More businesses today are using both Vendor Central and Seller Central to leverage the advantages of both platforms on Amazon’s Marketplace, known as the hybrid model.

Each side has their mutually exclusive advantages; lower fees and more sophisticated marketing tools for Amazon Vendors — while Amazon Sellers enjoy greater control, analytics, and margins.

Here’s how to evaluate if the hybrid approach is right for you, and how businesses are using both Vendor and Seller Central to manage their catalog and growth on Amazon.

What is the Amazon Hybrid Model?

The Amazon hybrid model is the business model of selling both to Amazon as a first-party Vendor (1P) and selling on Amazon as a third-party Seller (3P).

Amazon Vendor Central vs. Seller Central

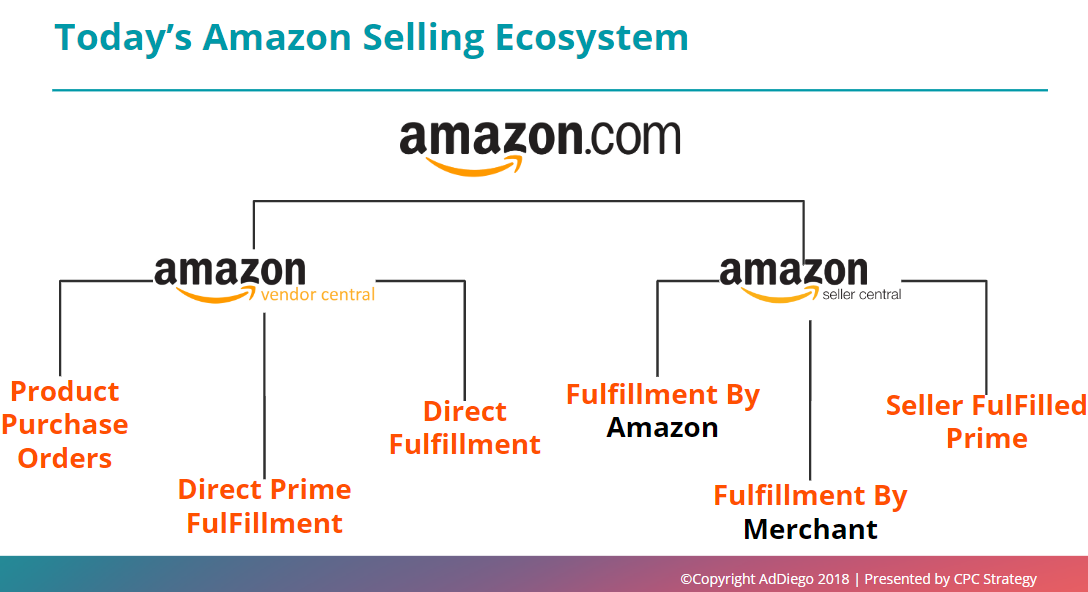

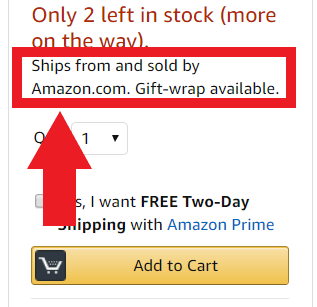

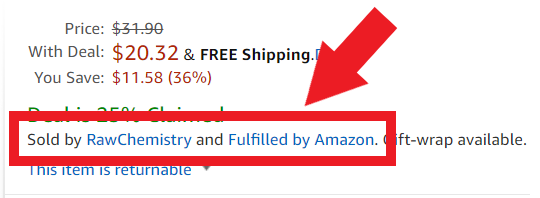

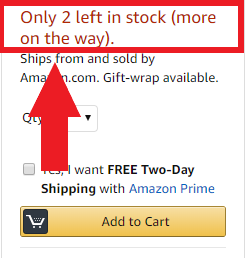

Anyone selling on the Marketplace today interacts with Amazon through of two portals: Vendor Central or Seller Central.

Each platform offers different methods for selling and shipping through Amazon.

Amazon Vendors (1P) can sell via:

- Product Purchase Orders

- Direct Prime Fulfillment

- Direct Fulfillment

Amazon Sellers (3P) can sell via:

- Fulfillment by Amazon (FBA)

- Fulfillment By Merchant

- Seller Fulfilled Prime

Do brands have a choice?

