The Google Shopping Ad Strategy Video Guide

Google Shopping is a very competitive environment but for brands that want to increase their traffic and expand to new customers, it’s a great arena to do that in.

Although there are still many companies running rudimentary Shopping campaigns, more and more are understanding how important Google Shopping Ad Strategy is to their business and their overall success with traffic generation.

In the following video guide, Christina Berry, Agency Development Manager at Google & Lew Brannon, Senior Paid Media Manager at CPC Strategy team up to discuss valuable tactics to improve your Google Shopping Ad Strategy in 2017.

FREE Guide: The Google Shopping Guide 2017

Click on the tabs below to skip to the following sections:

Unfortunately, a disorganized Shopping campaign structure can pose a significant threat to your brand’s success.

This is the reason it’s vital for advertisers to build out Google Shopping Ad campaign structures that utilize a variety of sophisticated strategies & advanced technology.

Click on the tabs below to skip to the following sections:

It’s important to remember there’s no “one size fits all” when it comes to structuring your Shopping campaigns. Advertisers should cater their campaign build – whether it be a campaign, ad group, or product build – to their goals and offerings.

If you’re a manufacturer, maybe it’s a product type or line. If you’re a reseller, maybe it’s brands.

If your campaign structure doesn’t fit the strengths of your business or if you’re just bidding on one blanketed campaign, you could be losing opportunities for profitability.

With the right Google Shopping Ad campaign structure in place retailers can:

If retailers don’t want their products to show up for unqualified searches, there are now several opportunities for them to “compete smarter” and leverage advanced search term targeting techniques.

The concept of brand versus non-brand segmentation seems pretty simple, and with traditional advertising on Google it’s easy to separate out brand traffic from non-brand traffic on the text ad side (aka on the keyword side).

But Google Shopping ads are different in that you don’t bid on keywords because it’s all based on the product data in your feed.

What we’ve been able to do is segment campaigns based on the query instead of the product through a strategy called ISO™ Campaigns.

The result?

Better control over the searches you want your products to show up for.

ISO campaigns leverage priority settings and negative keywords to isolate and allocate more aggressive bids and budget to certain high value searches.

BLOG POST: “What are Google Shopping Ad Campaign Priority Settings?”

This advanced strategy gives advertisers more control over which search queries their products show up for. It also allows them to isolate and dedicate budget to search queries that historically convert well.

It’s similar to how we think of text ad campaigns. With text ads, we can choose to set up our campaigns based on exact searches and bid higher and with more confidence because we know these are exact searches we want to go after.

With ISO campaigns, although we can’t target keywords directly, we can leverage negative keyword lists in an alternative campaign and then utilize the priority settings so that searches funnel into the right campaign.

Due to our unique ISO campaign implementation, ForPlay Catalog, a lingerie and costume retailer was able to increase sales and improve ROAS last October.

Aside from revenue growth, ForPlay Catalog also wanted to increase their visibility on Google Shopping across all costumes in their feed and improve overall impression share for relevant searches.

Aside from revenue growth, ForPlay Catalog also wanted to increase their visibility on Google Shopping across all costumes in their feed and improve overall impression share for relevant searches.

FREE Guide: Product Feed Optimization 101

In addition to breaking out campaigns by device (mobile vs desktop and tablet), we also segmented Shopping campaigns by intent. The result was a 280% increase in orders and a 270% increase in sales.

“We are very happy with the results of our Halloween campaign with CPC Strategy”, Cyrille Jan (Miguel) Delos Santos, Digital Marketing Manager, ForPlay Catalog, Inc. said.

“CPC Strategy delivered beyond our expectations, stayed on top of our campaigns throughout our busiest season and were truly proactive about the changes happening with our consumers and sales in real-time.”

We saw similar results with Augusta Active, a high-performance activewear manufacturer for athletes and coaches.

When we took over Augusta Active’s account in March 2016, they wanted to focus on a larger customer base by leveraging their product catalog to drive traffic and awareness to the B2C side of their business.

At the time, the company was primarily focused on text advertising but thanks to their partnership with CPC Strategy, we were able to significantly optimize the Google Shopping side of the business by reorganizing their feed and implementing our ISO™ campaigns.

This led to an estimated 60% increase in total Google Shopping revenue and 45% increase in new visitors to their site.

“We have been able to spend less while increasing ROAS, order volume and revenue. CPC Strategy makes me look like a rock star!” – Melissa Best, Digital Marketing Director, Augusta Sportswear.

