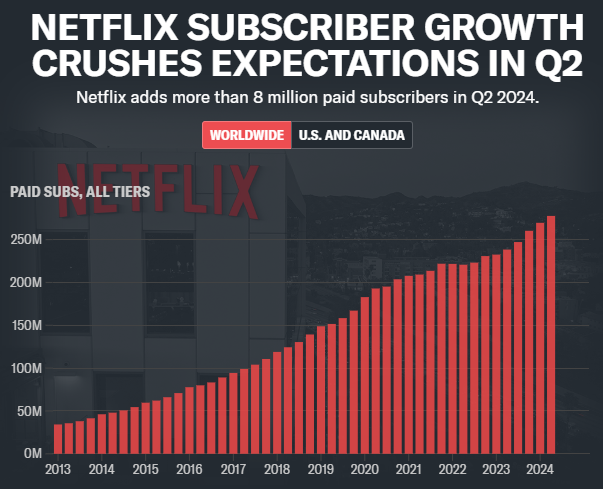

Where these sub-scale publishers have struggled, the cream of the crop has made gains. Netflix announced another 8M subscribers at its most recent earnings call; Amazon saw a 20% gain in ad revenue from Prime Video; and YouTube saw strong viewership and ad revenue growth over its past quarter.

Disney, too, has finally received some positive news on its streaming business, which became profitable for the first time ever this past quarter (supporting the company even as its theme-park business faces pains).

Our expectation, as we’ve noted previously, is that these bimodal outcomes will eventually lead to consolidation, as the weaker streamers have yet to show meaningful momentum against their larger competitors and the fractured landscape keeps profitability low. In a more immediate sense, we can expect some additional developments: spot costs on linear should continue to fall as audiences and advertiser demand decline, customer subscription costs on streaming platforms will rise as platforms push more aggressively for profitability, and streaming CPMs will likely stay depressed until the dam breaks and consolidation occurs. Overall, this spells opportunity in the short-term for advertisers to capitalize on, especially with publishers anxious to generate revenue and stave off their competitors. | Yahoo Finance, WSJ, eMarketer

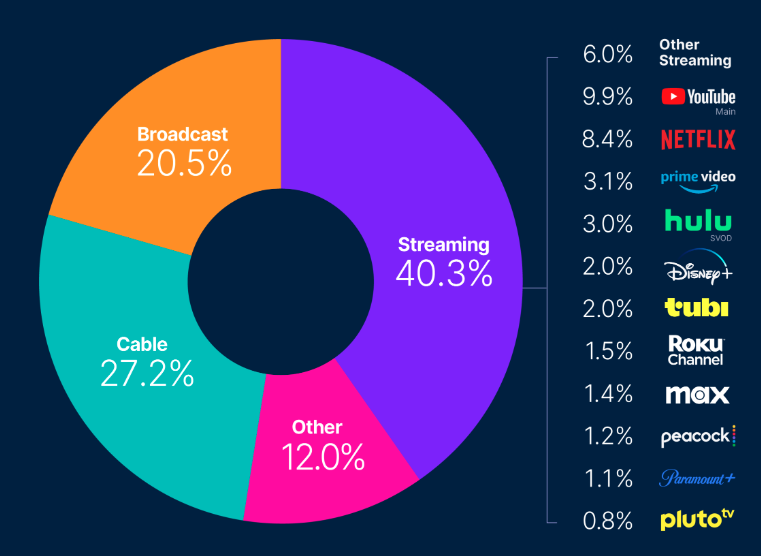

2. While the legacy publishers battle it out, the new kids on the block are coming into their own. Free Ad Supported TV (FAST) networks are skyrocketing in popularity, with Tubi, Roku, and Pluto in the vanguard.

Per the latest figures from Nielsen, the three platforms combined to account for more viewing time than anyone other than YouTube and Netflix, with Tubi and Roku beating Max, Peacock, and Paramount+ on their own. The platforms, particularly Tubi and Roku, have accelerated dramatically in 2024, driving more than 25% of the total streaming viewership growth since January.