Many brands wonder if going all Amazon 1P, 3P, or a mixture of the two (the Amazon hybrid model) is best for their business.

The truth is that there is no simple answer: it depends on your business.

Let’s take a look at how to best evaluate if using both platforms as a hybrid seller is right for your business.

Which platform is best? It depends. Determining which channel is more profitable for your business requires careful considerations for your entire catalog on a product-by-product basis.

-Jeff Coleman, VP of Marketplace Channels at CPC Strategy

Why Amazon Vendors Should Consider A Hybrid Approach

Here’s a list of the reasons why a first-party Vendor might consider transitioning their products to Amazon’s third-party Seller Central platform.

Common Amazon Vendor (1P) pain points:

- Contract terms, cost increases & consistent funding requests

- Amazon claiming that your products are unprofitable

- Confusing chargeback costs your CFO doesn’t like to see

- Product pricing control

- Inconsistent purchase orders

- New product launches

- Communication with Vendor managers

“Despite their ability to move a lot in volume, Amazon Vendors often feel like they’re getting squeezed by Amazon,” says Jeff Coleman.

“Every year Amazon is asking for slightly higher coop percentages, allowances, and slightly smaller price reductions, charge-backs, and more.”

How do we get Amazon to purchase new products? How do we control pricing? Addressing these challenges on the Vendor side can be difficult. Which is why we work with some of our clients to transition to the 3P side, or the hybrid model.

Amazon Vendor Central vs. Seller Central Business Considerations

What do Amazon businesses need to consider when evaluating a hybrid model? And how do you do it without losing revenue?

These are important questions, and our Marketplace experts advise evaluating these considerations on a product-by-product basis.

Inconsistent POs For Specific ASINs

Amazon Vendors can frequently face product stockouts, product order lag (not ordering in time), or even Amazon not ordering enough stock to meet demand.

Inconsistent Product Orders (POs) can be a major headache for vendors, and a compelling reason for migrating a product to Seller Central to exercise control over your own inventory.

“You have to keep in mind that Amazon doesn’t want to overstock because warehouse space is one of their scarcest resources,” says Jeff Coleman.

“If they’re at 100% in-stock, they are erring on the side of stocking too much.”

Rather than depending on Amazon’s POs for building your stock on the Marketplace, third-party sellers are able to take full control of their own inventory management — which can be critical for new product launches or high-traffic holidays. More on that below.

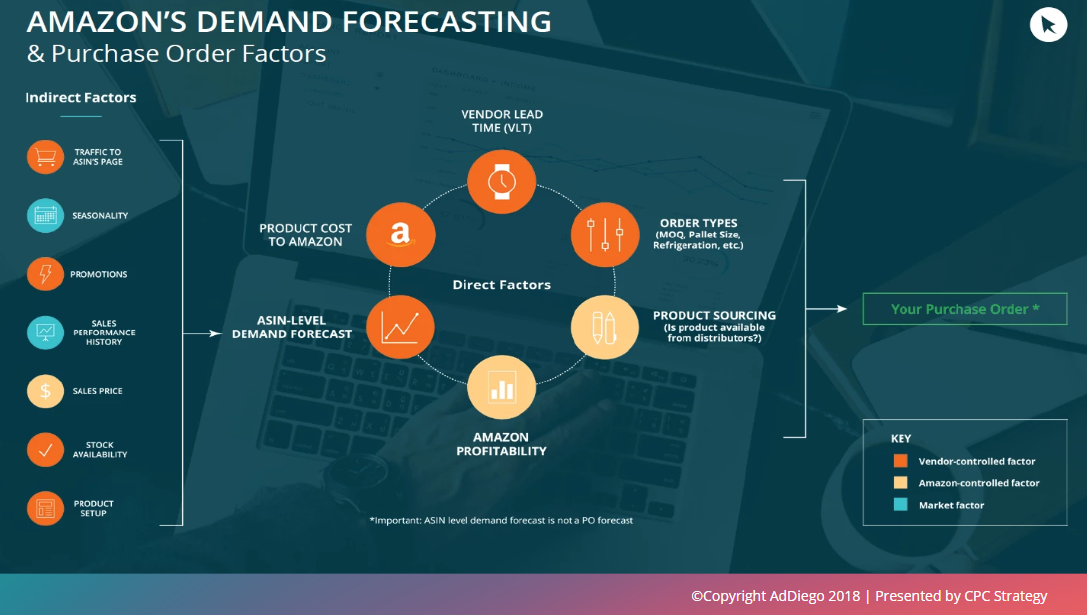

To better understand inconsistent product orders, you need to have an understanding of Amazon’s demand forecasting.