CLICK HERE to skip to Part 2: Attribution Modeling

Transcription:

Christina: Hi my name is Christina Berry, and I’m an Agency Development Manager on the Google Agency Team based in Mountain View Headquarters. Today I have the pleasure of welcoming Lew Brannon, Senior Paid Media Manager at CPC Strategy, one of our valued agency partners based in San Diego. Thank you for joining us today to hear more about CPC Strategy’s ISO Shopping Campaign Strategy for Retail Brands. CPC Strategy is a premiere Google Partner supporting clients such as Reef, Reebok, Dakine, and Invicta Watches. Today we’re going to learn more about their ISO strategy, and how they utilize this approach to really achieve client success with shopping campaigns. With that I’ll pass it over to Lew to introduce himself.

Lew: Yeah, thank you so much Christina, it’s great to be here in Mountain View with you in the studio after working with you guys for this past year. I’m glad to finally be here filming with you, so thank you guys for having me, thanks to Google for hosting. Yeah, like Christina said, my name is Lew Brannon, I’m a Senior Paid Media Manager at CPC Strategy. I’ve been with the company about four years now, and prior to that I was doing paid search in the Travel Industry. But at CPC Strategy we really focus on retail e-commerce, and primarily working with brands and re-sellers as well. but this video today we’re going to talk about the concept of a retail brand that wants to acquire new traffic, so we’re going to talk about brand versus non-brand, and specifically how that plays into our ISO shopping strategy.

Christina: Great, so as you mentioned with shopping campaigns and the shopping strategy with Google on AdWords it’s really important for clients especially retailers to reach new customers and grow interest with their brand over time. So tell us a little bit about, high level, how has your team achieved success with your clients and what approach do you take with shopping campaigns?

Lew: Yeah, definitely. So Google Shopping advertising is a very competitive environment, obviously and for brand that want to grow their traffic and grow new customers, it’s a great arena to do that in and the concept of brand versus non-brand, it seems pretty simple, obviously with traditional advertising on Google it’s easy to separate out brand traffic from non-brand traffic on the text ad side, on the keyword side. But Google Shopping ads are different in that you obviously don’t bid on keywords it’s all based on the product data in your feed, so what we’ve tried to do is make it very easy to do this on Google Shopping ads, so that you can segment your campaigns based on the query instead of the product. So to give you guys a little bit more detail on that, think of the traffic that you were acquiring through Google Shopping, a search that’s being done is either going to be people that know you already and they’re searching for your brand, or someone that doesn’t know you and they’re just doing like a generic, or what we call a non-brand search.

So this strategy attempts to segment out that traffic, which gives advertisers the ability to dedicate separate budgets for brand versus non-brand, and that’s really at the heart of this. and we work with our clients to first of all kind of understand what their budget is for new customer acquisition, what they’re general goals and strategies are, in terms of acquiring new traffic and then we build out these ISO campaigns or isolation campaigns that allow us to cleanly segment and separate that budget, and have a particular strategy that goes after that new customer acquisition. and just to note, AdWords and specifically Google Shopping is really well aligned to do this, although a lot of advertisers don’t really realize that you can utilize it in this way, but it’s a great point to emphasize that AdWords, and the tools within AdWords are really well aligned to help advertisers reach those kinds of goals.

Christina: Yeah, it’s really great that you called out some of the AdWord settings, so there are advanced AdWords features especially with shopping that CPC Strategy’s team has been utilizing, and we’re going to go into a little bit more detail about how your team has setup that campaign structure, and I just wanted to call out that you’re completely accurate on AdWords search campaigns. It’s very easy to separate your top performing brands, and top performing non-brand keywords and set budgets accordingly. where shopping makes it a bit more difficult at times is that you’re bidding on your data, your product data in the Google Merchant Center feed, not on keywords, but Lew’s team and at CPC Strategy, they’ve really utilize this ISO approach to use advanced settings and take it a step further. So tell us a little bit more in detail about that ISO Strategy.

Lew: Definitely, let me break it down a little bit how ISO works. So within Google Shopping ad campaigns there’s a setting which is called the Priority Setting. And the priority setting tells AdWords if there are multiple campaigns that share the same products or that are linked to the same product feed, which campaign should AdWords reference first for a given search, right? So the idea here is whereas traditionally you target based on products, we’re trying to target the actual search that’s being done, the actual search query, so we utilize that priority setting in a unique way we think. So the way that it works is, let’s say that you only have one campaign currently, it’s your master Google Shopping ad campaign.