The networks have done well with groups that have historically been underrepresented in streaming audiences; Tubi reports that more than half of its audience is over 50 and nearly half is black. While Tubi is not currently profitable, the platform claims this is a deliberate strategy to reach competitive scale, with CEO Anjali Sud claiming, “Our lack of profitability is a conscious choice.” Roku is leaning in on the audience growth strategy as well, recently announcing the launch of a premium sports channel featuring live MLB baseball, boxing, Formula E, and programming from former ESPN sportscaster Rich Eisen. We’ve discussed the rise of streaming sports often in this space, but with major publishers feeling both competitive and regulatory and judicial pressures, the door is open for the FAST networks to make further gains – especially as subscription streaming costs rise. While these names may not (yet) carry the same cultural cachet as Disney, Warner Bros., or Netflix, their impact is real and dramatic, and advertisers should seriously consider including them in CTV campaigns to capitalize. | Nielsen

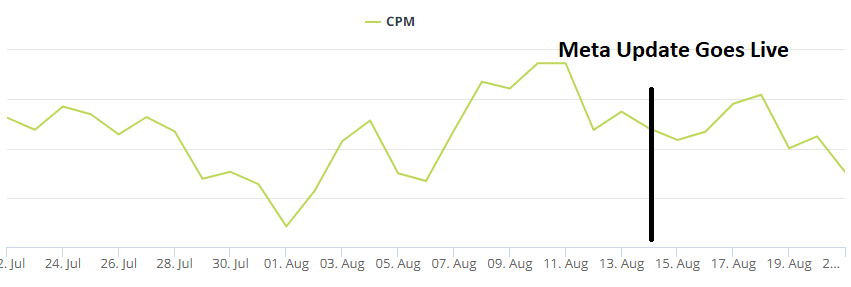

The big news this past week came following Meta’s announcement that it is overhauling its algorithm. The announcement included three meaningful additions: incrementality-based conversion optimization, native integrations with third party analytics tools, and conversion value rules that allow for audience segmentation. These updates were originally teased at Meta’s Performance Marketing Summit back in June, so while it’s not a total surprise, it is a lot of new change for advertisers. As we discussed last week, Meta’s latest earnings call doubled down on its intention to continue to lean into automation and AI to fuel platform and advertiser growth. As such, it is likely that further innovations and improvements will continue to roll out over the coming months and years.

The big shakeup with this announcement is that Meta is shifting directions from focusing on native lift studies to empowering advertisers to drive the algorithm with more relevant data points to their business. Conversion campaigns are going to see the impact first as Meta’s algorithm begins to more heavily weight 1-day conversions as the likelihood of a Meta ad impacting the user’s purchase decision is much higher in a 1-day window compared to a 7-day attribution window. For DR advertisers that don’t rely on last-click attribution as their source of truth, this presents a potential problem because the algorithm would, in theory, be delivering fewer conversions against a smaller audience.

So far, we are not yet seeing any major signs that warrant ringing the alarm bells, even for non-last click DR advertisers; across Tinuiti clients, we are seeing relatively stable performance in the last week. Notably, conversion rates are slowly declining, likely as a result of stable to slightly more efficient CPMs, but ROAS is still strong. This is a time where agencies and advertisers are keeping a very close eye on their performance. In the short term, we expect that there could be some performance volatility, but in the long term advertisers should expect to see Meta performance correlate more strongly to their business bottom line.

As an advertiser, there are a few areas where you can focus your attention to help minimize volatility and help fast track your performance growth.

There are still some unknowns associated with this announcement, but given the first step Meta has taken, it points to a potentially exciting opportunity and positive future for advertisers on the platform. Expect to hear more updates around Meta’s algorithm and any performance callouts in future newsletters. | Meta, AdWeek, AdAge, MDM

We often discuss YouTube in this forum because of its growth and impact across various industries. The sports world is the latest industry to experience the platform’s expanding influence. In a recent interview with the Financial Times, YouTube CEO Neal Mohan said sports content viewership on YouTube grew 45% YoY, amassing 35 billion hours, with much of that coming from the largest screen in the house.

