Media Update: Walmart's Vizio Acquisition, TikTok Growth Flatlining, and Game Advertising Growth

After a brief dip, linear sports viewership rebounded in the week of the 25th as the men’s and women’s NCAA tournaments reached the Sweet Sixteen and Elite Eight. Monday’s game between LSU and Iowa came in as the most-watched women’s college basketball game ever, averaging 12.3M viewers, almost 25% more than watched their title matchup a year ago.

1. While Walmart’s purchase of Vizio (valued at over $2B) gives the retail giant a massive presence in consumer electronics, the real value of the acquisition is something less tactile – consumer data. Vizio TVs leverage automatic content recognition (ACR) technology to identify what viewers are watching, a much more granular and robust form of behavior tracking than traditional audience sampling (à la Nielsen). While Vizio currently licenses this data out to third parties such as iSpot, expectations are that Walmart may not renew these licensing deals when they expire. Instead, Walmart would use this data to power its own ad platform, Walmart Connect, making the service all the more enticing to advertisers.

While Walmart is getting most of the attention, the move also puts focus on competitors in the smart TV space, such as Roku, who third parties could potentially explore to replace Vizio’s data. Time will tell if these competitors will step up to the plate or if Walmart will become the outright leader in ACR. | WSJ

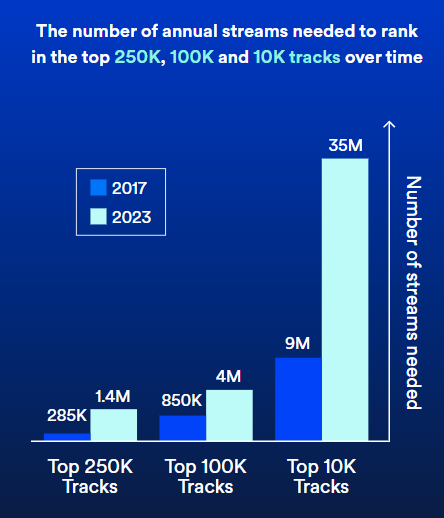

2. Spotify released its annual music economics report last month, showing the stunning rise of streaming audio listenership. The number of annual streams for the top-10K tracks has risen nearly four-fold since 2017, with similar jumps for the top 100K / 250K.

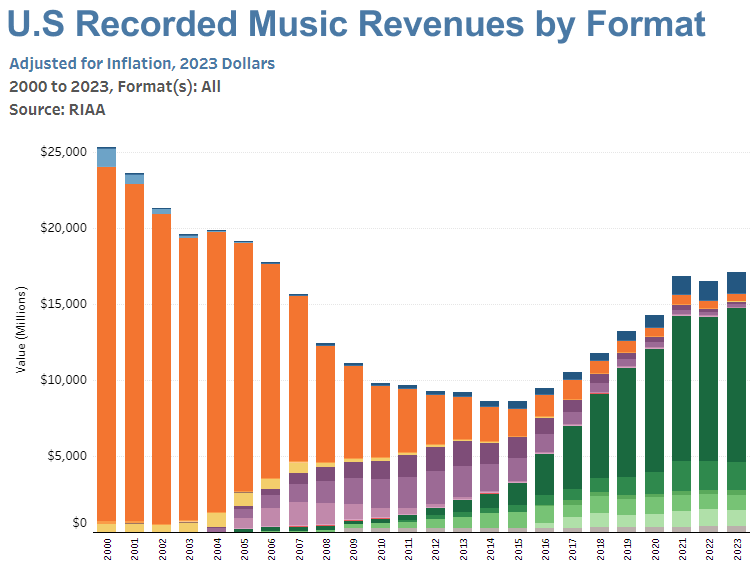

Meanwhile, the entire digital audio space claims an enormous portion of audiences’ media time; 75% of internet users engage with digital audio at a rate eclipsing major streaming platforms such as Netflix or Hulu. The below chart from RIAA shows how aggressively streaming has taken over the music space.

While physical media (orange) has essentially evaporated since 2000, so too has downloaded music (purple), being replaced almost entirely by streaming (green). The shift has been so dramatic as to bring music industry revenues to their highest levels in 15 years. | Spotify, eMarketer, RIAA

3. Many of you will surely recall the Peacock-exclusive NFL playoff game back in January. For those who don’t, perhaps this memento of the fourth-coldest game in NFL history will jog your memory:

The game was a big hit for Peacock. Not only was it the most streamed live event in U.S. history, it spurred the single highest day of U.S. internet usage ever! It was similarly impactful for NBCU, driving an incremental 2.8m signups, making it the single largest subscriber acquisition event in recent memory.

