OTT Advertising Stands Out as a Targetable and Measurable Opportunity Amidst Privacy-Led Industry Changes

With major data privacy-focused changes on the near horizon that are expected to heavily impact the ‘how’ of performance marketing targeting and measurement, many advertisers are seeking fresh solutions that allow them to shift some of their marketing dollars into areas that will continue to be highly targetable and measurable. One such solution that was already experiencing rapid growth long before IDFA and cookie deprecation became part of our everyday conversations is OTT advertising.

“In this moment of privacy, the TV screen is becoming one of the most targetable devices in an advertiser’s toolkit. Because the TV screen never had cookies or IDFA to begin with, their deprecation doesn’t affect TV screen targeting in the same way.”

– Jesse Math, OTT Lead at Tinuiti

If you aren’t familiar with OTT, or want a refresher on some of the foundational elements of how it works, we recommend checking out our comprehensive OTT Advertising Guide.

Much of the focus on how the COVID-19 pandemic shaped consumer buying decisions has centered, and continues to center on, pandemic-specific effects, such as a sharp increase in the need for masks and hand sanitizer. However, it’s also important to consider areas that were already experiencing rapid growth, but whose growth was further accelerated by the urgency of pandemic-necessitated changes—in performance marketing, this would include amplified interest in OTT advertising and retail media.

