Global Supply Chain Disruption: Experts Weigh in on Holiday Inventory Issues & Shipping Concerns

Headlines and news stories regarding supply chain shortages and related concerns are seemingly everywhere we turn in recent months, with countless outlets stressing the importance of starting your holiday shopping now—while physical and digital shelves are still full.

To wait for the traditional Black Friday holiday shopping kickoff is to risk an out-of-stock item not being restocked in time for gift-giving, a concern we wouldn’t typically be having nearly this early in the season.

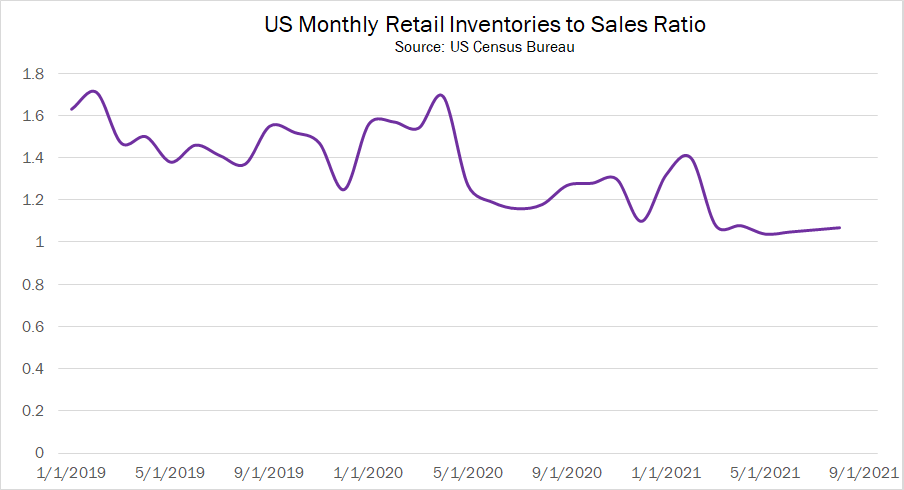

Retailer inventories are already near historic lows relative to strong sales.

The US monthly retail inventories to sales ratio, as calculated by the US Census Bureau, hit an all-time low in May 2021, and has only ticked up marginally in the months since. The ratio indicates how many months of inventory retailers have on-hand compared to their current rate of sales.

Prior to the pandemic, retailers typically held an average of ~1.5 months’ worth of inventory. Today, that average is now closer to just one month’s supply, and is set to fall even further as retail sales ramp up in November and December.

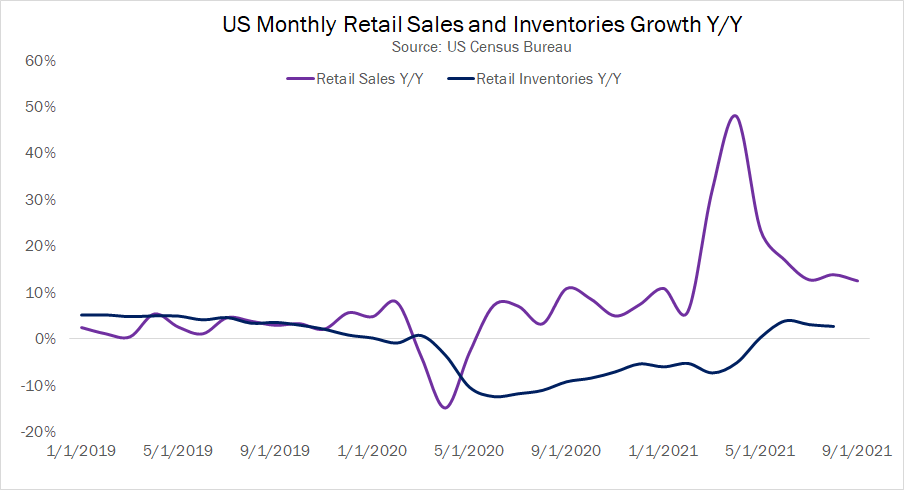

While retail inventory levels have increased in year-over-year terms for four straight months—following 13 months of declines—historically strong retail sales growth is preventing retailers from building up much of a product stockpile ahead of the holidays, even before considering some of the more recent supply chain issues.

So what is so different this year?