Amazon’s Demand Forecasting

Amazon Vendors can become understandably confused and frustrated when Amazon’s demand forecasting and subsequent product orders don’t seem to add up.

One of the most common questions Vendors ask our Marketplace Analysts is:

Amazon’s demand forecast tells me they need 1000 units for the next four weeks — yet they write me a PO for 400 orders only.

Why?

“The answer is that Amazon’s new demand forecast is not driven at the seller level,” explains Eric Kauss, Manager of Vendor Operations at CPC Strategy.

“It’s driven at the detail page-level by all impressions or views that go to that page — regardless of the sellers or vendors for that product.”

Amazon has no way of parsing whether demand for that product is for the sellers or vendor. The total number forecasted by Amazon includes all merchants of that product to meet that demand — which is why your PO is often less than the demand forecast.

-Eric Kauss, Manager of Vendor Operations at CPC Strategy

Like Amazon’s Product Ranking Algorithm, the Product Order Algorithm is influenced by both direct and indirect factors.

Eric Kauss explains that the three biggest factors that impact POs that hybrid sellers can influence are:

- Price

- Stock

- Reviews

Hybrid Demand Forecasting

Eric Kauss explains that Amazon hybrid sellers that have a “clean setup” with less than 30 offers against their products will be able to get a closer number to what demand truly is for both 1P and 3P for that particular product.

“In addition, the new demand forecast is more accurate than the previous one,” says Eric Kauss.

“It takes time to get used to, but you should start seeing more accurate demand forecast so that you can plan accordingly.”

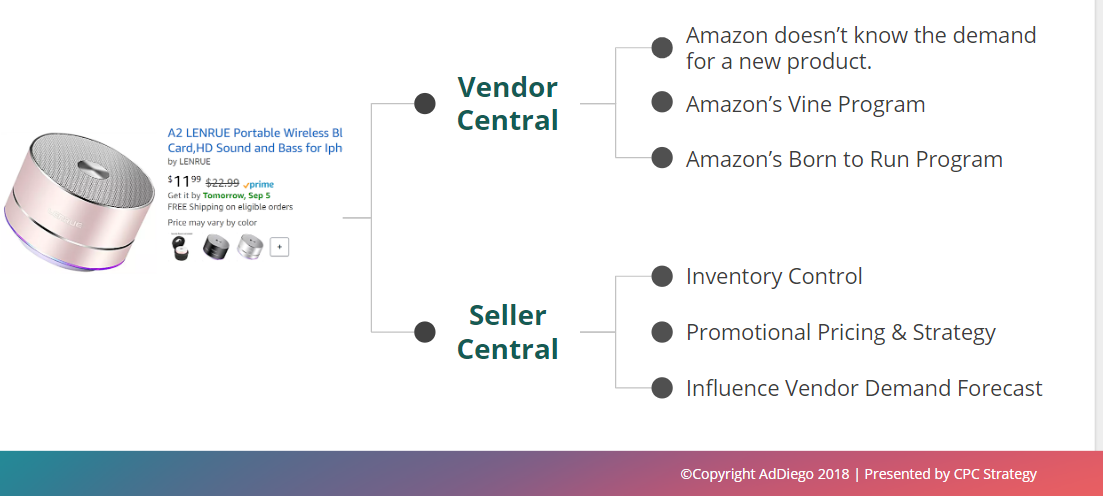

Launching A New Product On Amazon

Another reason to consider a hybrid approach is when launching a new product.

For those of us on the Vendor side, there’s no way to tell Amazon that our new product is going to move 1000 units in the first week.

That’s because there’s no product history for Amazon to calculate that demand.

Launch Your Product on Seller Central

“This is when it makes sense to launch your new product on Seller Central,” says Eric Kauss.

“Hybrid sellers can move more units for a new product by launching it on the Seller Central side.”

