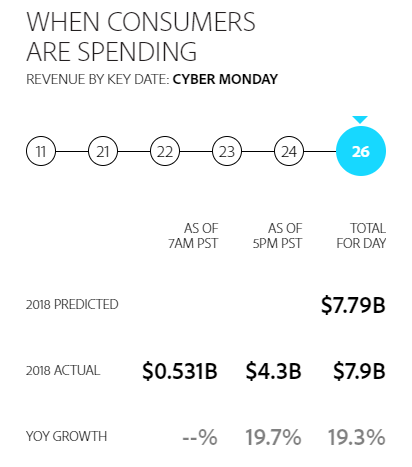

This year’s Black Friday and Cyber Monday holidays were the biggest ever for ecommerce, with retailers pulling a record $6.22 billion on Black Friday and then smashing that record again with $7.9 billion on Cyber Monday — a YoY increase of 23.6% and 19%.

Consumers shopped on their phones more than ever, with over 50% of Cyber Monday sales coming from mobile devices — a clear indication that investing in mobile-friendly shopping (mCommerce) experiences are paying off big for digital brands.

Here’s a look at how retailers performed during Cyber Week, trends that impacted performance marketing on Google & Facebook, and channel-specific data for Shopping, Search, and Display.

Jump To A Section

1. Thanksgiving Weekend 2018 Crushes Expectations

2. A Look At The Google Ads Data

3. Cyber Week Trends & Client Success Stories

4. A Deeper Look At Shopping, Search, & Display Data

5. Tips For Finishing Strong In Q4

Thanksgiving Weekend 2018 Biggest Ever On Record For Ecommerce

Each day of the “cyber five,” the five days between Thanksgiving and Cyber Monday — brought in record revenue numbers this year.

- Thanksgiving Day — which this year saw retailers offering discounts just as deep as those on Black Friday, saw the highest growth rate at nearly 30%.

- Black Friday itself brought in a record $6.22 billion in revenue — a 23.6% jump from 2018.

- Cyber Monday, a shopping holiday born out of the ecommerce craze, actually surpassed Black Friday to net a record-breaking $7.9 billion as consumers seized deals for everything from pet supplies to televisions and apparel.

As customers shopped online more than ever, brick-and-mortar foot traffic actually declined on both Black Friday and Cyber Monday.

Competition for holiday shopper spend also hit fever pitch this November, with major retailers Amazon, Walmart, and Target all offering free holiday shipping for all customers this year.

It’s the latest indication that free and fast shipping is no longer just an option for retailers — it’s become an expectation from holiday shoppers.

Cyber Monday Mobile Sales Top $2 Billion, In-store Pickup Orders Skyrocket By 65%

Not only did consumers spend more than ever this Thanksgiving weekend, but they also spent more time browsing and purchasing products directly from their mobile phones.

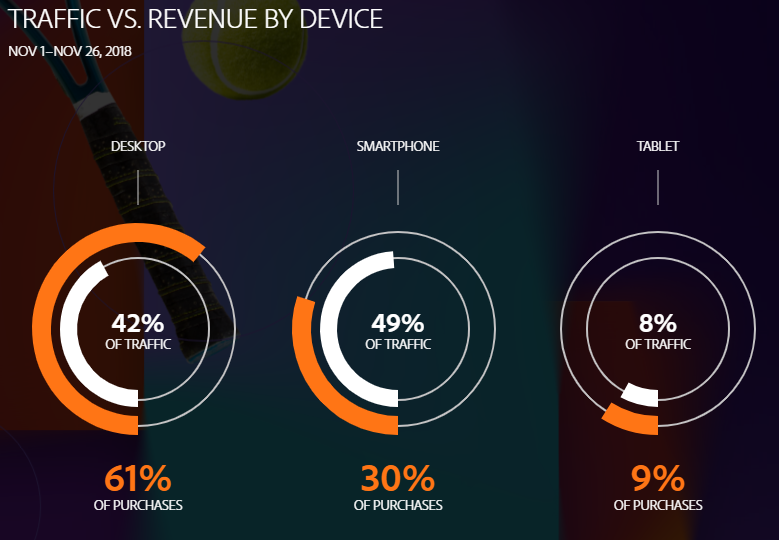

Smartphones were responsible for 49% of all retail traffic for most of November, and consumers used their mobile devices to spend a record $2.2 billion on Cyber Monday alone.

