Amazon Trends & Industry Predictions for Sellers [2024]

2023 was yet another huge year for Amazon and the retail media sector as a whole, bringing with it new ad placements, partnerships and measurement capabilities, relaunched platforms, a major IPO and more.

2024 retail media ad spend is forecasted to reach nearly $60B—continuing to grow at least 21% YoY through 2027—making “retail media the fastest growing ad spending channel in all of media.”

Looking at just a few of the most interesting current stats and impactful events and updates from Amazon over the past 12 months we find…

Amazon wasn’t the only RMN making moves in 2023, with some noteworthy milestones from other top retailers including…

None of these changes happened in a silo, with each connected to the evolving needs of brands, marketers, and shoppers as more cookies crumble, more signals go dark, and the demands for more personalized ad experiences increase.

The privacy-compliant, first-party insights retailers are able to offer advertisers to help in reaching the most qualified audiences is invaluable today and tomorrow, on Amazon and beyond.

We don’t expect you to change your entire product lineup to match evolving retail trends, but they are helpful to keep in mind when building your strategy, refining your goals, and accurately defining success.

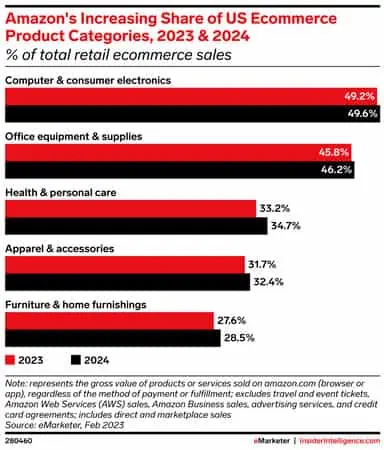

Heading into 2024, five of the hottest product categories on Amazon include:

Health and personal care — With inflation concerns and impacts far from over, the lipstick effect is in full swing, as many consumers are treating themselves to affordable little luxuries (like a nice lipstick) while their bank accounts aren’t padded enough for higher ticket items.

Consumer electronics — Long ago considered a nice-to-have, personal electronics including laptops and smartphones have become necessary tools in living a modern, connected life. And more people are turning to Amazon to buy them. In addition to the many top brands available, from Apple to Sony, Amazon also has a variety of their own electronics brands, including Kindles, Fire TVs, and Echo devices.

Office equipment and supplies — From printer cartridges to the printers themselves, being able to find it all on Amazon—often with fast, free shipping—has more shoppers turning to the site for their office supply needs.

Apparel and accessories — Amazon offers an extensive selection of apparel from top brands, their own AmazonBasics brand, and everything in between, in sizes to fit the whole family. Their fast shipping, easy returns, and Prime Try Before You Buy offering on many items are surely contributing factors to their increased apparel ecomm share. Note: Be on the lookout for Tinuiti’s Apparel Study, planned to launch in early ‘24!

Furniture and home furnishings — Whether you need a desk or desk lamp, sofa or sofa cover, table or tablecloth—you’ll find it on Amazon. And importantly, it often ships for free, a major perk for furniture especially, which often carries hundreds of dollars in freight and delivery charges from other retailers.

As we head into the new year, we asked the experts what they’re expecting from Amazon and the retail media sector at large in 2024. Here’s what they had to say…

With so many advertising avenues competing for their share of the marketing budget, brands and advertisers are placing an increasing focus on determining what is working best, how, and in what ways.

Incrementality looks to measure which specific interactions with your brand led to the desired outcomes from your audience. With this information, you can rank the effectiveness of different initiatives at helping you continue to drive desired results, focusing your efforts on the areas with the most impact and opportunity.

“Incrementality and proving investments in media beyond onsite search will continue to dominate conversations in 2024. I would challenge our peers to re-consider the definition of incrementality and if the Amazon shopper is also the Walmart shopper and is also the Instacart shopper—are they incremental? I think we will have to look harder, almost on a case-by-case basis as each retailer is eventually going to come with a slightly different incrementality calculation, each brand with a different goal, and each SKU a different reason for existing.”

