Amazon Prime Day 2024 Advertising Trends: Key Learnings Including Spillover Effects on Google and Walmart Ads

Prime Day 2024 was Amazon’s biggest Prime Day ever and advertisers were eager to bring in a slice of the record sales the event generated over July 16th and 17th.

Here we will examine some of the key ad trends we saw across Tinuiti’s client base this Prime Day, including whether there were spillover effects on platforms like Google and Walmart. These findings are drawn from anonymized data from programs that together have over $4 billion in annual digital ad spending managed by Tinuiti.

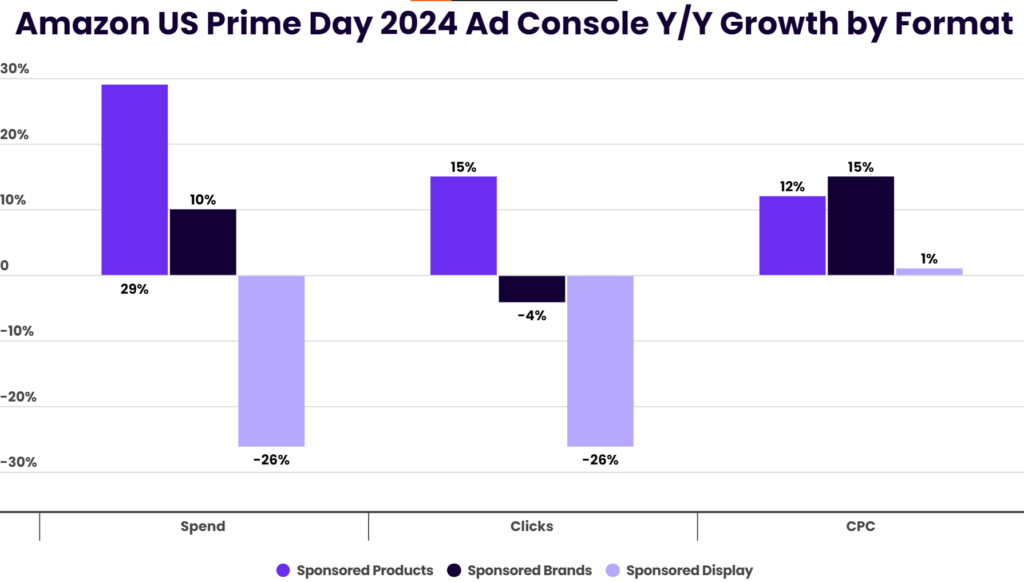

Across Amazon’s Ad Console formats, Sponsored Products, which accounted for over 80% Ad Console spend in Q2 2024, saw the strongest growth in advertiser investment over Prime Day 2024, with spending up 29% Y/Y compared to Prime Day 2023. Sponsored Product clicks were up 15% Y/Y, while average CPC was up 12%.

Sponsored Brands spending was up 10% over the Prime Day event, but clicks fell 4%, while CPCs rose 15%. Elsewhere, brands continued to pull back on Amazon’s Sponsored Display format, with spending down 26% Y/Y.

