The 7 Biggest CPG Industry Trends & Tactics For Brands

The consumer packaged goods (CPG) industry has evolved rapidly to meet consumer demands thanks to digital technology that has allowed brands to carve out markets by selling directly to customers, from online ordering and delivery to personalized meal kits and more.

We’ve seen retail giants (and now CPG industry leaders), Amazon and Walmart, launch their CPG marketplaces to capitalize on changes in consumer behavior, emerging channels, and the advent of smaller customer-centric digital brands that are taking over the CPG industry.

The Coronavirus has shifted even more demand on consumer goods marketers to offer their products and experiences online, further accelerating CPG trends and innovation.

“In many markets today, the online model, more accurately the online plus offline model, has the potential to offer better value to shoppers — on price, convenience, and choice. That said, it’s not totally clear that these advantages will persist for all time, the intensity of competition today gives shoppers benefits like 2-hour lead times and free delivery.”

-Peter Freedman, Managing Director at The Consumer Goods Forum

Here are seven of the biggest CPG industry trends and opportunities that CPG brands are capitalizing on in 2020.

Convenient and increasingly affordable, delivery is an industry that changes nearly every year.

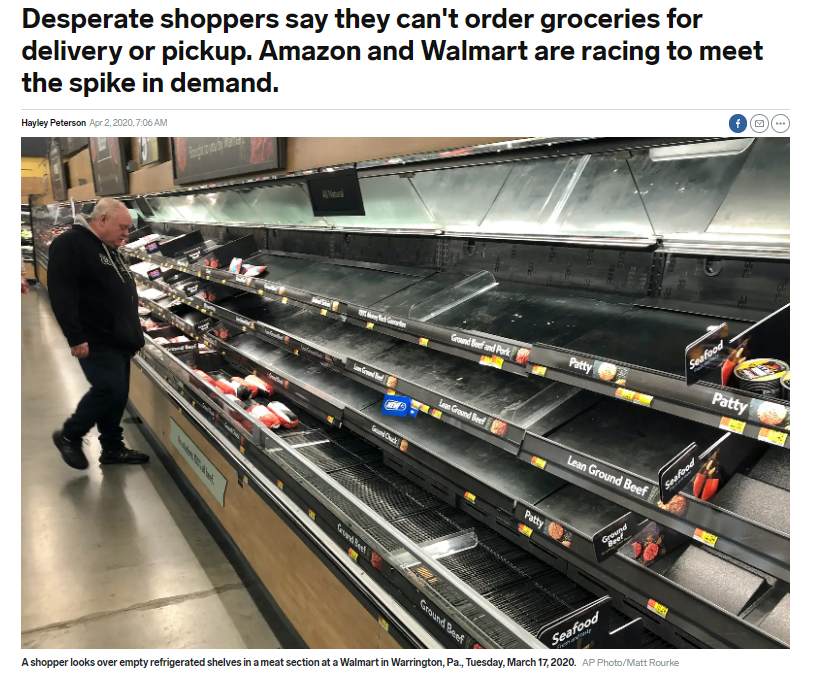

But with increased demand from global events like COVID-19, retailers in the consumer goods industry are being put under additional pressure to adapt to current purchasing behavior.