Holiday shoppers also displayed a growing preference to skip waiting in lines by purchasing online and picking up in-store this year, with “click-and-collect” orders skyrocketing by 65% compared to last year.

A Closer Look At Google Ads Black Friday / Cyber Monday Data

We know that many digital retailers won big this year, especially those with Black Friday & Cyber Monday deals on the Amazon Marketplace.

But how did advertisers on Google fare?

Here’s a deeper look into the numbers for our clients across Google Shopping, Search, and Display.

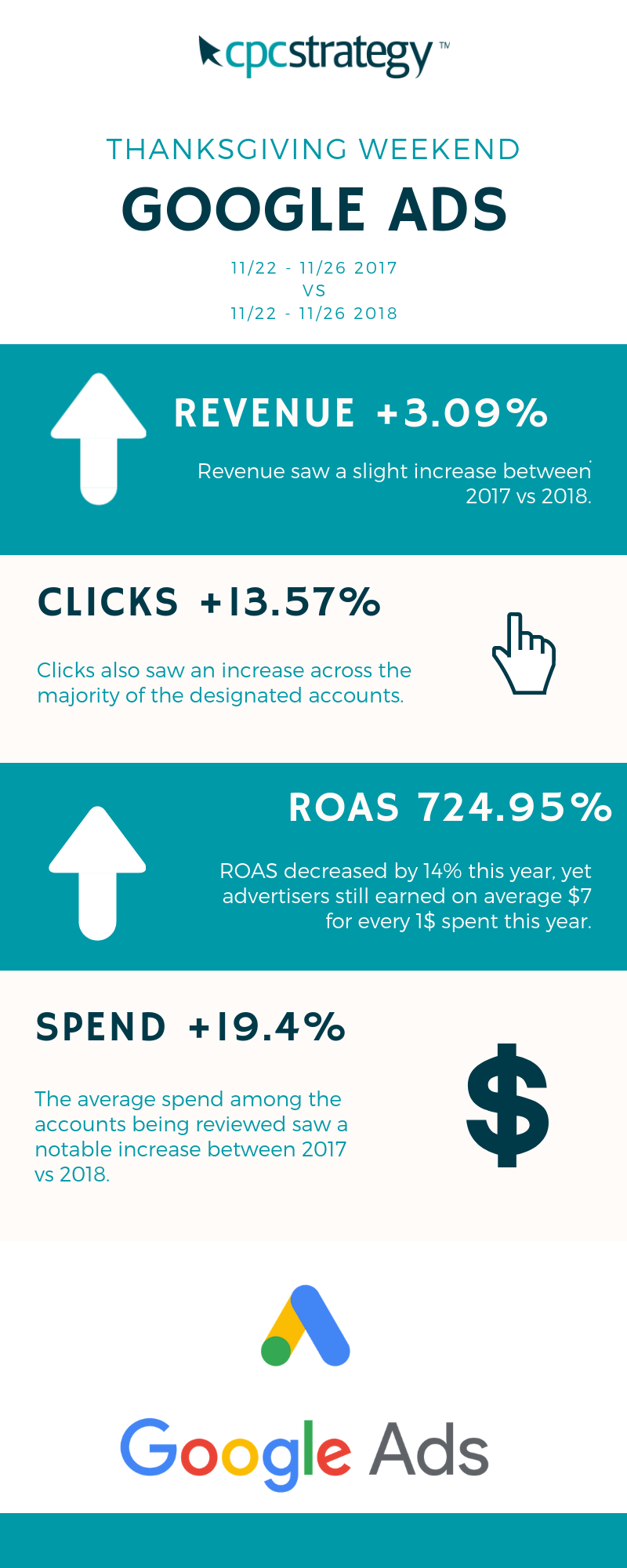

Based on CPC Strategy Google Ads account-wide data (11/22 – 11/26 daily average compared to 2017 Black Friday):