While the viewership growth is considerable, the main insights lie in how viewers engage with the platform and the content they watch. Viewers turn to YouTube to watch highlights and relive past moments, but more importantly, they go to YouTube to complement their viewing experience, engaging with leagues, teams, and creators for unique insights and exclusive content.

As Harry mentioned above, NBC’s Olympics viewership surged this year. While people can catch the action across NBC’s platforms, fans also turn to YouTube and other social platforms for a different perspective of the games. During the Tokyo Games, YouTube viewers watched over 200 million hours of Olympic Games content. Even though YouTube hasn’t shared insights from the Paris Games, we anticipate a large increase in watch time compared to the Tokyo Games largely due to the media outlets embracing these trends.

For the Olympics, NBC launched the Paris Creator Collective, a network of 27 creators across YouTube, Meta, TikTok, and other major social platforms, letting fans experience the Games with exclusive and behind-the-scenes content across the social platforms.

With viewership trends showing a growing interest in creator-driven content, we expect to see more creator networks to pop up. For example, ESPN introduced its creator network last year, and recently announced its second class of creators for 2024. This network provides creators with unprecedented access to ESPN events, bringing fans deeper into the experience.

These trends also create new opportunities for advertisers, especially as we reach prime sports season. By zeroing in on popular YouTube channels or teaming up with creators to develop unique and engaging content, advertisers can tap into the platform’s diverse community and connect with their audience in an impactful way. | Financial Times, YouTube Blog, NBC Sports, ESPN

It is likely a very hard time to be a member of Google’s PR team. In recent weeks, it has had to deal with shaping the narrative regarding Chrome’s 3P cookie policy shift; handling the fallout from the antitrust ruling; and now, a critical breach within the flagship advertising platform, Google Ads. Google has been downplaying what is arguably one of the largest missteps in Google Ads’ history: between July 30-31, some advertisers inadvertently showed products from other advertisers’ Google Merchant Center (GMC) accounts due to a “system issue.” In other words, an advertiser could have had their Product Listing Ad (PLA) appear alongside a mismatched competitor’s name and website details (or even a completely irrelevant other brand). Google claims the issue has been resolved, incorrect data has been removed, and campaigns are now serving as expected.

This data breach comes at a time when many advertisers’ trust in Google has already been diminishing due to multiple factors, namely the largely black-box nature of its increasingly AI-powered, hybrid advertising solutions like PMAX. The company’s speed of response was slower than ideal, especially given the potential magnitude of the issue.

Impacted advertisers should have received an auto-generated email from Google on August 19 with limited information or next steps. However, many questions remain about the scale of this cross-serving issue, the impact on short and long term performance for advertisers, and Google’s plans to prevent this from ever recurring in the future. Advertisers are asking: why did Google’s system not prevent cross-serving of ads between advertisers accounts? Were there no safeguards in play to prevent this, or if there were, why were they so ineffective? What other issues could potentially occur as we venture deeper into the world of AI-enabled advertising?

So far, Google hasn’t provided a specific reason or cause for this failure. According to an email from Google, there were two different categories of impact:

Google has said it will not be able to provide specifics about which products / campaigns were impacted, and that incorrect data in the accounts has now been removed.

For advertisers in Group 1, Google issued MSAs requiring customers to delete any copies of data they may have made during the affected period, and said credits will be issued in “the coming weeks”. For advertisers in Group 2, since their accounts were not billed for ads from other Merchant Center accounts, Google will not be issuing any credits.

Given the lack of reporting and transparency (likely due to advertiser confidentiality concerns on Google’s end), we don’t expect to be able to definitively quantify impact for any specific advertiser. However, we expect the following scenario is what likely played out in many cases:

It’s not unreasonable to assume that in the example scenario above, Advertiser B could have been limited by budget due to the unexpected pressure from Advertiser A. There were likely unfavorable auction impacts, not to mention potentially confusing and misleading consumer-facing ads in search result pages for this short period of time.

Tinuiti account managers noticed various issues accessing some GMC reporting in the days following this event, aligning with Google’s reported timelines (Aug. 1 – 6). Google stated that it “temporarily paused access to certain reports as we took the necessary steps to remove the incorrect data and resolve this issue.”

