Amazon Ad Clicks Declining in US as Reopening Appears to Impact Ecommerce Demand

Last week we wrote about Google paid search clicks declining for many US retailers over the past few weeks. While some of the slower performance can be attributed to funkiness surrounding year-ago comparisons and stimulus timing, it appears that a major shift has also taken place in consumer demand as the US has begun to reopen.

Looking over at Amazon advertising trends, it appears a similar trend is taking hold for many brands active on the platform, and Google Trends data seems to confirm that shoppers aren’t turning to Amazon (or other major ecommerce players) quite as frequently as a few weeks ago.

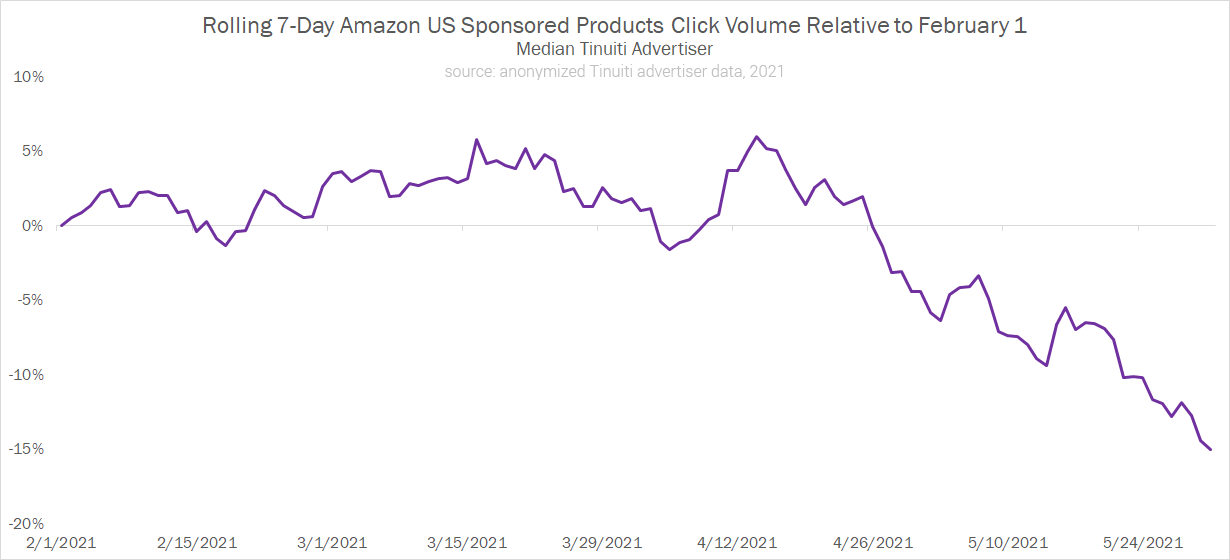

Taking a look at how US Sponsored Products click volume has fared over the last few weeks across a set of long-standing Tinuiti advertisers, it’s clear that there’s been a shift in volume since late April for many brands active on the platform.

This isn’t the case for all product categories, as some brands at Tinuiti focused on travel products are seeing rising click volume as the US reopens and daily TSA traveler throughpoint numbers grow.

It should also be noted that many advertisers are now experiencing tighter inventory restrictions, which is impacting some sellers’ ability to advertise products outside of shifts in consumer demand.

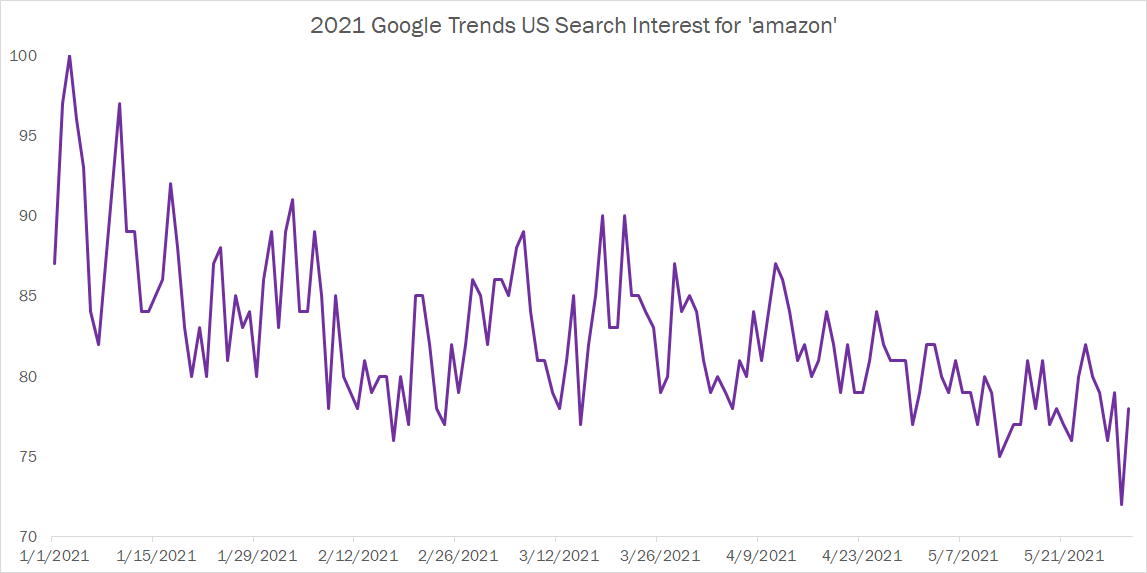

However, looking at Google Trends data for the search term ‘amazon’, it sure looks like consumers are becoming less interested in the ecommerce giant, at least relative to the wider search universe.