In order to setup an ISO strategy you would duplicate that campaign and then you would make one of them a high priority, and the other one would be a lower priority, it could be medium or it could be low. And the high priority campaign, kind of counter intuitively, but bear with me, the high priority campaign is going to be your non-brand campaign, the lower priority campaign is going to be your brand campaign. So in the higher priority campaign or your non-brand campaign, you’re going to take all of your branded keywords, probably the exact match of your brand name, and any phrase match of your brand name, even your product names if you want to list all them out. You build a negative keyword list of all your brand terms, and then you add that as negative keywords in the high priority or non-brand campaign.

So your lower priority campaign becomes your brand campaign. And the way that works in a real example would be, if someone does a non-branded search, it’s going to go into the high priority campaign first, which is your non-brand campaign. So immediately any non-brand search goes there, all your non-brand search is segmented. If it’s a brand search, if it contains your brand name, let’s say your brand name is Christina, if someone searches for Christina Jeans, it’s going to try to go into that high priority campaign. Because it indeed has the highest priority, but because your brand name is blocked there as a negative keyword, it funnels down into the brand campaign, the lower priority campaign. So that is essentially how using negative keywords and using priority settings in conjunction leads to this ISO structure, and that is a basic explanation and there’s a lot of other ways that you can spin off of that and get more advanced with it. But that’s the basic technological structure of ISO and it works really great for brands.

Christina: That’s so great to hear in greater detail, we definitely agree that it is a more advanced strategy and it’s a creative approach, and not the most conventional usage of priority settings that we typically see. So I wanted to ask for any ecommerce brand, are they able to utilize the ISO strategy starting today for example, or are there any criteria or requirements that should be met before taking this approach.

Lew: Anyone can benefit from the ISO strategy, in fact if you have a brand name that people search for and you have a Google Shopping campaign, one or multiple Google Shopping Campaigns, anyone can benefit from this strategy if you want to grow traffic, and you want to implement a more sound new customer acquisition strategy, anyone can benefit from this. there might be a couple of criteria that would limit this possibility for some accounts, if maybe you already have hundreds of different shopping campaigns built out for some specific reason, maybe there’s a need for you to segment your products by category or by season, and you have a really intense infrastructure already setup, maybe it doesn’t make a lot of sense to duplicate all of those campaigns and try to start with an ISO structure. But by and large anyone that meets those requirements that I mentioned is a great candidate to start using this ISO strategy now.

Christina: So it sounds like for anyone who’s currently running Google Shopping Campaigns have a good amount of data and also have search data from their search campaigns, they could gather that information and try to create an ISO strategy.

Lew: Yeah, definitely. If you have very low search volume, it might not be worth it for you to take this approach, maybe you want to focus on building up your searches and other things with growing your brand, but yes, if you have a Google Shopping Campaign running, or even if you’re not running Google Shopping yet, but you have a feed and you feel like there’s an opportunity for you to run Google Shopping, then this is a very good strategy for brands and e-commerce retailers to utilize.

Christina: That’s great to know. I think we can all agree that we’re only successful in AdWords if we’re achieving our clients’ goals. So I would love to hear more about your clients and the impact that the ISO strategy has had on your team?

Lew: Definitely, so we have a couple of good real world examples. one of my clients is Electric California Sunglasses and Snowboarding Accessories, they had a goal to grow new customers and get more conversions from generic searches, they previously really focused on branded searches primarily and so year over year, in 2016 we actually achieved double, 100% growth in conversions from generic searches. So all those are new customers that are finding them through generic searches, and previously they weren’t really playing in that space.

This approach has allowed us to be in play for those searches. Seeing great growth with them. Another client Reef, Reef Sandals, they have achieved kind of an opposite goal they had was to improve their efficiency, improve their cost per acquisition, and using this strategy we’ve been able to hone in on segmenting out brand versus non-brand and we actually have improved their cost per acquisition 40% year over year on branded terms. So rather than having everything jumbled in one campaign, we’re able to segment out brand versus non-brand. Able to really improve the cost per acquisition for Reef which has been really good. So those are two examples, and another really key thing to mention for the brands that we work with, is that this approach allows you if you would like to take it to this level to monitor impression share for your branded terms as well, which is something that is kind of hard to do or seemingly hard to do for Google Shopping. But with an ISO approach you can actually monitor the competitive metrics on your branded searches, which is really, really key for the brands that we work with to be able to see where they stand in the market, in terms of their piece of the pie or their impression share for their branded searches on Google Shopping. And so that’s another benefit of this and that’s something that all of our clients have benefited from. So yeah those are some good examples and it’s definitely been a key part of our strategy and it’s been a successful strategy for our brand clients.