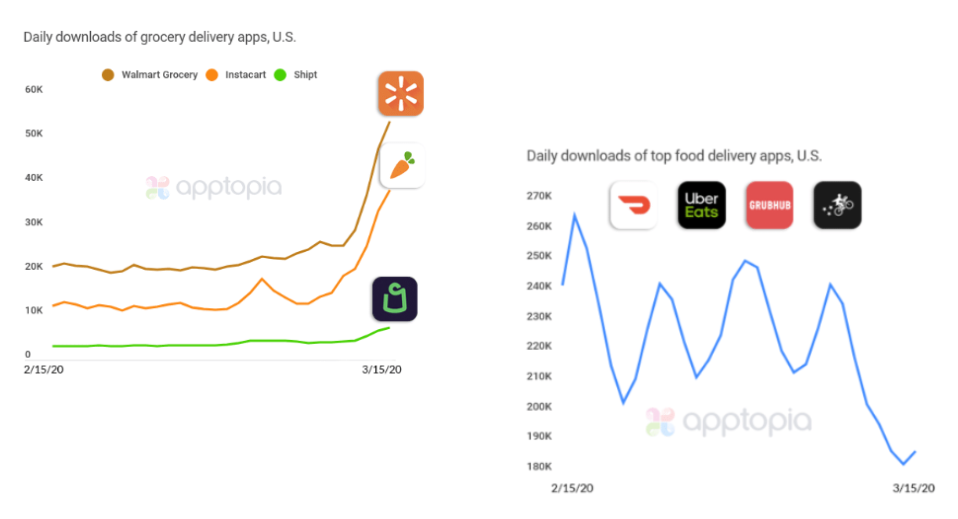

Moreover, since the outbreak of COVID-19, delivery apps have surged in the marketplace. As the virus continues to spread, consumers are becoming more and more hesitant to shop in brick-and-mortar locations, instead turning to more delivery-based services.

Amazon and Walmart’s delivery operations are emerging as major winners as consumers flock online for CPG products that they would have otherwise purchased in-store.

App-based research firm Apptopia provides more data-driven insight on this topic, spanning the period of COVID-19’s first influences on in the US market.

Due to rising infections and frenetic consumer behavior (such as Nielsen reporting a 23% increase in retail sales) the current state of the delivery market for the CPG industry is unpredictable but should likely stabilize and have stronger demand prior to Coronavirus.

Consumers, especially now, are unpredictable. However, a solution to this unpredictability is to meet them wherever you think they might be.

Do not assume the whereabouts of your target market, however. Invest time in researching their shopping habits.

If you are a digital retailer with a comprehensive digital marketing plan, you are likely already ahead of the curve.

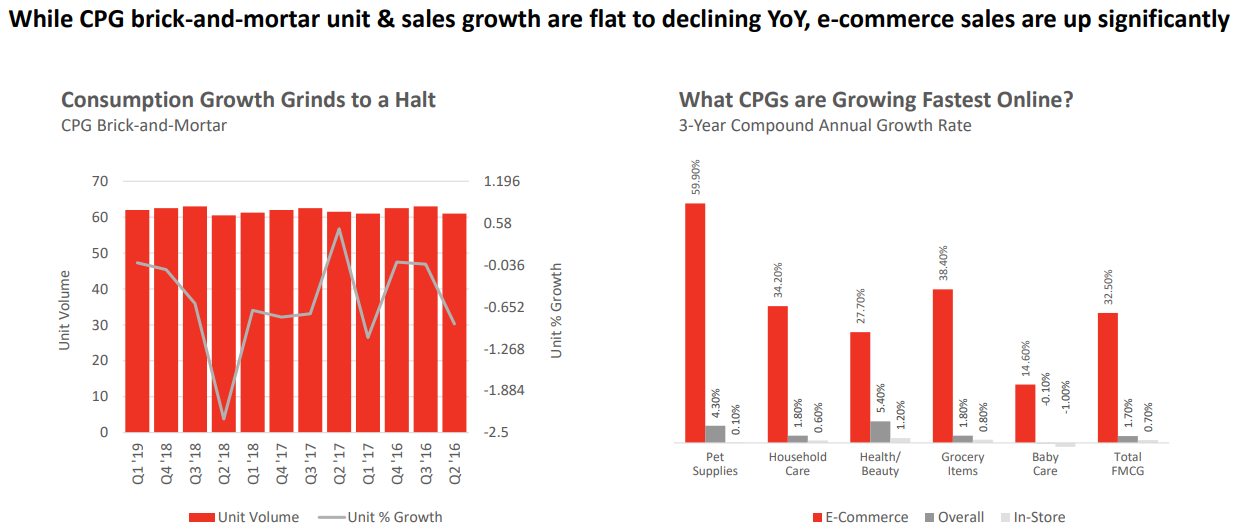

Over the past year, online channels contributed to nearly 70% of overall CPG growth.

As the lines between digital and physical shopping experiences blur, retailers need to make sure to be agile and responsive to customer needs with branded touchpoints at all parts of the buying journey.

“Indeed, there seems to be increasing alignment on what that future looks like: some variant of bricks & mortar and digital that is a bit different depending on each local market,” says Freedman.

“But the real challenge, whether you start as a digital or physical retailer is how quickly you get can get to that vision while still making money in the process.”