On the back of this success, Peacock has secured exclusive rights to the NFL’s week 1 game in Brazil, the league’s first foray into South America. This follows Prime Video’s takeover of Thursday Night Football, Peacock’s aforementioned exclusive playoff game last season, and Paramount+’s stream of Super Bowl LVIII in February. While fans may complain about having to sign up for additional services to watch their beloved football, it’s clear that the NFL is the sine qua non of American viewing and the major platforms are going to continue pursuing exclusives. | WSJ

Since TikTok first entered the digital media scene, it has positioned itself as an entertainment platform, citing as its competition the likes of Netflix and YouTube as opposed to traditional social platforms like Facebook and Instagram. It wasn’t until TikTok saw explosive growth in 2020 that Netflix officially named TikTok as one of its competitors as well.

For advertisers, much of TikTok’s narrative has surrounded the rapidly rising user time spent on the platform, boasting strong growth from 2020 to 2022. As of late, however, this momentum has seemingly hit a ceiling – Gen Z TikTok users are still spending over an hour and ten minutes on the platform, but growth in time spent seems to have hit a wall.

In an effort to continue positioning itself as an entertainment hub, TikTok announced in March that it has redesigned its creator monetization program to incentivize content over one minute in length, quite a break from its origins in fifteen-second videos. The company reported that its beta for this program yielded 250% more revenue for participating creators. It has acknowledged that for the platform to continue growing, it needs creators to grow in concert, and that has been reflected in reports on more diversified income sources for content creators.

What this all means for brands is that TikTok users are demonstrating that they don’t discriminate on content format, and will instead consume content that interests them and comes from their favorite creators. Creator and UGC content will continue to be important aspects of successful ad campaigns on TikTok, and it will become even more important to align the right audience with the right content. TikTok users have shown that they are willing to invest the time into the platform, so brands need to be impactful with capturing their attention. Opportunities to do this include leveraging more influencer packages, rotating them throughout the year, and being more thoughtful on which trends a brand joins in on to ensure they’re participating in an authentic and unique way to stand out within the feed. | eMarketer, eMarketer, TikTok For Business