Christina: Thank you so much for sharing those client success stories, it’s really nice to hear these stories firsthand about how the ISO shopping strategy has impacted your team’s success as well.

Lew: Definitely. And so if you want any more information about ISO specifically, check out our blog at cpcstratblogsite.kinsta.com, also go to our YouTube channel and look for any video in the series AdWords for Retail Brands, and also if you just want to hit us up directly feel free to contact us at [email protected].

Christina: Thank you so much Lew and thank you for tuning in.

In ecommerce, attribution can be a complicated concept for retailers to understand but it’s imperative for retailers to know which marketing channels or campaigns are having the most impact on their customers.

Click on the tabs below to skip to the following sections:

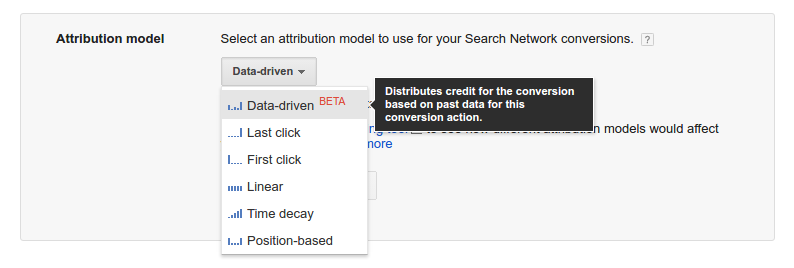

An attribution model is the rule, or set of rules, that determines how credit for sales and conversions is assigned to touchpoints in conversion paths.

Attribution is essentially assigning value to your campaigns. But what we are seeing in today’s world of digital commerce is that the average transaction has more than 30 touchpoints in it.

For example, if you are buying a new pair of jeans, it’s likely you will conduct quite a bit of research before you decide to convert. You might type in multiple searches (on various devices), visit a dozen or more websites, click on 10 to 15 ads and browse pages of product reviews for feedback.

Customers can engage in all of these different touchpoints before they ultimately make a purchase. By dissecting the pathways that customers take to discover and make a purchase, retailers can better inform their budget and marketing strategy.

Have you ever seen discrepancies between how your Google Analytics and your Google Adwords accounts attributes conversions? You probably have because Google Analytics and Google Adwords use different Attribution Models.

Below is an example to help explain how each of the attribution models apply to a conversion:

“Laura finds shoes.com by clicking one of it’s AdWords ads. She returns one week later by clicking over from Facebook. That same day, she comes back a third time via one of shoes.com’s email campaigns, and a few hours later, she returns again directly and buys a pair of sneakers.

Last Interaction attribution model: In this case, the Direct channel—would receive 100% of the credit for the sale.

Last Non-Direct Click attribution model: In this case, all direct traffic is ignored, and 100% of the credit for the sale goes to the last channel that the customer clicked through from before converting (in this example) the Email channel.

Last AdWords Click attribution model: In this case, the first and only click to the Paid Search channel —would receive 100% of the credit for the sale.

First Interaction attribution model: The first touchpoint—in this case, the Paid Search channel—would receive 100% of the credit for the sale.

Linear attribution model: Each touchpoint in the conversion path—in this case the Paid Search, Social Network, Email, and Direct channels—would share equal credit (25% each) for the sale.

Time Decay attribution model: In this case the touchpoints closest in time to the sale or conversion get most of the credit. In this particular sale, the Direct and Email channels would receive the most credit because the customer interacted with them within a few hours of conversion. The Social Network channel would receive less credit than either the Direct orEmail channels. Since the Paid Search interaction occurred one week earlier, this channel would receive significantly less credit.

Position Based attribution model: 40% credit is assigned to each the first and last interaction, and the remaining 20% credit is distributed evenly to the middle interactions. In this example, the Paid Search and Direct channels would each receive 40% credit, while the Social Network and Email channels would each receive 10% credit.

With AdWords attribution, you can use various reports to see how many conversions, or how many days until your user converted.

Typically AdWords focuses on the “Last Click” model – which unfortunately doesn’t show how all of the touchpoints contributed along the entire shopper’s journey and is a big reason why advertisers often say “Last Click Attribution is Dead“.

The good news is, AdWords has recently made changes to provide advertisers with better attribution features to improve their ability to track the users path to purchase.

Through Google Analytics (and also with AdWords), you can also use Google’s attribution modeling report, which actually allows you to select different data driven attribution models to compare revenue and conversions under each model.

The Multi-Channel Funnel reports shows how your marketing channels (i.e., sources of traffic to your website) work together to create sales and conversions.