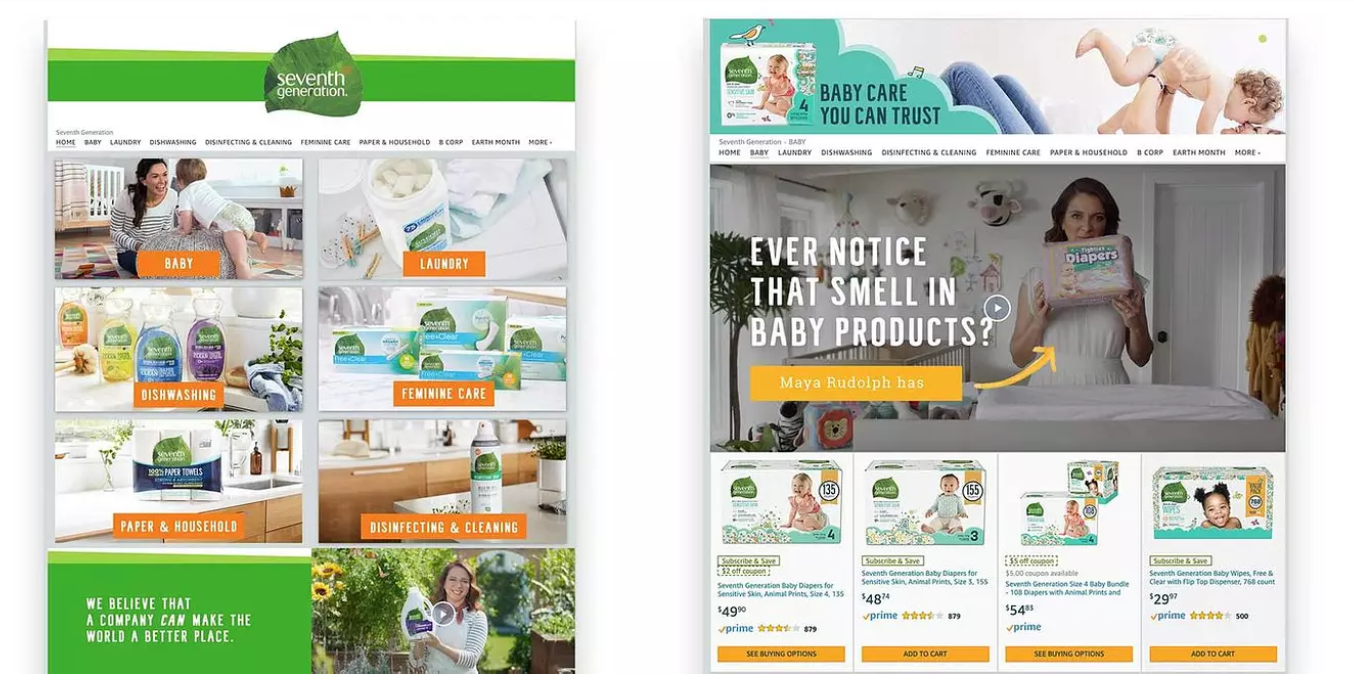

The Honest Company made a name for itself by promoting natural, sustainable ingredients in its baby products. Seventh Generation emphasizes plant-based ingredients and recyclable packaging.

Online consumers are more eco-oriented than ever before. In fact, CPG industry sales and marketing leader, Acosta, reports that more than 73% of consumers are willing to change their purchasing habits to improve the environment.

“Millennials and Generation Z are very concerned about issues that, incidentally the Consumer Goods Forum focuses on – that is the future of the planet and the people on it,” says Freedman.

In addition to sustainable practices, showcasing authenticity & brand values in all aspects of your CPG products will lead to higher yields and more loyal customers over time. In fact, 50% of CPG growth from 2013 – 2018 came from sustainable products alone.