It’s also worth noting that Amazon has a program that may help Amazon Vendors to accelerate their new product launch: the Born to Run Program.

While moving your new product to Seller Central might help you better launch more units in a shorter time, it’s important to note that it’s not a set-it-and-forget-it solution.

“On the 3P side you have complete control over your inventory,” says Jeff Coleman.

You have the ability and responsibility to control your pricing and stock with this approach. It’s your responsibility to stay competitive.

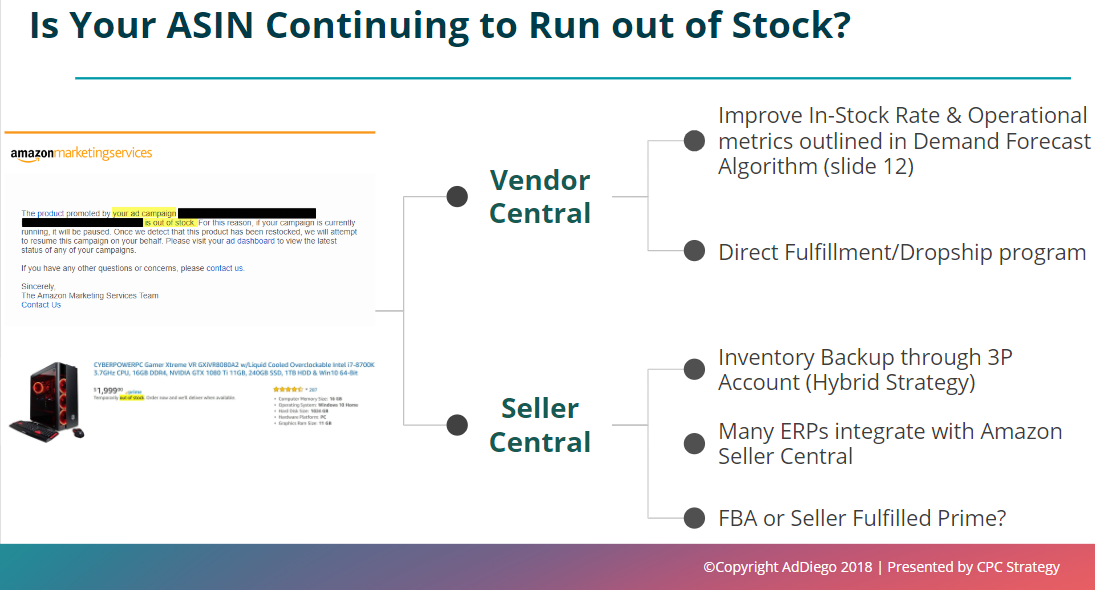

ASINs Running Out Of Stock

Stockouts can harm any seller on Amazon — not only will it decelerate your sales, but it can also cause your product to lose organic rank on the product listing page.

Eric Kauss says that this is a common problem for Vendors because they don’t have full control over their inventory.

Vendors receive this message all of the time and it’s a major problem when trying to grow your business. They don’t always stock at the inventory that you would like.

Use 3P Fulfillment Options to Support 1P Inventory

Even if you get to 80% stock rate on the 1P side, that means 20% of the time you’re out of stock. You can fill that gap with 3P fulfillment options to ensure that you’re in stock all of the time.

This requires special attention from the Seller side to ensure you have the stock to be fulfilled.

“On the Seller side, you can use the 3P inventory as your primary sales channel for a product, you can also use it strictly as inventory backup,” says Jeff Coleman.

“Not all of your ASINS will be in stock 100% of the time on the 1P side. You can supplement that stock with 3P fulfillment options, like direct fulfillment.”

The Amazon Direct Fulfillment Program can help with this by helping you protect your sales with drop shipping.

Amazon’s Direct Fulfillment/Dropship Program

Here’s how the Direct Fulfillment program can help hybrid sellers manage their inventory:

-

- The Vendor’s inventory acts as a backup for when Amazon is out of stock.

- Build demand for new products at a quicker pace – historically Amazon will order minimal quantities of new items until demand dictates to order more.

- Protect Sales – By having direct fulfillment in place a vendor’s products will continue to be available for purchase if Amazon runs out of inventory.