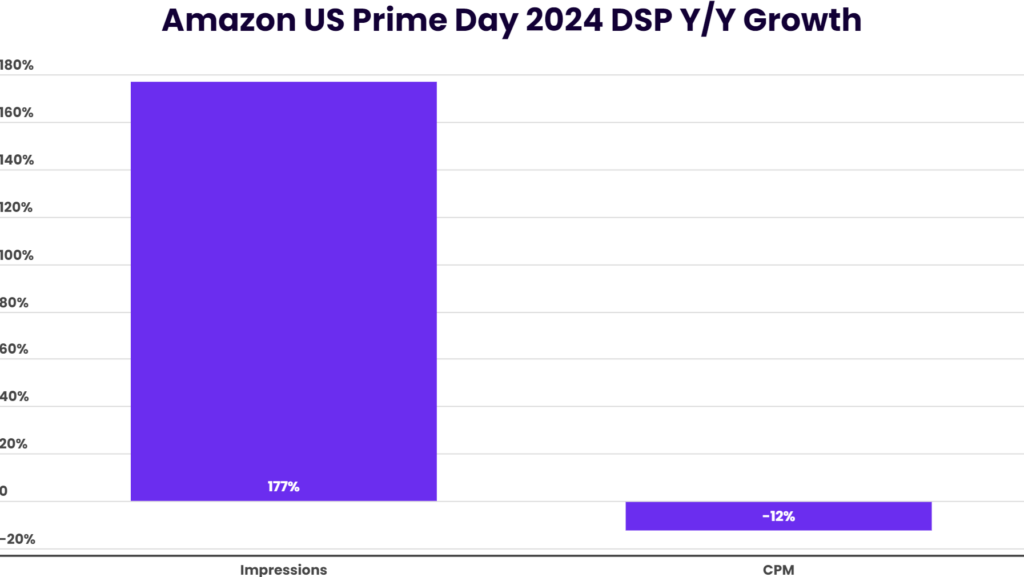

The decline in spending observed for Sponsored Display on Prime Day followed a 36% decline in Q2 2024. At the same though, advertisers have accelerated their investment in Amazon’s DSP display inventory.

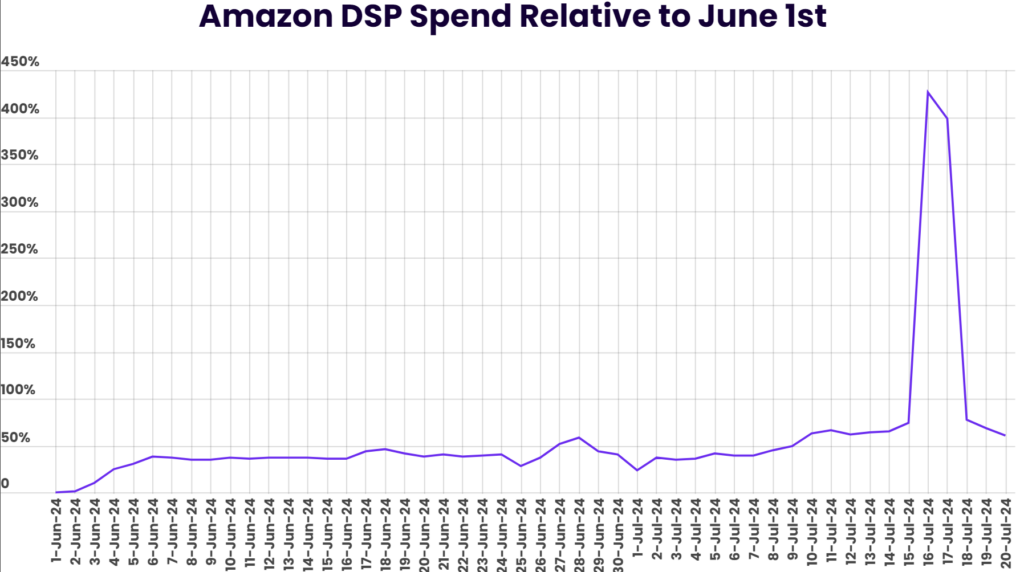

Relative to June 1st, spending on Amazon DSP ads spiked by over 400% across the two-day Prime Day event. In 2023, DSP spending also jumped relative to June 1st over Prime Day, but to a far lesser degree. Advertisers were also aggressive with DSP ads in the runup to Prime Day 2024, with daily spending in the week before Prime Day running 63% higher than at the start of June.

Ultimately, Amazon DSP spending grew by 143% Y/Y compared to Prime Day 2023. Advertisers saw a 177% increase in impressions with CPM declining by 12%. These figures were strong even compared to a solid Q2 2024, which saw Amazon DSP spend up 32% Y/Y on an 86% increase in impressions.

