Media Update: Netflix vs. Amazon, X's New Stats, and the Future of Programmatic Digital Out-of-Home

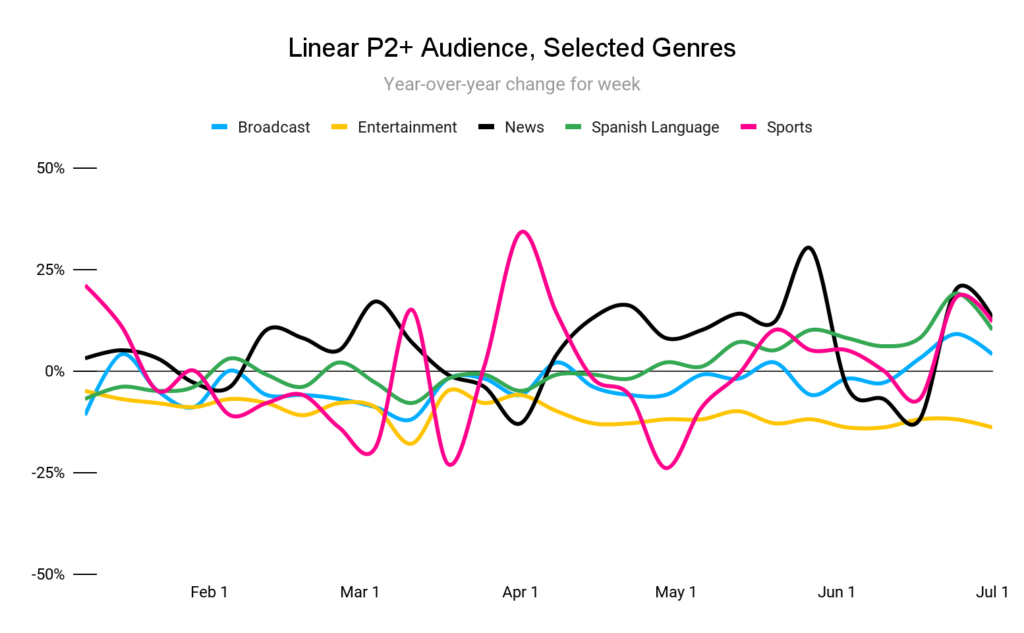

News and sports viewership spiked significantly in the final week of June. News viewership accelerated amid the fallout from the first Biden-Trump debate; while viewership for the debate itself was markedly lower than 2020, ongoing discussions around the viability of Biden’s candidacy and a high-profile interview with ABC’s George Stephanopoulos have kept attention high in recent days. While the NBA, NHL, and NFL are in the offseason, the WNBA continues to capture major viewership, with a matchup between Caitlin Clark and Angel Reese giving the league its highest viewership since 2001.