Keep in mind, even though a purchase is made via a Google search, customers could have been introduced to a brand via a blog or while searching for specific products and services. The Multi-Channel Funnel reports show how previous referrals and searches contributed to that sale.

The Model Comparison Tool allows retailers to compare the impact of different attribution models on their marketing channels.

Within the tool, the calculated Conversion Value (and the number of conversions) for each of the marketing channels will vary according to the attribution model used.

For example, a channel that predominantly initiates conversion paths will have a higher Conversion Value according to the First Interaction attribution model than it would according to the Last Interaction attribution model.

The Model Comparison Tool allows retailers to compare up to 3 different attribution models at once to measure the impact of their marketing channels.

It’s vital that advertisers have access to models and evaluation platforms that allow them to see not just how the last click contributed to the purchase but how all of the touchpoints contributed along the entire shopper’s journey.

That way, when you are analyzing the ROI of individual campaigns (for example: “how well did my Google Shopping non-brand campaign do this month?) You have a better understanding of your campaign performance as a whole.

A good way to think about attribution is to visualize a basketball game. A point guard gets a pass from his teammate, then he shoots and scores.

The point guard gets the recognition for the points on the scoreboard but the reality is – if his teammate never passed him the ball – it’s likely he never would have had the opportunity to shoot in the first place.

So, in this scenario the point guard is the branded text ad and if we’re following the last click attribution model – unfortunately his teammate gets zero credit for the pass and looks like he’s not a good player judging by the hard numbers.

“If your paths to purchase are direct enough, the default last-click approach may be the right choice but the reality is – this is usually not the case.” – Lewis Brannon, Paid Search Manager, CPC Strategy

The good news is AdWords has taken a lot of steps to provide advertisers with more of those ‘big picture’ metrics.

BLOG POST: “The Death of Last Click Attribution“

One of the latest models introduced to help advertisers gain a better understanding of attribution is Google’s Data-driven model.

According to the announcement, for the first time, AdWords advertisers with sufficient data will also be able to select the new data driven attribution model as a public beta, which is also available in Analytics 360, Attribution 360, and DoubleClick.

Unlike rules-based models, data driven attribution uses machine learning to evaluate all the converting and non-converting paths across your account and identifies the proper credit for each interaction.

BLOG POST: “The Rise of Google’s Data Driven Model“

Transcription:

Christina: Hi My name is Christina Berry, and I’m an Agency Development Manager on the Google Agency team based in Mountain View headquarters. Today, I have the pleasure of Welcoming back came back Lew Brannon, Senior Paid Media Manager at CPC Strategy, one of our valued agency partners based in San Diego.

CPC Strategy is a premier Google partner working primarily with e-commerce brands and retailers across the U.S. Thank you so much for joining us today to learn more about attribution modeling for retail brands. Lew, tell us more about yourself and your team’s approach to attribution.

Lew: Definitely. Well, first of all, thank you, Christina, for hosting me back here in the Googleplex in Mountain View, it’s always great to be back. A little bit about myself, my name is Lew Brannon and I am a Senior Paid Media Manager at CPC Strategy. We are a retail focused e-commerce advertising agency based in San Diego.

And today we are going to be talking about attribution as Christina mentioned, and the topic of attribution is one that’s a little bit scary for people to hear for the first time. And I think it gives people all this kind of complicated…people have a complicated perception of attribution because it does seem like quite a complicated topic.

But today we’re going to break it down a little bit, explain what really it means to understand the customer buying journey and the path to purchase. And talk about some simple and effective ways that advertisers can implement some attribution strategy that can really help drive forward their performance.

Christina: Exactly. So, as Lew mentioned, the customer journey and path to purchase is very complicated and continues to get extremely complex. For online retail brands, the average shopper engages with five plus digital touch points before purchasing, and along that process, they can engage with all sorts of different advertisements across the web.

Critical fact to remember is that now 75% of online adults start a search on one device, but actually continue or finish it on another. This is a really important piece of the puzzle to keep in mind.

Lew: Yeah, and that’s a really interesting statistic, kind of eye-popping. And as someone who works in AdWords every single day, I had to say that I’m really glad that Google has taken a lot of measures to provide us with tools within AdWords.

Not only Google Analytics, where I think people understand in Google Analytics. They understand a little bit more that there are attribution tools already built in there, but even in AdWords there are specific metrics and reports that we can look at that help us to get a handle on that attribution. And it’s true, the customer buying journey is definitely longer and expanding every day, and these tools that Google has provided are really key components of a good attribution strategy.