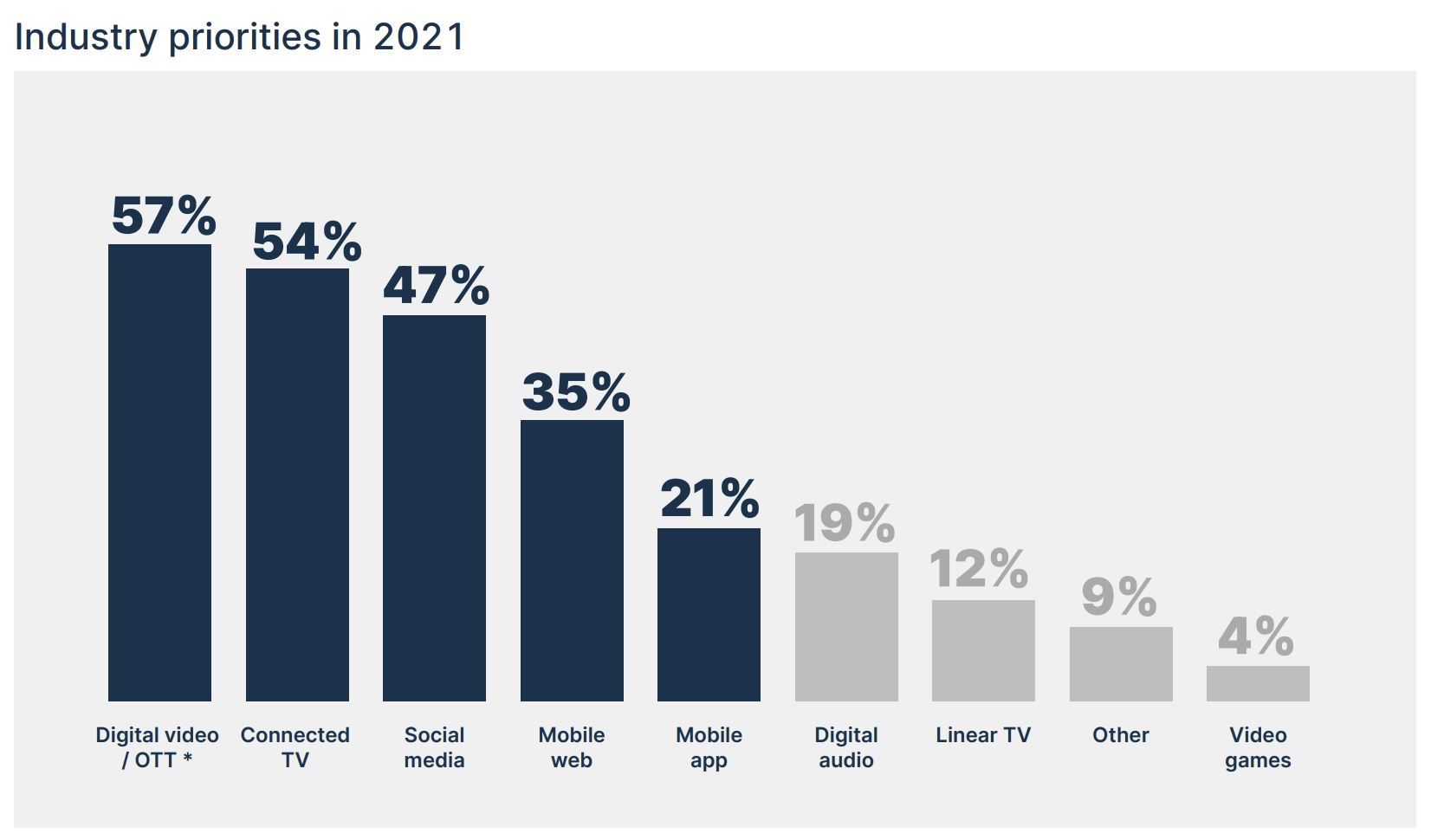

As highlighted in the above graph from IAS Insider’s 2021 Industry Pulse Report, which “investigates the trends, challenges, and technologies that will propel the digital ecosystem into the next frontier of advertising,” we find that 57% of advertisers cite OTT as their top priority this year.

IAS insider notes: “Compared to last year, the list bumps mobile from its top spot—an indicator that consumers remain more stay-at-home than on-the-go.”

While we agree with this takeaway in part—many Americans continuing to spend more time at home, and more time watching TV, than they did before the pandemic is certainly a major component of the equation—privacy concerns have added even more fuel to the OTT interest fire.

To explore what makes OTT targeting and measurement more “privacy proof” than some other channels, we sat down with two Tinuiti experts to ask them the questions on many of your minds.

At the highest level, there are two different ways to buy OTT— guaranteed purchases that resemble the ways in which TV ads are traditionally purchased, and programmatic purchases, which more closely resemble how display and social ads are bought.

When you’re purchasing OTT inventory directly from a publisher, your targeting capabilities are fueled by their first party data-backed understanding of who their customers are.

In example, let’s say you wanted to do a direct OTT buy with Hulu, and you want your ads shown to parents. While Hulu might not explicitly know that a given customer is a parent, they can determine this based on the type of programming a given household is tuning into.

If Hulu sees that a particular household tends to watch children’s shows in the morning, and adult programming at night, they can infer from their first party data that parents of young children live in that household.

No, not necessarily. Whether purchasing OTT advertising directly or programmatically, we can match third party data to the publishers’ first party data to create further audience segments, providing us the ability to target based on extremely niche and insightful behaviors, life stages, and interests. Remember, quality third party data is often made up of other parties’ first party data, so while some 3P will suffer from loss of cookies, preferred providers will remain a strong option.

One example of what’s possible is our ability to target audiences based on the specific grocery SKUs and categories they have been shopping for more often, or less often, in recent weeks.

For another client in the financial space, we are currently targeting audiences that are based on the specific liquidity balances in their investment portfolios.

No matter who your bullseye audience is, they are likely targetable in an OTT environment.

When publishers themselves are using third party data, they’ll typically do a data match. In this scenario, they could say, “OK, we know the names, email addresses, and credit cards of our subscribers, and we’re going to match our data to this first party list, make it privacy compliant, overlay it with our third party data, and target people who we know have the attributes we’re targeting.”

