Not long ago, doubt was cast on Walmart’s ability to ramp up its ecommerce game to fend off Amazon.

However, in the last 12 months, we’ve seen Walmart’s ecommerce strategy begin to pay off.

The retail giant recently surpassed Apple to become the world’s third largest online retailer, accelerated its quarterly ecommerce growth to a staggering 43%, and has positioned itself for an even stronger 2019.

Here’s a top-level overview of how Walmart’s transforming ecommerce strategy makes it a viable contender with Amazon in the long game.

Acquiring Digital Brands That Resonate With Younger Shoppers

Walmart has been on an ecommerce acquisition shopping spree recently — and for good reason.

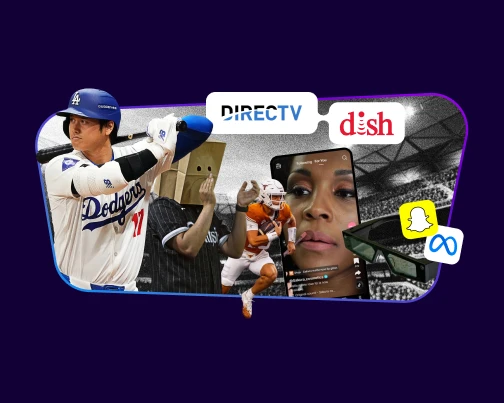

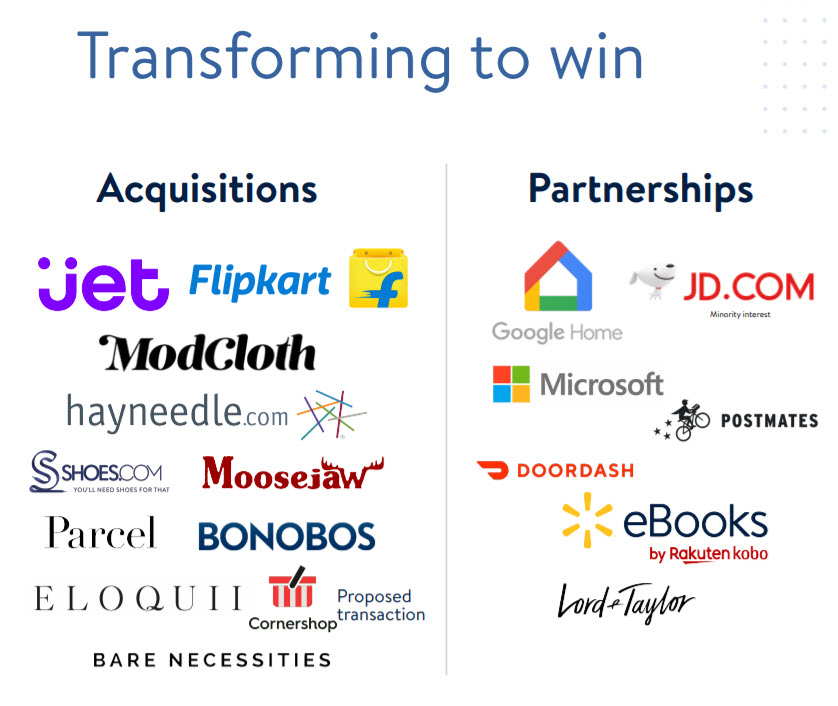

Since 2016, Walmart has made a number of online retail acquisitions and strategic partnerships to bolster its ecommerce offering and engage new cohorts of shoppers it has struggled with reaching in the past.

These acquisitions include a number of important retailers and digital brands:

- Jet (2016) – Ecommerce retailer that has been re-designed to focus on urban and millennial shoppers

- Shoebuy (2016) – Footwear

- Moosejaw (2017) – Outdoor apparel

- Modcloth (2017) – Women’s apparel

- Bonobos (2017) – Men’s apparel

- Eloquii (2018) – Plus-size fashion

- Bare Necessities (2018) – Women’s intimates

- Art.com (2018) – Home accessories

At the same time, the company has also made strategic partnerships that enable it better compete with Amazon’s marketplace — like its partnership with Google to bring Walmart items to Google Express and shoppers that use voice with Google Home.