— Elizabeth Marsten, VP, Commerce Strategic Services at Tinuiti

Any store with physical locations has certain advantages over online-only retailers—including in-store advertising and click-and-collect capabilities. But only one of those stores—Walmart—has the massive physical footprint (~4700 stores), brand recognition, and extensive inventory that separates them from the pack in proving just how ‘big’ those advantages can be.

“Progress in incrementality and measurement will invariably remain at the forefront of discussions in 2024. However, when considering under-leveraged opportunities, it becomes apparent that a strong physical footprint will act as a true differentiator for retailers in the coming year and beyond.

With the increasing prevalence of omnichannel shopping behaviors and the current under-utilization of in-store advertising and measurement opportunities, this positions “in-store” as an emerging avenue for sellers to strategically engage the entire spectrum of consumers, from those ready to make a purchase to individuals seeking to explore new products during their regular in-person shopping experiences. Additionally, when done right, these stores can double as fulfillment centers, allowing for greater geographical reach for expedited shipping options such as same-day and 2-day.”

— Stuart Clay, Director, Commerce Strategic Services at Tinuiti

Amazon’s ad opportunities are more robust than ever, both on-and-off Amazon.com. Outside Amazon’s walls, growth can be seen from a variety of ad types and locations, including: Sponsored Products launched on third-party inventory in October 2023; expansion of Streaming TV opportunities with the release of Sponsored TV ads in Q4 2023; and Prime Video inventory coming in Q1 2024.

We expect those expanded opportunities coupled with the ability to measure Streaming against D2C (direct-to-consumer) web purchases will result in more brands feeling comfortable entering the Amazon Streaming space in 2024.

“2024 will be the year Amazon tears down the perception that it is a retail-focused advertising platform. Brands will need to assess, or reassess, how Amazon’s ad tools contribute to their digital marketing strategy whether Amazon is a major sales channel for their products or not. The unique and proprietary audience segmentation within their DSP, massive incremental reach of Fire TV’s streaming inventory, and the sophistication of analytics tools, like Amazon Marketing Cloud, provide critical value to any advertiser’s digital marketing strategy.”

— Joe O’Connor, Sr. Director, Strategic Marketplace Services at Tinuiti

“I predict Amazon will continue to make off-Amazon advertising placements, and non-endemic advertisers, part of their larger vision. We’re already seeing things like the Amazon Ad Tag become more popular and I believe this is just the beginning. Amazon will continue to make the case for brand budgets from non-endemic advertisers due to new placements such as video on the Amazon Prime app. I believe, eventually, they’ll take budgets from DV360 and The Trade Desk as these non-endemic advertisers explore Amazon DSP placements.”

— Tony Heuer, Strategist, Programmatic at Tinuiti

Many consumers—particularly Gen Z—strongly consider a brand’s values when deciding who to shop from. As Tinuiti’s From A to (Gen) Z study found, “74% of Gen Z CPG shoppers across all three product categories studied said that the values and beliefs of CPG brands were at least moderately important to deciding which products to purchase, the highest share of any generation.”

“In 2024, personalized customer experiences will take center stage on Amazon. Brands that harness consumer data to curate tailored shopping experiences will be better equipped to boost sales and brand loyalty in the competitive marketplace. This bespoke approach will make brands more memorable and enhance customer satisfaction. As this trend accelerates, the use of Amazon Live, Amazon Posts, and strategic influencer partnerships will become increasingly influential. Live demos, real-time engagement, and influencer endorsements will drive conversion rates and foster a community around your brand.

Simultaneously, sustainability will no longer be a niche selling point but a primary driver of consumer choice and Amazon’s algorithmic preferences. This pivotal shift is evident with initiatives like the Climate Pledge Friendly Certification, which spotlights products with high sustainability standards. Brands that integrate eco-friendly products, packaging, and sustainable practices into their business model will likely receive organic ranking benefits and improved Buy Box visibility. Amazon’s commitment to sustainability will mirror consumer consciousness, rewarding environmentally responsible brands with higher visibility and sales. The synergy between personalization and sustainability will be paramount for brands and sellers aiming to thrive on Amazon in 2024.”