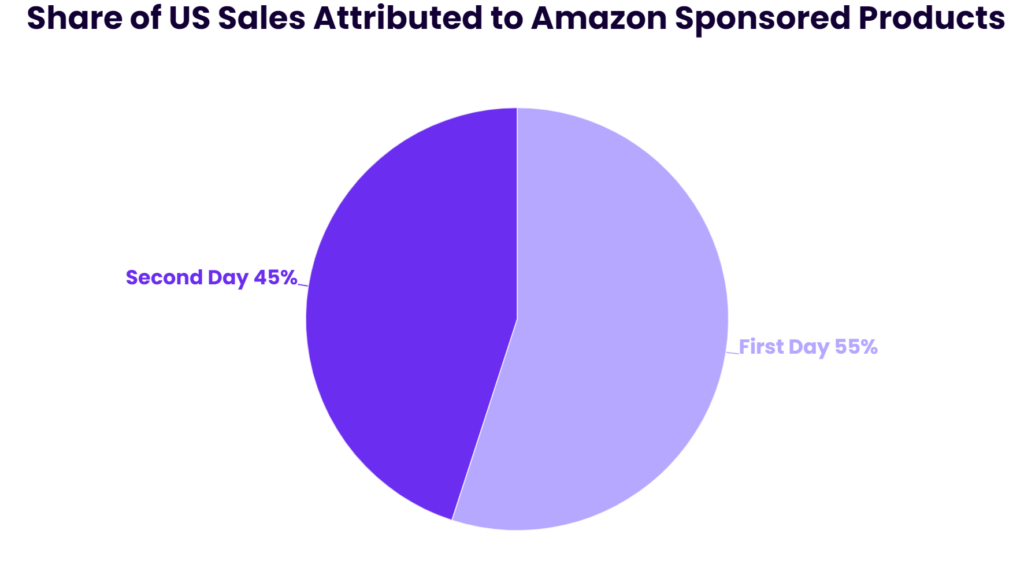

Between the two days of Prime Day 2024, advertisers generated a larger share of sales attributed to Sponsored Products on the first day, which accounted for 55% of Sponsored Product sales for the event.

Historically, the first day of Prime Day has been the bigger of the two days, but the difference can vary from year to year. In 2023, 61% of Prime Day sales from Sponsored Products were generated on the first day. In 2022, that rate was 54%.

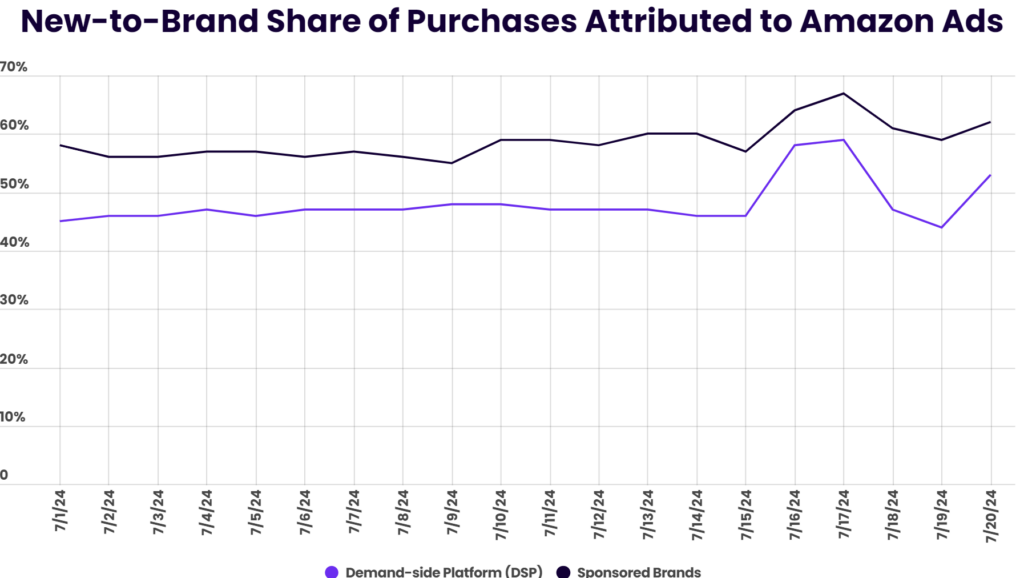

During Prime Day, Amazon advertisers have also tended to see an uptick in the share of purchases from new-to-brand customers and that held true again in 2024. For Sponsored Brands ads, new-to-brand accounted for 66% of Prime Day purchases, up from an average of 57% in the first half of July.

Amazon DSP ads see a lower share of new-to-brand purchases than Sponsored Brands ads, but they also saw a larger lift during Prime Day. In early July, new-to-brand customers accounted for 47% of Amazon DSP orders, but that jumped to 59% over Prime Day.

