Facebook Revenue Growth is Slowing Down, but Pockets of Opportunity Still Hold Promise for Advertisers

Facebook’s Q4 2019 earnings call sent waves through the investment community, as ad revenue growth slowed from 27.3% in the US in Q3 to 21.5% in Q4. Further, Facebook offered guidance that the impact of privacy concerns lay not behind it but before it, with the issues potentially producing headwinds moving forward.

While advertisers should take note of this in order to temper expectations for potential on the platform moving forward, there are still opportunities for advertiser growth on Facebook properties moving forward.

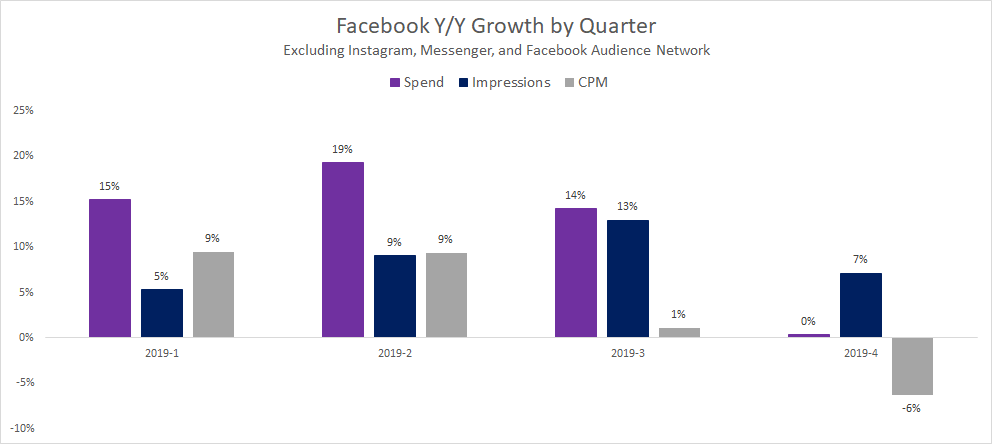

Looking at spend for Facebook proper excluding Instagram, Messenger and Facebook Audience Network, growth was flat year over year for Q4 2019 for same-client Tinuiti US advertisers, meaning those that were active on the platform since at least Q4 2018. This represents a pretty meaningful step down from the 14% spend growth observed in Q3.

As daily active user growth has slowed over time and competition for ad real estate has continued to heat up, it’s becoming more difficult for advertisers to drive the once impressive 40%+ growth observed on the platform. However, Facebook proper accounted for only 2/3 of ad spend on Facebook properties in Q4 2019.

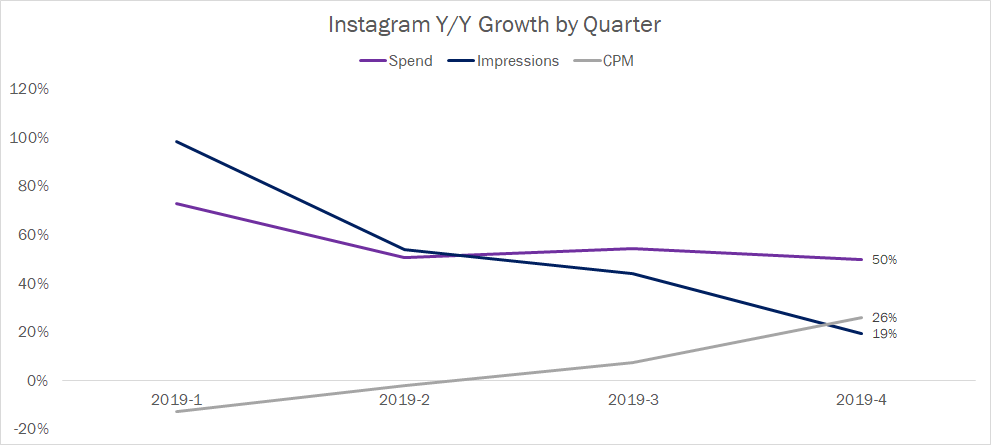

Instagram accounted for 32% of all spend on Facebook properties in Q4 and, as we wrote about earlier this week, grew at an impressive 50% clip in Q4 2019.

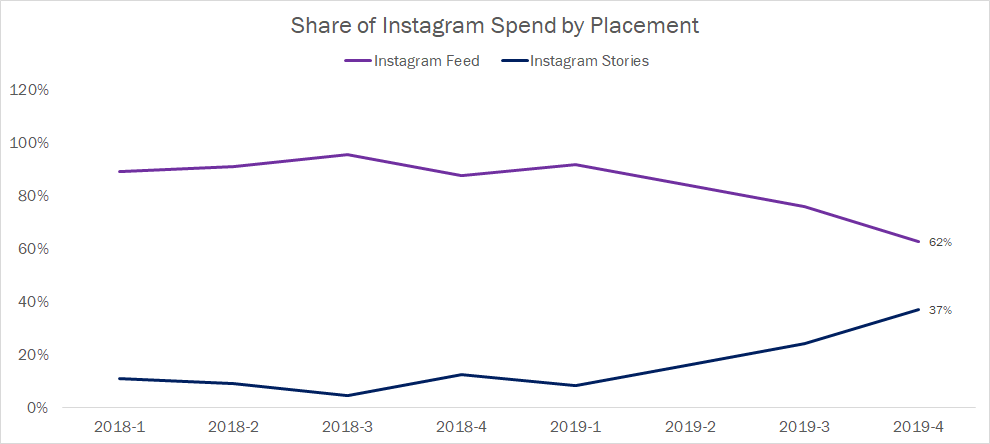

The biggest opportunity for growth on Instagram over the past year has been Stories, which went from accounting for 13% of Instagram spend in Q4 2018 to 37% in Q4 2019.

While Stories are unlikely to continue this torrid pace of growth now that adoption and competition have matured significantly, there’s still room for optimism with regards to Instagram growth moving forward thanks to Explore Ads. Announced in June 2019, this new inventory has seen steady adoption among advertisers. In Q4 2019, Explore placements accounted for just 1% of Instagram spend, but that share promises to climb as Stories growth slows and Explore adoption increases further.

Still, it’s likely that advertisers will have a hard time growing campaigns targeting Facebook properties at the impressive rates that were possible over the last few years. In order to fully capitalize on the Facebook opportunity moving forward, advertisers must look to quickly adopt and optimize for new inventory opportunities like Stories and the Explore tab moving forward. That means not just targeting this inventory, but crafting compelling creative to get the most out of these impressions.