Is Bing Carving Away at Google’s Search Dominance?

Ever since Microsoft announced in February that Edge and Bing would be powered by ChatGPT, observers have wondered if Google’s search dominance would hold up. If other sites like Bing could provide a superior AI-driven experience, the thought goes, maybe, just maybe, Google’s lead in the realm of connecting the US population with information would start to slip away.

Looking at how two sources of interest in Google compared to Bing have trended over the last few months, we see competing stories for how the AI revolution has moved the needle.

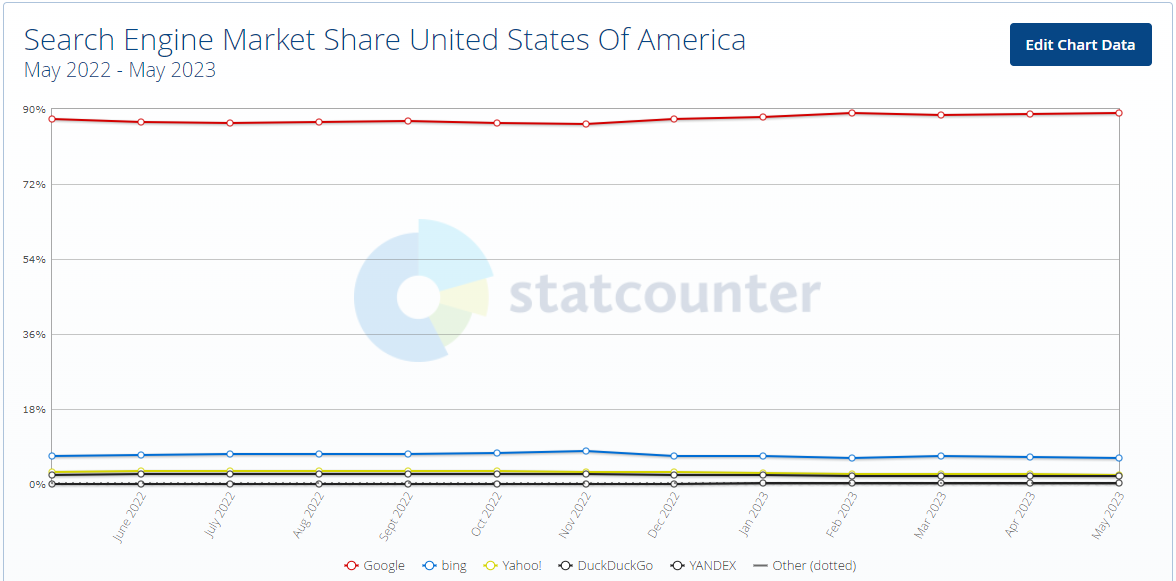

One source of US search engine market share by platform is StatCounter, which bases its calculations on every page view referred by a search engine to the more than 1.5 million sites its tracking code is installed on globally. No source is perfect and all should be taken as directional indicators, but StatCounter is a widely-used source for this kind of information and its search engine market share numbers in particular have long looked in line with expectations.

Looking at how things have shifted since Bing’s announcement, Google’s share went up from 88.13% in January to 89.1% in May. Over the same time frame, Bing’s share actually fell from 6.67% to 6.36%.

As such, this is an early indicator that Google may actually be slightly expanding its dominance in the US search market, despite Bing’s best efforts to make hay out of the AI news cycle. However, looking over at a source of Google’s own making, there are more positive signs that Bing’s moves might be attracting new users.