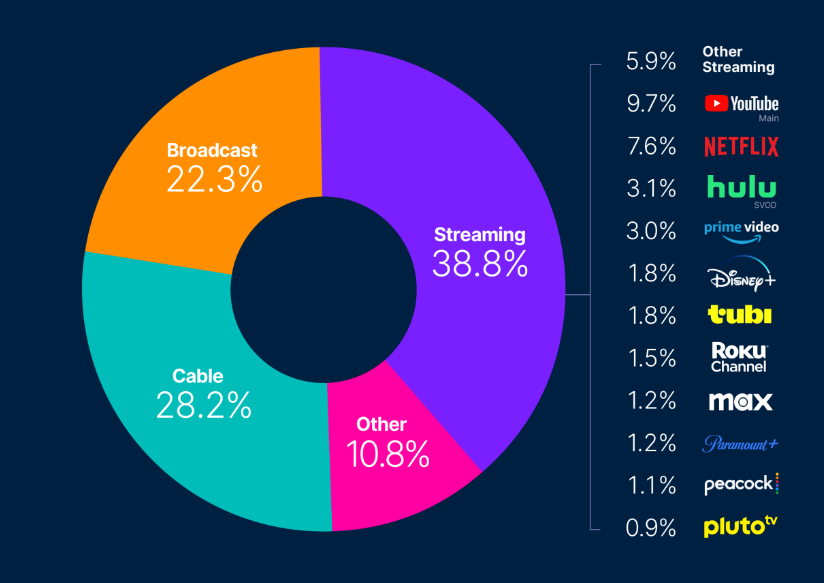

As the streaming TV landscape continues its march toward consolidation, the competition between its largest players is growing fiercer. Netflix and Amazon are fighting hard across multiple fronts – for advertiser investment, for audiences, and for content. With respect to investment, the two giants’ competition is pushing ad prices lower. UBS projects that streaming CPMs will decline an average of 10% in the coming year as Amazon adds more supply to the mix, and Netflix has already begun lowering its advertiser rates while deprecating its cheapest ad-free tier.

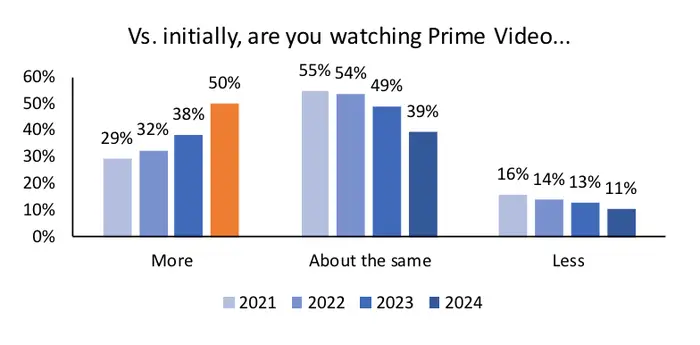

Meanwhile, the contest is on for engaged, sticky audiences. Surveys from Evercore show strong marks for Amazon, with a 75% satisfaction score for Prime Video compared to Netflix’s 61% figure. Platform viewership is up, with half of viewers reporting increased consumption vs. the year prior.

It’s not a completely dire situation for Netflix, however, as incumbency does give the platform certain advantages. Netflix viewers spend ~2-3x the time on the platform as do Prime viewers, including on ad-supported tiers. Nielsen’s Gauge has consistently shown Netflix far ahead of Prime Video in aggregate viewing as well.

While this competition benefits advertisers with declining prices, it benefits creators as well, as the two platforms are boosting the market for TV shows. More than half of new series orders in the start of 2024 came from Netflix and Amazon, with Netflix having its most active quarter since 2022 and Amazon setting its personal record.

While this competition may pressure the two companies’ bottom lines, advertisers should be encouraged by these developments. With CPMs dropping, viewership rising, and inventory plentily available, the opportunity to invest is growing more appealing. Further developments are likely to follow, especially on the ad tech side – Netflix has already announced that it will open up inventory to an expanded slate of DSPs in the coming year, while Amazon looks for ways to increase usage of its own DSP. Advertisers can expect only more opportunities here as 2024 rolls on. | Nielsen, Business Insider

Such heavyweight competition leaves little room for other players, putting further pressure on publishers like Paramount. After weeks of speculation and start-stop negotiations, the company has finally agreed to a merger with David Ellison’s Skydance. While the deal will not officially close until a 45-day “go shop” period expires, we are certainly nearing a conclusion to this saga, as Paramount would now be on the hook for a $400M breakup fee should it back out at this stage. The new investors are explicitly gearing up to compete in the evolving media landscape; said RedBird Capital’s Gerry Cardinale, “The recapitalization of Paramount and combination with Skydance under David Ellison’s leadership will be an important moment in the entertainment industry at a time when incumbent media companies are increasingly challenged by technological disintermediation… [W]e believe that the pro forma company under this leadership team will be the pace car for how these incumbent legacy media businesses will need to be run in the future.”