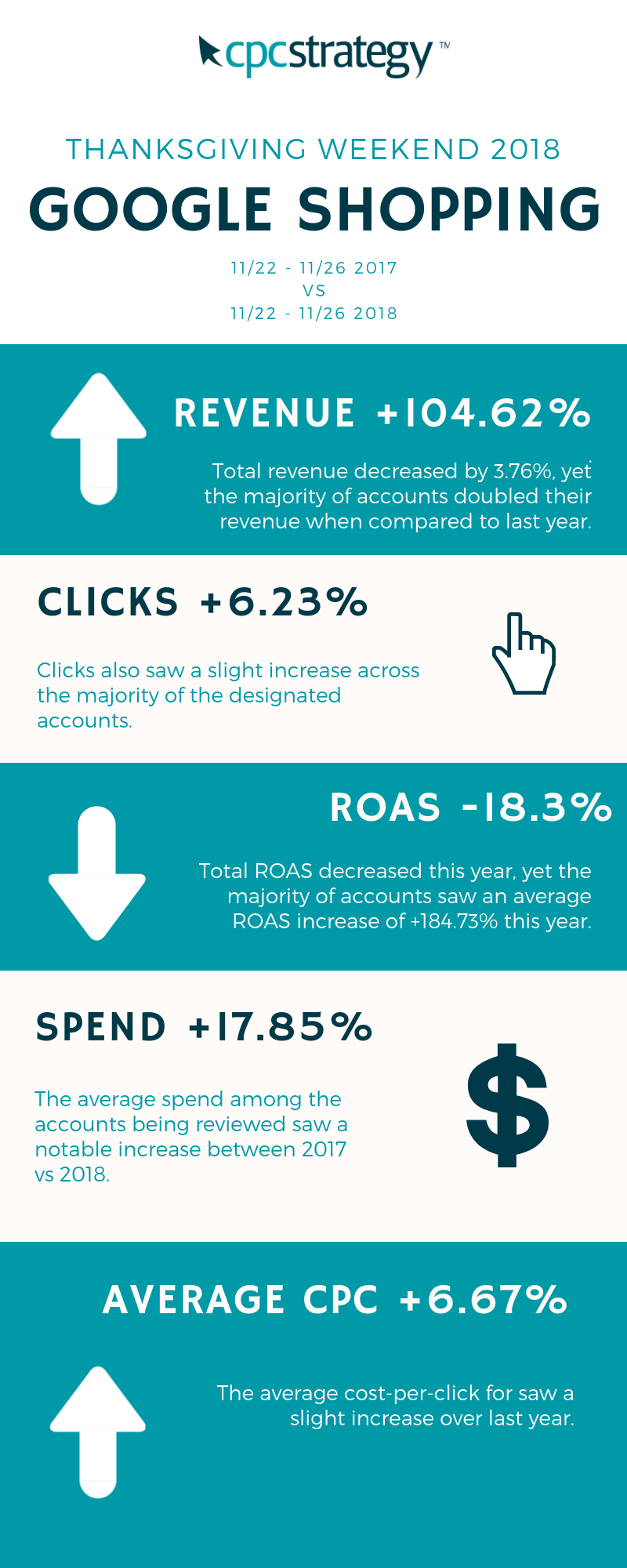

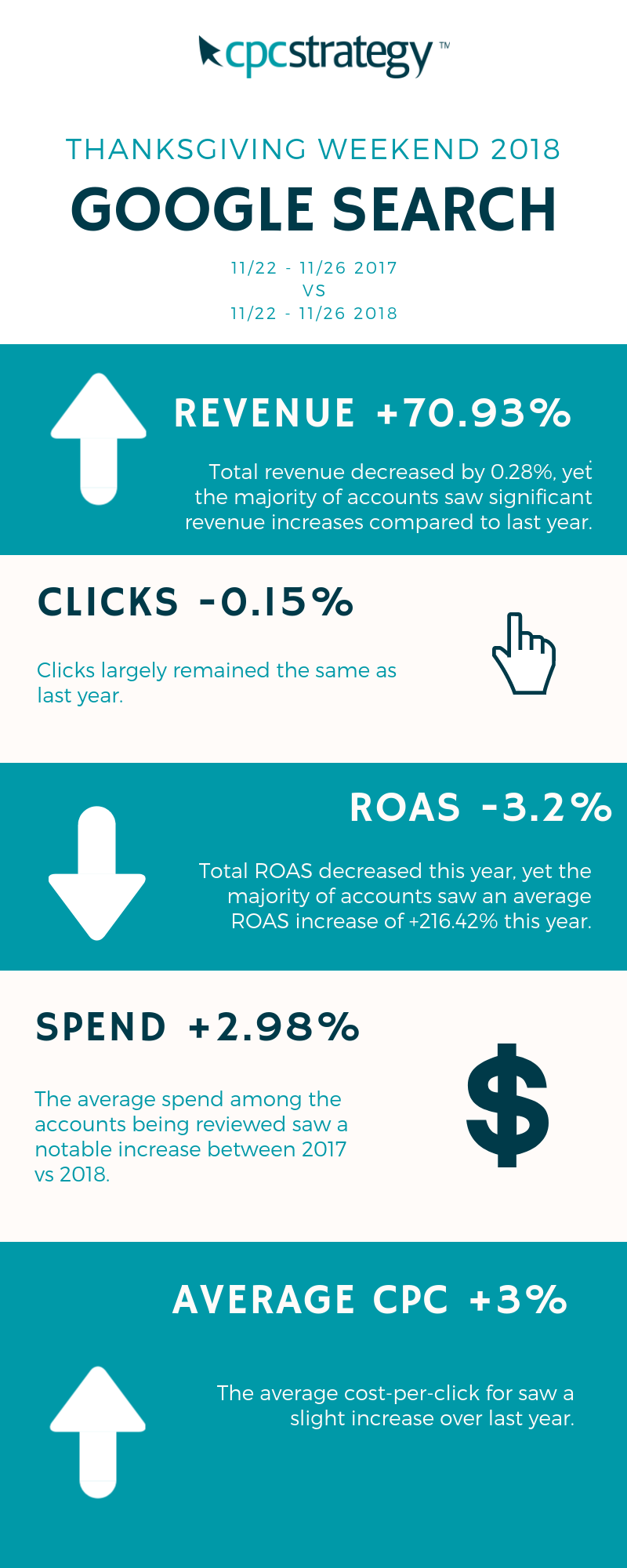

- Total revenue increased by 3%, with average account revenue up by 49.2% over last year.

- Advertisers saw an average ROAS of 724.95%, yet total ROAS decreased by -14%.

- Advertisers invested more than ever in Google Ads this year, with average spend across all accounts up by +19.4%.

- Average CPC for Google Shopping increased by 6.67%, Google Search by 3%.

- Clicks saw a slight increase all accounts by +13.57%.

We also gathered Google channel-specific data from CPC Strategy clients (Shopping, Search, and Display) between 2017 and 2018. You can view those here.

Black Friday/Cyber Monday Success Stories & Trends

We spoke with our Google and Social teams at CPC Strategy to get their take on how the holiday weekend panned out.

Here’s what we found:

1. Traffic Spikes, Conversions Dip Leading Up To Holidays

Every year conversions take a dip just before the holidays.

The first reaction of many advertisers is to panic: impressions are up, yet conversions are way down — which makes keeping ROAS in line much more difficult.

The good news is that this is normal for pre-holiday traffic: consumers are browsing and researching what to buy later.

“Search demand will stay steady or increase; meanwhile conversion rates decline because consumers are anticipating deals, so there is no incentive to buy yet.”

-Caroline Rice, Retail Search Manage at CPC Strategy

Rather than panicking, advertisers should be making use of cookies and tracking to retarget these website visitors later on — a solid opportunity to turn browsers into buyers.

“For most categories, early-mid November is the time to build demand and grow your email and remarketing lists, once BF/CM hit they should already be at consideration and your BF/CM strategy will carry them through to purchase,” says Rice.

“If you’re waiting until Thanksgiving to build awareness, you’ll have a very short window to get people’s attention and will pay a premium to compete for top-of-funnel searches.”

2. Engaging Top-funnel Shoppers With Segmented Dynamic Search Ad Campaigns

Investing in generic, non-branded key terms is crucial for reaching top funnel shoppers during the holidays.

