Amazon Prime Day 2023 Advertising Trends: New-to-Brand Customers Surge and Other Key Learnings

Amazon once again broke records with its signature Prime Day event, producing the single largest sales day in company history. To capitalize on the huge influx of demand, Amazon vendors and sellers relied heavily on Amazon’s extensive suite of advertising options to get in front of shoppers.

Here we’ll unpack some of the key trends observed using anonymized results from the more than $400 million in annual Amazon ad spend under management at Tinuiti. All figures are based on sets of same-store advertisers that remained active during the time period studied.

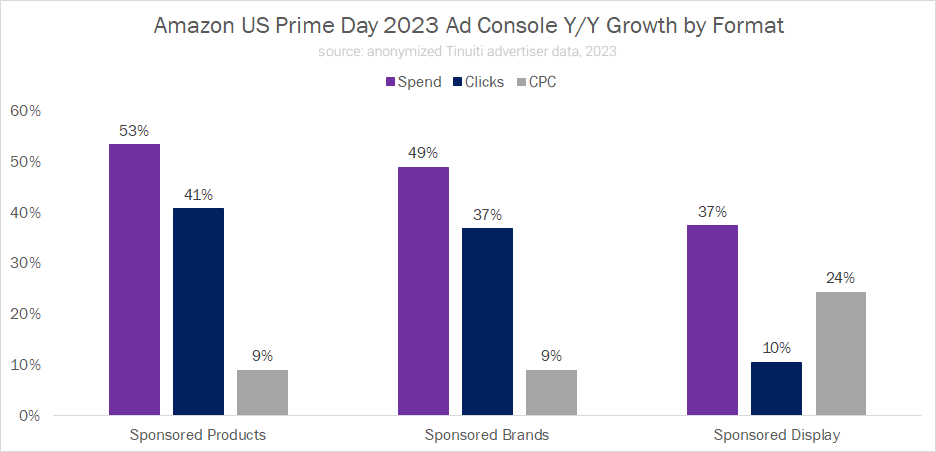

Looking at the growth of Ad Console formats, Sponsored Products led the pack with a 53% increase in spend compared to Prime Day 2022, driven by a 41% jump in clicks and 9% increase in CPC. Sponsored Brands and Sponsored Display also grew substantially, with spend on the two formats up 49% and 37%, respectively.

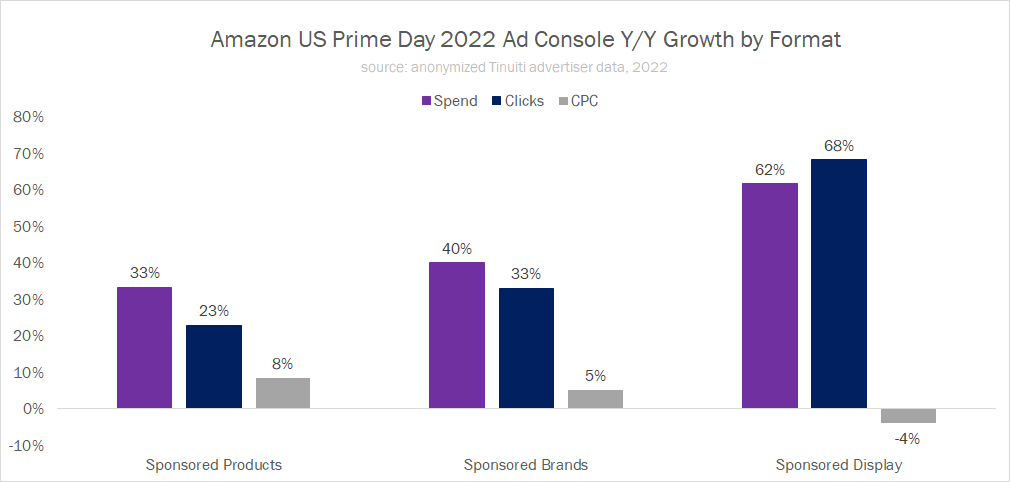

This is a reversal of how these formats fared against one another in terms of year-over-year spend growth during last year’s event, when Sponsored Display led the pack, followed by Sponsored Brands and then Sponsored Products. Across all three formats, the cost of ad clicks increased more in 2023 than in 2022.