To be certain, availability concerns during the holiday season aren’t a completely new phenomenon; there have always been those one or two “must-have” gifts of the year that shoppers start looking for months ahead of time. But those are exceptions whose “hard to find” nature is based not on widespread issues getting them from Point A to Point Z, rather their uniquely high popularity.

The headlines we’re reading today aren’t talking about the Cabbage Patch Kids clamor of 1983, or Tickle Me Elmo craze of 1996—this is concern about the availability of just about everything.

We’re more than accustomed to heightened demand for the “hottest” gifts leading to a few empty shelves, but the grander supply chain concerns retailers are facing in 2021 aren’t as closely related to amplified demand or situational popularity. We’re dealing with actual breaks in the chain—often more than one at a time—that are making any guarantees very difficult to grant at every stage.

In this article, we will explore exactly what some of those supply chain issues are, and how we, and the brands we work with, are actively navigating the necessary changes.

Before we dive into the links on the chain that are experiencing undue stress, let’s first explore exactly what a supply chain is.

A supply chain encompasses the full process of conceptualizing, manufacturing, and distributing goods to the end user. The number of links within the supply chain vary from retailer to retailer, and depend in part on whether the retailer is creating the product themselves, or sourcing it from a brand or other supplier.

If you are producing a product, your supply chain will include raw material acquisition. Let’s assume you’re creating a luxury hand cream. In addition to sourcing the ingredients for the hand cream, which may come from several different suppliers across the world, you’ll also need to find a supplier for the tube and box the hand cream will be packaged in. The more individual ‘links’ you’re working with in that sourcing chain, the more opportunities there are for potential disruption.

In example, perhaps the cocoa butter that’s so essential to your formula is currently sitting in the Port of Los Angeles. Even if that is the only broken link in your entire supply chain, it still prevents you from creating the product to begin with, let alone packaging it and shipping it to partnering retailers for sale.

That’s why even if you aren’t creating the product yourself, supply chain issues being experienced by those who are still impact your inventory levels, and ability to provide shoppers with a full variety of in-stock items to cross every name off their holiday shopping list.

Let’s take a closer look at a few of the most impactful supply chain issues we’re experiencing this Q4.

The production of goods has screeched to a halt across areas of the world currently, or recently, in lockdown due to high contraction rates of the COVID-19 Delta variant, including Vietnam.

Among the brands impacted by Vietnam factory closures is Nike, who shared that “it had lost 10 weeks of production there because of factory shutdowns.” Nike expects “demand for its products will exceed available supply for the next eight months,” and is currently working to move some of its production to factories outside of Vietnam, including China, the top manufacturing country in the world in terms of output. And they aren’t alone.

As noted by the WSJ:

“A late August survey of nearly 100 representatives of manufacturing sector companies by the American Chamber of Commerce in Vietnam found that one fifth had already moved some production to other countries.”

We’ve all seen the pictures of container ships stuck in ports across the world, awaiting their turn to dock and unload as their hours on the water turn into days. As for why they aren’t able to off-load their cargo as usual? That relates to another supply chain issue—a shortage of truck drivers during the busiest shopping time of the year.

Customers are still placing orders, and ships are still setting sail packed with goods, but the necessary link to get those goods from ports to trucks and railways—and from trucks and railways to stores—has been fraught with issues long preceding the holiday season.

As reported by CNN in May 2021, “America’s truck driver shortage is driving pay higher. But it’s not solving the scarcity of truckers.”

That’s partly due to this pay increase having some potentially unexpected consequences:

So exactly how many additional truck drivers are needed to strengthen this weakened supply chain link? That would be 80,000.

CNN reports:

“Truck drivers move 71% of the US economy’s goods, but represent just 4% of the vehicles on the roads, said Spear. If nothing is done, the latest figures put the industry on track for a shortage of 160,000 drivers by 2030, and the need for 1,000,000 new drivers over the next ten years, according to the American Trucking Associations.”

COVID-19 isn’t the only global issue impacting the supply chain; extreme weather conditions—and the monumental impact they have—is far-reaching, and seemingly unrelenting.

Let’s consider just two examples from this past July:

Among Tinuiti advertisers, the supply chain issues impacting brands’ ability to market their products are varied:

These issues are impacting marketing plans for Q4, with some brands adjusting advertising investment to reflect the fact that they won’t have enough inventory to support promotional efforts during the peak season. As Facebook and Snapchat confirmed in recent earnings reports, these issues stand to weigh on spend in a quarter that’s usually a banner time for ad platforms.