However, it’s easy to burn through daily spend on competitive generic keywords, which is why advertiser that can do so efficiently stand to gain the most.

This is where audience targeting and a tiered bidding strategy with Google’s Dynamic Search Ads came into play this holiday season.

“Since our allocation for non-brand/generic keywords was limited, this was a good way to spend the budget evenly throughout the day and ensure that the shoppers who saw our ads were familiar with the brand.”

-Lewis Brannon, Senior Retail Search Manager at CPC Strategy

The strategy:

Some of our accounts saw big success over the holidays by running Dynamic Search Ads that targeted audiences that had a prior engagement with a brand’s domain (website visitors, past purchasers, cart abandoners).

With targeting layered in, account managers leveraged a tiered bidding structure that prioritized the highest bids for audiences that were the most engaged — and thus the most likely to convert.

“I also added in brand terms as negatives at the campaign level to ensure that the only traffic we bought through this campaign was non-brand/generic.

The results:

Accounts that leveraged this strategy were able to earn impression share in high-traffic, generic keyword auction without burning through limited daily budgets too quickly.

This then gave advertisers an opportunity to turn a solid ROAS on traffic generated from Dynamic Search Ad campaigns.

“This tactic worked well for driving engaged shoppers to a website to convert. I’d recommend it for advertisers who want to invest in generic / non-brand terms but need to be highly efficient with the spend,” says Brannon.

3. Big Wins For Advertisers That Leveraged Google and Facebook Together

Many advertisers that leveraged both Facebook’s demand generation capabilities in tandem with Google Search ads to capture demand when users researched branded keywords found big success this year.

It’s one of the key reasons why Facebook and Google advertising campaigns work so well together — and this Thanksgiving holiday weekend was no exception.

Richer Poorer Doubles November Revenue YoY Using Facebook Video Prospecting & Google Search Campaigns

Apparel brand Richer Poorer more than doubled their Black Friday & Cyber Monday revenue this year by investing in top funnel awareness campaigns on Facebook and Google Search ads to drive that demand to their ecommerce website.

“During October and the first part of November, we focused on generating top of funnel awareness on Facebook. Leveraging a mix of user-generated content and video, we focused the bulk of our spend on introducing Richer Poorer to new audiences, while capturing data and building up our first party audiences.”

-Brent Villiot, Social Marketing Manager at CPC Strategy

“The two weeks leading up to BF/CM we shifted away from conversion focused campaigns (Purchase, Add To Cart) and allocated our budget towards a Brand Awareness campaign,” says Villiot.

“Leveraging the brand awareness objective meant that we were able to get in front of more people at a lower cost while building robust retargeting audiences.”

With a solid brand awareness campaign pulling new audience data, Richer Poorer positioned themselves to capitalize with a solid retargeting strategy on Black Friday & Cyber Monday.

“With strong upper funnel demand being generated via Facebook, we then leveraged targeted Google Search Campaigns that captured demand from those same audiences that would later research the brand on Google.”

-Rob Shepard, Retail Search Manager at CPC Strategy

“By the time we launched our final BF/CM promotions, we had a strong re-targeting strategy in place that included Google Search Ads to capture demand created in October and November.”

- Revenue up by 372%

- ROAS was up 450%

- Orders increased by 380%

Marcy Pro Sees 109% Revenue YoY Through Facebook Prospecting and Google Ads Promotions

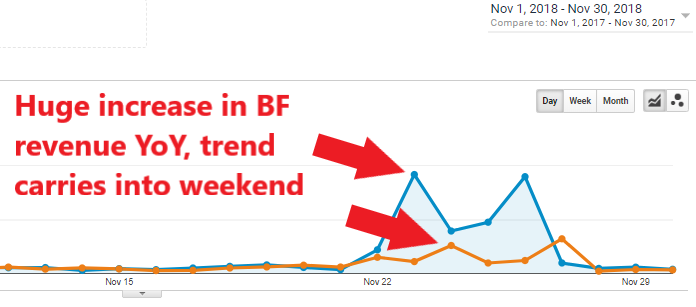

Marcy Pro, a home gym equipment brand, also saw enormous success this year, exceeding last year’s November revenue during Thanksgiving weekend alone.