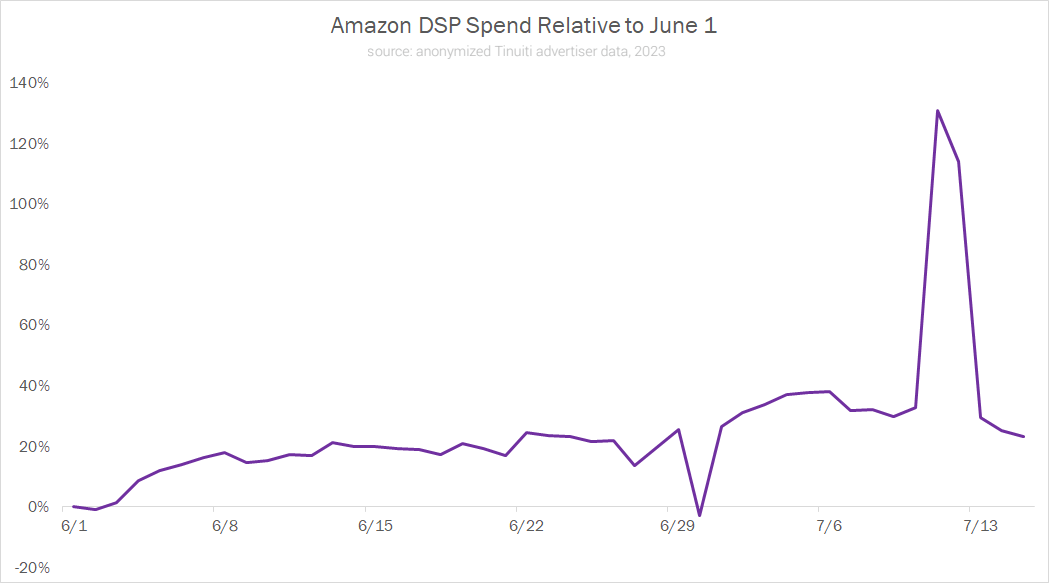

Amazon Demand-side Platform (DSP) advertisers started ramping up ad spend well in advance of the event to help build product awareness and consideration both on and off Amazon, with steady growth in daily ad spend starting in early June. DSP spend peaked during Prime Day, with advertisers spending more than twice what they had on the first day of June for each of the two days of the event.

Looking at the results driven with increased ad dollars during Prime Day 2023, sales attributed to Sponsored Products increased 39% compared to last year’s event. As such, sales per click growth did lag cost per click growth, in contrast to the last several quarters and last year’s event, when sales per click and cost per click grew roughly in line with one another.

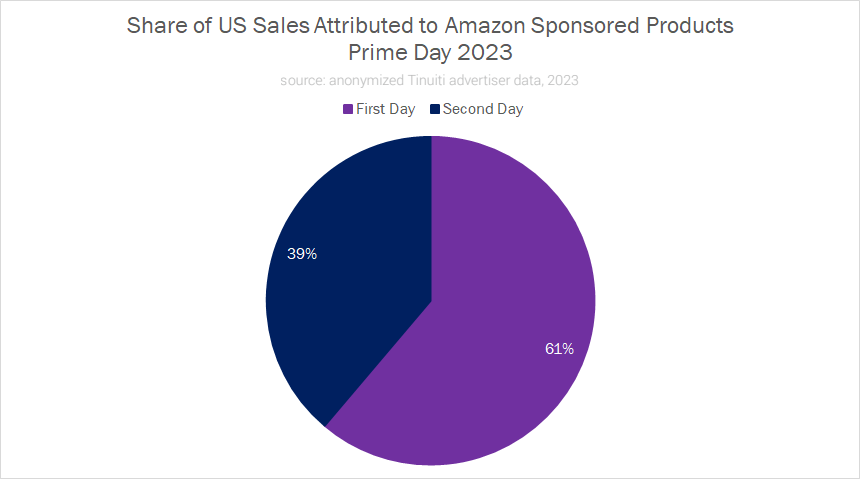

Zooming in on how these sales broke down by day, 61% of all sales attributed to Sponsored Products occurred on the first day of Prime Day, with the remaining 39% of sales coming in the second 24-hour stretch.