“Advertisers experiencing limited inventory concerns are responding in a few different ways this year. In rare cases, brands are planning a full advertising pause once key items have been sold through. Others aren’t pausing completely, but are reducing spend in some areas, and/or have decided to continue advertising for visibility, but are going non-promotional, with no major price reductions or sales.”

—Josh Brisco, VP, Growth Media at Tinuiti

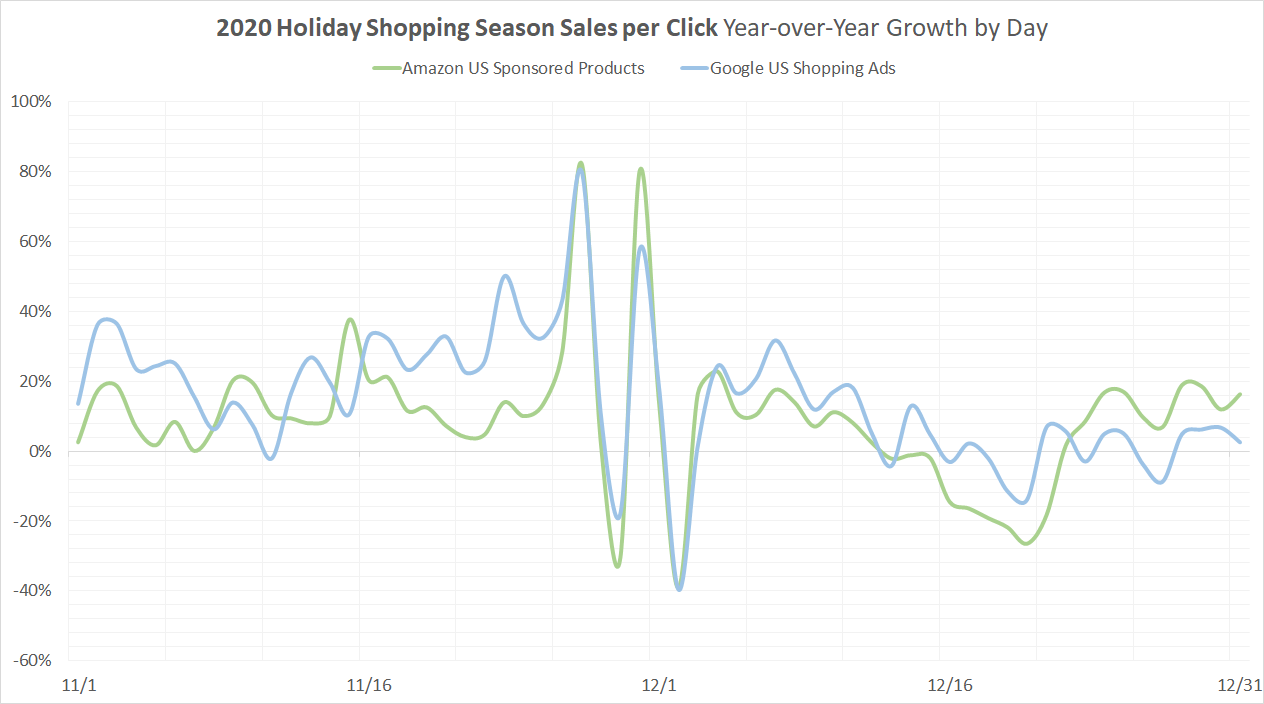

In 2020, earlier shipping cutoffs clearly weighed on consumers’ willingness to make purchases later in the holiday shopping season.

Looking at how this impacted advertising performance for Tinuiti clients, Google Shopping and Amazon Sponsored Products advertisers both saw sales per click slip below 2019 levels in the third week of December, following six weeks during which ads were largely more valuable than the year prior.