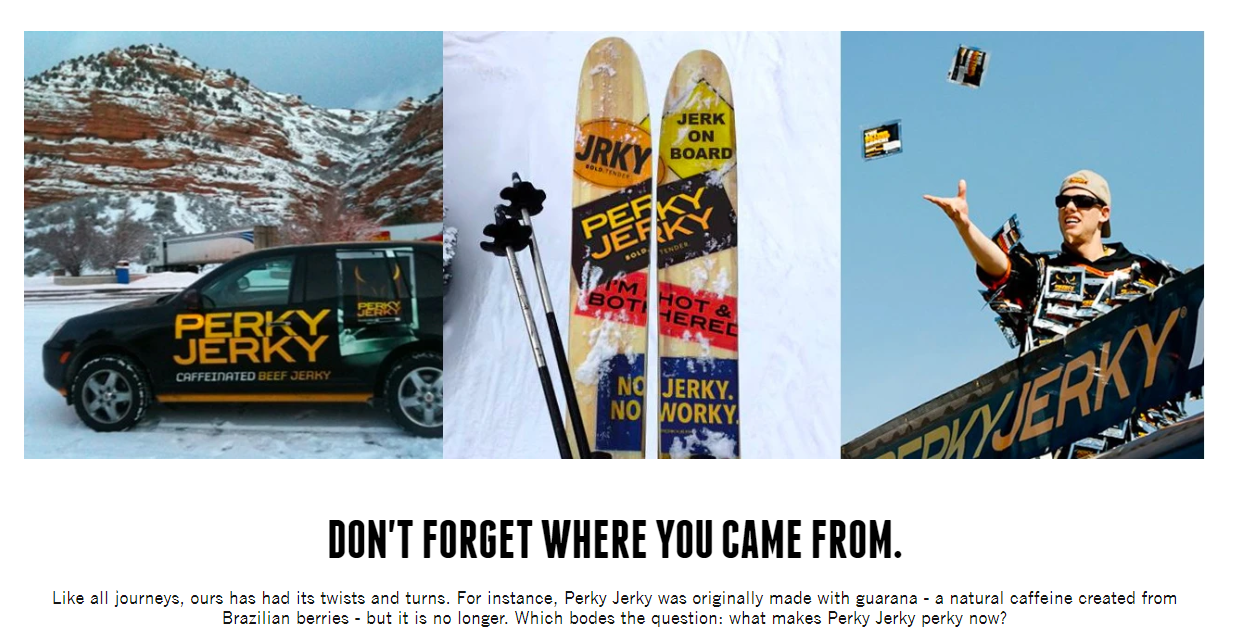

For example, Perky Jerky‘s founder, Brian Levin, advocates for disability awareness throughout his messaging and donates a portion of sales revenue to Down Syndrome and Muscular Dystrophy research.

“Many simply will not buy brands or shop in retailers that don’t in some way provide real leadership on issues like environmental sustainability, human rights, and health,” elaborates Freedman.

By aligning your products with a sustainable cause, authentic story, and company values, you can surely grow your business and brand-awareness — all while staying on-trend.

In 2019, self-care, CBD, and plant-based products were the strongest performing trending products across the CPG industry.

In 2020, they are continuing to outperform almost all other products, revealing themselves as some of the most lucrative trends. A deeper dive into the data illustrates some key findings for the coming months:

Take, for example, consumer brand BOTA, which is ahead of the competition, offering plant-based, CBD-infused skincare and self-care products.

About these breakout CPG industry trends, Colin Stewart of ACOSTA states that “Healthfulness is becoming increasingly important to consumers as nearly 66% of U.S. adults agree it has a significant impact on their food and beverage purchase decisions.”

In 2020, the total market size of the subscription e-commerce market is estimated to be about $12 b to $15 b, and is expected to grow. Subscription models are notorious disruptors of the direct-to-consumer brands disrupting the CPG industry.

Replacing the brick-and-mortar store with a digital experience offers more convenience and value for the customer. Buyers no longer have to leave their home or jostle with other shoppers in-store. The delivery process is completely automated, saving the customer precious time.

Many of the subscription models leverage data in order to curate precise recommendations or services for the specific customer’s needs, with powerful results.

Leaders in subscription research, clutch.co reports that more than half of online shoppers (54%) say they subscribe to a subscription box service. The subscription box industry appeals to consumers’ desire for convenient, novel experiences.

In 2019, the top 5 CPG subscription box services were:

Customers that purchase CPG products make repeat purchases, making many of these brands a perfect fit for the subscription model.

As technology improves, so does the ability to personalize consumers’ products.

There are many tools available to understand your shoppers’ needs: online assessments, machine learning, chatbots, and artificial intelligence.