This is a meaningful increase in the share of sales that occurred on the first day compared to last year, when 54% of all Prime Day Sponsored Products sales happened in the first 24 hours.

But what kinds of customers did the event truly attract? As in years past, many were new to the brands they purchased from.

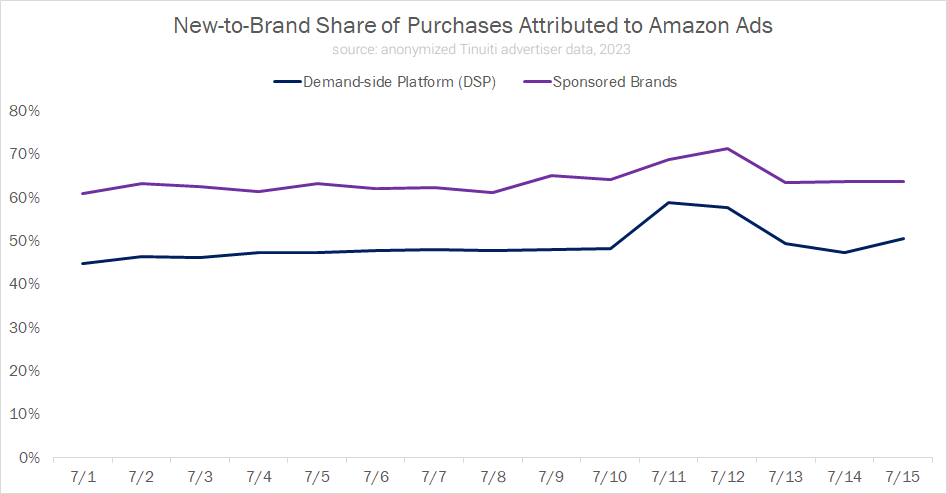

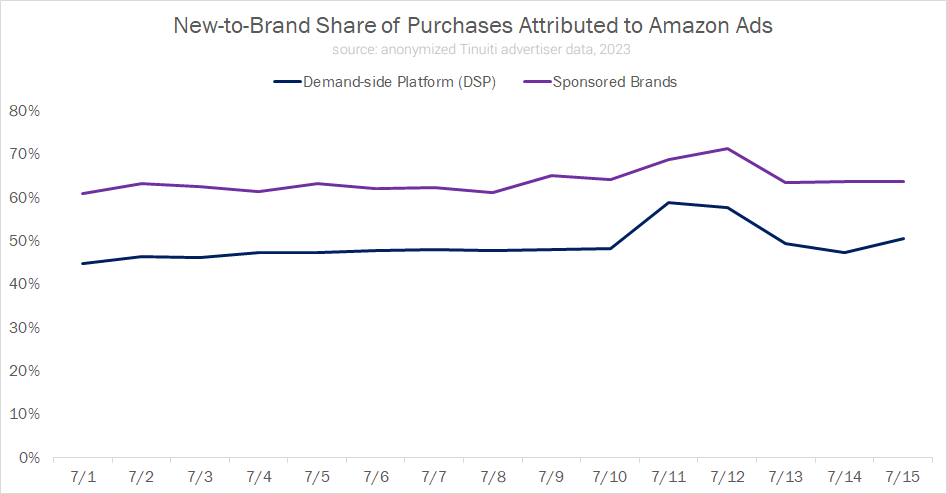

Looking at the share of purchases attributed to new-to-brand customers for both the Amazon DSP and Sponsored Brands, advertisers saw a meaningful jump during both days of Prime Day compared to before and after the event. New-to-brand customers are defined by Amazon as those shoppers who have not purchased from a brand in the last twelve months.

