The Best Way to Prevent Chargeback Fraud

The rise of ecommerce has made it easy for shoppers everywhere to get what they want when they want it. Unfortunately, it’s also made it easier for online shoppers to commit fraud.

Because ecommerce has evolved so quickly, regulations that both protect shoppers and preventing fraud have had a hard time keeping up, leading to new forms of fraud. One of the most damaging to retailers? Chargeback fraud.

Chargeback fraud, also called “friendly fraud,” refers to a customer making an online purchase with their credit card, then requesting a chargeback from the issuing bank after receiving their purchase.

When the cardholder disputes the charge to their credit card, the bank forces a refund while the customer keeps their purchase.

Here are the most common claims fraudsters make in order to file a credit card chargeback:

In addition to the loss of the physical goods, friendly fraud negatively affects businesses through chargeback fees, lost shipping and transaction processing costs, and the time and money it takes to dispute chargebacks.

Luckily, there are steps that ecommerce merchants can take to prevent chargeback fraud.

Here are some of the top ways that ecommerce retailers can prevent chargeback fraud:

Online purchases are categorized as card-not-present (CNP) transactions. These have different best practices from in-person transactions because more needs to be done to confirm that the customer is an authorized cardholder.

First, make sure that you use a secure ecommerce platform and a reputable payment processor. A good payment processor should automatically have seller protection and fraud detection features in place, such as address verification services (AVS).

AVS matches a customer’s billing address with the one on record with the credit card company. In addition, require that cardholders enter their CVV, the 3- or 4-digit number on the back of their cards.

We also recommend keeping as much documentation on hand as possible, including copies of sales orders or receipts, charge documentation showing AVS results, proof of delivery for online sales, and a copy of your return policy. Having these documents on hand will be helpful during the dispute process.

Your payment processor should also offer fraud detection and monitoring services that go beyond the basics above. These include:

Examples of payment processors that offer seller protection features include Square and PayPal.

To learn more about the top payment processors available to ecommerce retailers, check out An In-Depth Review of the 10 Best Online Payment Solutions.

Your payment descriptor is how your business name appears on your customers’ credit card statements. If you signed up for your merchant account or payment processor using a parent company’s name, or have changed your business name since then, there’s a chance that your descriptor is different from your store name.

If that’s the case, customers may not recognize the charge, leading to a chargeback.

If you don’t know what your payment descriptor is, you can reach out to your merchant account service or payment processor and they should be able to let you know.

While it may be tempting to fight every chargeback or dispute that comes your way, that can actually harm your business in the long run. If the chargeback amount is minimal, it may be best to just refund the customer.

Payment processors track how many chargebacks are filed against your business and can penalize your account if you seem too high-risk. Penalties can include higher processing rates, held funds, added fees, or even having your account suspended.

When compared to the loss from a low-value chargeback, this can be much more trouble than it’s worth.

Monica Eaton-Cardone, COO and co-founder of Chargebacks911, got on the phone with us to discuss the state of credit card chargeback fraud, why it’s a growing problem, and how ecommerce merchants can avoid these issues in the first place.

Interestingly, there’s a gender divide when it comes to chargebacks.

According to Chargebacks911, women are mainly responsible for 76% of all chargebacks, including fraudulent cases.

Eaton-Cardone believes this is because traditionally, women have controlled the purse strings in families, and this extends to ecommerce today.

“So if we take a look at the primary buyer online, the decision makers are typically women,” says Eaton-Cardone. “One of my favorite quotes is a quote from Jack Ball of Alibaba–someone had asked him what’s causing the internet to grow so rapidly, and he said the secret is women.”

Online shopping taps into three key values for busy women (and anyone, for that matter): efficiency, cost-effectiveness, and time.

“The world is very different than it was 10 years ago,” continues Eaton-Cardone. “Women can also multitask more efficiently by buying more things online, find that things cost less, and more importantly, save time–especially for mothers.”

Women also have a tendency to pay more attention to the details.

“Many of us will call and complain if we get overcharged 30 cents. It’s been proven this attention to detail is definitely a part of our makeup as women. The same issue is carried out throughout the world–China has the same statistics as the U.S., so it’s not limited to culture.”

