The Most Important 2021 Cyber Five Findings Across Google, Facebook and Amazon Advertising

The biggest five-day stretch for many brands is now officially in the books. As we at Tinuiti do every year, we’ve unpacked the most important trends that shook out across Google, Facebook and Amazon advertising during the key Cyber Five period between Thanksgiving and Cyber Monday.

The charts included in this recap are produced using anonymized, same-store samples derived from the more than $3 billion in total media under management at Tinuiti.

Special thanks to Mark Ballard for his massive contributions to this year’s recap.

Released in September, Tinuiti’s 2021 Holiday Consumer Spending Trends survey showed that consumers were anticipating making more purchases earlier in the holiday shopping season while also planning to spend more total over the entire season than in 2020. Both trends are on track so far as we look at Google search ad data covering the beginning of November through Cyber Monday 2021.

Many consumers likely remember the shipping headaches towards the end of 2020 holiday season, and in recent months, they’ve faced a barrage of news stories detailing the very real challenges with the supply chain. Tinuiti’s survey showed that 57% of consumers planned to start holiday shopping on or before Thanksgiving and our latest Google data shows particularly strong sales growth in early November.

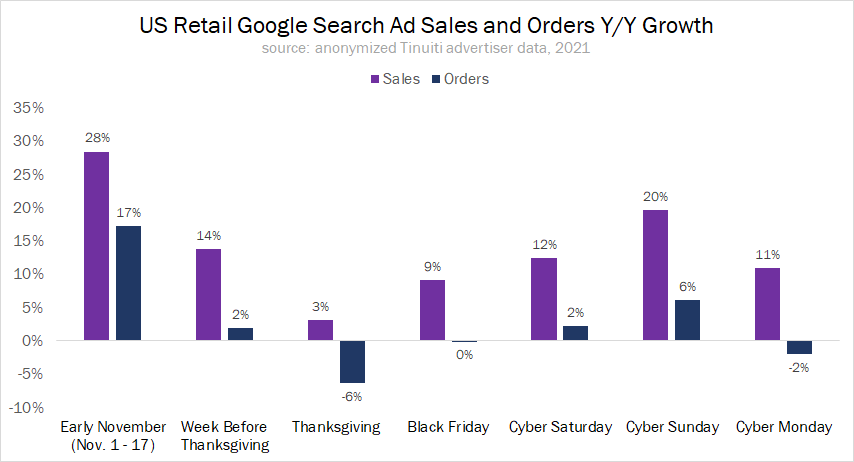

Over the period of November 1 through November 17, sales generated by Google search ads were up 28% Y/Y among Tinuiti’s US retail clients. Over the following week, sales growth remained strong, but slipped to 14% Y/Y.

With many consumers travelling for Thanksgiving for the first time in two years, sales growth on Thanksgiving Day fell to 3% Y/Y. Growth accelerated on Black Friday and through the weekend before settling at 11% on Cyber Monday.

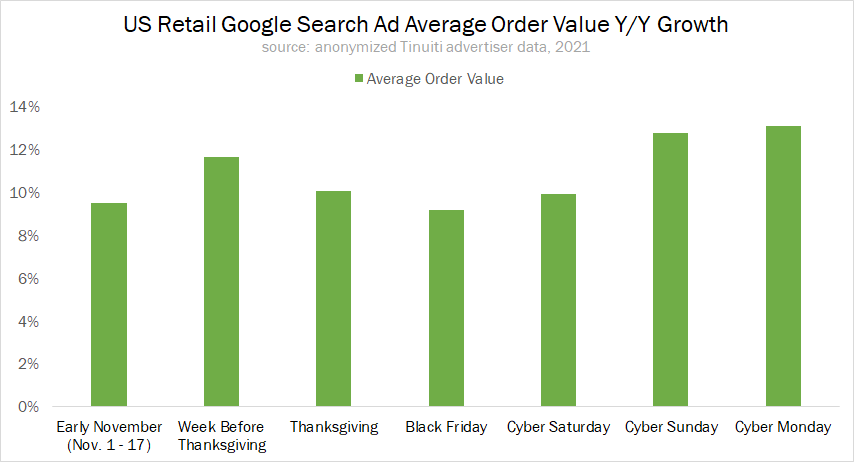

Throughout the month of November, retailer sales produced by Google search ads have benefited from consistently higher average order value (AOV). Whether driven more by consumer generosity or inflationary pressure, AOV has run between 9-13% higher than in 2020.