We will have to wait to see how Paramount maneuvers in the coming weeks and months, as the publisher has been engaged in or linked to several potential moves. Just days before the announcement, WarnerBros Discovery showed interest in partnering with Paramount on a streaming JV, while other reports suggested a sale of BET was forthcoming. The new leadership team has signaled openness to some of these partnerships, so it remains to be seen if Paramount will pursue a “lean-and-mean” strategy or look to become a consolidator. | NYTimes, Hollywood Reporter

A few weeks ago, we noted in this space that the NFL faced a class action lawsuit surrounding alleged anti-competitive behavior in its NFL Sunday Ticket product. At the time, the outcome of the case was unclear, but the jury has since returned a punishing verdict, fining the NFL ~$5B, nearly a quarter of the league’s annual revenue. The league is planning an appeal, and no changes to the offering are expected in the near term, but there is speculation that the ultimate outcome could be a cheaper Sunday Ticket offering through multiple companies. The NFL has already announced that bars and restaurants will be able to access Sunday Ticket through streaming this year for the first time. For advertisers, broader access to Sunday Ticket could lead to greater opportunities for investment, and Tinuiti will be monitoring the appeals process to track new opportunities in the nation’s largest sports league. | Washington Post

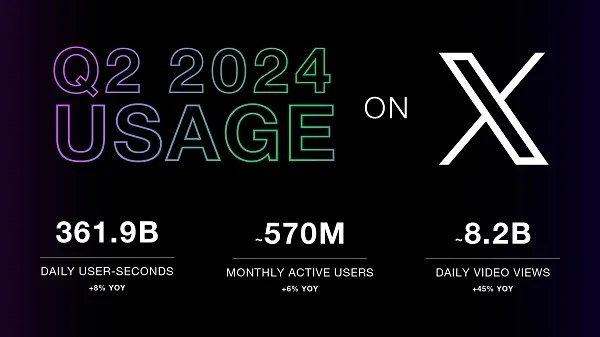

X, formally known as Twitter, has re-emerged in the news this week following a release of updated usage numbers showcasing growth of the platform, contrary to various previous reports. The numbers below aren’t the entire story, and have raised additional questions.

Notably missing from the above infographic is daily active users, which was reported back in March 2024 at 250M, which is the same number that was reported in November 2022, signaling that there has been no growth in daily users in at least 16 months. In that same report, monthly active users were reported at 550M, which is up from the 500M reported by X CEO Linda Yaccarino in October 2023, meaning X has added 70M monthly active users since October, which is pretty remarkable, even if daily active users are flat. Elon Musk posted back in May that X has 600 million active users and 300 million daily active users, which, based on the Q2 numbers, appears to be an overestimate.

The metric that is raising questions is the “Daily User Seconds.” This is not a metric that other platforms typically use or regularly report on, so it is difficult to weigh the value of it. Aside from that, the number itself, 361.9B, which equates to 6.03B minutes, is significantly lower than the 8B number that X reported in March of this year. This averages out to 24 minutes per day, which again is below March’s reported numbers (30 minutes per day).

Piecing this together, given discrepant numbers and large swings from report to report, it is difficult to take the Q2-reported numbers at face value. Instead, these numbers potentially show signs that engagement is decreasing, and while X users are still checking the platform, they are not sticking around as long as Twitter users used to. For advertisers, this is a sign that X likely is not going anywhere anytime soon, but it is still plateaued in terms of their user base. For a brand looking to do a tentpole activation, this could be good news to tap into cheap inventory, but for brands who historically relied on Twitter as part of their evergreen strategy, X likely will not drive the same performance or engagement the brand is used to seeing. Further adding skepticism is the report yesterday that the FBI shut down 968 accounts coming from an AI bot farm in Russia, raising questions about authenticity of users and user counts, an issue that Elon Musk has been vocal about trying to clean up. | Social Media Today, X

Out-of-home (OOH) has been going through a metamorphosis, which is why we discussed the growth of digital out-of-home (DOOH) back in March and dove into the measurement evolution of Gas Station TV (GSTV) in May. Recent articles from both eMarketer and AdExchanger illustrate that digital out-of-home is continuing to grow and evolve, providing new ways for advertisers to connect with their audience.