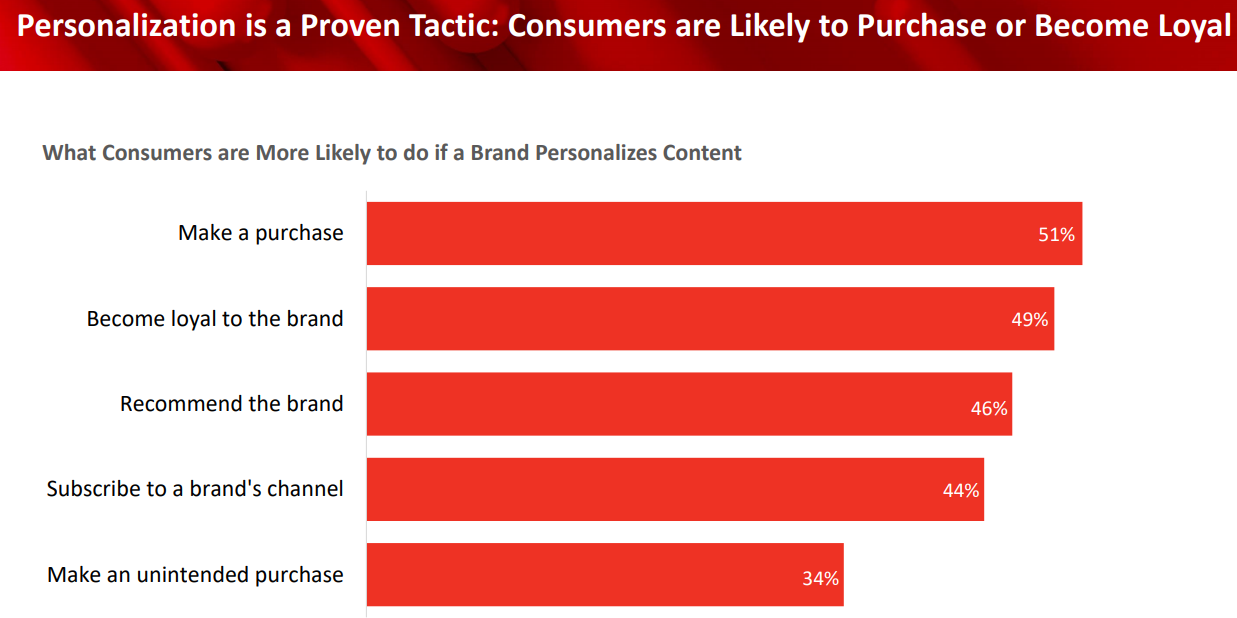

But why invest in personalization for CPG products at all?

First, the value of personalization is well documented. On top of increased sales and loyal customers, personalization strategies gather huge amounts of data that you can leverage for future brand experiences.

Second, many successful CPG personalization experiences follow a similar (yet simple) formula.

After shoppers have submitted their preferences online, they are able to purchase a product that is personalized for them. As both the customer has invested time into the service and the product cannot be copied by other businesses, consumers may be less likely to switch brands.

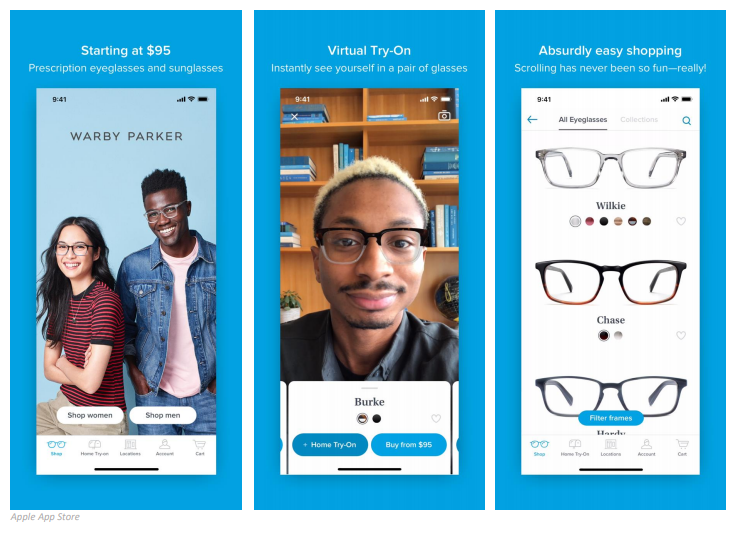

Third, as shoppers provide information about their habits, preferences, and body type — such as hair type or skin condition — brands can utilize this data to inform their future product design and marketing efforts. Another great example from IAB’s brand report Warby Parker’s Virtual Try-On App.

