Shopzilla a Gamechanger in Q4? – Check The Facts

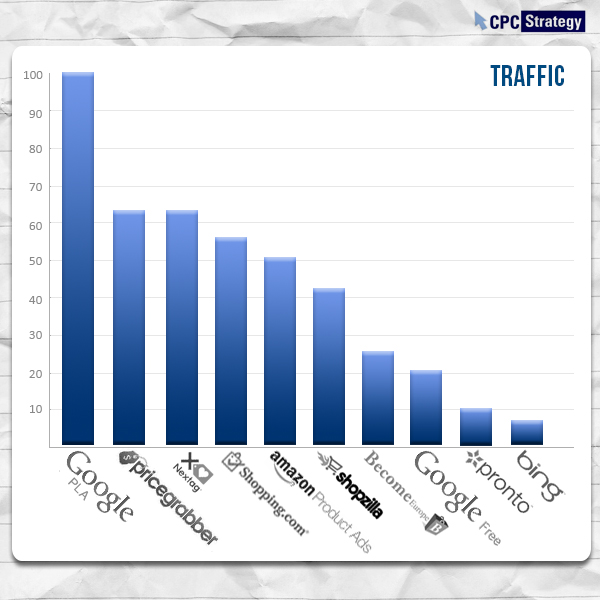

Our most recent analysis of the Top 10 Comparison Shopping Engines in Q4 revealed some unexpected truths but also some rather predictable realities. What we all saw coming was Google Shopping and Amazon Product Ads, 2 of the most recognizable names in e-commerce, to be among the main players during the crucial holiday shopping season. Certainly, we saw these 2 CSEs’ positions solidified as mainstay crutches when it comes to maintaining retail relevancy, but perhaps not all of us saw Google Shopping’s clear pull away on the final leg.

You have to really dive into the numbers to get a clear sense of which engines may be rising in popularity or conversely, slipping. This is important because persistent business owners always want to know what the proverbial bottom line is. Well, let’s check the numbers on what one of the most popular and fundamental CSEs out there today: Shopzilla.

Before we assess Q4 2012’s data, let’s see how Shopzilla performed a little over a year ago (most criteria are based on 10 CSEs).

Traffic: 2nd

Revenues: Tied for 5th

Conversion Rate: 9th w/ CR of 1.4%

Cost of Sale (COS): 6th of 7 paid CSEs w/ a COS of 27.5% Note: This COS stayed about the same in Q4 2012

Average CPC: 6th of 7 paid CSEs

Engine Responsiveness: 4th

Merchant Tools: 3rd

Overall Finish:6th of 10

Perhaps not one would call a stellar performance, but they can only improve from here, right?

To see Shopzilla’s traffic drop from 2nd in Q4 2011 all the way down to 6th in Q4 2012is disappointing to say the least. Fortunately, there’s somewhat of a logical explanation for this. Amazon was last Q4’s #1 finisher, but they, along with Pricegrabber, Shopping.com, and Nextag, fell short to the rapidly growing Google Shopping.

How did Pricegrabber, Shopping.com, and Nextag oust Shopzilla this year? All 3 of these CSEs had started listing their products on Google Shopping early on in 2012. Thus, they benefit from the huge traffic pool of the Google CSE. Shopzilla has indeed begun to do the exact same thing with Google, yet they are simply slowest to start doing it. What’s also reflected in these traffic rankings is Shopzilla’s more recent emphasis on lead quality. They made many changes to their traffic pool this past year, removing many of the low quality traffic sources that led to unqualified clicks.

Next Q4, we should expect Shopzilla to be among the top traffic performers once again.

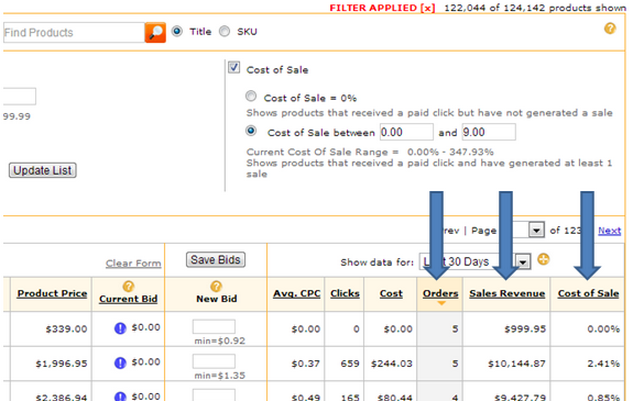

For the 2nd year in a row, we see Shopzilla finish 3rd among all major CSEs in merchant tools. There are 3 particular aspects of Shopzilla that make its campaign management perhaps THE easiest and most appealing to online merchants.

1) Zero-bidding: The zero-bid feature pretty much removes the need to entirely remove a product from your Shopzilla data feed. When you zer0-bid a product, you basically add that product to a back-fill of other merchants’ zero-bid products within that product category. Thus, when Shopzilla deems that there aren’t enough overall listed products in a given category, they pull zero-bid products from the queue. This is a great scenario for retailers because not only do they not have to remove a product from their data feed (and destroy hope of a sale entirely), but they don’t have to pay for any potential clicks that the zero-bid product may receive.

2) Filter Option: Just another tool that enhances the merchant management experience is the Shopzilla filter option. This feature makes the process of making bid changes and making product feed cuts more efficient.

3) Product Search: One of the fundamentals of Shopzilla bidding is that it allows for individual product bids. However, Shopzilla optimizes this idea even further with its product search bar that allows you to make product bids more quickly.

Shopzilla may not be a giant like Google or Amazon, but in this case, let’s revel in this truth. While the big guys tend to give retailers the cold shoulder, smaller CSEs like Shopzilla are pretty good at helping retailers out. Shopzilla ranks 3rd among all CSEs in merchant support, and so they’ll have your back when you’re experiencing those “dire emergencies” (budget runs out, campaign stalls, miscellaneous listing issues) with your campaign.

One of the more alarming findings was Shopzilla’s 30.56% increase in average CPC in Q4 from a year ago. The CSE’s average CPC in Q4 2012 was $0.47, and when comparing this to Q4 2011’s $0.36, we have the 2nd highest CPC increase in a year. Not great news for retailers. However, despite this average CPC increase, we see that Shopzilla’s Cost of Sale (COS) remained relatively consistent over the year, increasing only 1.8% at most.

To end on a brighter note, we can see Shopzilla’s conversion rate increase from about 1.4% in Q4 2011 to 2% in Q4 2012. However, interestingly enough we see the majority of CSEs’ CRs increase. What does this mean? Well, perhaps now more than ever are we starting to see shoppers make their purchases at home from computers and tablets. After all, this was a record year in online holiday shopping season sales.

Shopzilla’s Smart Pricing model is also to thank for the increase in CR. This feature essentially better aligns CPC charges with a given retailer’s conversions and cost of sale percentages, and one of its goals is to lead to higher conversion rates.

In the end, we see Shopzilla finish 7th overall in the Top 10 Rankings, just one place off of Q4 2011’s 6th place finish. But hey, this isn’t so surprising or alarming considering the meteoric rise of Google Shopping. Shopzilla is no doubt cemented as a mainstay CSE that many online retailers will utilize to maximize their company’s revenues. The reality is that while it may not stack up stat for stat with Google Shopping or even Pricegrabber, Shopzilla is still a lucrative marketing channel for thousands of internet retailers.