You’re not imagining–Amazon listings are flooding Google Shopping Product Listing Ads (PLAs).

If you’ve been paying attention you know that Amazon isn’t new to PLAs; they have been slowly ramping up their investment over the last few years.

But now, Amazon is skyrocketing in impression share–in some product categories, increasing by +50%. Nii Ahene, COO of CPC Strategy, explains:

“Amazon got very aggressive with social advertising–specifically with the DPA retargeting product unit–during Q4 of 2016, which heavily distorted the market and increased CPMs during that period of time. Given the significant increase in PLA visibility during the year, it’s safe to assume the Amazon will double down on Google the same way they did with Facebook last year.”

Some reports indicate that over 50% of the top 10,000 queries bring up Amazon’s PLAs, which is a fivefold increase from early 2017.

Here’s what you need to know.

Who’s Being Impacted by Amazon’s Investment in PLAs

If you’re currently selling your products on Amazon, you may find yourself competing with your own products for SERP space. We’ll talk more about that below.

If you’re not currently selling on Amazon, you’ll likely find yourself jockeying for visibility against the biggest competitor you’ll meet. There are a few retailers who will be impacted more than others:

- Unknown brands selling in competitive categories

- Poor shipping (speed or cost)

- Poor seller reviews

We’ve also noticed specific product verticals that have been most affected. Here are a few:

- Home goods

- Drapery

- Generators

- Mattresses

- Household appliances

- Tableware

- Apparel

- Shoes

- Pet supplies

- Pet food

- Pet supplements

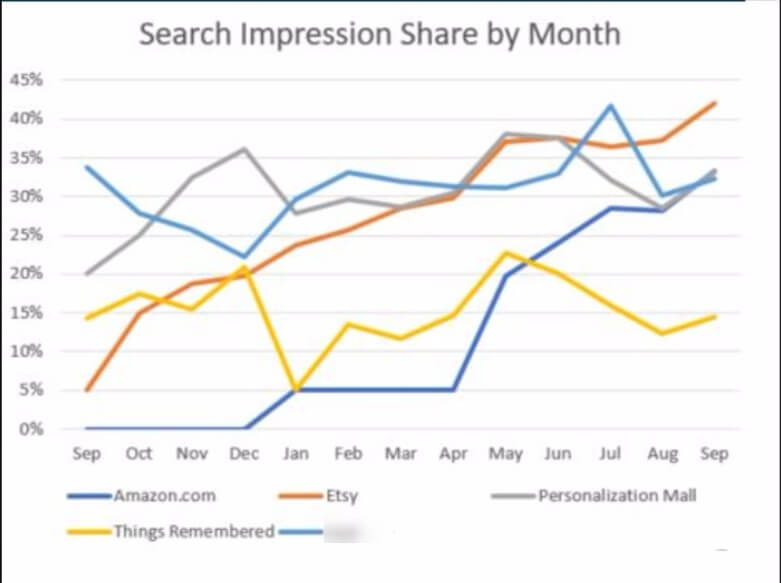

Here’s an example of one retailer (in light blue) who was bidding significantly higher year-over-year, but still losing impression share to Etsy and Amazon:

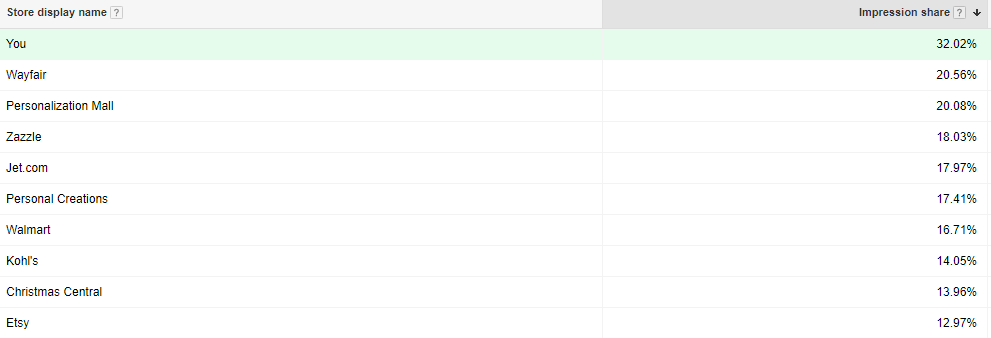

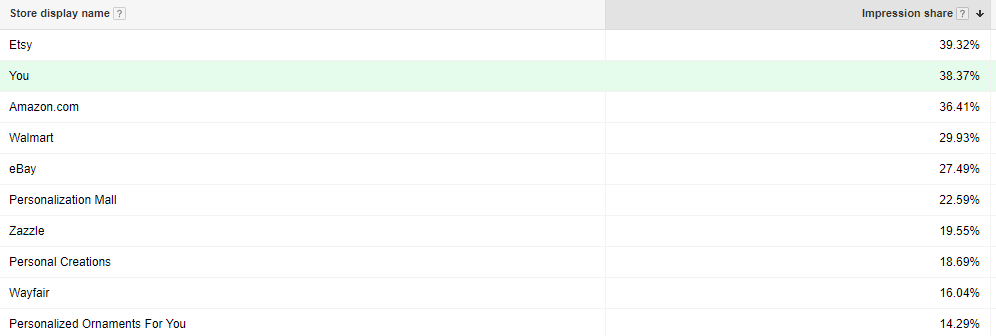

Here’s another example of a retailer who saw ​Amazon jump from non-existent in the SERP to the top two:

Before

After

With all of these changes, we’ve also noticed that average CPCs have also been higher for the same or lower impression share.

How to Combat Amazon’s Google Shopping PLA Takeover

Now more than ever, it’s important to get strategic about the way you run your Google Shopping campaigns.

“Your campaign architecture should maximize your Google Shopping return.”

“Your campaign architecture should maximize your Google Shopping return, and you should shift budget to the most impactful keywords for your business,” says Nii Ahene, COO of CPC Strategy.

Here are some tactics you can use to boost your impression share and potentially conversions.

1. Isolate Specific Keywords on Google Shopping (Leverage ISO™ Strategy)

What you really want to do is maximize your product’s exposure for top-converting search queries while decreasing exposure for unprofitable ones. Easy to do on text ads; not as easy on Google Shopping.

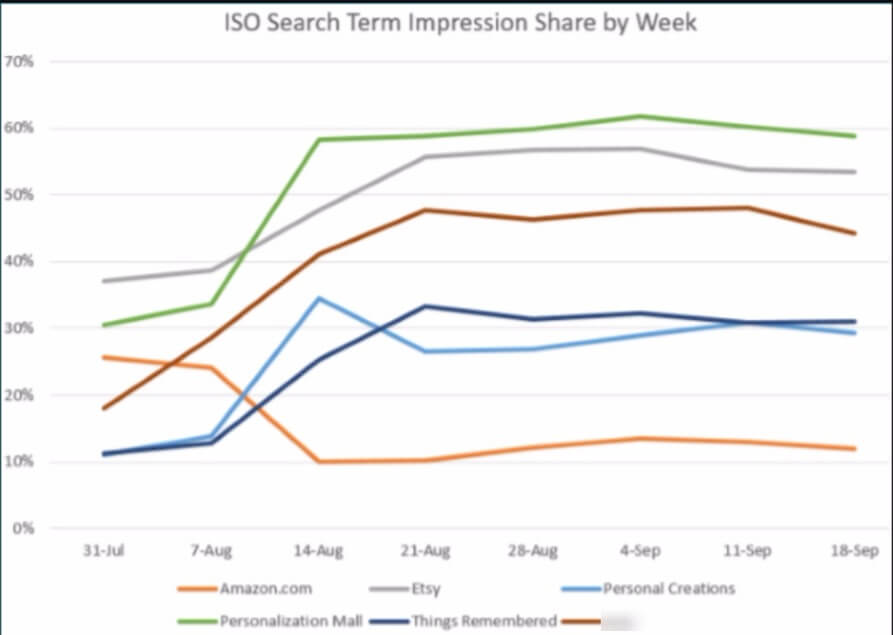

At CPC, we use our ISO™ strategy to ensure our clients products stay competitive. ISO campaigns™ use priority settings and negative keywords to isolate and push aggressive bids and budget to high-value searches.