This huge increase in revenue was due to a revamp of the brand investing in upper funnel awareness campaigns on Google, DPA campaigns on Facebook, and various ad promotions.

“We leveraged Facebook Dynamic Product Ads to make sure we were hitting all touch points of the purchase cycle, especially considering the higher order values associated with this brand,” says Mike Nefalar, Retail Search Manager at CPC Strategy.

“We also ran promos through Google Merchant Center and used promo extensions and specialized copy.”

With demand for Marcy Pro’s products being generated on Facebook, the brand was then able to capture that demand by using Google and Facebook to send that traffic to their website.

“We broadened our reach within Facebook and then captured that traffic using Google and remarketing initiatives on both Google and Facebook.”

-Michael Nefalar, Retail Search Manager at CPC Strategy

“CPC Strategy has done an outstanding advertising job during this year’s Black Friday weekend, leaving us with a YoY increase of 109% in transactions and 88% increase in revenue with Google Ads. Since partnering with CPC Strategy, we’ve seen an overall +200% increase in transactions and +150% increase in revenue.”

-Shawn Aperocho, Social Media Marketing Manager at Impex Fit / Marcy Pro

Specialty Bowties Maker Triples November Revenue With Facebook Prospecting, Giveaway Promotions, and Search Campaigns

A specialty bowties brand (which will remain anonymous for confidentiality reasons) recorded their highest grossing revenue day yet this Cyber Monday by leveraging a mix of Facebook prospecting campaigns, giveaways, and Google & Bing Search campaigns.

“We built a large pool of unique site visitors via Facebook prospecting campaigns and then ran remarketing campaigns aggressively leading up to Cyber Monday. This, along with new holiday-themed ads across Google & Bing helped to convert a larger percentage of users this year.”

-Stephen Messana, Retail Search Manager at CPC Strategy

“We focused on prospecting campaigns, mainly on Facebook targeting and Lookalike audiences for site visitors,” says Messana.

“We also added a certain luxury watchmaker as an interest because we found through previous testing that this upper funnel audience has converted well for this brand.”

This bowtie brand’s prospecting campaigns also included re-purposed content — images of celebrities wearing their ties — that worked well with ad copy in addition to reviews from popular men’s style magazines.

With a large amount of data from unique site visitors, Messana then re-engaged these visitors during the holidays using Google RLSAs with large bid modifiers for these audiences.

“We also implemented a new promotion giveaway exclusively for Cyber Monday. It included a timed giveaway that was promoted on Facebook to our new audiences and past visitors,” explains Messana.

“This offer worked incredibly well, as visitors clicked to the website to learn how to receive their free gift, and ended up making purchases along the way.”

- November as a whole:

- 208% revenue and order volume increase YoY

- ROAS up from 10x to 20x

- Cyber Monday:

- 158% revenue increase YoY

- 171% order volume increase YoY

- ROAS up from 29x to 45x

Beauty Wellness Brand Sees 134% YoY Black Friday Revenue With Facebook Video & Traffic Campaigns

One beauty and wellness client more than doubled their revenue and orders this year by leveraging Facebook video to prospect and build engagement audiences, and then re-targeting these audiences to send them off-site to their ecommerce store.

“In the last couple of months leading up to Cyber Week we focused on building brand awareness for this brand,” says Casey Edwards,

“We had been running lots of video to build up engagement audiences at the top of the funnel and then re-target them with a campaign to send them to the ‘Featured Deals’ page of the store.”

-Casey Edwards, Senior Social Marketing Manager at CPC Strategy

Edwards notes that last year’s limited budget had resulted in the brand leaving money on the table.

This year, with a larger budget, Edwards was able to greatly increase orders and revenue by reaching more audiences through Dynamic Product Ads.

“CPMs had been high for this account, so we switched to optimize for ATC (add-to-cart) on Black Friday and Cyber Monday and saw a huge increase in traffic,” says Edwards.

“We also made sure to update budgets daily, and also leveraged a Gmail re-targeting ad campaign with a promotion.”

Site-wide results:

- +111% orders YoY

- +134% revenue YoY

- +33% conversion rate

Black Friday was also their biggest revenue day ever which quickly got beat by Cyber Monday.