Though the ad serving issues only lasted about a day, it remains to be seen what kind of longer term impact this type of breach will have on advertisers’ performance and trust in Google’s ad solutions more generally. | Google Ads Status Dashboard, Search Engine Land

1. We told you last week about the Google antitrust case, and speculated as to the scope of remedy that would address the specific findings from the ruling. From the mitigation of exclusivity agreements to forcing the breakup or sale of elements of the company, the speculation runs across the spectrum. Critically, the appropriate remediation will need to ensure that consumers and competitors are not severely impacted by the fallout. Firefox (under parent company Mozilla) receives 81% (in 2022) of its annual revenue from Google, which could dry up overnight if the pay-to-play relationship with Google is ended by decree. In that event, it would mean almost certain extinction, and limiting choice in browser options is not in the interest of the consumer. So, what then would be a reasonable remedy? One idea that sits at the intersection of brilliant and absurd that’s being floated is to compel Google to make its search index part of the public commons. The idea could have merit insofar as data equality underpins the foundations of search. While both Google and the Justice Department declined to comment, this does seem like a viable path forward that would allow for novel search experiences to stand on the shoulders of the giant that is Google’s index of the internet. | Mozilla, Business Insider

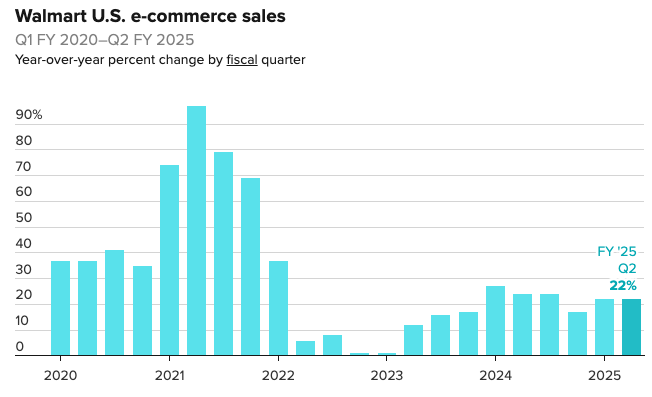

2. Walmart is continuing to blossom into the advertising giant it dreams of being. On the back of continued growth in ecommerce sales, its recent earnings beat estimates, increasing revenue by 4.8% to $169.3B. Walmart Connect, its US ad unit, continued to show strong growth (up 30%), and ad sales from marketplace ads were up nearly 50%.

Walmart is a unique brand for many reasons, but most notably, in the era of the digital consumer it maintains a gigantic physical footprint and is making significant investment into the in-store ad experience. The store aisle would seemingly appear to be the next great advertising surface, and while cooler screens may have mixed reviews from consumers, the advertising experience as part of in-store activations, in-aisle promotions, or checkout advertising may finally provide a more complementary experience for consumers and enable brands to meet their consumers during the last mile of their transaction experience.

Walmart is not just making investments in advertising experiences, but also in the measurement of these experiences. As of our editing deadline, Walmart has just launched Luminate, a merchant and supplier data collaboration platform that could signal some major shifts in data transparency that rivals such as Amazon may be taking note of. | CNBC, MarketingDive, CNBC, Walmart