This has worked especially well with products that must be “personalized” or “customized” by a manufacturer–something Amazon isn’t able to accomplish (at least right now).

We did this for one of our clients who also sells products on Etsy.

“Instead of trying to keep up with Amazon on all of our terms, we just focused on top-converting ones,” says Adam Harms, Retail Search Manager at CPC Strategy. “And it worked. Amazon fell off the map for search terms containing ‘personalized’ or ‘customized’.”

“Figure out which search queries do really well, and you can potentially knock Amazon out of the SERP, says Michael Ward, Retail Search Manager at CPC Strategy. “For example, if a shopper is searching for a ‘blue polka dot party hat’ but Amazon’s only showing pink party hats, and we can target that query better than Amazon, we’re probably going to win that click.”

However, even if you win that click, there’s no guarantee that shopper won’t head back to Amazon to finish their purchase, so you need other tactics in your back pocket.

2. Ensure Your Product Feed is Optimized

As we’ve stated before, your product feed is how you communicate your inventory to a product advertising channel. Google Shopping actually cross references this data with shopper search queries and your bids to determine ad visibility.

At CPC Strategy, we take the Google Shopping feed seriously. The more you know about optimizing your data, the more likely your content is to be surfaced for relevant queries.

For instance, your product titles should be comprehensive enough so that it increases your ad relevancy for those valuable bottom-of-the-funnel searches.

3. Diversify Traffic

If you haven’t already, you should be considering how to grow conversions by investing in different digital marketing channels–there’s only so far you can go with just one. (It’s also risky.)

“It’s important to diversify your product mix and having a strategy for which products are available on which channels,” says Brannon.

Whether it’s Instagram or influencer marketing, there are huge opportunities to grow your brand awareness, traffic, and conversions on other platforms.

“With Amazon aggressively encroaching on PLA’s, it’s more important than ever to diversify your traffic sources.”

“With Amazon aggressively encroaching on PLA’s, it’s more important than ever to diversify your traffic sources,” says William Parris, VP of Account Management and Co-Founder of CPC Strategy.

“Start where you won’t have to compete with Amazon for traffic–for instance, with Bing PLAs and Facebook ads. Both can be valuable sources of additional traffic and conversions and you can avoid getting into a bidding war with Amazon.”

If you’re a brand manufacturer, it’s more important than ever to build a memorable brand.

We suggest you drive upper funnel traffic through channels such as Instagram, Facebook, Pinterest, and even programmatic display and video. Essentially, build a brand that’s strong enough to transcend whatever channel you’re on.

“Dollar Shave Club, Seventh Generation, and RXBARs are all digital-minded organizations with products in spaces deemed to commoditized,” says Ahene. “However, their distinct marketing allows them to capture market share in spite of Amazon’s increasing dominance in product discovery and fulfillment.”

The bottom line? Create your own demand to draw customers into your site–don’t just rely on a channel to make your sales.

4. Ensure Your Reviews, Prices, and Shipping Options are Competitive

There’s nothing harder than competing with the biggest name brand in the world–especially if you’re an unknown.

“If Amazon has all the same products you have even at the same price, it’s going to be tough to win that customer over,” says Brannon.

However, in our 2017 Amazon Consumer Survey, we found that 54% of Amazon shoppers still price check Amazon against other sites.