During Prime Day, 58% of all DSP purchases were tied to new-to-brand customers, compared to a daily average of just 47% for the ten days leading up to the event. For Sponsored Brands, new-to-brand customer share rose from a daily average of 63% in the ten days prior to Prime Day to 70% during the event.

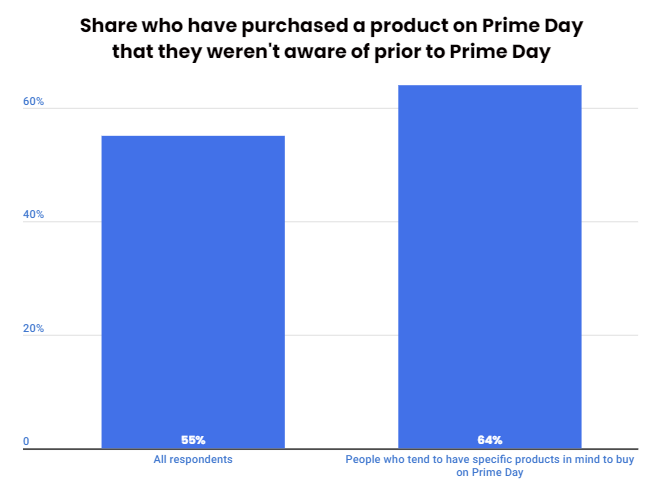

The jump in customers ordering from new brands makes sense given that part of Amazon’s goal with the event is to drive up Prime member subscriptions, such that new shoppers are joining the program in order to snag deals. But even among existing Prime members, there’s clearly a willingness to buy products they might not have encountered prior to Prime Day.

Tinuiti surveyed over 1,000 loyal Prime members in April to get a sense for their Prime Day plans, with results published in the comprehensive 2023 Prime Day Study. When asked if they had purchased a product on Prime Day that they weren’t aware of prior to Prime Day, more than half said that they had.

Thus, Prime Day not only produces a surge in total sales, but also typically allows vendors and sellers to reach more new customers than usual.

Amazon wasn’t the only one throwing a big sales event last week, as competitors like Walmart sought to cash in as well.

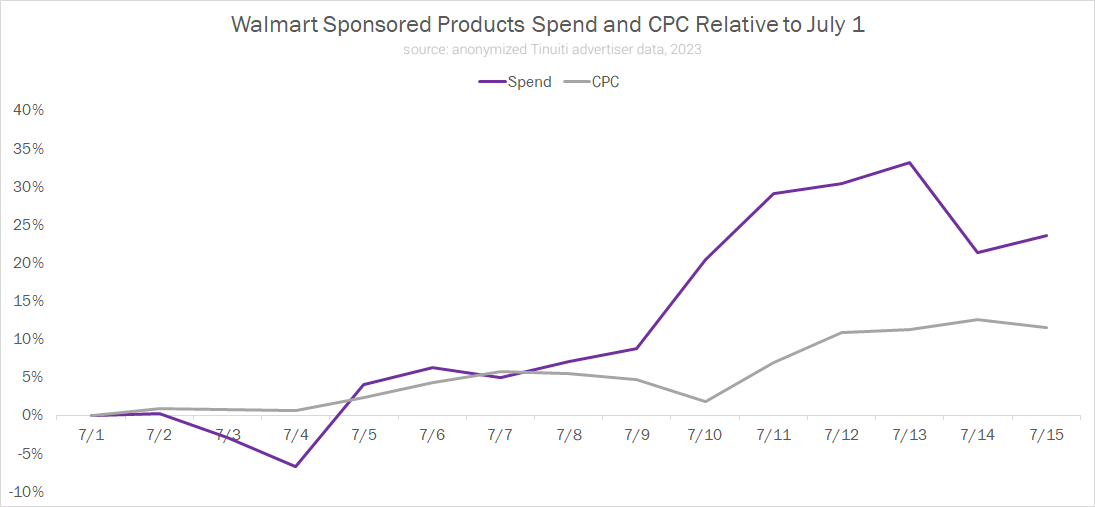

Walmart kicked off its own membership-focused event on July 10, with Walmart Plus members getting early access to deals that went live to all shoppers on July 11 and lasted through July 13.