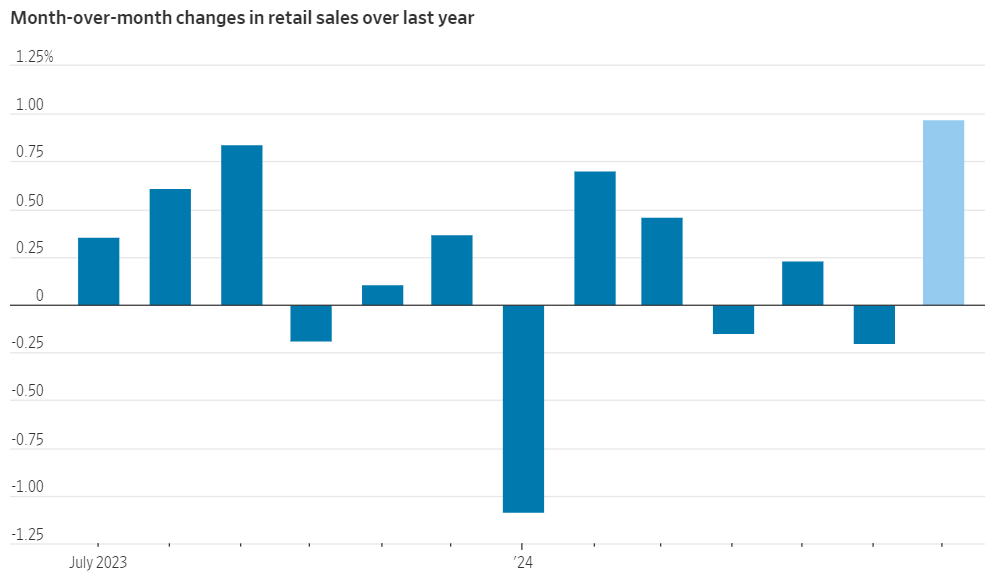

1. The health of the American consumer is always closely scrutinized, especially so at a time when the Fed is on high alert for recession signals as it considers monetary easing. The Commerce Dept recently came bearing good news, with its most recent data showing consumer spending rose by 1% MoM in July, far surpassing economists’ expectations; financial markets soared on the news.

Much of July’s pickup came from vehicle sales, which rose by 3.6%; studious readers may recall that June’s vehicle sales were depressed due to a large cyberattack that took dealers’ systems offline for much of the month, so some of July’s gain is demand being pushed forward from June. Apart from vehicles, groceries and electronics were the other categories seeing strong consumer spending gains MoM. | WSJ

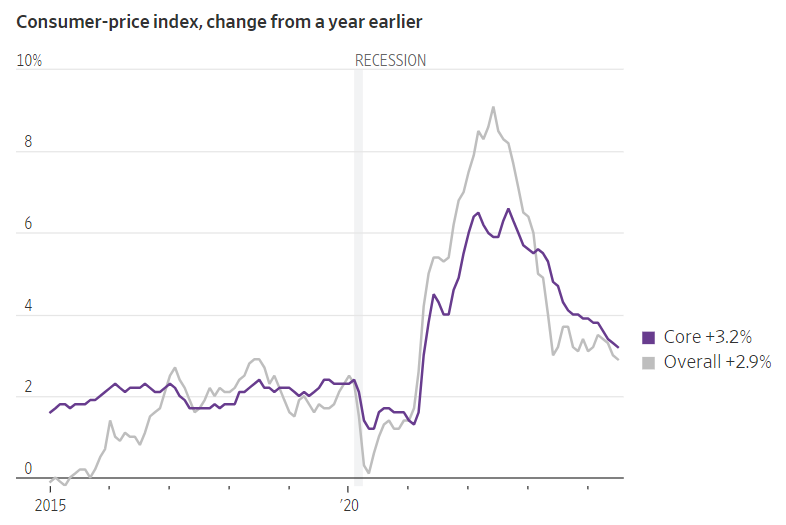

2. The big macroeconomic news is undoubtedly the encouraging inflation print for July, which showed 2.9% CPI inflation on a YoY basis, the lowest it’s been since March 2021. Core CPI inflation, which excludes volatile food and energy prices, rose 3.2% in July.

We told you last week that futures markets were pricing in a half-point rate cut at the Fed’s next policy meeting in September; the new inflation data keep the Fed on track to cut rates, but it now seems less clear whether that will be a standard quarter-point reduction or a more aggressive half-point. The argument against a larger cut would be that, for all the progress that’s been made in bringing inflation down, it still remains well above the Fed’s explicit 2% target; the argument in favor would be that monthly inflation over the past three months has been below the 0.165% that is consistent with 2% annual inflation. | WSJ, Bloomberg