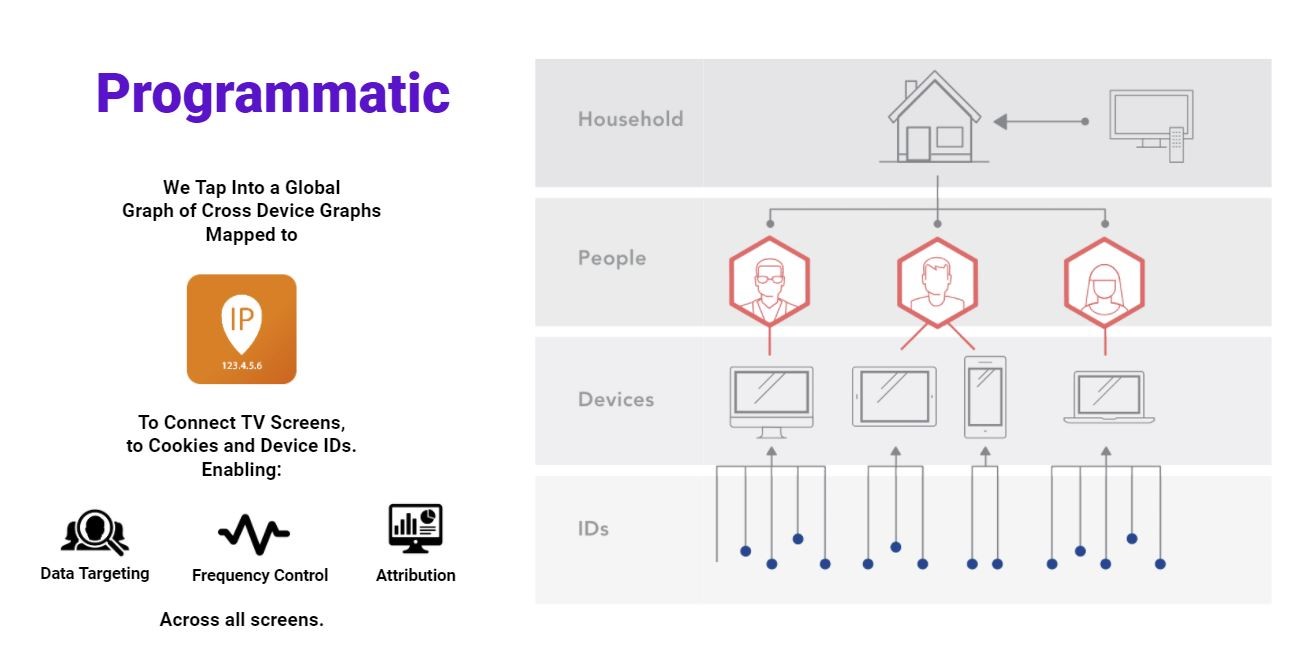

Through programmatic channels, the buyer is in control of the data targeting; we’re matching it to the household graph, and making our own determinations about who we want to reach. We can retarget site visitors, or target consumers on a brand’s email or CRM list, for example. This method of buying targeted OTT is often the easiest opportunity to enter into the space.

We’re also talking about an auction with programmatic targeting. Whenever someone tunes into ad-supported OTT, an opportunity to present an ad is unlocked.

Using Hulu as an example, they will share that there is an ad opportunity, and include the necessary information about that opportunity with potential advertisers. This can include the IP address, location, and which device a user is watching on. We still don’t know exactly who the user is, so their privacy is protected.

Cross-device graphs are built on multiple signals, with one of the most important being the IP address. No matter which internet-connected devices you are using in your household, the common denominator across all of them is the IP address.

By considering which devices are regularly accessing the internet on that same IP address, we are able to create a unified cross-device graph for the household as a whole, to include its connected TVs, desktops, mobile devices, tablets, and more.

In short, very minimally. Even if viewers opt out of tracking on their desktop, tablet, and mobile devices themselves, our cross-device graph capabilities remain largely unaffected. This is because they aren’t and weren’t relying on user-specific information in their creation.

