The 2019 Prime Day Recap

2019 Amazon Prime Day tells a unique story than previous years. Due to an increase in competition from Walmart, Target, and Best Buy paired with press surrounding the Warehouse strikes and EU Probe Investigation – it was absolutely vital for retail brands to have a sophisticated Prime Day advertising strategy heading into the self-made summer holiday. And for those who did – the payout was big.

According to Adobe Analytics, which said it tracks e-commerce transactions at 80 of the top 100 U.S. online retailers, brands with over $1 billion in annual sales saw their sales on average jump 68% on Prime Day this year (July 15 &16), compared to a regular Monday and Tuesday. Adobe confirmed Prime Day passed $2 billion in revenue, a benchmark that has only been hit three times outside the Q4 holiday season.

But don’t feel bad if you weren’t able to snag the $13,000 camera gear (accidentally sold for $100 on Prime Day), according to our team there were still plenty of popular deals to choose from including the new Echo Show 5 and Fire TV streaming sticks along with more every day use items including Crest Whitestrips, baby products, and office supplies.

With a current list price of $119 per year, a Prime subscription entitles members to free, fast shipping as well as access to Amazon’s streaming content library and a host of other perks. Members also have a shopping event all to themselves, Prime Day, that last year beat Amazon’s Black Friday and Cyber Monday sales.

When Amazon debuted Prime Day in July of 2015 to celebrate the site’s 20th anniversary, bystanders griped about another manufactured holiday being added to the commerce calendar. But the event has grown every year since then, with last year’s Prime Day out-earning Amazon’s Cyber Monday and Black Friday sales events.

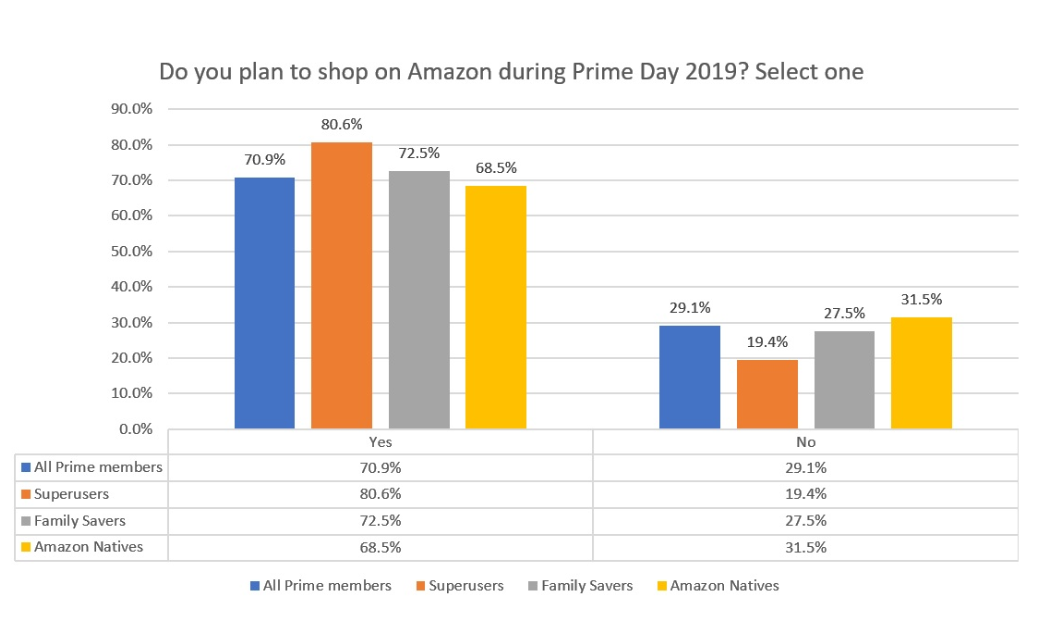

This year, the promise of more than 30 hours of steep, exclusive discounts was certainly attractive for Prime members, nearly 71% of our respondents to the Tinuiti Amazon Prime Shoppers Survey said they planned to shop on Prime Day this year. Amazon Superusers (also known as individuals who spend $100+ on Amazon per month which includes about 30% of Prime members overall) were especially enthusiastic, with more than 80% planning to participate.

In contrast, we found that members of Gen Z were less likely than Millennials to take advantage of the occasion, with just 68.5% saying they’ll participate — 3.3% lower than the average Prime member. The lower level of enthusiasm among younger shoppers may be due to more limited access to disposable income, or it could be a generational distrust of brands and advertising.

By now, most sellers understand that being proactive and having a Prime Day strategy in place is a must.

Whether or not merchants decide to sell on the Amazon platform, they should have a promotional messaging strategy around Prime Day so that Prime members who visit their sites to price-check encounter a compelling reason to stay and buy.