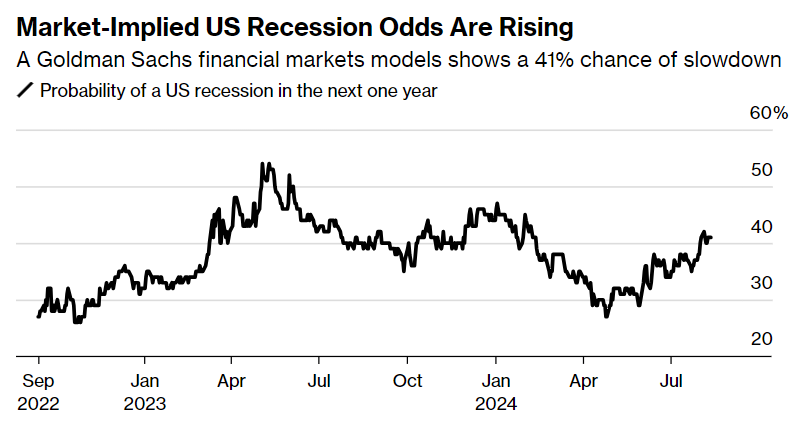

3. The Fed’s rate decision will be an attempt to balance the risks of failing to subdue inflation on the one hand and damaging the labor market, ultimately triggering a recession, on the other. (as we’ve pointed out previously, the US has never had a soft landing, though we are getting close to one now) We’ve highlighted in recent months that the labor market, after years of seeming invulnerability, is beginning to slacken; unemployment has risen from 3.5% to 4.3% in the past year. Following these and other signals, forecasters at Goldman Sachs and JPMorgan have upped their probability estimate on a recession within the next year, with Goldman’s model now showing a ~40% chance.

We would hasten to point to the school of thought that says recessions are not forecastable. While there is an extensive academic literature on this topic, it is perhaps best expressed in joke form: “Forecasters have successfully identified nine out of the last five recessions.” | Bloomberg

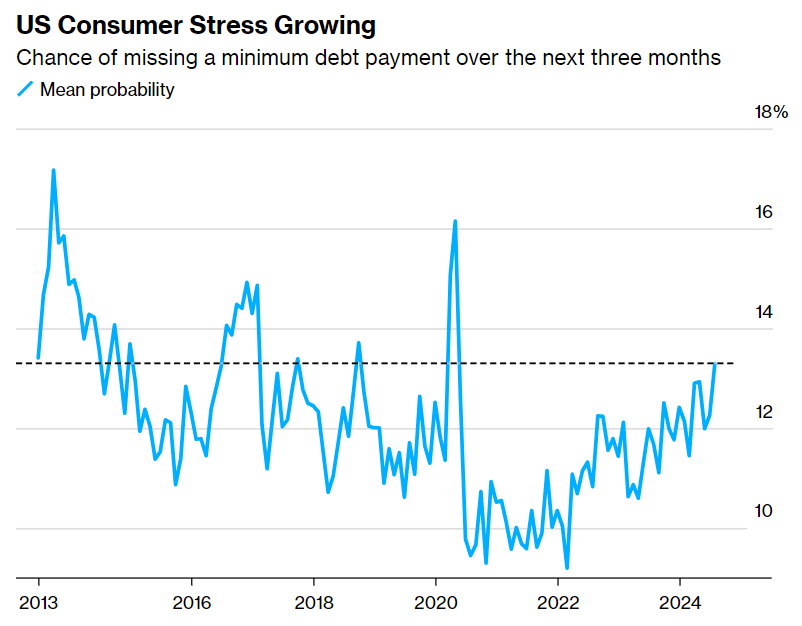

4. We noted last month that past-due credit card balances recently reached a high last seen in 2012, suggesting that consumers have drawn down any excess savings and are stretching themselves to cover consumption. A new survey from the New York Fed reinforces this picture, as it shows consumers’ fears of credit delinquency rising to levels last seen at the onset of the pandemic.

Some perspective is valuable – the post-pandemic years’ delinquency fears were unusually low, presumably because of mitigation measures including stimulus checks, suspension of student loan repayment, moratoria on eviction for non-payment of rent, etc. Now that we’re back to something like normal, and consumers have fully drawn down excess savings accumulated during the pandemic, worries about credit delinquency are also back to something like normal. Should the Fed go ahead with rate cuts next month, thereby making credit card debt somewhat cheaper, consumers’ worries should be at least mildly assuaged. | Bloomberg