Christina: Yes. Exactly. So, with AdWords attribution, you can use various reports such as the Path Length Report or the Time Lag report to see how many conversions, or how many days until your user converted. Through Google Analytics and also with AdWords, you can also use our attribution modeling report, which actually allows you to select different data driven attribution models to compare revenue and conversions under each model.

Lew: Yeah, definitely. And not only utilizing the attribution modeling within AdWords, which is super helpful, but also there are actually metrics that you can add into your inline column view that will give you greater insight into your attribution analysis. And some of those columns would be the assist columns which we call the click assisted conversions, impression-assisted conversions, click assisted conversion value and impression assisted conversion value.

Those are metrics that you can look at in AdWords, it’s really simple to add them in and start to get a handle on the true performance of a given keyword or a given add group or a given campaign. We can talk a little bit about Google Analytics because I think that many of our viewers will have a little bit more familiarity with Google Analytics. And there are attribution models like you mentioned that exist within Google Analytics which are very valuable to take advantage of.

And so, I want to discuss a little bit about the different models that you can look at in Google Analytics in terms of the different attribution models. I think most of our viewers will have heard of the last click versus first click, and that’s two different models that you can look at. The last click is looking at the last interaction. So, assigning credit to the last click or the last campaign that drove traffic to your website and first click is the opposite of that. It’s assigning credit to the first ad click even if ultimately there were ten more clicks on that path. The first click would get the full credit there, so that’s first versus last.

Most people default to a last click in their reporting. Certainly, Google Analytics defaults to the last click. Google AdWords is actually first click. But you can dig into those reports those metrics that we talked about earlier and start to see more insight there.

But there are other attribution models that you can look at in Google Analytics which are very interesting. One of them is called the linear model which attempts to distribute the value throughout each touch point on the customer journey.

There’s one that’s called time decay in which you can give more credit to an earlier click than you would to a later click or vice versa. And there’s also a position based model which gives more credit to the first and last touches and less credit to the touches on the middle of the path. So, it’s very interesting how all these models are set up, but one of the most valuable things is actually the fact that you can set up a custom model in Google Analytics. So, you can determine as a business an organization which one makes the most sense for you and then you can set up a custom model within Google Analytics, and that’s very helpful to do that.

Christina: So Lew, how does your team establish a starting point for clients who are new to attribution? And how does that strategy change for existing clients who you’re currently managing? I’d love to hear how you’ve created successful attribution models for your clients.

Lew: Yeah definitely. I think the first key is that I get often asked, what is the best model to use and a really important point to make is that there is no one size fits all solution for attribution modeling. The key is figuring out which model works best for the client and the individual advertiser.

So, the first thing that we do is we try to establish where the client is in the attribution process, do they understand it? Are they already doing some type of attribution reporting? If not then we work with them to establish which one of the models might work best for them. If they’re already using a particular model, we usually just work with that because it’s great for them. It’s great that they’re already down that path of understanding attribution, so we’ll work with that. We might make some tweaks to it.

But yeah, that’s the key is establishing buy-in from all of the people involved all the stakeholders in the account and establishing a model that works best for everyone and then establishing a timeline for where we’re going to you know periodically reference that data and the benchmarks and so on and so forth. But yeah, the big thing is understanding that there’s not just one perfect model.

But in terms of success stories, we found great success with working with our clients to not only set up an attribution model but like we talked about earlier with the metrics and AdWords where you can apply the assisted metrics to your campaigns.

That’s one of the first things that we want to establish with our clients is, let’s start looking at those metrics so that we can get deeper insight into keyword or ad group level or campaign level performance. When we’re considering not only the last click performance but we’re looking at those assisted metrics, so we’re understanding how each level of our account is playing into the ultimate performance.

Another key thing is that we do work with our clients to build custom attribution model. Within Google Analytics there is the ability to completely customize the attribution model. You can change different factors, different scoring, there’s all this kind of complicated things that you can do, but it’s quite simple when you really get into it and break it down.

So, we do work with our clients’ one on one to develop a model that works best for them. And we absolutely leverage that data in our day to day management. And our clients have found great success, and really our clients are very pleased that we do that because it gives them additional insight and much more context into the performance of their campaigns.

And we always talk about seeing the holistic picture and modern advertisers, modern brand advertisers especially realize that customer journey dynamic and having this attribution strategy in place is something that’s great for them and they love to see that full funnel holistic approach to growing their brand on AdWords.

Christina: So, as you mentioned, it’s absolutely essential for not only clients to understand their client path to purchase but also to understand attribution in their AdWords account. Because understanding these two main factors can completely impact a digital advertising strategy.