For Thanksgiving and Cyber Monday, stronger AOV was enough to turn a small decline in order volume into positive sales growth for the day. Indeed, on Thanksgiving Day, orders produced by Google search ads fell 6% Y/Y, but again, sales eked out a 3% gain.

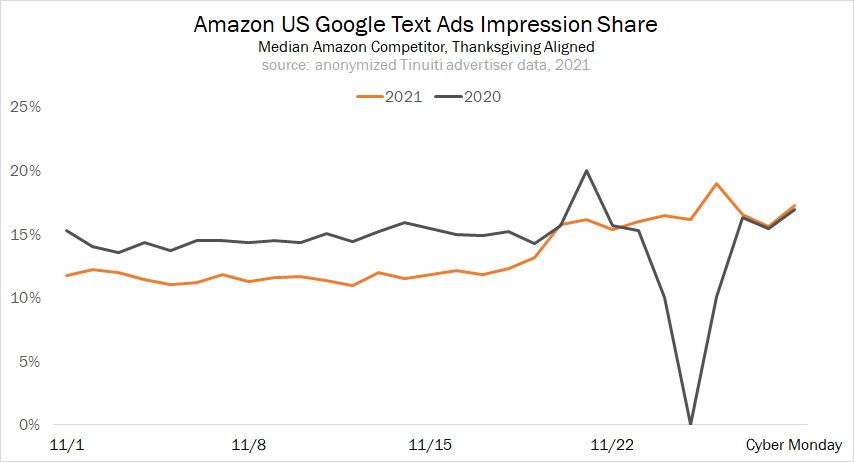

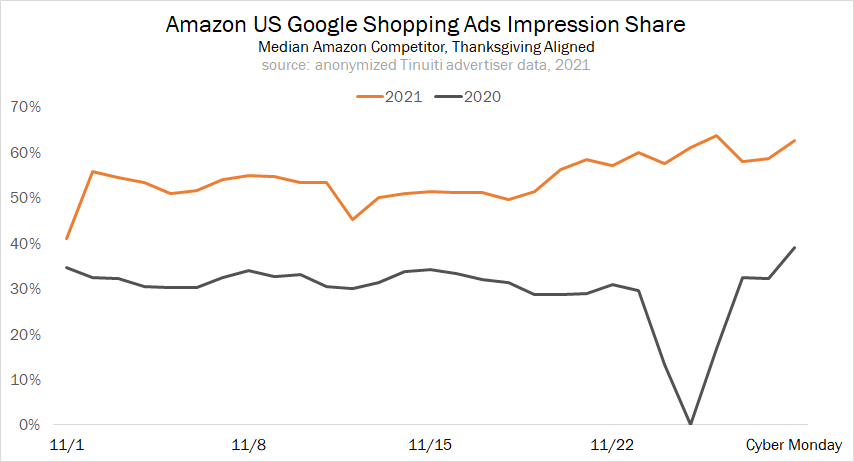

In addition to consumers shopping earlier, advertisers also faced greater competition from Amazon for Google ad impressions over the Cyber Five period compared to earlier in the month. Amazon’s share of Google text and shopping impressions began to ramp up in the week leading up to Thanksgiving, ultimately hitting a peak on Black Friday.

A year earlier, Amazon dropped out of Google auctions entirely on Thanksgiving and saw a diminished presence the day before and after. Although Amazon is just one competitor, it is most retailers’ single biggest competitor for Google ad impressions, so its absence from auctions on Thanksgiving 2020 led to a relatively strong year-ago sales comp for that day.

While Amazon’s share of text ad impressions was below 2020 levels in early November, it had already significantly increased its share of Google Shopping impressions heading into November. For both formats, though, Amazon eventually met or surpassed its 2020 impression share several days before Thanksgiving.