Every branch we’re able to build on the ‘tree’ that is our cross-device graph is rooted in the IP address that we will still have access to, with some exceptions. Those who will see an impact include collectors and aggregators of third party data; the quality and quantity of some 3P sources will be diminished.

Brands with 1P data—or who partner with 2P providers who collect and sell the 1P data of others—will continue to be able to effectively target on connected TVs and measure the impact.

What makes OTT advertising so valuable in the age of privacy concerns is that none of the information advertisers are concerned about losing—to include mobile device IDs and cookies—lives natively within a TV screen.

The ability to target and measure OTT continues to ensure that OTT advertising is more accountable than traditional TV advertising ever was; OTT allows us to target and measure the downstream performance of ad exposure, like advertisers have grown accustomed to with other digital channels.

While metrics regarding ad performance on connected TVs (CTVs) aren’t available in Google Analytics, their performance is still very much measurable; it’s just a ‘clickless’ form of advertising that doesn’t filter through an analytics platform like GA.

All Tinuiti advertisers benefit from in-depth reporting that is tailored to their campaign goals— including conversion-oriented campaigns, and those more heavily oriented toward enhancing brand reach and frequency.

From a performance perspective, we are able to answer questions including how many households that were exposed to an ad on a CTV screen visited the brand website—and how much they spent once they were there—or visited the brick-and-mortar store. We can determine if we were able to successfully secure new customers, and improve brand loyalty.

For other brand advertisers we are measuring the incremental reach and frequency that OTT brings to their TV schedules, and we’re using these measurement solutions to identify “waste.” Among linear TV’s primary drawbacks is a lack of insight into individual exposure.

OTT allows us to see which audiences have already exceeded frequency goals, and which have been underexposed to the brand. We can activate based on those insights, ensuring a greater frequency of delivery for those underserved, and a reduction in frequency for those that have been overexposed. This is crucial information to ensure we’re prioritizing brand safety; exposure is undeniably important, but we don’t want to risk becoming an annoyance.

We can bring closed-loop measurement where we understand the reach and frequency across channels that leads to the highest propensity of conversion.

That goes back to the IP address. We’re taking exposure logs, which tell us every impression that we serve. The information in those logs includes, most importantly, IP addresses and timestamps.

On the site itself, we have a pixel. Among the data the pixel collects is a conversion, the conversion timestamp, what was purchased, the value of the purchase, and the IP address. So we have a timestamp of impressions served, and the IP address that was served to, and we can match that to see if the conversion happened before or after we served the ad.

“As cookies and certain mobile IDs are deprecated, the information advertisers were historically relying on isn’t going to work on desktop and mobile anymore. However, thanks to OTT advertising’s IP address-based targeting, it is still going to work on TV screens.”

– Jesse Math, OTT Lead at Tinuiti

If we see the IP address someone converted on, and we know that conversion happened after that same IP address was delivered an OTT ad, we know that OTT was a touch point on that conversion path.

One key differentiator is that when customers sign-up for an ad-supported OTT service, they’re already agreeing to receiving those ads—non-skippable, non-minimizable, 15-30 second ads.

A Q2 2020 ad blocking study “found that 45 percent of respondents aged 15 to 25 said that they used an adblocker,” with “42 percent of respondents between the ages of 26 and 33” reporting the same. Simply put, that is a lot of missed eyes on ads—eyes that ad-supported OTT can capture.

“The value exchange in ad-supported streaming is strong today. As long as viewers continue to have a positive experience, we expect ad-supported OTT/CTV to thrive for years to come. Additionally, the television viewing audience is more accustomed to and open to advertising in that space. While some consumers might find ads on mobile and desktop devices obtrusive, “commercials” are more commonly thought of as part of the “social contract” when watching TV.”

– Nirish Parsad, Marketing Technologist at Tinuiti

Want to learn more about how our team can take your brand to the big screen, and beyond? Contact us today to chat with an expert!