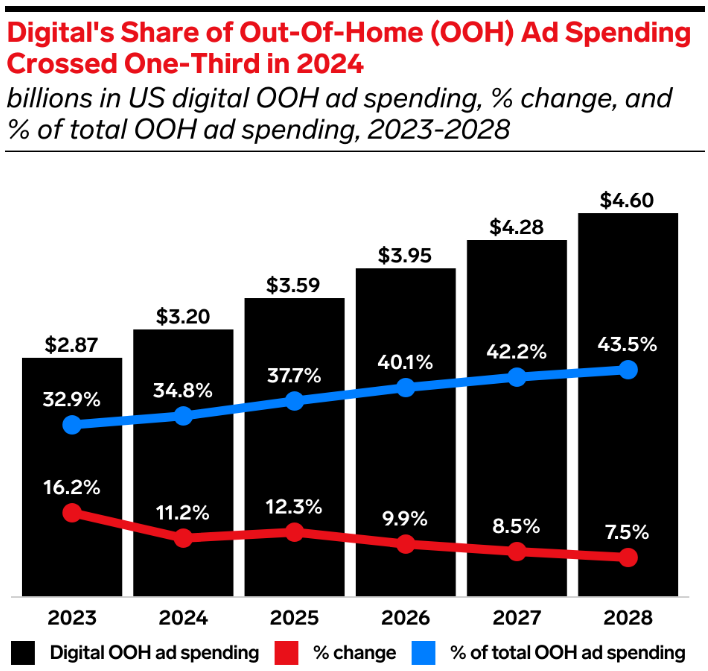

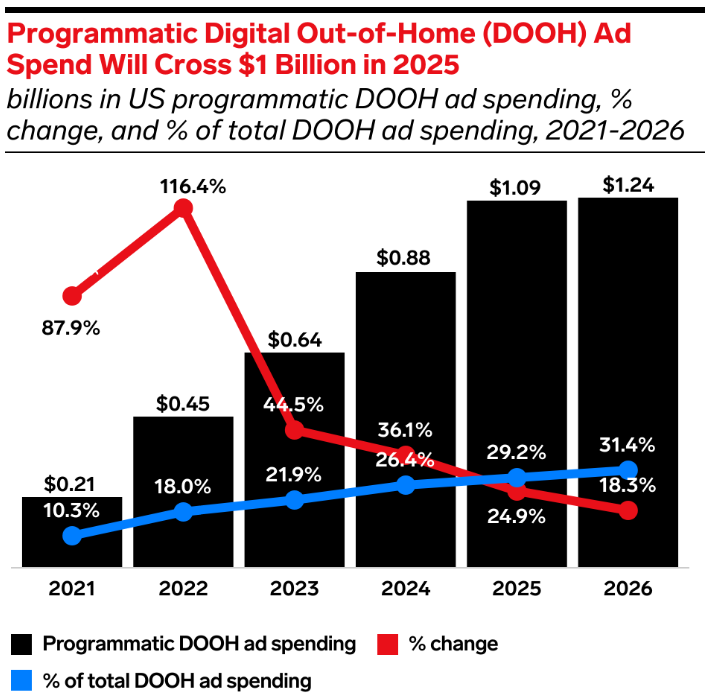

In eMarketer’s recently released 2024 out-of-home forecasts, they project OOH ad spend to reach $10.58B by 2028, representing consecutive years of low single-digit growth. While traditional OOH may be declining, DOOH is rapidly gaining prominence, projecting to capture over 40% of the OOH market share by 2026. This shift toward digital formats is reshaping the industry and allowing advertisers to lean into OOH in a few specific and strategic ways.

AdExchanger’s “must read” from Monday, featuring BarBoards, is an example of video and tech innovation coalescing. BarBoards, as I’m sure you guessed it, is a DOOH tech platform and network focused on TV screen inventory in bars and restaurants. Outside of reaching a unique audience, it is reported that their in-venue technology can provide insight into the number of people in the venue and whether they’re looking at the TV screen. While we are apprehensive about the ability to “see” the crowd, we are interested in ability to reach a niche audience and customize the messaging to provide a more memorable experience.