— Eva Hart, Amazon Growth Expert, Enterprise Marketing Manager, and Brand Owner at Jungle Scout Cobalt

Walmart continues to place a focus on their already-strong measurement capabilities, and Amazon has set quite a high standard of what’s possible with Amazon Marketing Cloud. With new tools like AMC Audiences, brands are more empowered to take direct action based on these omnichannel insights. Being able to measure and execute omnichannel campaigns at scale is essential in confidently investing your dollars in the most impactful channels.

“2024 will be the year of maximizing first-party data and enhancing measurement to showcase omni-channel growth and incrementality. With the deprecation of the cookie becoming a heavier conversation, brands (including non-endemic advertisers) will need to lean heavier into utilizing first-party data to target relevant customers. As Retail Media Networks are continuing to make their data easier to access and measure on, advertisers are able to target prospective customers based on actual purchase data, allowing display and CTV (tactics that are traditionally known as upper-funnel) to become higher converting tactics.”

— Raquel Kozlowski, Sr. Manager, Retail Programmatic at Tinuiti

“I expect AMC audience usage to continue to expand in 2024, as tools become more standardized and advertisers demand more creativity and granularity with audience strategy. The possibilities with AMC audiences are endless, and they have already proven to be a great way to reach new customer subsets and drill down on the most relevant segments to drive high rates of engagement and conversion.”

— Duncan MacPhee, Specialist, Marketplaces Programmatic at Tinuiti

“Each year we learn and understand more about the purchase journey of consumers across multiple retailers, but with the widespread rollout of Amazon’s Real Time Mix and partnerships with third party data sources like Crisp, brands will have more reliable and holistic knowledge in 2024 than ever before. We can use this data to implement towards media strategy, understanding the degree in which each retailer impacts the others, and that firing on all cylinders will set brands ahead of the competition.”

— Jessi Shapp, Sr. Specialist, Marketplace Search at Tinuiti

The giants in retail, social media, affiliate marketing, martech and more often leverage each other’s strengths to move quickly and intelligently in today’s increasingly complex advertising landscape. There are some interesting powerhouse partnerships in existence and shaping up that we’ll be keeping an eye on in 2024, including Amazon’s deals with Meta and Snap.

“Amazon’s deals with Meta and Snap signal another move around ‘making the purchase journey easier for the consumer’ as well as additional emphasis on the upper funnel. Giving consumers additional paths to easily make purchases will likely shorten the path to purchase, increasing the importance of having a presence on these channels, not just within Amazon. Look to the brands funding the full funnel to come out on top compared to those not wanting to sacrifice the short term ROAS by the end of 2024, while also keeping an eye on how this deal will eventually bleed into actual Amazon advertising opportunities down the road.”

— Ken Magner, Strategist, Marketplace Search at Tinuiti

“I’m looking forward to seeing how Amazon is going to innovate given the birth of TikTok Shop. There’s a great Wall Street Journal podcast about how the two platforms are directly trying to compete, especially as TikTok builds a network of fulfillment centers like Amazon. We saw Amazon launch the INSPIRE social shopping feed this year and Amazon Live a few years back, but how will they invest more into video and influencer components? Recently, Amazon and Meta announced a partnership that permits in-app purchases on Facebook and Instagram. More than ever, brands will be tasked with layering in external social media strategies into moments on Amazon to create buzz on and offsite. Amazon is a purchasing and research destination first, so how brands integrate that with external traffic drivers will be the big bet of the new year.”

— Megan King, Sr. Manager, Commerce Strategy at Tinuiti

With many brands facing uncertain marketing budgets, it can be difficult to bake testing into the strategy. That said, with all the new ad opportunities becoming available, not testing shouldn’t be considered an option or you’ll risk falling behind.

“Now more than ever is there a need to create space for a testing budget. Amazon has announced new placements like Prime Video ads, but there are other innovations in ad strategy brands will need to vet. Utilizing a separate budget with flexible metrics will enable brands to decide whether new betas are worth their weight. Same goes for omnichannel; understanding audience overlap (or lack thereof) between platforms will give better insight on how brand dollars should be spent.”