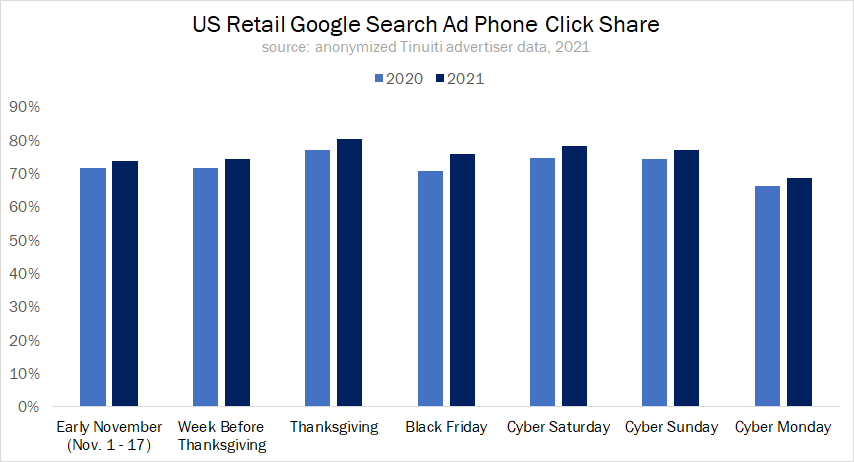

Most indicators show that Thanksgiving travel was up sharply compared to 2020, helping to drive more consumers back to their phones for holiday shopping. The TSA, for example, clocked over twice as many passengers as it did a year ago.

On Black Friday, phone share of Google search ad clicks peaked at 80%, up five points from a year earlier. Earlier in November, phone click share was up just two points compared to 2020. Between 2019 and 2020 desktop share of Google search ad clicks increased by three points over most of the Cyber Five days.

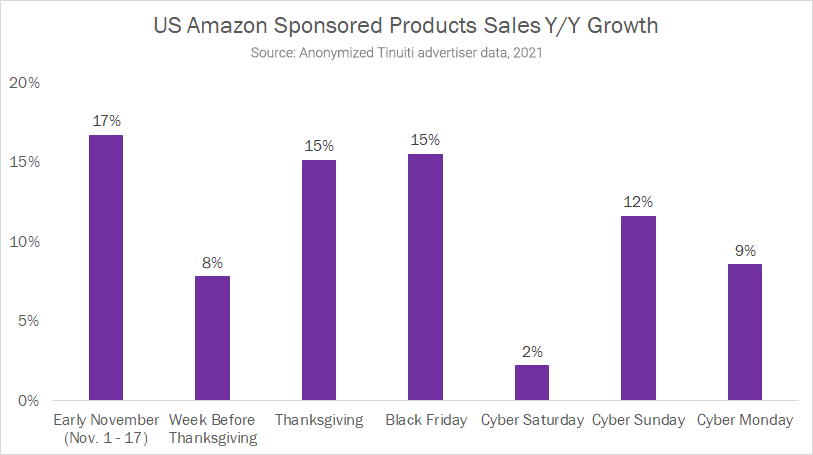

Much like what Google advertisers saw, Amazon Sponsored Products advertisers found sales growth strongest in early November, as shoppers appeared to pull holiday purchases earlier in the season to avoid supply chain issues and ensure gifts arrive on time. Sales attributed to Sponsored Products grew 11% year over year across the Cyber Five, compared to 17% growth between November 1 and November 17.

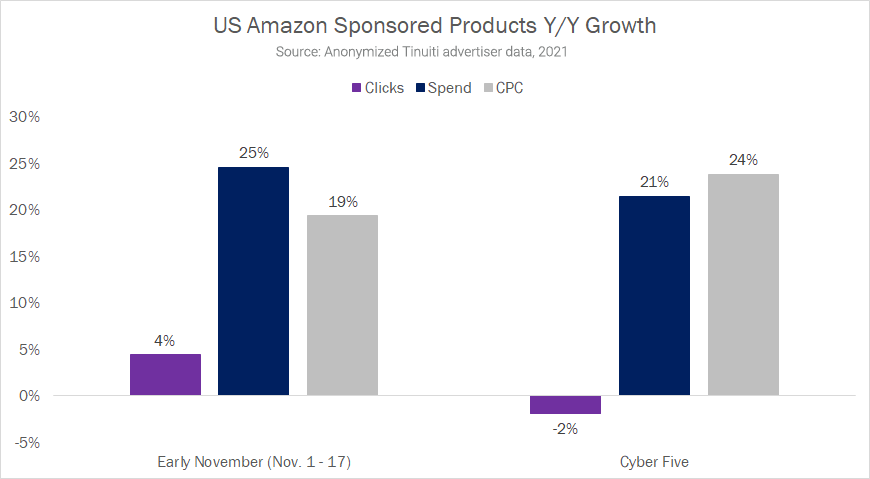

As has been the case for most of 2021, spend growth for Amazon Sponsored Products in November was driven primarily by increases in CPC, as ad auctions are now much more competitive than they were last year. In early November, CPC grew 19% year over year for Sponsored Products advertisers, and CPC growth accelerated to 24% during the critical five day stretch between Thanksgiving and Cyber Monday.