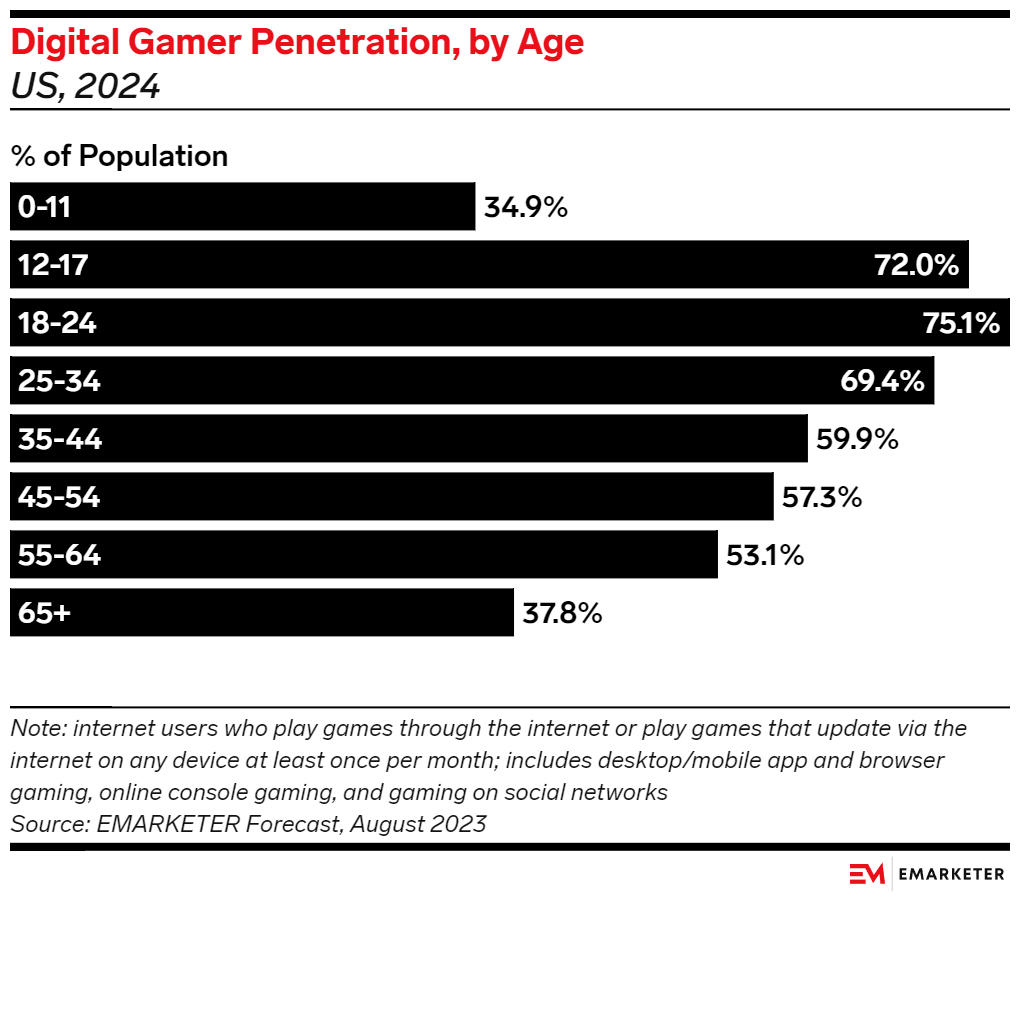

The gaming sector is burgeoning as an advertising medium. Since the launch of Twitch in 2011, the gaming industry has been evolving, building online communities across the world and producing innovative advertising opportunities. To highlight these advancements, the IAB hosted its third-annual Playfront last week in New York, where it released its Changing the Game study, outlining the impact of game advertising and calling game advertising a brand-safe and effective channel to engage users throughout the consumer journey.

A key takeaway from the report is that 40% of advertisers surveyed said they are planning to increase investment within the gaming channel. This aligns with an updated eMarketer forecast, projecting that ad spending in the gaming industry will grow by 34% over the next 4-years, exceeding $11B by 2028. The growth in advertiser demand is also paving the way for new advertising opportunities.

Gaming is a particularly interesting channel to many advertisers because it affords an opportunity to reach otherwise hard-to-reach audiences. To put it bluntly, older people in the U.S. are easy to reach because they watch so much TV, and women are relatively easy to reach because they’re heavy social media consumers. But younger men are much more elusive, which is why the combination of gaming and advertising is so intriguing. And gaming is now deeply penetrated:

Last week, NVIDIA and PlayerWon introduced a pre-roll ad product for cloud gaming, which serves while users wait for the game to become available. The value exchange allows a brand to be front-and-center and brings a previously paywalled game to players; in essence, the advertiser says to the gamer, “Let us buy this game for you.” These advancements allow brands more opportunities to engage with the diverse 200+ million U.S. gamers in a creative manner and reinforce the modern adage, everything is an ad network. | eMarketer, eMarketer, IAB, ESA

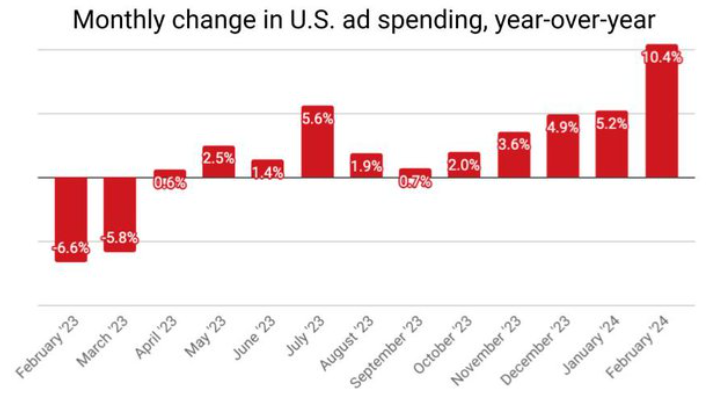

We told you last month that the U.S. ad industry had posted its tenth consecutive month of YoY growth in January; that streak has now extended to an eleventh month, and February’s numbers show a significant acceleration in ad spending growth, posting the first double-digit gains in over two years.

This data point is consonant with a broadly more optimistic feeling among ad industry participants. Key industry forecaster Magna raised its 2024 projection for the U.S. ad market to $369b, representing 9.2% YoY growth for the full year. Magna’s previous projection was growth of 8.4%, so this latest revision indicates a more optimistic view of advertisers’ ability and desire to invest.

It should be noted that the +9.2% figure represents some cyclical components, namely the upcoming Summer Olympics and the presidential election cycle this fall. Without those factors, YoY growth would be about 6.7%, up from the previous forecast of +5.9%.

From a vertical perspective, the picture is an inversion of the ‘20 – ‘21 pandemic years: retail and travel are both expected to grow by 9%, while entertainment (-4%) and technology (+1%) are not expected to see material growth.