Lew: Yeah, absolutely. And so for more information about attribution modeling, feel free to go to our website cpcstratblogsite.kinsta.com and check out our blog. Also, go to YouTube and check out our YouTube channel. And look for any videos in the series marked AdWords for retail brands.

And lastly, if you want to just reach out to us directly feel free to contact us at [email protected], and we’d love to give you guys more information about attribution in general and how we approach attribution modeling.

Christina: Well, Lew thank you so much for joining us again in the Google studio.

Lew: Thank you.

Christina: And thank you for tuning in.

Most retailers and brands agree that every product deserves to be treated as it’s own business, but managing hundreds or thousands of SKUs manually isn’t feasible for Marketing Managers today. The investment of time would greatly outweigh the net improvement in performance.

If you’re product catalog is relatively small – automation might not be necessary, but for retailers managing a large number of SKUs or seeking to expand their product offering, automation will play a critical role in the management of your campaign bids.

Click on the tabs below to skip to the following sections:

Working within the Google Shopping space for the last 5 years – even 7 years before it even went paid, we’ve had a lot of time to iterate on the process to figure out how to scale and optimize bids across variant product catalog sizes – ranging from 500 to over a million products. There are a lot of nuances associated with managing a large catalog and there is not a one size fits all approach.

A lot of the work that we’ve done over the past two years has been developing our own internal technology, so that we could most effectively scale the management of large Google Shopping accounts.

Automation can alleviate the guesswork associated with Shopping campaign management and rules or algorithms can be applied to your campaigns to meet specific business objectives.

If applied correctly, automation technology, which is largely operated by programmatic rules, can help retailers streamline their bidding process, save time, and optimize product-level campaign management and efficiency.

Having an advanced marketing strategy on Google Shopping that incorporates programmatic bidding, budget pacing, search term harvesting, and negative keyword grouping is essential to keep up with the channel’s competitive landscape.

Fortunately, there is a tool available to alleviate the threat of inefficiency, without having to sacrifice the attention of product level bidding: CAPx Shopping Platform

A lot of the success that we’ve had with Google Shopping can be attributed to two key abilities: Custom Label Management & Programmatic Bidding Rules

We teamed up with our Paid Search team to create a powerful tool to empower Shopping managers with the same technology we use to execute on both of those abilities. With the CAPx Shopping Platform, practitioners can use programmatic technology to customize bidding strategy, monitor campaign vitality, and analyze product-level data at scale.

The CAPx Shopping Platform allows us to extend our methods out to other practitioners who:

– Don’t have as much control over the data feed as they’d like.

– Have less trust in algorithmic bidding.

– Want the most control over their Google Shopping Ad strategy.

– Are running a lot of text ad campaigns.

Want to learn more about CAPx and how it can improve your Google Shopping management efforts?

Transcription:

Christina: Hi, my name is Christina Berry, and I’m an agency development manager on the Google Agency Team based in Mountain View headquarters. Today I have the pleasure of welcoming back Lewis Brannon, Senior Paid Media Manager at CPC Strategy, one of our valued agency partners based in San Diego. Thank you so much for joining us today to learn more about how CPC strategy leverages their in-house technology platform for AdWords optimizations. CPC strategy is a premier Google partner supporting retail clients such as Reebok, Reef, DaKine, Invicta Watches, and many more. In 2015, CPC Strategy launched their in-house technology platform called CAPx to assist to analyze product data and optimize performance. So, Lewis, tell us a little bit more about yourself and why this is top of mind for your team.

Lewis: Yeah, well, thank you, Christina, for having me back here at Mountain View at the Googleplex. It’s great to be back in the studio with you and, yeah, to give you a little bit of background on myself. My name is Lewis Brannon, a senior paid media manager at CPC Strategy. Our agency is based in San Diego, and we focus primarily on retail e-commerce. And today we’re gonna be talking a little bit about the ever-evolving, ever-changing industry that we’re in, which is online advertising, and we want to talk about utilizing technology to enhance, not replace, but to enhance and help you optimize your AdWords performance. So we’re going to go into the CAPx platform that we developed back in 2015 and talk a little bit about how we utilize that platform to enhance our campaigns.

Christina: Great, I’m excited to hear more about it. So after working with CPC Strategy the past year, we know that you pride yourself on a technology-enabled agency, so tell us a little bit more about why CAPx has been a great investment for your team.