Overall, we are bullish on the future of DOOH and the rise of programmatic, so don’t be surprised if you hear more from us on this topic. When strategically planned and aligned with other media channels, it can be a very impactful medium, which is why we built an offering connecting with audiences in specific moments such as events or engaging them throughout their day with billboards on the way to work, in their office buildings, at the gym, in the grocery store and more. Leveraging this approach allows advertisers to maximize their DOOH campaign and drive business results. | eMarketer, AdExchanger, Place Exchange

Perplexity, an up-and-coming AI chatbot-powered search answer engine, has recently been in the hot seat over content theft allegations from multiple major news outlets. The cloud division at Amazon Web Services is investigating whether Perplexity’s AI has been ignoring important protocols (like robot.txt files) and accessing content behind paywalls. And publishers including Wired, Forbes and The Shortcut have claimed that Perplexity is scraping then republishing their content without proper attribution.

These types of allegations have implications around lost advertising revenue for publishers, and emphasize just how dependent certain AI chatbots are on media companies for training data and content generation. Publishers are having to take new, proactive approaches to defend their intellectual property as AI-powered search becomes more and more ubiquitous. Some news outlets are brokering licensing deals and creating revenue-sharing partnerships with AI companies, while others are pursuing legal actions.

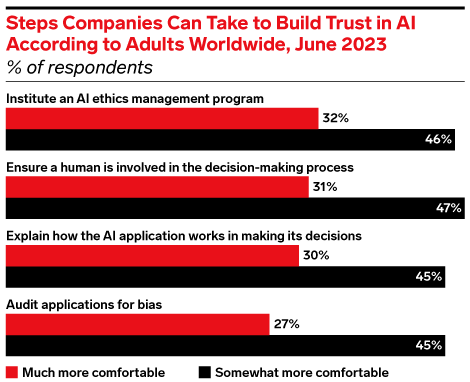

In a survey from last summer, eMarketer found that around a third of respondents felt that in order for companies to help build trust in AI, those companies should be taking steps like instituting AI ethics management programs and ensuring that humans are involved in decision-making processes.

As the world of search continues evolving and becomes increasingly powered by AI, we expect both consumers and businesses will become more mindful of the ethics behind AI aggregation methods. | Emarketer, Axios, Emarketer

While not an official holiday, Prime Day may as well be one with the amount of dollars expected to be transacted during the upcoming event. This year, Emarketer estimates shoppers will spend $13.8 billion across Amazon & other retailers during the two-day event (July 16 & 17, 2024). This, of course, is not even close to the largest global day of commerce; that title is consistently awarded to Single’s Day, which according to Bain saw ¥1.12 Trillion (~$150 Billion USD) in 2023.

Prime Day is an interesting beast for brands. It is, inherently, an Amazon-centric event; Amazon keeps the dates secret until just a few weeks before, giving retailers little time to plan (though it’s generally known that this event will typically occur in the middle of July) and consumers have been (no pun intended) primed to focus their attention on transacting via Amazon. Notably, Amazon has accounted for ~60% of transactions since the inception of Prime Day. This should not be assumed to be due to competitive promotions or discounts, rather this recognizes the total share of commerce revenue for a given day. Annually, Amazon accounts for ~40% of all US ecommerce sales, so this inversion associated with Prime Day is certainly notable.

It is clear that Amazon’s dominance around Prime Day persists, although we are now seeing the emergence of competitive days of sales. Of note, both Walmart & Target looked to pre-empt Prime Day with their own sales periods in the form of Walmart Deals Day from July 8th-11th & Target Circle Week from July 7th-13th. At this time the jury is still out on Prime Day performance this year, but it would appear unlikely that the needle will move away from Amazon, at least for 2024. While Prime Day presents a major moment in the commerce calendar and will undoubtedly have an outsized impact on various brands’ annual revenue targets, it is important for brands to remember that this is a marathon rather than a sprint and that this event only accounts for 1.2% (compared to the average 2-day period accounting for 0.55%) of annual US ecommerce sales. | Emarketer, Bain