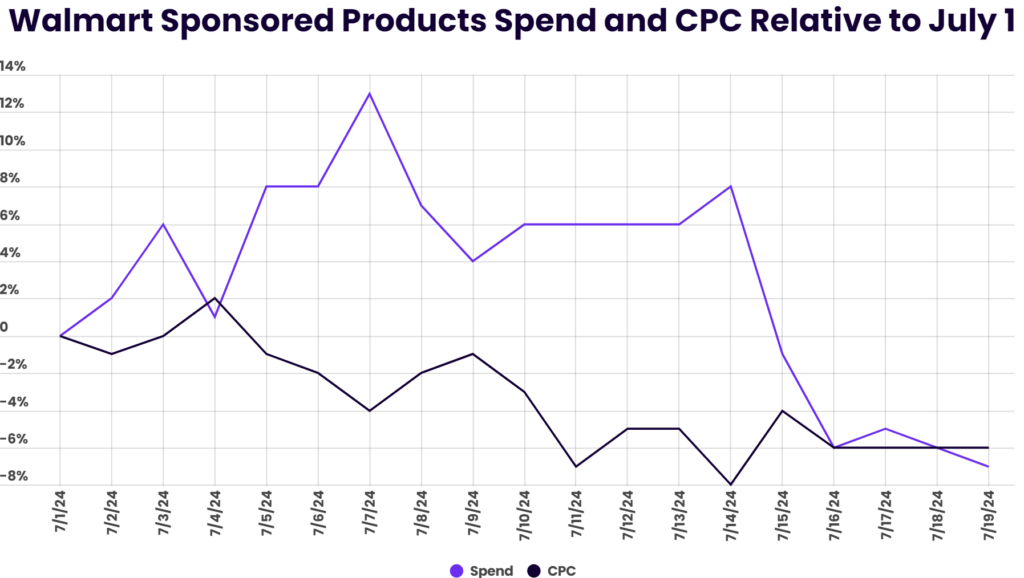

Ahead of Prime Day this year, Walmart ran its own similar “Walmart Deals” event from July 8th through 11th. Walmart billed this as its “largest deals event ever” and it did see a moderate increase in advertiser investment in Walmart Sponsored Product in the days before, during, and shortly after the event.

Relative to July 1st, spending on Walmart Sponsored Products was up 6% over the Walmart Deals event, but that turned into a 5% decline during the two days of Prime Day and a slightly larger decline over the next two days. Still, Walmart Sponsored Products have had a strong year so far, with spending up 45% Y/Y in Q2 2024.

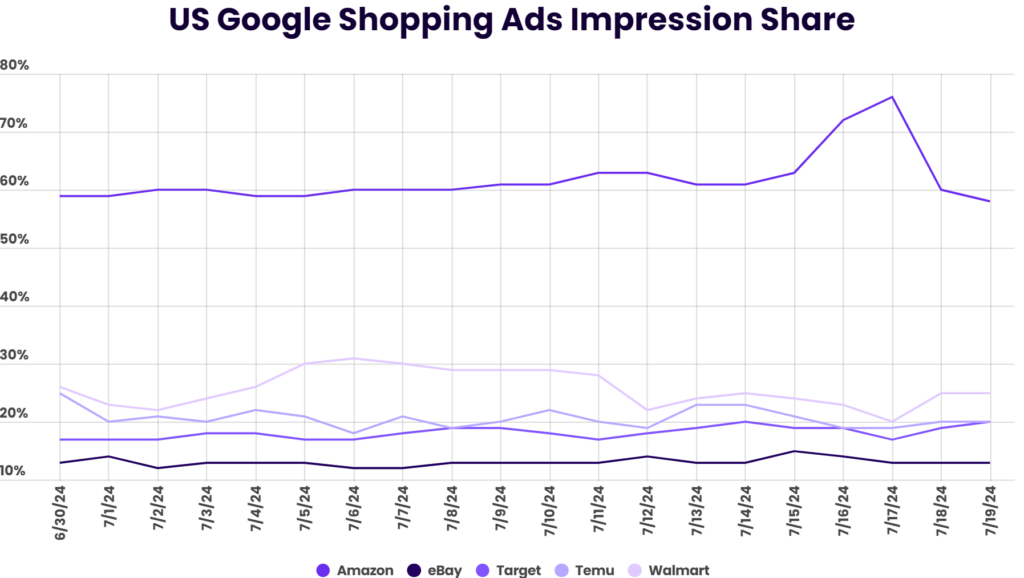

Although it notably stopped running Google shopping ads entirely during Prime Day in 2019, Amazon itself is usually a major advertiser on other platforms during Prime Day and has been ramping up its presence in Google auctions during Prime Day in recent years, including in 2024.