“During high traffic times like the holidays, Amazon might not have enough inventory in stock,” explains Eric Kauss.

“You tell Amazon that you will fulfill the order through the dropship program if Amazon’s stock runs out,” explains Jeff Coleman.

“This program can be successful if you are capable of one-off shipping units that can help you save sales and continue to build demand which will generate purchase orders down the road.”

Whether its seller fulfilled prime or fulfilled by Amazon, the key here is the Prime badge. Products that lack the Prime badge will dip in velocity.

“When transitioning to a 3P or Hybrid model, it’s important to make sure that you retain the Amazon Prime badge to make sure you don’t sacrifice sales in the process,” says Jeff Coleman.

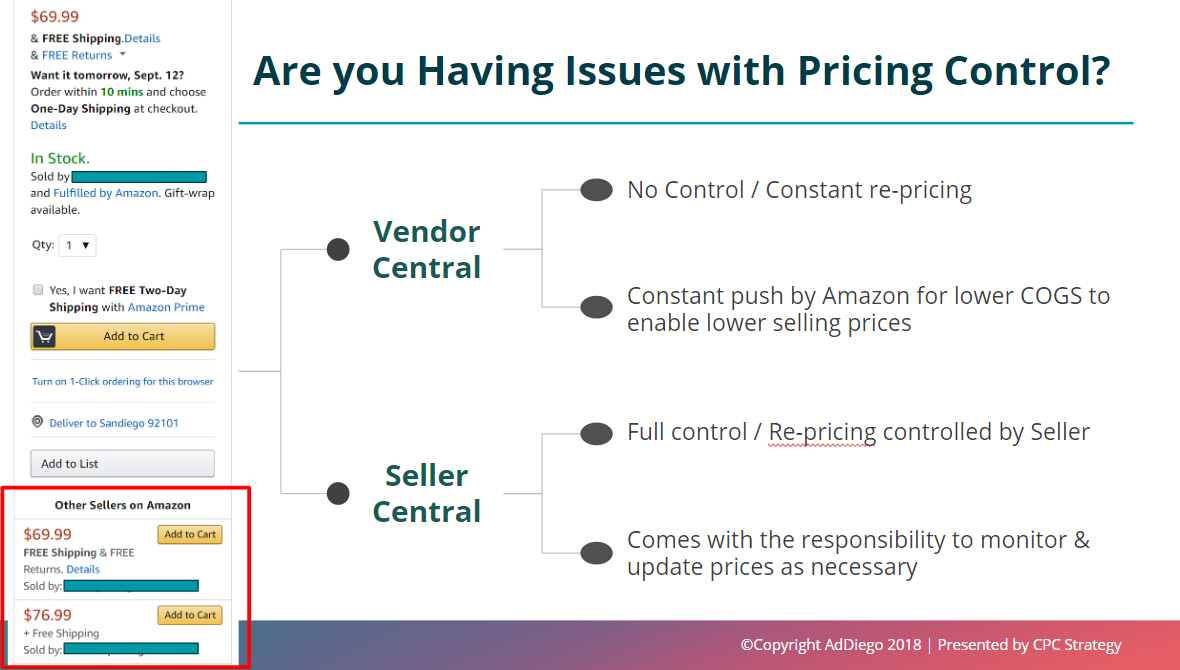

Issues with Pricing Control

Let’s face it: everyone has issues with pricing control — especially Amazon Vendors.

The inconvenient truth is that Vendors have no real control over their pricing — only Amazon does.

Amazon Sellers, on the other hand, have a lot more flexibility when it comes to pricing their products.

“On the third-party seller (3P) side, you have full control over the pricing of your products,” explains Jeff Coleman.

“You also have the responsibility to set and reset them as necessary to remain competitive and rank on the product listing page.”

If you have MAP pricing or MSRP pricing you must uphold, then you may need to consider a hybrid model to ensure your pricing can meet those agreements.

Issues with ASIN-level Profitability

For Amazon Vendors, it’s also difficult to address issues with ASIN-level profitability, especially when your margins are already small.

These challenges are much easier to address with the control and flexibility offered by selling your products on Seller Central.