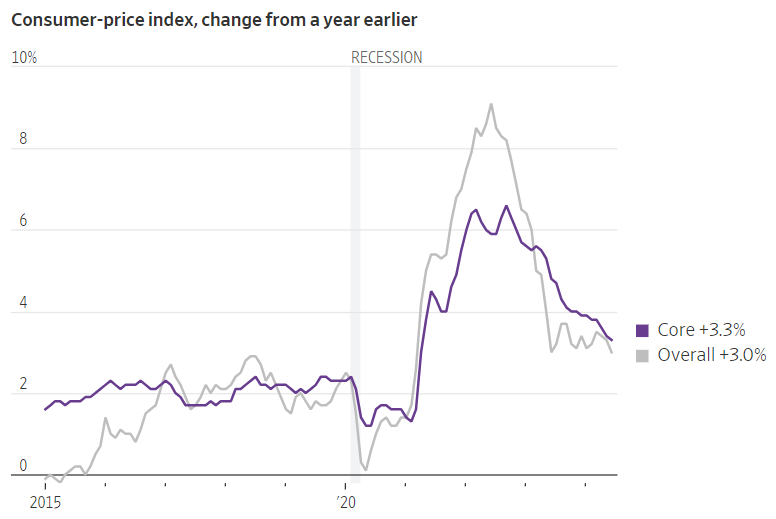

The hotly anticipated CPI print for June was released Thursday, and contained good news on the inflation front – overall inflation was 3.0% YoY, and core inflation (which excludes volatile food and fuel prices) was 3.3%, the lowest it has been since early ‘21 when inflation began its painful rise.

The immediate implication is that this raises the already-high probability that the Fed will cut its benchmark interest rate at least once this year; options markets are now pricing in very high probabilities of rate cuts in both September and December. This would of course be great news for borrowers across the economy, from businesses to homeowners.

Notably, June actually saw price deflation on a MoM basis, to the tune of -0.06%. This is the first MoM price decrease since the summer of ‘22. | WSJ, FRED

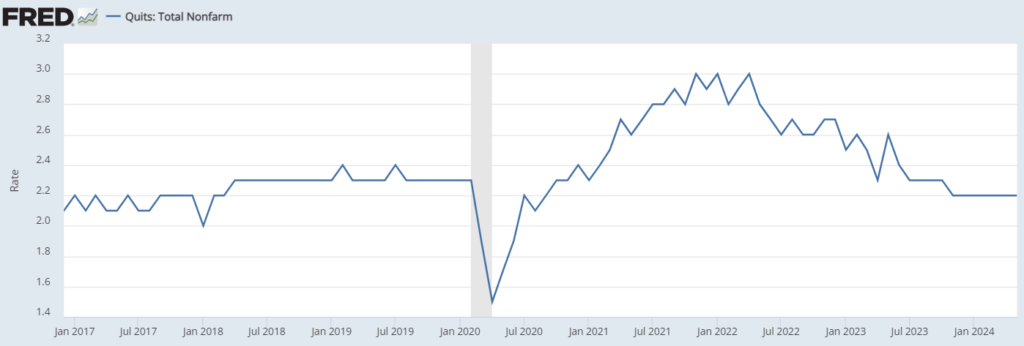

In our last update we discussed soft retail spending and falling consumer sentiment, both potential signs of economic troubles. Over the past two years we’ve often discussed the seemingly unshakeable resilience of the US labor market in the face of a torrent of adverse factors, from unprecedented inflation to rapidly rising interest rates; we are now, however, seeing continuing signs that the labor market is not invulnerable. In May we told you about emerging signs of softness in the labor market; new data this month show US employers are posting fewer openings and employee quit rates have declined significantly; in other words, we have a full reversion from the ‘Great Resignation’ of 2021.

The slackening of US employer demand for labor is evident in the unemployment figures as well; while the current rate of 4.1% remains very low by historical standards, it is materially higher than the 3.4% we witnessed in early 2023.

While no one celebrates a rise in the unemployment rate, most economists feel that the gentle increase the US has experienced over the past year is probably the best case scenario. The US has never had a soft landing from a recession, and while inflation has still not returned to the Fed’s 2% target, we are inching closer while remaining near historical unemployment lows. | Bloomberg