That’s great news for most big manufacturers who can compete with low prices and have the operations to compete on shipping. But if you’re an unknown seller in a competitive product category, you’ll need to rely more on seller reviews, low prices, and fast shipping.

“Even if you’re an unknown brand, it helps to have great reviews or a lower price to differentiate yourself on the SERP,” says Ward. “Just make sure you don’t focus too hard on just getting a click. If a shopper enters your site and finds out your shipping policy is terrible, you’ll have wasted money on clicks because they’ll likely bounce.”

What if You’re Already Selling Your Products on Amazon?

Many of you reading may be selling your products on Amazon, and dealing with the awkwardness of competing 1:1 with your own product inventory.

On one hand, you need Amazon for audience exposure and more sales–but on the other hand, you still want to build a relationship with customers so you can continuously market to them in the future.

Dianne Manansala, Retail Search Manager at CPC Strategy, explains:

“You may be selling products on Amazon and making money there, but you also might notice it generates lower AOV orders, and much lower repeat customers.”

Fortunately, there are a few ways to make your Amazon strategy successful without jeopardizing on site sales.

1. Don’t Sell Amazon Everything

We’ve written before about how to negotiate trading terms with Amazon. However, this isn’t a process the vendor who’s faint of heart.

“One thing that might help is not selling your top sellers on Amazon–only give them a limited product range, says Melysa Hawkswell, Senior Retail Search Manager at CPC Strategy. “In addition, avoid immediately selling your newly launched products on Amazon. When you launch that product on your site instead, you give the user a reason to come to you first instead of Amazon.”

You can also use Amazon as your sole distributor for products that need to be liquidated, or are out of season–but it’s a risky proposition if you’re in a contract with the biggest retailer in the world, according to Brannon.

Parris agrees, and points to a risk of decreased profits when launching a product.

“Amazon has so much more traffic than you do, it’s risky to give them only a subset of your products.”

At the very least, take the time to understand how an Amazon Buyer’s mind works and how to get the best deal for your company:

2. Try Pushing Samples or “Gateway” Products via Google Shopping

At the end of the day, you need to convince a shopper within seconds that your site is worth visiting instead of Amazon.

Shoppers already know what they can expect from Amazon. Do they know what they can expect from you?

Shoppers already know what they can expect from Amazon. Do they know what they can expect from you?

“Focus on creating unique value props to get people to interact with your website as opposed to Amazon,” adds Brannon. “It could also be free samples or a loyalty program.”

One of our clients is in a highly competitive vertical. Rather than competing head to head on full-priced full-sized products (which they also successfully sell on Amazon), they choose to prioritize samples of their products at low prices.

It’s an easy way to start building that relationship with your shoppers and increasing customer lifetime value (CLV).

Caroline Diehl, Retail Search Manager at CPC Strategy, explains:

My client sees high repeat purchases in general, so we prioritize samples priced around $1 in Shopping with the goal being new customer acquisition. Customers can repurchase from my client’s website or from Amazon, as long as we can get the consumer to start buying [our product].

The best part of this “sample” strategy is the fact that you can gain a customer’s email and start marketing directly in their inbox–a much cheaper form of advertising.

Conclusion

We can’t prescribe a one-size-fits all method to combat Amazon on the SERP because that’s just not the way any business works.

Many advertisers can benefit from using one of the above strategies to push Amazon back down on the SERP.

However, that could be a fruitless endeavor as Amazon has a virtually unlimited budget, and is likely automating their AdWords operations.

Maybe instead of fighting Amazon, the conversation should be more about winning more revenue over time–via all sources.

“Instead of trying to compete with Amazon, what if we try to understand if it actually makes more sense to let Amazon win?”

“Instead of trying to compete with Amazon, what if we try to understand if it actually makes more sense to let Amazon win?” says Hawkswell. “In an ideal world, that sale would come from your own ecommerce site so you have more control. But at the end of the day, it’s about overall profits.”

But sometimes–and you might already know this–that’s just not the way digital advertising works.

You Might Be Interested In