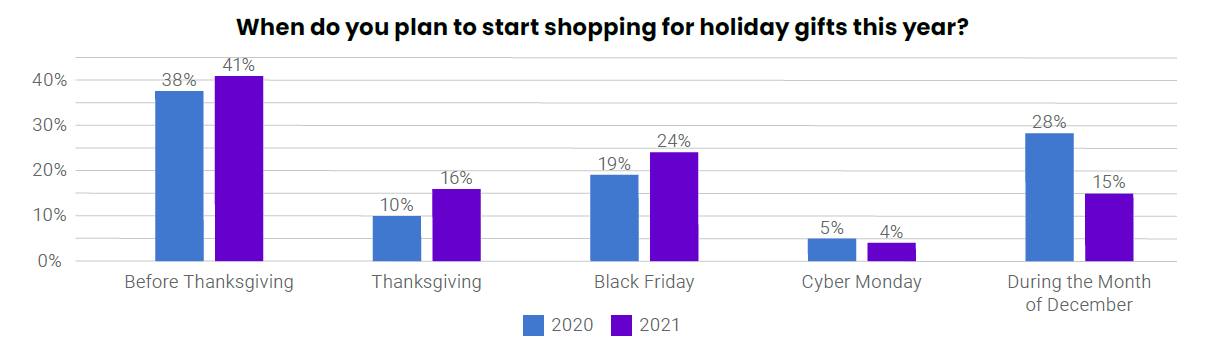

Given the issues that consumers ran into last Q4, as well as the expansive news coverage warning of current issues that could hamper last-minute shopping, it’s not surprising that many intend to kick off holiday shopping earlier this year than they have in the past.

Results from the Tinuiti 2021 Holiday Consumer Spending Trends show that 57% of US shoppers expect to begin shopping on or before Thanksgiving in 2021, compared to just 48% in 2020.

“In a year with multiple massive changes to the fabric of performance marketing, and in a time of year that is already high intensity for advertisers, supply chain issues add a whole new level of complexity. The marketer no longer has to just worry about media mixes, measurement and CPMs, they must also account for macro economic trends to be successful this holiday season.”

—Josh Brisco, VP, Growth Media at Tinuiti

“The consumer journey doesn’t come to a halt because of supply chain issues; brands that are and aren’t impacted must augment the conversations that they are having with existing and prospective customers, but should not stop engaging them. There will be both defensive and offensive wins to be had but silence will accomplish nothing. “

—Geoff Litwer, VP, Programmatic Media at Tinuiti

“2021 has undoubtedly been a challenging year for marketers. April saw the release of iOS 14.5, which brought up a seismic shift in digital advertising for targeting, measurement, and attribution. Today, those challenges continue as brands battle supply chain issues as Q4 peak time approaches. Despite this, there are more tools and options at an advertiser’s disposal than ever before, especially within the Social realm. Platforms like TikTok, Snapchat, and Reddit have rapidly advancing ad capabilities that can drive incredible opportunities for brand equity and intent growth that will last well past Q4. Now is the time to explore these areas of expansion with a focus on building the brand amongst new and highly engaged consumers.”

—Avi Ben-Zvi, VP, Paid Social at Tinuiti

“It’s going to be a unique holiday period for brands and advertisers. Flexibility when it comes to media flighting is going to be critical for success. Brands should consider capturing demand earlier than in previous years—saving substantial budget for the weeks before Christmas when uncertainty will be at its highest could lead to disappointing results and a poor customer experience.”

—Evan Kirkpatrick, VP, Shoppable Media at Tinuiti

“If you’re only using one channel for inventory management, you’re behind. With warehouse capacity constraints, staffing shortages, and COVID protocols, the timeline to receive inventory has increased significantly. For some of our clients on Amazon, the receipt timeline has jumped from 7 to at least 21 days! It’s vital to use a multi-channel approach to ensure sufficient inventory coverage.”

—Megan King, Senior Account Manager, Retail Operations at Tinuiti

“In preparation for the holiday period, brands should shift to prioritizing management of their transportation-chain for the short-term, as opposed to a singular focus on the broader supply-chain. Domestic supply-chain issues don’t disappear after leaving the port (which we know is where most of the media attention is focusing). The delays continue throughout the (1) delivery to the brands’ own warehouses, and (2) delivery to and received by their retail partners’ fulfillment centers. After managing these hurdles, it is only then that we are able to display In Stock messaging on our product detail pages. Shipping inventory to distributors early and providing conservative lead time messaging to customers are both key in managing demand and expectations during this holiday period.”

—Mark Russo, Senior Specialist, Retail Operations at Tinuiti