This is in contrast to what Google Trends showed over the course of 2019 (ignoring 2020 since it was a year like no other), during which search interest for the term ‘amazon’ rose meaningfully from late March to the end of May.

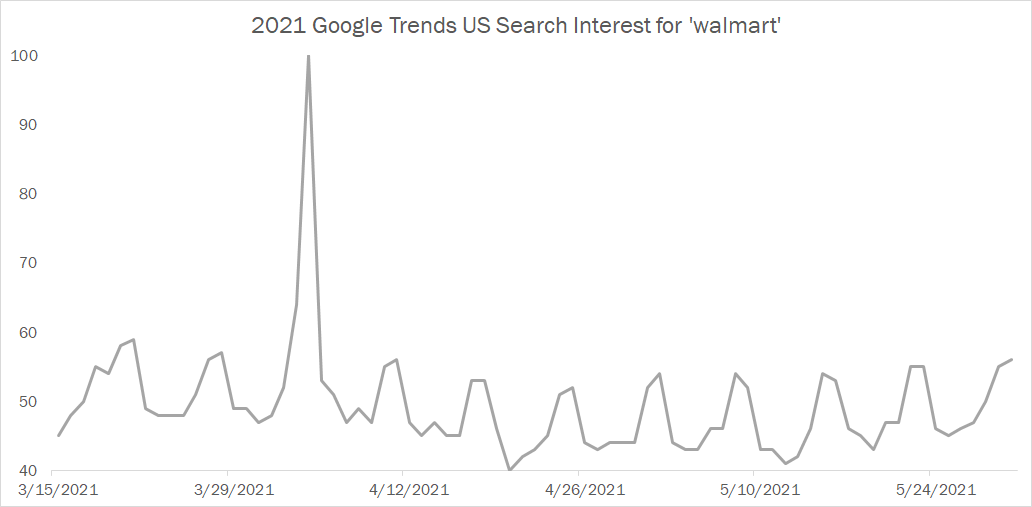

It’s possible that the downward shift this year is heavily influenced by the effects of the March stimulus, which might have pulled some demand forward, as well as possible effects from the delayed tax deadline. However, looking at search interest for ‘walmart’, there hasn’t been the same decline over the last few weeks, ignoring a brief surge in interest on Easter Sunday, April 4.

With a huge brick-and-mortar presence, Walmart is naturally less exposed to being negatively impacted by a shift back to in-store purchasing now that restrictions are being relaxed and consumers feel more confident shopping in crowds.

Further, there’s been a clear shift downward in relative search interest for other well-known ecommerce brands, including eBay and Wayfair, but no such decline for Target. If the biggest brick-and-mortar brands are seeing steady search demand, and the biggest ecommerce brands are seeing lighter search demand, it seems like the shift back to physical retail for some purchases is happening right now.

All in all, there’s a lot of evidence that US ecommerce has slowed here in the middle of Q2, at a time when restrictions are being lifted across the country and many consumers are itching to get back to experiences they missed during the pandemic.

What we don’t know is how long demand will slide, and where a new equilibrium will appear.

It’s possible that consumers are going through a temporary Rumspringa of sorts, drifting away from ecommerce for a time before returning to purchasing habits they picked up during the pandemic.

It’s also quite possible that we’re only at the beginning of a fuller shift back to physical retail and travel/experience spending, with OpenTable seating in the US only recently starting to draw even with 2019 levels.

For Amazon specifically, the ecommerce giant is set to run its Prime Day event on June 21 and 22, which will certainly lead to a boost in performance for many vendors and sellers. Was a slowdown in ecommerce demand part of the reason Amazon went with a June event instead of its pre-2020 norm of July? It’s obviously hard for outsiders to say, but the timing will boost Q2 numbers beyond what they would have been otherwise.

Brands on Amazon can only do so much when it comes to once-in-a-generation (hopefully?) shifts back to physical shopping from a pandemic that turned the US upside down for more than a year and continues to rage in some regions of the world. As such, it’s important to not overreact to recent shifts, and to understand how your brand and product offering fit into how the reopening will play out.

However, brands will certainly need a strong strategy to compete on Prime Day later this month given the recent slowing that many are experiencing, and we’ve assembled some of the most important considerations for how brands should prepare for Prime Day this year. Regardless of recent trends, Amazon will likely continue its tradition of breaking through new sales volume records each year, and vendors and sellers should do everything they can to take advantage.