Walmart Sponsored Products spend ramped up on July 10 and remained elevated all the way through the end of the event and for a couple of days after. Daily spend was 26% higher from July 10 through July 15 on average than at the start of the month.

CPC also rose as advertisers competed for customers, and Walmart’s June 2022 move to a second-price auction makes it so that these auctions behave more similarly to Amazon around key events than when Walmart used a first-price auction.

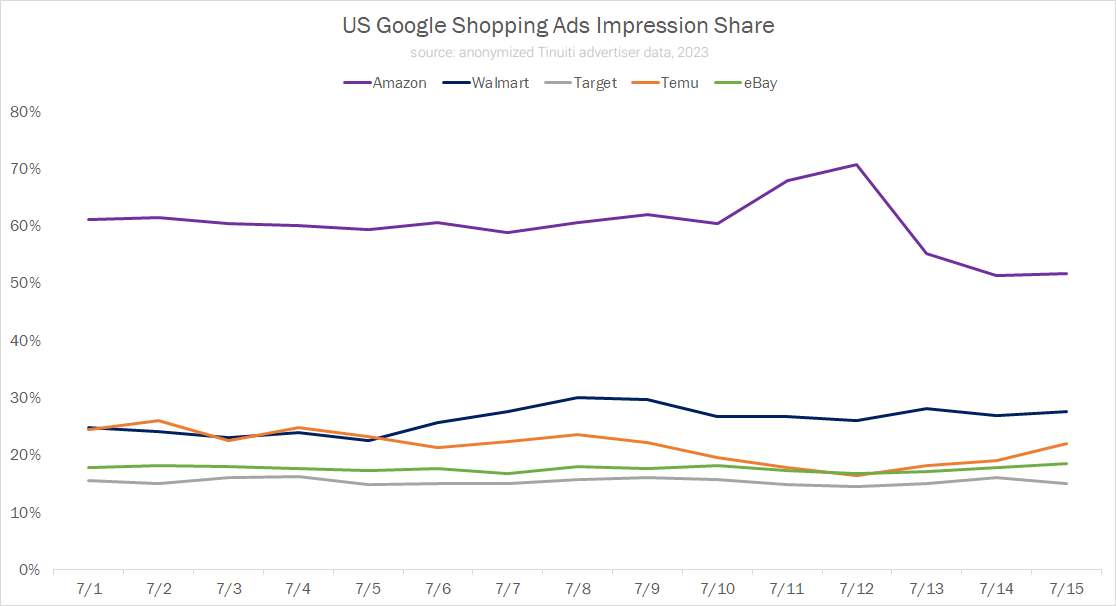

Both Walmart and Amazon turned to Google Shopping in order to bolster their events.

Over the last couple of years, Amazon has gotten more aggressive in Google ad auctions during Prime Day, ostensibly to lure even more customers to its website. 2023 was no different, with its impression share in Google Shopping auctions averaging 69% over the two-day event, compared to a daily average of 60% for the first ten days of the month.

Amazon quickly stomped on the brakes after Prime Day, with impression share averaging just 53% from July 13 to July 15.

Walmart also got a bit more aggressive during its event, averaging a 28% impression share in the second week of the month compared to 25% in the first week. Target, which ran Circle Week from July 9 through July 15 for members of Target Circle, held relatively steady throughout the first half of July.

Looking at who lost out in Google Shopping auctions as Amazon surged, one answer is Temu. A relatively new major player in Google Shopping auctions, Temu rose to become a competitor against more retailers than Walmart by the end of Q2 2023. During Prime Day, however, its impression share dipped to just a 17% daily average, compared to 23% over the first ten days of the month.

For even more detail on what helped advertisers make Prime Day 2023 the best yet, head over to Amazon Prime Day 2023: Results, Insights & Tips for Sellers.