Everything You Need to Know About Amazon Apparel

Today’s shoppers are becoming more and more comfortable with purchasing apparel online — and these changing shopping behaviors are projected to boost online apparel to a value of $118 billion in 2019.

Nowhere is this growth more apparent than the Amazon apparel category. The Marketplace has attracted big-name apparel brands, launched over 70 private labels of its own, and generated over 5 million apparel sales on Prime Day alone.

Interested in growing your apparel or fashion business on Amazon?

Here’s a quick walk-through of the industry at large and the competitive landscape of the Amazon apparel category.

Introduced on November 7th, 2002, Amazon shocked the internet when they announced that they were partnering with major clothing companies to offer 400 apparel brands through their online platform.

Since then, they’ve expanded to offer 1.12 million clothing products and several subdivisions under the apparel category, including:

Thanks to Amazon’s strategic partnerships and growing market share, customers can find big name brands on the platform, such as Michael Kors, Calvin Klein, and Kate Spade. The presence of such large household names draws in consumers, but Amazon also has their own private label offering that customers can’t get anywhere else.

Amazon currently has 74 private label brands, and 87.8% of them fall within clothing and apparel. Aimed at several different markets, you can find the most popular ones below:

Judging from forecasts within the e-commerce fashion industry, Amazon apparel is headed for rapid growth.

Worldwide revenue is expected to hit $713 billion by 2022, resulting in an increase of 48.23% in just five years.

On Amazon, clothing sales are going up as well: along with its $30 billion in sales last year, Amazon also saw a rise in apparel listings with an increase of 27.3% just between February and September.

Here’s where it gets interesting: only 2.2% of that increase was attributed to Amazon’s own first-party sellers, while 30.5% was because of third-party sellers.

Roughly 88.9% of products listed for sale were offered by third-party sellers, meaning the market is booming for third-party retailers who want to sell clothing on Amazon.

Amazon also has a good hold on Millennials and Generation Z.

Amazon offers several advantages to selling clothing on its platform over other online sites.

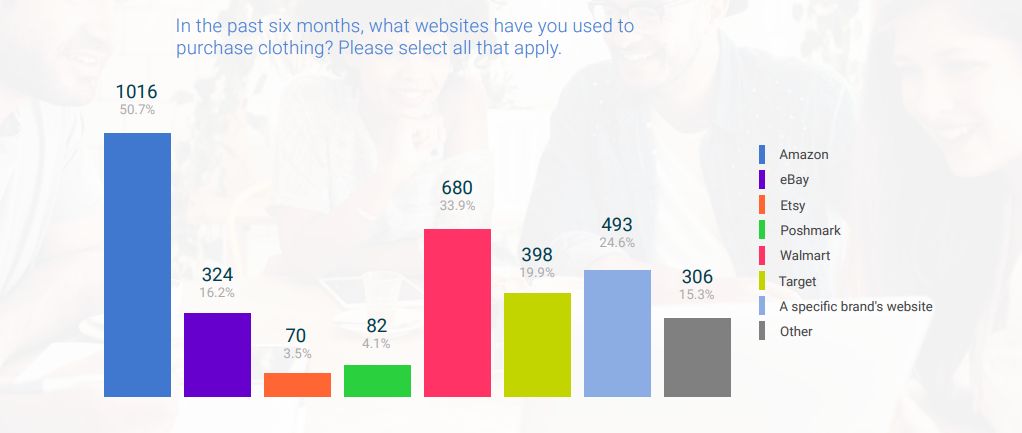

The most powerful benefit of using Amazon to sell apparel is access to their 300 million active users and 50 million Prime members. Not only are these 300 million people online, but they are also actively looking to buy products, making their accessibility that much more valuable.

Part of this willingness to buy is because of the fact that any product sold on Amazon has the added benefit of Amazon’s brand name. Consumers shop there because they trust its brand, and that trust is transferred to you when you sell clothing on Amazon.

To keep its platform popular among third-party sellers, Amazon also offers very generous terms.

Although an Amazon Pro Merchant account costs $39.99/month and a percentage of your sales, you don’t have to pay for any listing fees. This means you can list as many products as you want with no additional cost.

Some other benefits include:

That’s not to say that there aren’t obstacles to selling apparel through Amazon. Because of its popular platform and booming market for apparel, you’re going to encounter a highly competitive selling environment which can make it difficult to build your own corner of the market space.

Amazon also limits payouts to every two weeks. This can be a problem for some, especially small companies that are operating from payout to payout.

The strict quality control protocol has been a problem for third-party sellers as well. Since you’re operating on Amazon’s platform, your inventory can be restricted at any time and there isn’t much you can do about it.

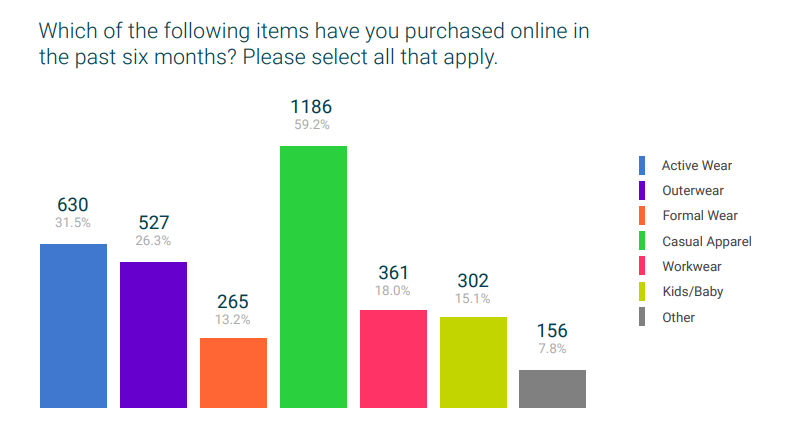

While Amazon originally focused their apparel efforts on sportswear, they have since expanded to clothing for every market, with 59.2% of Amazon consumers purchasing casual apparel.

As the largest online apparel retailer, Amazon faces competition in all directions, not the least of which are big name brands like Walmart, Target, Kohl’s, and TJ Maxx, but so far has been able to stay ahead.

Read: Why Walmart’s Ecommerce Strategy Makes Them A Contender Against Amazon

A large part of Amazon’s success can be attributed to the recent downfall of department store giants like Sears, Macy’s, and Ralph Lauren, which has driven even more consumers online.

Whereas shoppers used to be apprehensive about not being able to return apparel items they didn’t like, hassle-free return programs like Prime Wardrobe have helped bring more customers into the online category.

More and more consumers are simply going to stores to try out products and then buying them cheaper off of Amazon. If businesses hope to keep up, they’ll have to adopt a model that focuses on customer satisfaction and price-matching to keep consumers buying.

“Successful Amazon strategy in 2019 means tightening your operations, building your brand equity with creative content, and leveraging Amazon’s advertising tools to reach your customers on and off the Marketplace.”

– Nancy McLaughlin, Senior Manager, Marketplace Channels at Tinuiti

Want to learn more?

Amazon Strategy 2019: 3 Steps to Marketplace Success

Prepping for 2019 Amazon Prime Day [The Brand Guide]

The 2019 US Forecast on Apparel Shopping Trends