Eaton-Cardone points to a couple reasons why credit card chargeback fraud is growing online: consumer entitlement and higher standards for customer service.

But which came first? Were customers demanding fast and free shipping before Prime, or did Prime set a precedent?

“We’re not sure if technology is evolving consumer behavior or vice versa,” says Eaton-Cardone. “Regardless, the two of these working together have created new evolving habits and demands.”

Beyond just shipping, customers now complain more about things like packaging and return policies. The bar is getting higher for all ecommerce sites.

“We’ve created these amazing customer service policies with the goal to provide good service and create customer loyalty. However, it’s now created new standards–we have consumers that now believe if they didn’t get their product overnight, or can’t return it within a year if they’re dissatisfied, then they can simply call their bank and file a chargeback.”

There’s also the fact that technology makes credit card chargeback fraud so much easier to commit.

“It’s a digital transaction, not a human process–so none of us feel any guilt when we’re working with a bank to get a refund, not necessarily a seller,” says Eaton-Cardone. “You’d may feel OK pretending you never received those shoes and requesting a refund, while you wouldn’t consider going into a store and stealing a pair of shoes off the shelf.”

Traditionally, chargebacks have been a line item for doing business. In the past, not many customers would take advantage of it. However, as ecommerce exploded in the past 10 years, things changed.

“As the industry has grown, not enough merchants have defended themselves, and we’ve seen the chargeback numbers increase,” says Eaton-Cardone. “There’s nothing yet to counter the policies in place.”

In other words, most sellers don’t fight chargeback fraud.

Instead, they’re focusing on are how they can prevent chargebacks in the first place– particularly in apparel, where the rate of return is already so high.

This is part of the reason why clothing rental companies such as Rent The Runway and Le Tote have been so successful.

“The rental clothing industry is so brilliant because that’s what people were doing before–only there was no industry,” says Eaton-Cardone.

Aside from try-before-you-by programs, sellers spend a lot of time looking at what is the best defense they have against chargebacks–their return policy. Eaton-Cardone points to one big merchant who has really tightened up return policy standards in the past few years: Amazon.

“Amazon started out just like Zappos–totally on the defense, just considering whatever the customer says is right,” says Eaton-Cardone. “But Amazon has grown so rapidly and has taken up so much market share, they’ve decided they need to impose policies.”

“Now, on Amazon, they have very strict 30-day return policies, which used to not be the case. On top of it, they have strict requirements–and will proactively dispute and will even win back funds on credit card chargeback fraud cases.”

Now that you have all the details, it’s time to talk about how you can combat credit card chargeback fraud.

One of the ways you can do that is by proactively planning for chargebacks. It doesn’t mean as an apparel retailer that you should start a clothing rental line like Le Tote’s, but it could mean you need to get more creative.