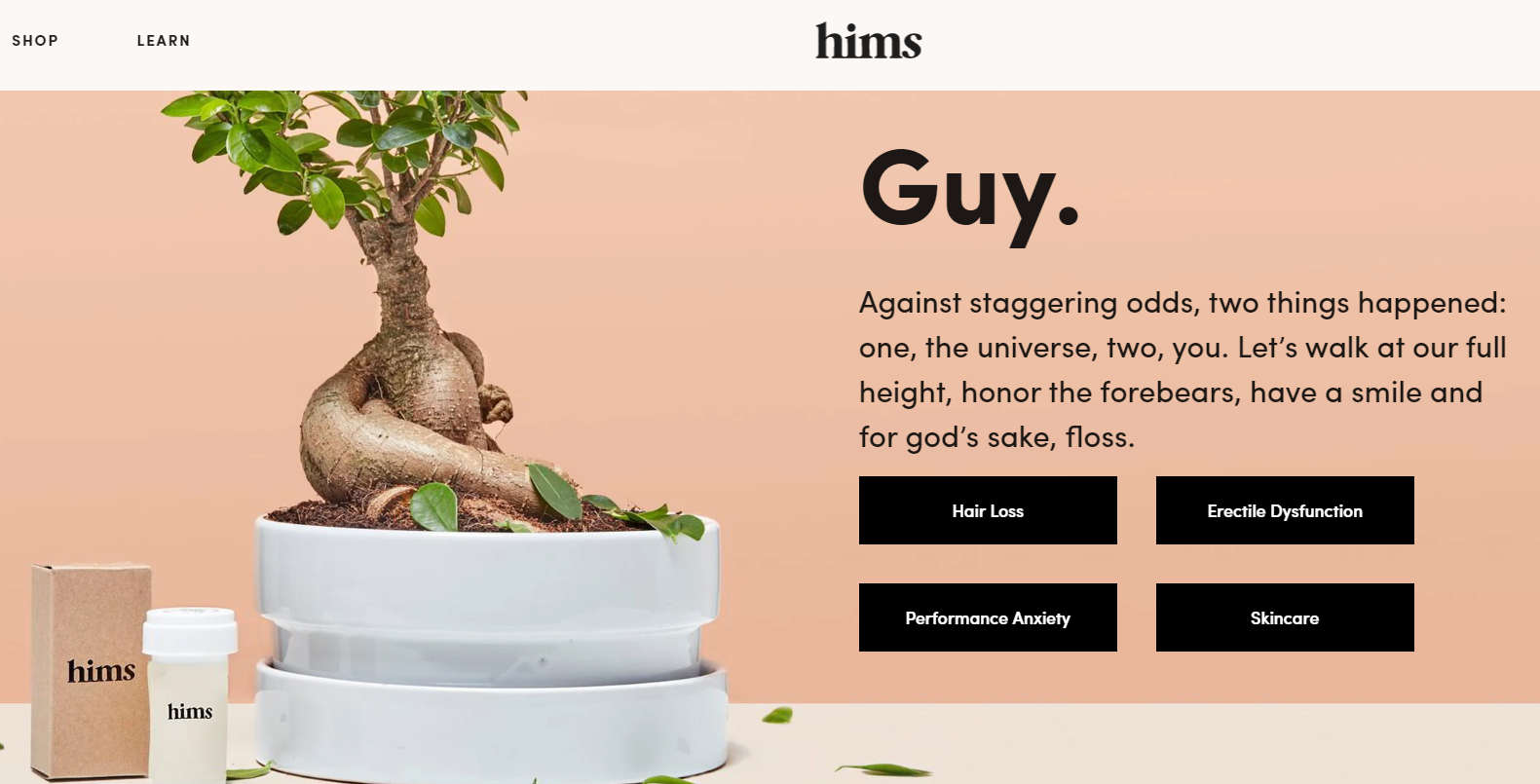

And, finally, a CPG startup with a highly-personalized and robust data store — like Dollar Shave Club, Hims, or YourSkin — is a much more attractive acquisition for CPG leaders.