Footwear and Apparel Brand Smashes Records With Branded Shopping and Search Campaigns

This European footwear and apparel brand had set a modest goal of +50% revenue YoY for Cyber Week — but ended up far exceeding their original goal by aggressively targeting lower funnel audiences that were closer to conversion.

Here are their results from Search and Shopping compared to Cyber Week 2017:

- +82% Search revenue YoY

- +322% Search ROAS

- +682% Branded Shopping ROAS

- +1176% Non-branded Shopping ROAS

- Mobile revenue up by over +100% YoY

This brand earned most of their revenue gains from branded Search campaigns, with a majority of valuable traffic coming from two high volume keywords.

These advertisers also saw incredible success on the Shopping side, making huge gains over the prior year for both branded and non-branded Shopping campaigns.

“Our key wins here were navigating a competitive space to earn impression share on high volume keywords, and leveraging holiday creative & copy to drive high engagement and beat out the competition on Search and Shopping.”

-Kyle Wiebalk, Senior Retail Search Manager at CPC Strategy

“Our channels were so efficient that we actually had spend left over — a testament to how cost-effective branded campaigns on Search and Shopping can be with the right creative, copy, and lower funnel targeting.”

4. Pushing Promos On Wednesday Before Thanksgiving

This year, brands that were able to meet shoppers early before Thanksgiving with discounts and promotions overall saw better performance than those that waited until Thursday.

Many of our account managers found that starting promotions on Wednesday rather than Thursday (Thanksgiving day) had better performance throughout the entire Cyber Week.

“I’d say that one of my biggest takeaways from Cyber Week overall is that my clients who started promotions on Wednesday rather than Thursday saw much better performance,” says Edwards.

“It was exciting to see strong results from our traffic campaigns early on from Facebook. We had super efficient CPCs and were able to drive traffic to Amazon and other ecommerce websites.”

5. Strong ROAS Efficiency With Facebook Messenger Ads

A functional fitness brand leveraged Facebook Messenger Ads during Cyber Week and saw an incredible ROAS of $30+.

The high ROAS Messenger campaign targeted users who had engaged with the brand over Messenger in the past.

“I tested out this Sponsored Message campaign for both Black Friday and Cyber Monday by sending notifications to customers who had existing conversations with the business. The Messenger ads were incredibly efficient from a ROAS perspective.”