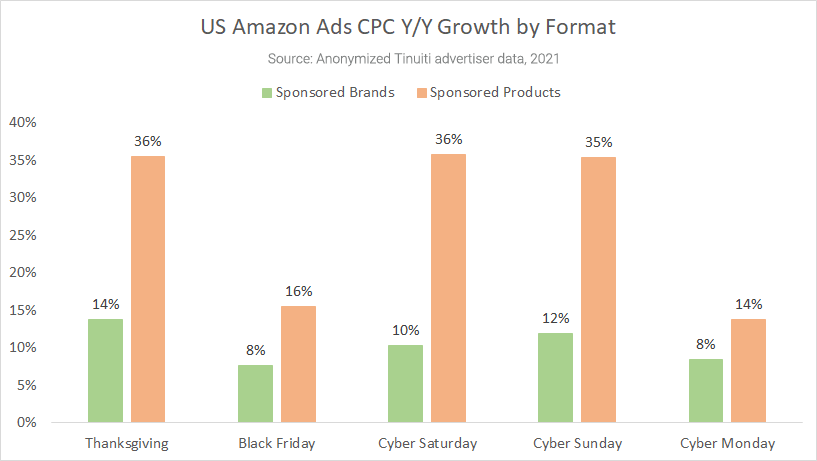

Looking at how CPC growth trended by day for both Sponsored Products and Sponsored Brands, year-over-year increases were the smallest on Black Friday and Cyber Monday for both formats compared to other days in the Cyber Five. Sponsored Products CPC growth meaningfully outpaced Sponsored Brands CPC growth on every day of the Cyber Five, a reversal of the trend observed during these five days last year.

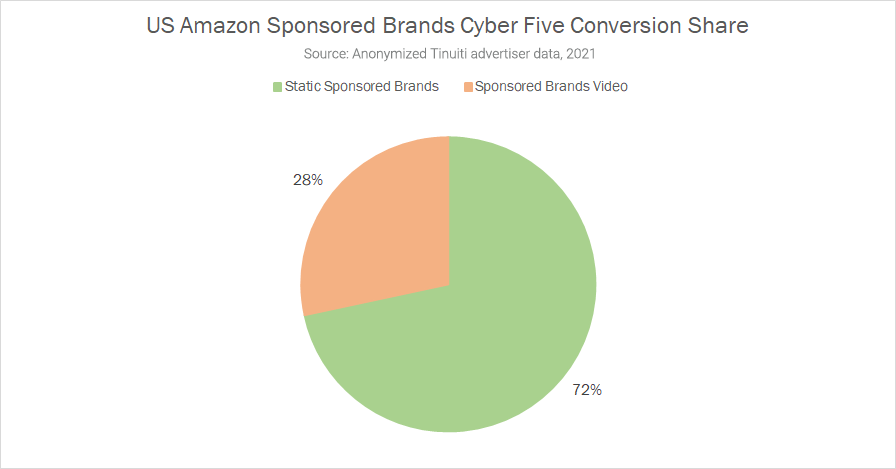

Sponsored Brands video was already well on its way to becoming an important part of advertiser strategy last holiday shopping season, and during the 2020 Cyber Five video accounted for 17% of conversions attributed to Sponsored Brands ads. That share has continued to rise over the last year as brands continue to lean into the engaging video format, and during the 2021 Cyber Five video ads drove a whopping 28% of conversions attributed to Sponsored Brands.

Sponsored Brands video ads also produced a CTR more than three times that of static Sponsored Brands during the Cyber Five, and it’s safe to say that any advertiser not currently taking advantage of the Sponsored Brands video format should look into deploying it as we finish out the year.