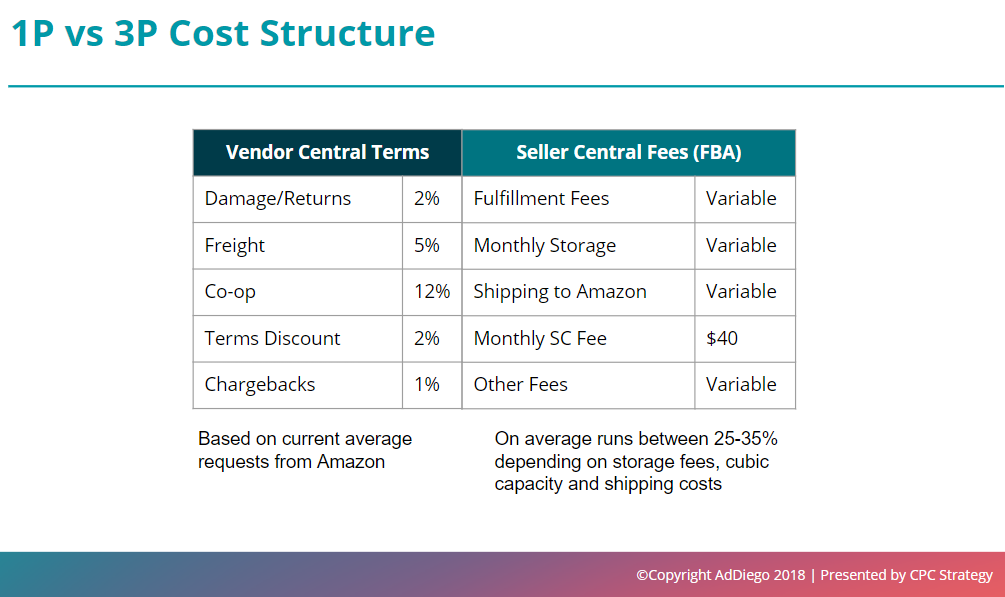

1P vs. 3P Costs/Fees

Five years ago, Amazon’s growth was strictly focused on volume.

Nowadays, the ecommerce giant is more focused on profitability than ever before, and that means making more money from both Amazon Vendors and Sellers.

When considering a hybrid strategy, it’s important to understand the costs of both platforms.

Amazon Vendors, on average, pay about 20% of their Marketplace revenue to Amazon today when accounting for all of the fees.

On the Amazon Seller side, you can expect to pay anywhere between 25%-35% in costs to Amazon.

The variance between these two percentages is based on two key factors:

1. Inventory storage costs (how much and how long your products will be stored)

2. Cubic size of the product (makeup and televisions take up varying space and Amazon will charge for this)

3. Shipping costs

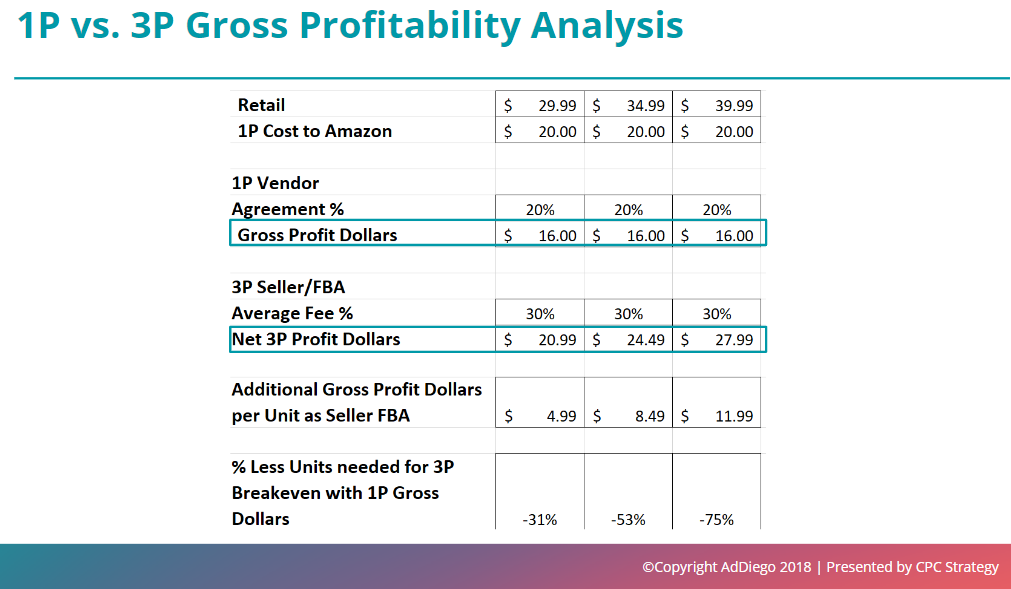

1P vs. 3P Gross Profitability Analysis

Let’s take a better look at how Amazon’s fee structure for Vendors and Sellers would impact a product in your category.