“The most successful brands are those which are not seeking ways to fight or resist the impact of Prime Day, but rather to leverage it as a unique opportunity to amplify the exposure to their brand and their products,” Pat Petriello, Head of Marketplace Strategy at Tinuiti said.

“One of the most powerful aspects about Prime Day is that it gives a brand mass visibility to shoppers who may not have otherwise seen or been aware of that brand. Brands can run coupon and deal campaigns on their own site and in other channels in parallel with Amazon so that no matter where a potential shopper initiates their interaction with the brand, they’ll be getting a consistent and customer-friendly experience.”

It’s nearly impossible to cover Prime Day 2019 without mentioning three issues that may have had an impact on Prime Day shoppers:

1. Increased Competition from eBay, Walmart, & Target:

Although Amazon invented the self-made summer shopping holiday, retail competitors including Walmart, Best Buy, Target, and eBay all invested in their own marketing campaigns to lure shoppers.

Reports indicate data from global search intelligence company Captify shows “that while Amazon’s search traffic (“search index”) was up 184% yesterday compared with the two days prior to Prime Day, Walmart achieved gains of 130% and Best Buy trumped all major retailers with an index increase of 255%.”

According to Forbes, “Amazon competitors are not only copying Amazon’s massive 48 hours of hot deals, they are creating events of their own for consumers to look forward to. And it’s working. Best Buy, Walmart and eBay all saw significant increases in search index during the first 24 hours of Prime Day.”

2. Amazon Warehouse workers go on strike:

Workers at the Amazon Fulfillment center in Shakopee, Minnesota organized a six-hour work strike on July 15, the first day of Prime Day. Protesting “inhumane conditions”, reports indicate Amazon is using a “severe efficiency metric called the rate to surveil employees’ productivity.”

3. Amazon Facing Probe in Europe:

According to CNBC, the European Union’s antitrust chief is planning to open a formal investigation into Amazon in coming days, Bloomberg reported Tuesday, citing sources familiar with the case.

In September, EU Competition Commissioner Margrethe Vestager launched a preliminary probe. This preliminary investigation will focus on how Amazon uses data on its third-party merchants that sell through Amazon.

Regardless of the recent news reports, at Tinuiti we still saw significant wins across the board for many of our clients. I sat down with our Amazon experts to find out which tactics were the most successful on Prime Day and what we can expect in the week to follow.

With the amount of competition there is on Amazon now compared to the first Prime Day, brands can no longer ride the wave on Amazon Prime Day. You have to increase your competitiveness by giving your customers the deal(s) they are looking for.

The “Prime Day” badge was a great way to do just that. Prime Day badges incentivized buyers to watch certain deals closely or add products to their Wishlist to buy later. Amazon rewarded those brands with additional free real estate in category-specific deals pages and Amazon’s main “Deals” page, which had the most traffic throughout Prime Day(s).

“From what I saw, having a “Prime Day Deal” badge early on Monday morning was the most successful,” Tony Heuer, Marketplace Channel Analyst at Tinuiti.

“Investing in organic ranking and trying to get Best Seller badges in the week or month prior to Monday and Tuesday paid off because we were able to combine the Sale and Best Seller Badge. Setting bid rules that increased bids and budgets during the deals were really successful too.”

“We saw that a 5% to 10% discount really did not move the needle, but 35% discount (or more) was really the sweet spot,” Stuart Dooley, Marketplace Channel Analyst at Tinuiti said.

“It also became more competitive when comparing year over year. Average CPC increased, meaning an increase in ad spend YoY did not correspond to the same percentage increase in sales due to that rise in average CPC.”

There’s a fine balance between keeping enough inventory in stock to meet demand without overstocking. The equation gets even more complex when you factor in advertising.

“Making sure you had enough inventory to support the deal you ran was also critical for our clients. I saw a competitor ran out of stock for a couple of hours which allowed us to take some sales,” Tony Heuer, Marketplace Channel Analyst at Tinuiti said.

The most notable difference was the purchase of more everyday items vs. gifts or high price items.

“Categories such as baby products, supplements, office supplies, and other everyday items crushed it on Prime Day. Those were the verticals to focus on. The biggest differentiator between Prime Day and Q4 is that the holidays are much more focused on gifts and larger ticketed items,” Casey Flynn, Marketplace Channel Analyst at Tinuti said.

We also saw a significant bump in impressions leading up to Prime Day – meaning many shoppers were browsing for deals the week prior and saving items to cart.

“On Prime Day a lot of people are not allowed to sit on their computer and shop (while at work),” Flynn said.

“Those brands that started advertising their deals earlier (and saw an initial lift in clicks and impressions, although not sales) saw a big spike in purchases when folks hit the checkout button on Monday. By Tuesday, most shoppers had already made their purchases.”

For more on Amazon Prime Day, email [email protected]