— Karie Casper, Strategist, Amazon Search at Tinuiti

As with all digital marketing sectors, the full impact of AI and LLMs in shaping and reshaping the future of retail media is still to be seen. Today, AI is being used in a number of ways, with Amazon recently “[debuting] AI technology for product images and ad targeting, aiming to enhance the quality of advertising on their platform.”

“I predict we will see more obvious deployments of Generative AI and Large Language Models directly within Amazon advertising platforms and product search functionality. As companies are increasingly being rewarded by higher share prices when they talk about all the ways they are using AI (regardless of impact or efficacy), we should expect even more new features in 2024. This year we’ve already seen ad copy suggestions, and the ability to use AI to generate lifestyle images within Ad Console for Sponsored Brand and Sponsored Display ads.

I expect there to be massive improvements in functionality and the quality of these outputs, and perhaps even see these tools be able to create high quality custom creative for DSP and video ads. This will level the playing field for smaller brands who are able to take advantage of these free tools and allow them to better compete with larger brands that leverage in-house teams or creative agencies.

We’ve also seen a recent announcement about being able to have a “conversational product search” with a chatbot on Amazon. It would not be a stretch to think that in 1-2 years similar uses of chatbots could be deployed within Ad Console to help less experienced advertisers get the most out of the platform by asking for strategic advice, suggested optimizations, and audits of existing campaigns.”

— Nick Sandberg, Strategist, Marketplaces at Tinuiti

“I predict that Amazon will greatly enhance their users’ shopping experience by offering more interactive and immersive ad experiences, including more video capabilities and AI. Right now, we are seeing AI create big waves across many industries, and I foresee Amazon being on the forefront of this innovation when it comes to advertising.”

— Lauren Wood, Manager, Marketplaces at Tinuiti

We talk a lot about full-funnel advertising, but what about full-funnel collaboration? In today’s holistic advertising landscape, nearly every team not only needs to know what other teams are working on, but can also leverage their individual strengths to support them. As it turns out, team work really does make the dream work.

“In 2024, I expect the gap between the Merchant/Buying teams and the Marketing/Advertising teams to significantly shrink. Currently, some buying teams are not directly involved in marketing efforts that their brands are doing with the retailer. It’s imperative that the retailer marketing teams and buying teams work in closer collaboration to ensure that buying initiatives are tied to marketing initiatives. More and more merchants are becoming aware of the benefits of advertising and the specific levers that can be pulled. I expect this gap to shrink and buyers to become more involved in planning, and requesting, marketing support from the brands.”

— Scott Glaser, Director, Commerce Media at Tinuiti

Kroger has been busy with valuable advances for advertisers, including the recently revamped In-House Kroger Advertising Platform that went live in October.

“The launch of the new Kroger Ad Platform enables Tinuiti to manage our Kroger buys more efficiently by allowing us to see everything we need for our on-site campaigns within one platform. This gives us the ability to measure, gather insights and optimize campaigns quickly to drive better performance for our clients.”

— Raquel Kozlowski, Associate Director of Retail Programmatic at Tinuiti

But that isn’t all Kroger has been up to.

“It’s not every day that a retailer builds their own ad-serving platform. After Walmart’s launch in 2019 and Instacart’s in 2020, it’s been a quiet ride until now. Kroger won’t be the last, but there may not be another for a year or two. So for now, we’re closely watching to see the full effects of the potential Albertsons merger. If Kroger and Albertsons combine, they would have more physical locations than even Walmart.”

— Elizabeth Marsten, VP, Commerce Strategic Services at Tinuit

Want to learn more about what to expect from Amazon, Walmart, Instacart, Target, Kroger and other retail media networks next year? Be sure to download our 2024 Amazon & Retail Media Marketing Guide for more great insights, including which top retail media networks are most worth your attention. Our guide aims to help you in kicking off or growing your own retail media investment, with better clarity about your options and where it makes sense to devote your ad budget.

Editor’s Note: This blog post is updated annually to reflect the current and expected trends in the year ahead.