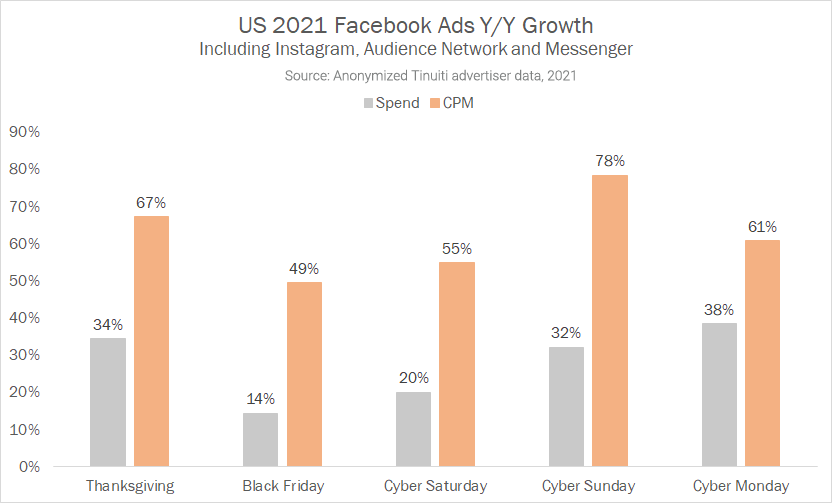

Facebook ad spend grew the fastest on Cyber Monday, rising 38% compared to a year earlier, while spend grew the slowest on Black Friday at just 14% growth. CPM increased at least 49% year over year for every day of the Cyber Five, continuing a trend of explosive growth that started earlier in the year and highlighting how much more competitive paid social auctions are this year compared to 2020. Overall across the Cyber Five, spend grew 27% while CPM rose 62%.

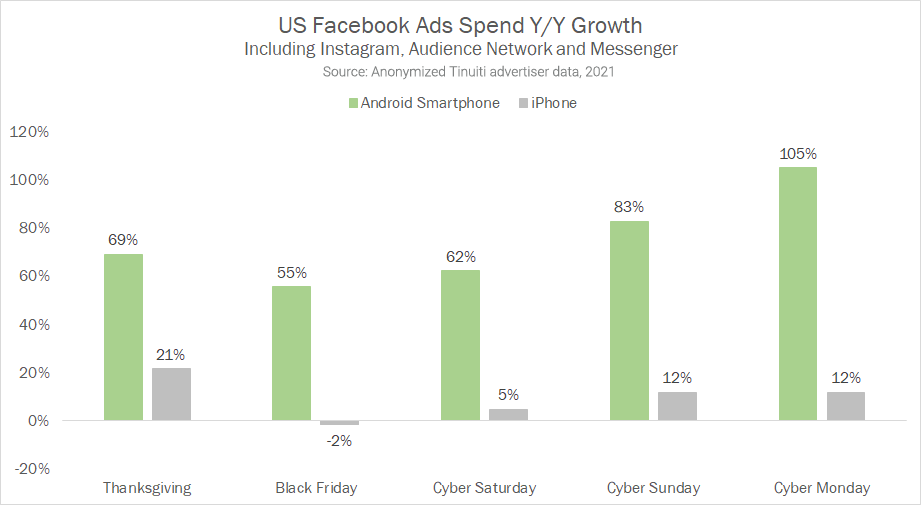

Android spend growth has far outpaced iOS spend growth since June for Facebook advertisers, when iOS 14.6 rolled out and a majority of Apple device users upgraded to a version of the operating system that required the App Tracking Transparency (ATT) prompt. This trend was prevalent over the course of the holiday weekend as well, with spend growth attributed to iPhone users lagging far behind that of Android smartphone users.