Lewis: Yeah, we developed CAPx because we realized that in a competitive and growing environment, especially Google Shopping, which we’ve seen big growth in that area, and as I’ve mentioned, a lot of our clients are retail e-commerce brands and re-sellers, and in that environment, we really needed to develop a specific specialized tool that allows us to optimize around product performance and product data. There’s obviously a lot of things already built into AdWords that you can do and automate, and there are a lot of tools that plug in to AdWords that allow you to automate. But a lot of it is focused on the text ad side, and being that a large percentage of our spend and our investment is through Google Shopping, so we really wanted to develop a platform that focuses on that particular channel. Like I mentioned, there are a lot of tools that focus more around text ad management, but ours really wants to grab data from the Merchant Center and bring it into AdWords and allow those two systems to work together, as well as the reporting that we get as kind of a three-part system, Merchant Center, AdWords, and then our CAPx reporting and analysis. And so it has some features for text ad management. It has some things around keyword, search query, cohort analysis that we can utilize and leverage for text ads, but primarily it’s a Google Shopping-focused product management and product data tool.

Christina: So CPC Strategy works with tons of retailers and brands that will have thousands, if not hundreds of thousands, of products that you’re working with on a daily basis. That can be very tough to manage on search and shopping campaigns. So what are some examples of the bidding strategies that you utilize within CAPx?

Lewis: Yeah, so a really good one and a key one to talk about, specifically if we’re talking about brands that are going for brand versus non-brand kind of segmentation as we talked about ISO earlier, impression share tracking is something that’s really key. And a lot of brands or a lot of advertisers are not able to track accurately impression share within Google Shopping, so our CAPx tool actually allows you to pull back that impression share data and bake that into your bidding strategy. So you can look at products, for example, that might have a low impression share that are in your branded campaign and they’re doing well but there’s room to get more visibility on those. So that would be an example of one of our rules where we would say, if impression share is low on X product but performance is good, then let’s raise the bid on that product until it reaches a certain threshold. Another example, or a couple other examples, of basic rules that we would use would be what we would call pulling back on bleeders or high-cost products that are not performing well. We wanna make sure that we reduce bids continuously on those until we get them down to a more profitable level and conversely pushing up on low-visibility products. So there might be products in your catalog that are not getting a lot of visibility, they have really low impression share, but they have pretty solid performance, so in that case, we really want to focus on incrementally raising the bids on those products. So those are a couple of examples of rules that we would run within CAPx that are pretty standard and that work really well.

Christina: Speaking of your team strategy, last time we hosted you in the Google studio, we talked a bit more about your team’s ISO strategy, really looking at top performing keywords and using negative keywords, and advanced settings, and shopping campaigns to optimize for performance. How does CAPx or your technology play a role in this piece of the puzzle?

Lewis: Yeah, so CAPx and the ISO strategy really go hand in hand really well together. You can utilize CAPx without having an ISO strategy. It works on any kind of Google Shopping Ad structure, but it really plays well with ISO, because, like we mentioned in a previous video, the ISO strategy, to briefly give an explanation of it, is a way to target certain search queries rather than certain products, and it allows you to segment your campaigns based on the nature of the queries. So you can break out brand versus non-brand campaigns, or you can break out top performing searches versus lower performing searches. And so once you have that structure in place, the CAPx platform allows us to set up rules that are based on those different considerations. So, as I mentioned earlier, if we’re trying to set up rules to aggressively raise bids on top performers or lower bids on poor performers, for example, if we have an ISO structure set up where we have perhaps a brand campaign, maybe we’re a little bit looser, more loose on our rules for that, because we’re more willing to bid aggressively, whereas on the non-brand stuff, maybe our CAPx rules are a little bit more conservative. So that’s a good example of how the ISO and the CAPx play well together, because it just allows us to set up specific bidding logic based on the type of campaign.

Christina: It’s great to hear that your team is able to leverage your in-house platform and utilize it on a day-to-day basis to optimize campaign performance for your clients. Google definitely believes in the future of automation and leveraging technology to optimize your AdWords campaigns and really take your approach a step further, which just sounds like CPC Strategy is already on the right track to do so. Looking forward to hearing what’s in the future for CAPx down the road.

Lewis: Yeah, definitely, if you guys want any more information about CAPx specifically, then check out our blog at cpcstratblogsite.kinsta.com. Also, check out our YouTube channel and look for any other videos that are in the AdWords for Retail Brands Series. And if you wanna hit us up directly, feel free to reach out to us at [email protected], and we’d love to give you more information about our CAPx platform.

Christina: Thank you so much for joining us in the Google studio today, Lewis, and thank you for tuning in.

For more on how to optimize your Google Shopping Ads, email [email protected]