Finally, Magna expects CTV to hit the $10b milestone this year, helped along by the January launch of advertising on Amazon Prime Video, a huge viewing surface. Streaming ad sales are expected to capture about 22% of total TV ad revenue this coming year. | MAGNA, AdExchanger, WSJ

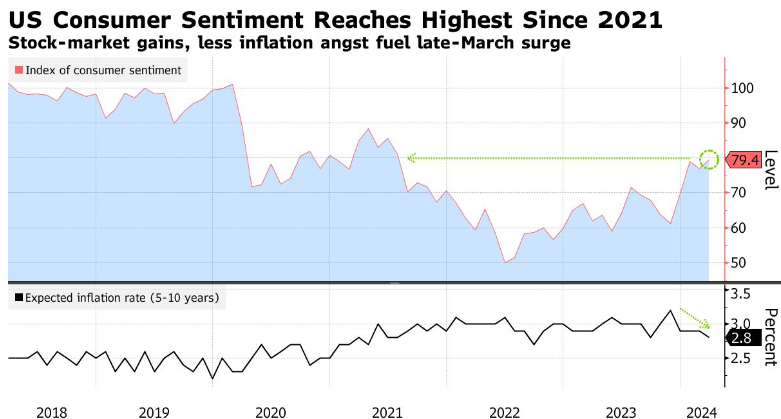

1. We told you last month about the consumer confidence index having see-sawed a bit recently, with a notably large increase in February being followed by a sudden downturn in March. A feature of high-frequency data on slow-moving economic indicators is that what seems like signal can be just noise; that may have been the case with the previous reading, as the US consumer sentiment index reverted to its upward trend in March and hit its highest level since July 2021.

The improvement in sentiment seems to broadly track improvements in the macroeconomy, including inflation (both measured inflation, and consumers’ forward expectations of inflation) and overall growth: GDP rose by an annualized 3.4% in the fourth quarter, the second-fastest pace across the last eight quarters stretching back to the start of 2022.

For all of these positive trends, it is worth keeping in mind how far we remain from a pre-pandemic consumer mindset. Sentiment understandably plummeted in early 2020, and we’re still quite a long way from climbing out of that hole (from a psychological standpoint at least). | Bloomberg

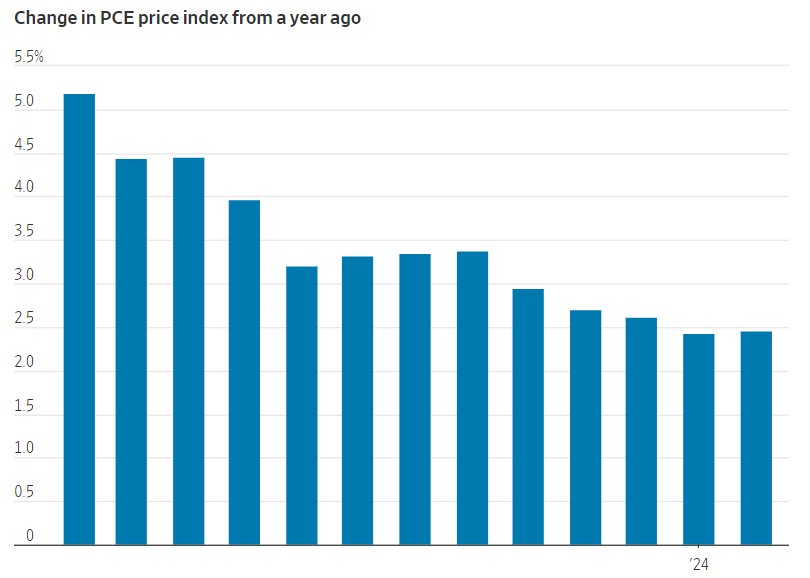

2. The Fed’s preferred inflation gauge (the personal consumption expenditures series) rose in line with most economists’ expectations last month: the PCE price index rose 2.5% in February from a year earlier, while so-called core prices (which exclude food and energy) rose by 2.8%.

The glass-half-full reading of the new data point is that it further solidifies a picture of sustained disinflation, with the pace of consumer price increases having fallen significantly and consistently from its peak of 7.1% in June of 2022. The glass-half-empty reading is that 2.8% is still too high; the Fed’s dual mandate includes achieving low and stable inflation, which the Fed judges to be 2% per year. Inflation, as measured by the PCE, has now been above 2% for three full years.

The current readings are in the Fed’s wait-and-see zone, with markets pricing in a 64% likelihood of a rate cut by June but the Fed stressing “we don’t need to be in a hurry to cut.” | WSJ