Since the outbreak of COVID-19, the online grocery shopping industry has undergone many transformations and smart DTC brands will adapt with the shifts, not against them.

Online grocery sales are still on track to make up 20% of all grocery sales, becoming a $100b market by 2022, but consumer behaviors in the time of COVID-19 change frenetically — depending upon the latest news.

In the four weeks leading up to March 12, 2020, ACOSTA – CPG industry sales and marketing research firm – reported that:

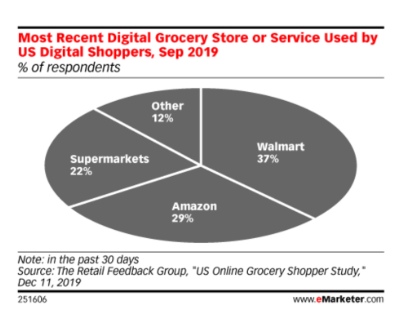

Despite complications from COVID-19, Amazon and Walmart will continue to lead online grocery through 2020 and beyond. CPG industry research firm eMarketer posits that 37% of US digital shoppers most recently purchased groceries from Walmart, compared with 29% who used Amazon.

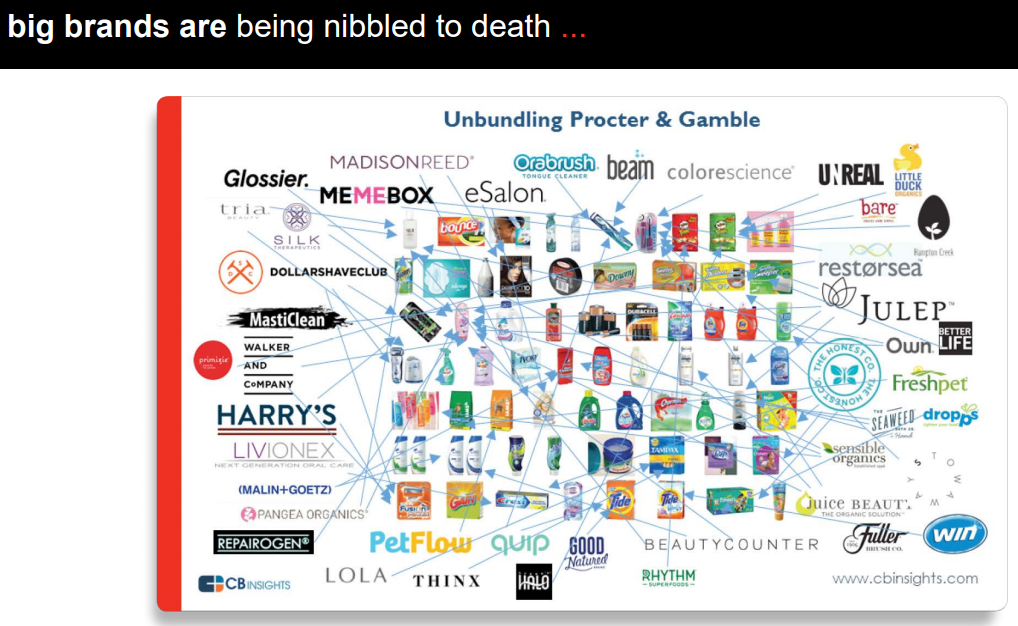

“New CPG brands are entering markets dominated by big-box retailers and selling similar products in a way that addresses the exact pain points of their niche target market. They’ve given a fresh take on an old product and can project themselves as something new and worth trying.”

— Ben Whitrock, Senior Growth Media Manager at Tinuiti

Though Walmart currently has the advantage in the marketplace, Amazon’s free, fast shipping could carry the company over the finish line with shoppers. Many changes in Amazon’s business model, like eliminating Amazon Fresh’s monthly fee for Prime members and expanding for the third time, have made their presence significantly impactful in all major US markets.

As 2020 heads into continuing uncertainty with COVID-19, CPG companies cannot overlook or underestimate the impact their spend has on the bottom line. Focusing on consumer behaviors, food trends, and breakthrough technologies is the key to success for digital retailers in the CPG industry.