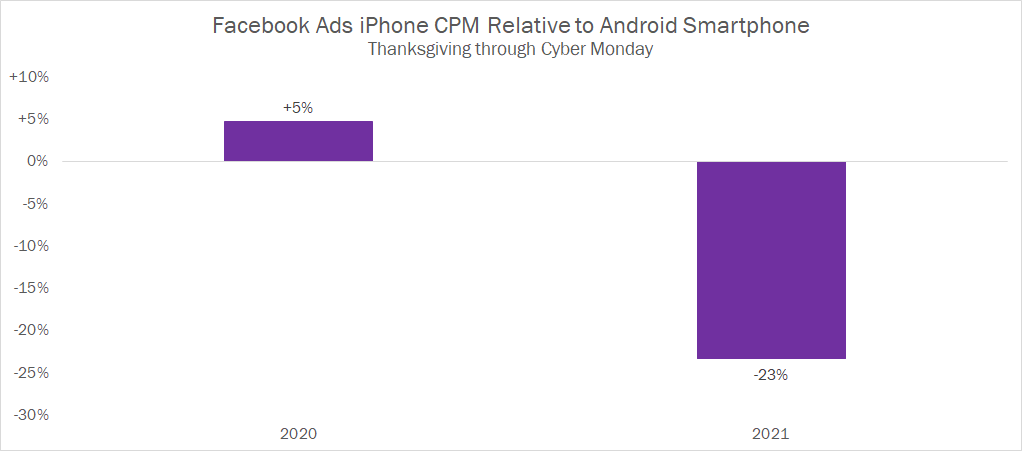

Another trend that has been clear since June is that ad pricing for Android users now far outpaces that for iOS users for many advertisers, as ad auctions for those users who can still be targeted using mobile identifiers are now relatively more competitive. Over the course of the Cyber Five, iPhone CPM for Facebook ads was 5% higher than Android smartphone CPM in 2020, but in 2021 iPhone CPM lagged Android smartphone CPM by 23%.

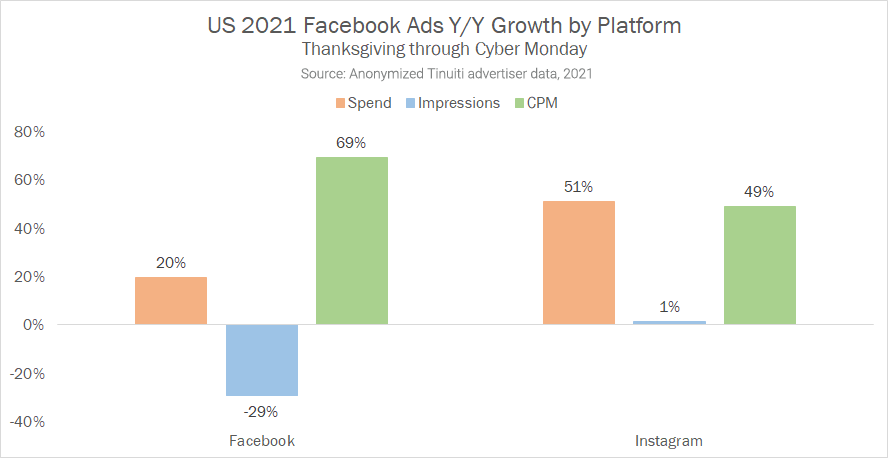

As has been the case for some time, Instagram spend growth continued to outpace Facebook proper spend growth through the Cyber Five, with spend on the former growing 51% compared to 20% for the latter. CPM grew much faster on Facebook than Instagram, but ad impressions were down 29% year over year for Facebook’s flagship app, compared to 1% growth for Instagram.

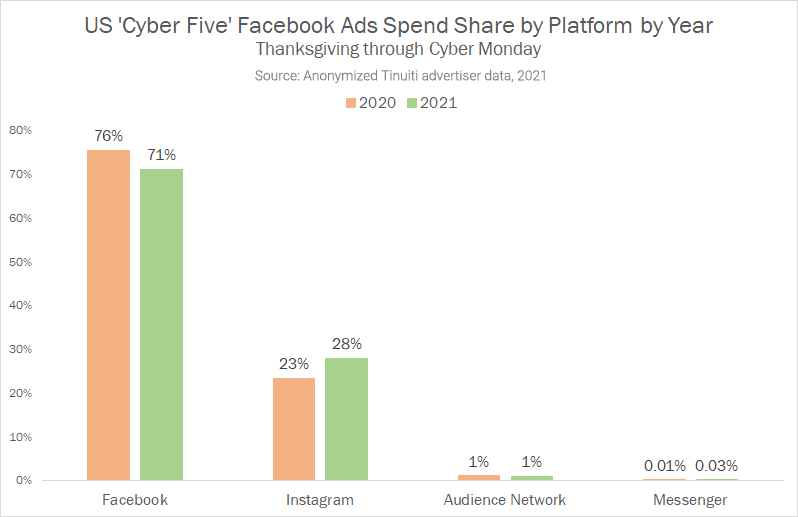

Given the faster growth rate year over year compared to Facebook, Instagram obviously accounted for a greater part of advertiser investment during the Cyber Five in 2021 than a year prior. The share of spend attributed to Instagram rose from 23% last year to 28% this year, while Facebook share dropped from 76% to 71% and Audience Network share held roughly steady at around 1% of spend.

These are just some of the trends we’re keeping an eye on as the 2021 holiday shopping season unfolds. Be sure to check back in over the coming weeks to see more analysis on other key happenings across the digital ecosystem.