Let’s pretend you were to sell a product for $29.99 on the Marketplace today.

As an Amazon Vendor, on average, you could expect to see $16.00 in gross profit with 20% in fees — without accounting for operational costs.

As an Amazon Seller, on average, you would receive $20.99 in gross profit with 30$ in fees — which can then scale upwards depending on your retail price.

The most significant unknown factor is your internal operational costs (labor, warehouses), which affect your profitability dramatically.

Keep in mind is that 3P sellers can enjoy greater gross profit should they decide to raise the retail price, whereas Vendors are entirely dependent on Amazon for setting the price (and therefore, your margins).

“Although fees appear higher on the 3P Seller side, they are deducted from your retail price,” explains Jeff Coleman.

“Whereas for Vendors, those deductions are coming from your wholesale price.”

The larger the discrepancy between your retail and wholesale prices, the larger the opportunity to make more profit. The smaller that difference, the smaller the opportunity for profit. This is a compelling reason for shifting a product to the 3P Seller platform.

Challenges of the Hybrid Model

Whether you are an Amazon Vendor or a Seller, expanding your catalog to two platforms is not without challenges of its own.

1. Managing your catalog across two separate systems

Managing your business with two different platforms means that you will need to have a solid understanding of both Vendor Central and Seller Central.

Amazon communicates with you independently, invoices you separately, and you need to be able to manage your operations, from ordering products to accounting, to warehousing, to labor costs, to inventory and taxes — on both platforms.

2. You have full responsibility for your own inventory

Managing your own inventory is both a pro and a con. Amazon isn’t going to issue product orders on the Seller Platform.

You are responsible for managing your inventory availability and your own distribution channels.

3. Product content control

If you migrate an ASIN from Vendor Central to Seller Central, the content control of that ASIN will remain on the 1P Vendor side.

If you are considering a hybrid approach, don’t shut down your Amazon Vendor account — or you risk losing your product page content.

“You can mark that ASIN obsolete once it’s moved to Vendor Central,” says Eric Kauss. “But don’t have the detail page taken down if you want to keep control of the content.”

4. Sales tax

Amazon Sellers have to remain in compliance with sales tax laws in each state that their customers are purchasing from.

5. Different marketing capabilities

There are marketing programs exclusive on the 1P side that are exclusive to Vendors (like Vendor coupons) and also platform differences for Lightning Deals and Deal of the Day.

When it comes to Amazon’s paid advertising, Vendors also have access to AMS (which is being rebranded to Amazon Console).

It’s important to note that in AMS you have access to PDAs which allow Vendors to target particular ASINs, whereas 3P Sellers can only target keywords.

The Final Takeaway

The hybrid approach to selling on Amazon offers greater control for businesses, but it requires careful planning and operational management to make both of Amazon’s platforms work well together.

Although many businesses may be tempted into thinking that transitioning their catalog to the 3P side will solve all of their problems — it won’t.

“Operational challenges that you face as a Vendor aren’t going to simply go away when you transition to the 3P side,” says Jeff Coleman.

The challenges are different, but there are measures you can take to improve your efficiency on both the Amazon Vendor and Seller side. Effective Hybrid strategy requires effective strategies on both sides — Vendor and Seller Central.

Want to learn more?

Sign up for our live webinar or recording: The Amazon Hybrid Selling Model on October 18th @ 11am PT

Amazon Seller Central vs. Vendor Central 2018 Guide

Seller Central: How Amazon Vendors Transition to Third Party Sellers

Balancing an Amazon Seller and Vendor Strategy Guide

How Will the New Amazon Demand Forecast Impact Vendors?

Inventory Management Strategies for Q4

The Best Amazon Inventory Management Tools

You Might Be Interested In