Search Monitoring: Brand Manufacturers' Secret Weapon

This is a guest post by Ken Barber. Ken is a the VP of Marketing at The Search Monitor, a competitive intelligence agency for paid search.

Manufacturers are a segment of advertisers that can gain a lot from monitoring online ads. Like any other advertiser, they need to know how their competitors are behaving and the click and spend benchmarks for their specific industry.

However, manufacturers also need to be keenly aware of what their re-sellers are doing and whether they’re cooperating with their agreed-upon pricing. Monitoring this process gets even trickier when you factor in the hundreds of SKUs, dozens of re-sellers, and multiple search engines (including the CSEs) that are part of their business.

Marketing teams for manufacturers need to keep a close eye on three important areas: PPC text ads, display ads, and MAP policies.

When we say ‘manufacturers’, we are referring to companies in categories such as electronics (e.g., Dell, Apple), apparel (e.g., Patagonia, Coach), beauty (e.g., Estee Lauder), food (Coors, Kraft), sports & outdoors (e.g., Trek Bicycles, Bayliner Boats), vehicles (e.g., GM, Ford), and home goods (e.g., John Deere, Ethan Allen).

Text ads are a treasure chest of helpful competitive insights. A manufacturer should start by entering their list of keywords to monitor (ex: Oakley sunglasses) into a competitive monitoring tool.

They will quickly see every text ad that appeared for that keyword list. Monitoring text ad performance highlights data to manufacturers including:

For the product category itself (ex: sunglasses), manufacturers can learn essential market presence and share statistics. Such as who the top advertisers are, the market share each one has, and how these percentages trend over time.

Text ad monitoring best practices for brand manufacturers:

In addition to text ads, it’s extremely helpful for manufacturers to see the display ads run by competitors and re-sellers. And it’s easy to do. To view display ad data, manufacturers can enter any company name into an ad monitoring platform.

Monitoring platforms highlight where display ads are running, and images for those ads.

Monitoring display ads allows manufacturers to stay on top of specific offers and promotions from competitors and re-sellers. Manufacturers can view data trends to answer the following questions:

For example, Patagonia could learn that L.L. Bean loves to run its ‘Free Shipping with $35 purchase’ on Backpacker.com, with ad emphasis on female imagery to target women.

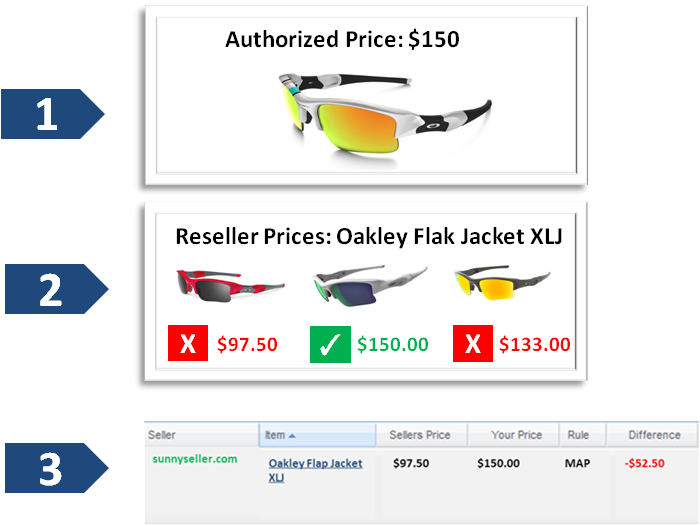

After monitoring text and display ads for competitive information, it’s time to make sure your dozens or hundreds of re-sellers are obeying your minimum advertised prices (MAP).

There’s too many to do by hand, so manufacturers need to again rely on an ad monitoring tool to do the heavy lifting. These tools simply require you to provide your entire list of SKUs and the authorized price for each.

MAP software monitors continuously to finds instances where the re-seller’s price is below the acceptable threshold. Since the search results include the re-seller’s name, manufacturers can also identify unauthorized re-sellers of those products.

Marketing teams at manufacturing companies have a formidable SEM challenge. The challenge gets a lot easier, however, once they realize the power of monitoring their industry, doing it often, and looking for the right things. Only with precise, recent data can they gain a full picture of their industry and make smarter SEM decisions.