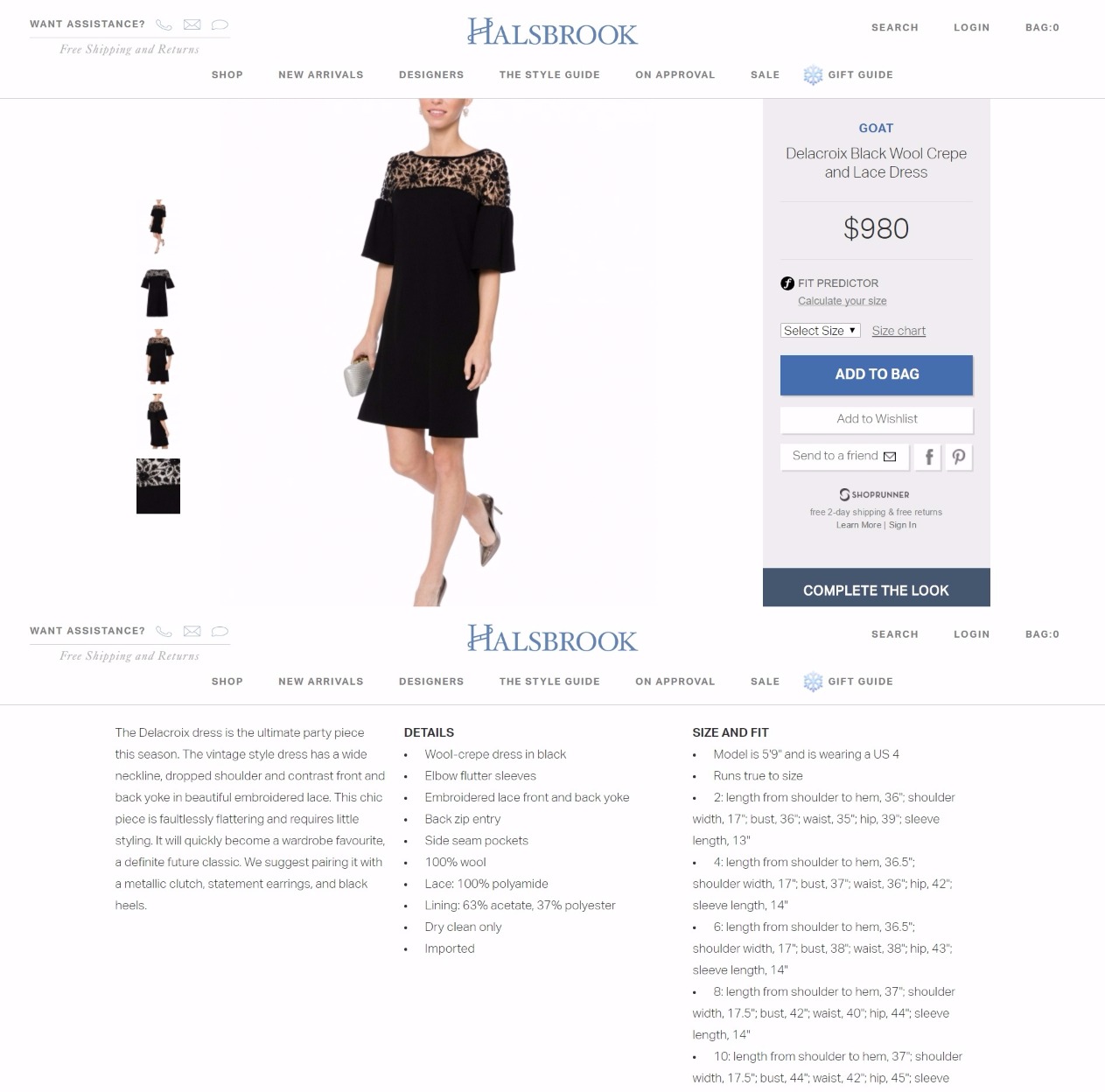

“If a company caters to a female-dominant demographic, they should proactively plan for more chargebacks,” advised Ms. Eaton-Cardone. “This means using ultra-precise language when describing products, posting up-to-date images from various angles, investing in high-end customer service, and creating a clear and transparent refund policy.”

High-end women’s apparel company Halsbrook does a great job of providing the right information up front (along with easy access to contact information in the top left corner):

If you do you choose to fight credit card chargeback fraud, you probably shouldn’t attempt to do that on your own.

There are several companies or lawyers you can work with to resolve disputes directly with the cardholder or the issuing bank in order to get your money back on illegitimately filed chargebacks. This requires is that you outline your terms and conditions and provide proof the customer violated the policy.

“For example, a seller may have a dispute complaint from a seller who contacted Capital 1 about shoes they didn’t receive. A credit card chargeback specialist can help the seller prove there was a delivery made, and show proof that the buyer know they did receive these shoes with a signed delivery receipt,” says Eaton-Cardone.

At the end of the day, not all customers start out as chargeback fraud artists, reminds Eaton-Cardone.

“Most customers who file chargebacks start out totally innocent, but once they realize how easy it is, they do it again and again.”

However, as more ecommerce companies acknowledge this is a problem and proactively tighten policies, it will help all ecommerce sites lower the number of fraudulently filed chargebacks.

For more information, email [email protected]