Thanksgiving Weekend 2018 Channel-specific Data

Google Shopping Performance Data Thanksgiving Weekend 2018

Google Search Performance Data Thanksgiving Weekend 2018

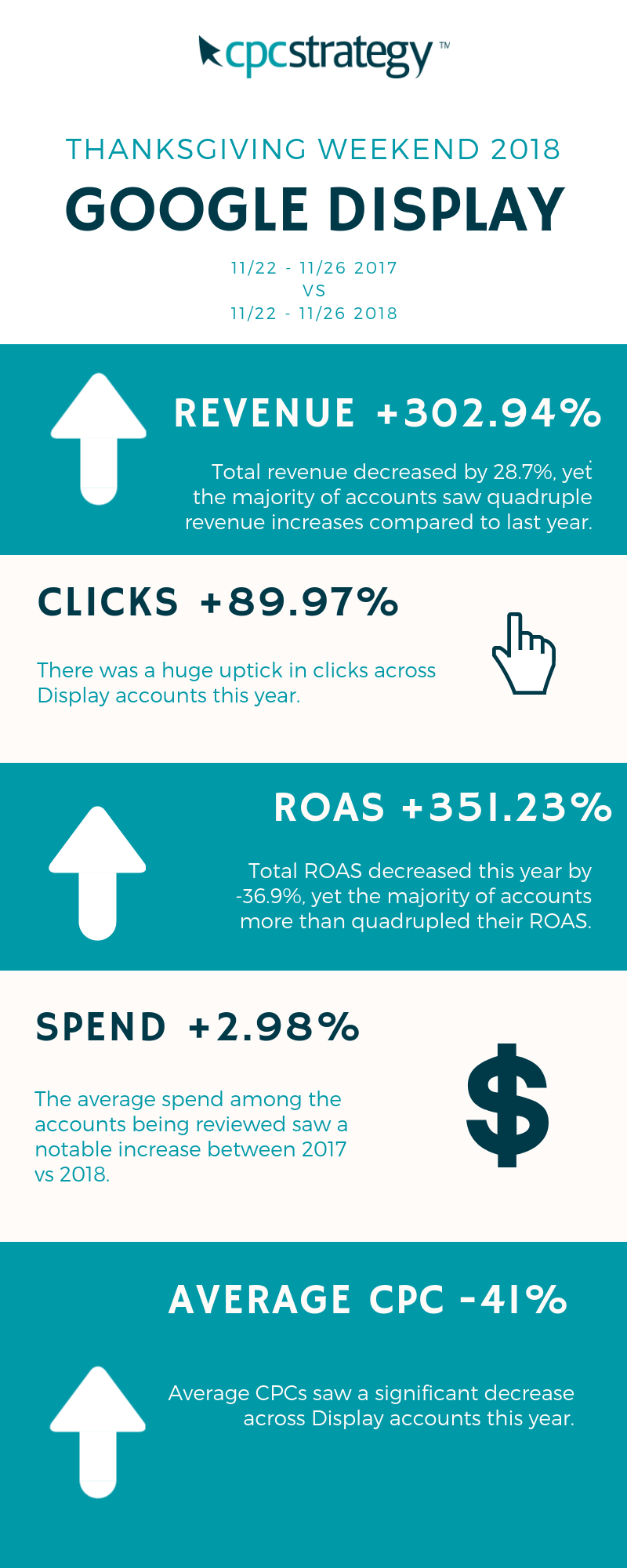

Google Display Performance Data Thanksgiving Weekend 2018

*CPC Strategy introduced many newer, less-mature accounts to Display this year, which brought down average CPCs significantly.

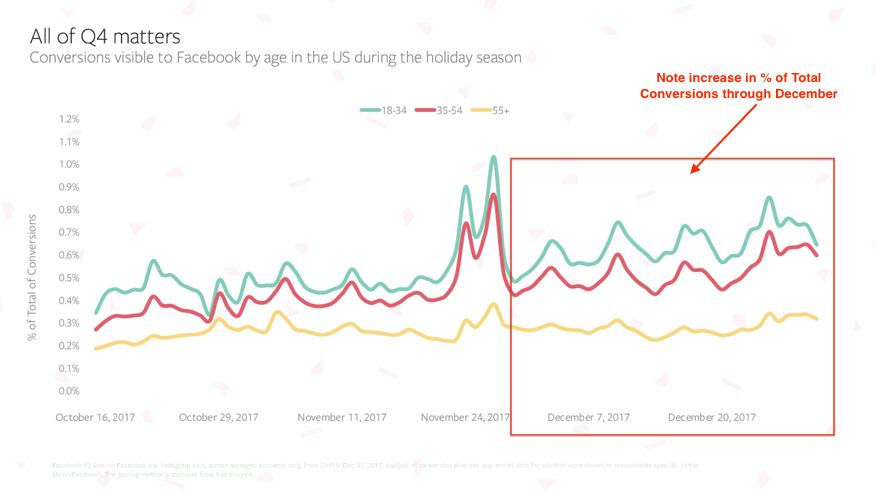

Q4 Isn’t Over Yet — Plan To Finish Strong

Black Friday and Cyber Monday may be over, but the holiday shopping season is far from over.

Shoppers will continue to search for gifts and deals throughout the rest of the year — meaning retailers still need to stay top-of-mind and engage shoppers through the end of December.

This is especially true when you consider the fact that “3 out of 4 (77%) consumers plan to do last-minute shopping,” according to Dropoff’s 2018 Holiday Survey.

Finishing strong in Q4 calls for:

- Continued prospecting using Facebook Dynamic Ads with Interest-based and Lookalike audiences based on those that performed well during Cyber Week.

- Re-targeting, cross-selling and upselling those audiences that visited your website, made purchases, or abandoned carts using RLSAs and DPAs.

- Leveraging Q4 bidding and ad campaign best practices from our Q4 guides on Amazon, Google Shopping, Facebook, and Bing Shopping.

Facebook Ads Guide: Setup, Strategies And Tips From The Experts

You Might Be Interested In