For the bulk this year, including the first half of July, Amazon’s share of Google shopping impressions versus the median retailer averaged in the low 60% range. Over the two days of Prime Day that jumped to an average of 74%, including 76% on the second day.

Like a number of major retailers, Walmart offered its own deals over Prime Day, but it saw its share of Google shopping impressions fall more than other brands, including eBay, Target, and Temu. Walmart’s median impression share fell from 26% in early July to 21% over Prime Day.

eBay, Target, and Temu, each saw their share of Google shopping impressions dip by a couple of points from the day before Prime Day to the peak of Amazon’s push in Google auctions on the second day of Prime Day, while Walmart saw a four-point drop.

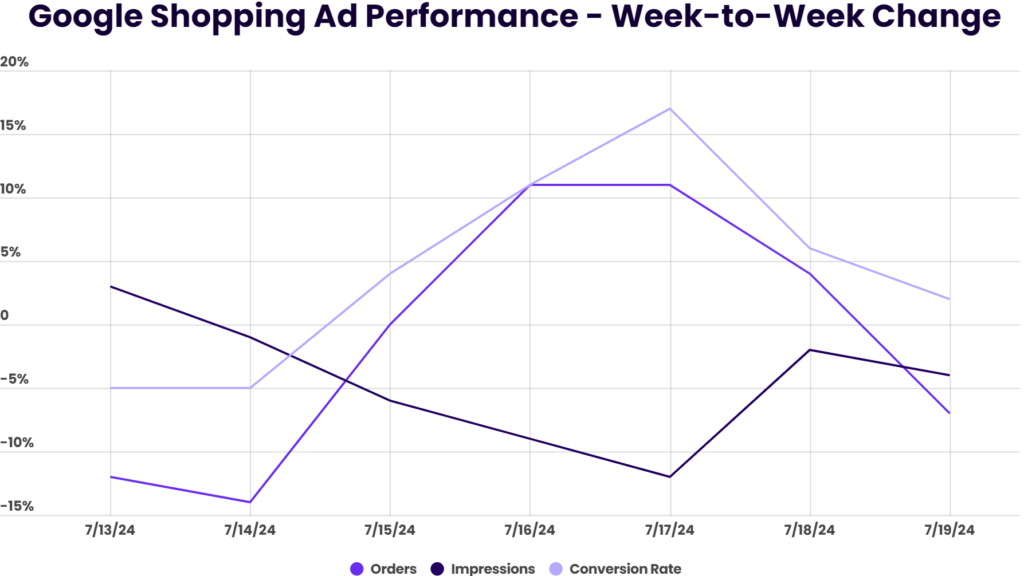

Prime Day and Amazon’s aggressiveness in Google auctions appeared to have a widespread negative impact on the number of impressions other retailers generated from Google shopping ads. However, retailers did appear to see some halo benefits from Prime Day to their Google shopping conversion rates and order totals.

Compared to the week prior, the median Tinuiti retail client saw its Google shopping ad impressions fall by 10% over the two-day Prime Day event. The bigger drop was on the second day of Prime Day, which correlates with Amazon’s Google shopping ad impression share peaking.

On a more positive note, retailer conversion rates for Google shopping ads were up by 17% from week to week during the second day of Prime Day, helping drive total order volume up by over 10%. Conversion rates picked up the day before Prime Day after running down by about 5% from the previous week, suggesting they may have been depressed a bit from consumers researching before Prime Day what they might buy during the event.

Following Prime Day, retailer conversion rates from Google shopping ads remained elevated from the previous week, but order volume was trending lower by Friday. With an event like this, there’s always some degree of demand simply shifting from one time period to another, so it’s important for brands to capitalize when they can.

For more on this year’s Prime Day, including tips on what worked best from Tinuiti experts, please see our post: Amazon Prime Day 2024: Results & Data Analysis for Sellers