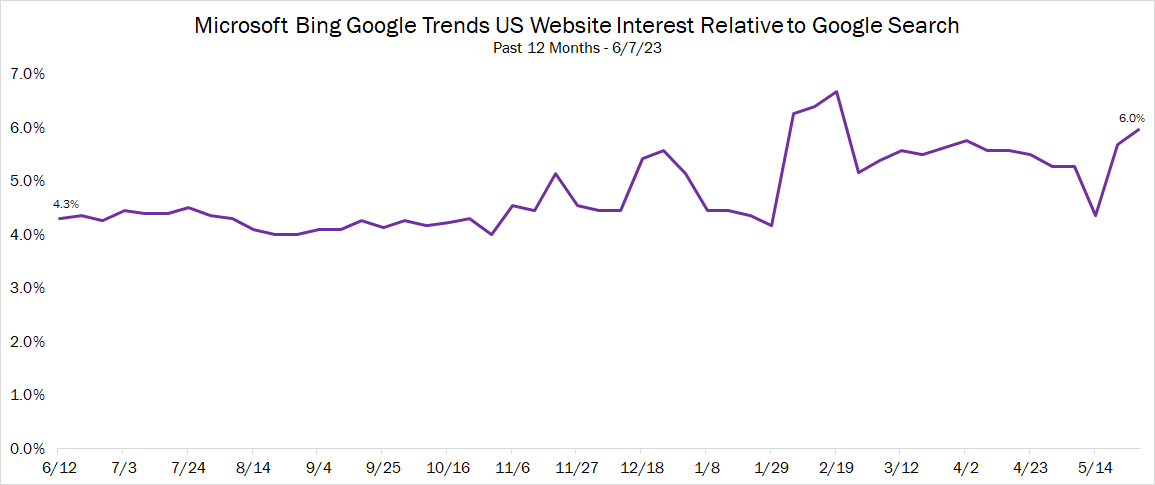

Google Trends provides relative search interest over time, and while hard values for volume aren’t provided, we can get a sense for not only how popular a search term or topic is, but also how popular an entire website like Microsoft’s Bing or Google’s search engine is at a given time compared to other options by comparing the normalized values provided. These values are always whole numbers, and thus aren’t but so precise in terms of providing users the ability to quantify such comparisons, but can certainly be used directionally.

Comparing Microsoft Bing and Google Search website interest over the last twelve months, the gap in interest between Bing and Google has gotten a bit smaller since the February announcement. One way to visualize this is to divide Bing’s interest by Google’s to provide a simpler relative interest than what’s provided directly in Google Trends. If Google’s relative interest for a given day was 80 and Bing’s was 5, this would yield a result of Bing producing 6.25% as much interest as Google.

The chart below shows that Bing’s relative interest grew substantially in the middle of February after its big announcement. Interest has since waned relative to Google search, but remains meaningfully above where it was prior to the ChatGPT announcement most weeks.

Any source showing relative demand for Bing and Google is bound to come with its fair share of caveats, and marketers are going to have to think critically about the types of analyses shared over the coming months when it comes to how much stock to put in particular data sets. Looking at StatCounter and Google Trends, we find conflicting stories, with one showing Bing search engine market share slightly down and the other showing Microsoft Bing interest slightly up.

Microsoft itself has been modest in its public statements regarding the impact of its ChatGPT integration, stating that its accomplishment of crossing 100M DAU announced in March was aided ‘with a little bit of a boost from the million+ new Bing preview users.’ One million users is a nice bump, but pretty small in the grand scheme of things. Small gains are still appealing for Microsoft, with its CVP of Finance noting that just one point of share gain in the search advertising market is a $2 billion revenue opportunity.

Google is also quickly maneuvering to integrate generative AI into its own search experience, and touted that its tools have relied on AI and machine learning for years. The arms race will only continue to heat up as it becomes clearer what users actually want moving forward.

Regardless of whether you put more stock into the StatCounter or Google Trends data presented here, the reality is that neither source is a strong indicator that the game has meaningfully changed so far, and that’s not that surprising. According to a recent Pew Research report, just 14% of Americans have used ChatGPT for entertainment, to learn something new, or for their work, and the engagement of average users with AI is still in its infancy. As such, we shouldn’t expect current indicators to reveal much about the future potential for disruption, and it will take time and adoption for the true form of this powerful technology to take shape.

For marketers, the key will be keeping tabs on this progression while not getting too caught up in the immediate hype. As the saying goes, many are likely to overestimate the impact in the short run but underestimate it in the long run. Make sure you’re playing the long game as you evaluate how the search game is evolving.