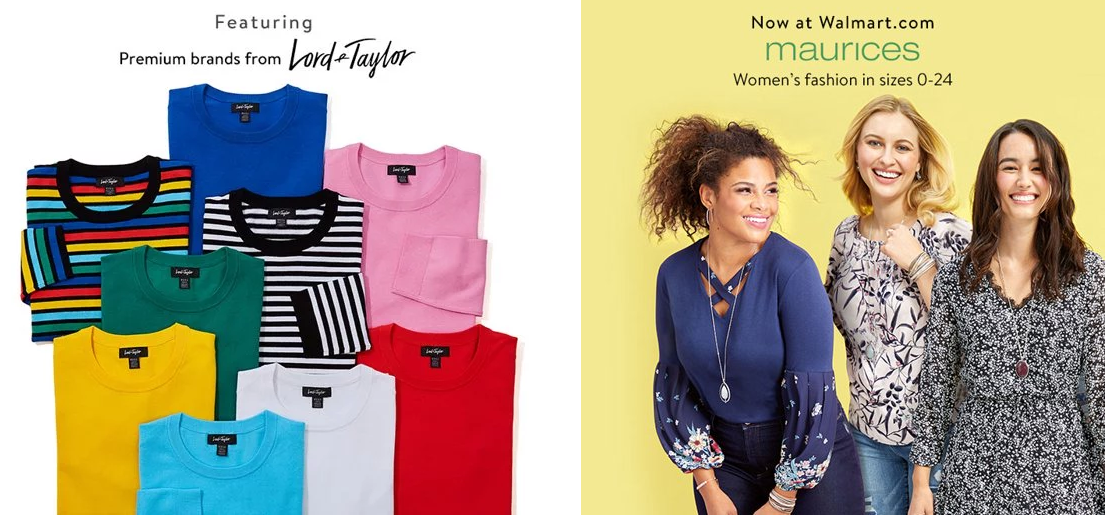

Reinventing Its Apparel Offering

It’s no secret that Walmart and Amazon are in a heated battle for online apparel.

Amazon has moved aggressively into almost every apparel vertical over the years with both name brands and private labels — just as major department stores like Sears and JCPenney have stumbled and crashed.

Walmart has answered by launching new fashion lines of its own into major apparel segments, which has helped the retailer to maintain its position top online apparel retailer in the US, despite forecasts that Amazon would replace the retailer as number one.

Walmart continues to gather more data to understand its new audiences, and part of the way they’re accelerating the process is by making purchases of brands that have built-in millennial equity.

Celebrity Brands & Private Label

Long known as a market leader for budget apparel, the retailer has also launched new fashion-forward clothing styles for both men and women that include both private labels as well as celebrity brands.

Private label launches in 2018 include Wonder Nation, Time and Tru, Terra and Sky, and George.

Walmart has also launched label partnerships with celebrities like Elizabeth Stewart and Ellen DeGeneres.

“We listened to our customers and are proud to deliver apparel choices that meet at the intersection of everything they desire: on-trend styles, comfort and quality, all at unbeatable prices,” says Deanah Baker, SVP of Walmart U.S.

Baker explains that the new brands are “a thoughtful reflection of current trends and styles while considering our customers’ busy, on-the-go lifestyles.”

Walmart’s Ecommerce Grocery Growth

Competition between Walmart and Amazon has hit fever-pitch, with both doubling down on their buy online, pick-up in-store (BOPUS) platforms in 2018.

It’s worth noting that groceries is Amazon’s fastest-growing category, and the ecommerce giant has supported this growth with investments in Amazon Fresh, Amazon Pantry, and its buy online, pick up in-store (BOPUS) model with its network of Whole Foods stores.

However, Walmart has held its own by improving on its own in-store pick up model (Walmart Grocery Pickup) by leveraging its massive network of over 4,700 physical stores that can reach 90% of the US population.

While Amazon may be catching up to Walmart in online apparel, it’s Walmart that is catching up to Amazon in online groceries. Walmart’s investments into its ecommerce grocery offering appear to be paying off: the retail giant’s grocery shopper growth accelerated to 33% in 2018, compared to just 26% the year prior.

This growth places Walmart ahead of Amazon in grocery ecommerce for the first time in a fight that will only intensify as both companies push their omnichannel grocery capabilities in the year ahead.

Website and Mobile Redesigns To Improve Shopper Experiences

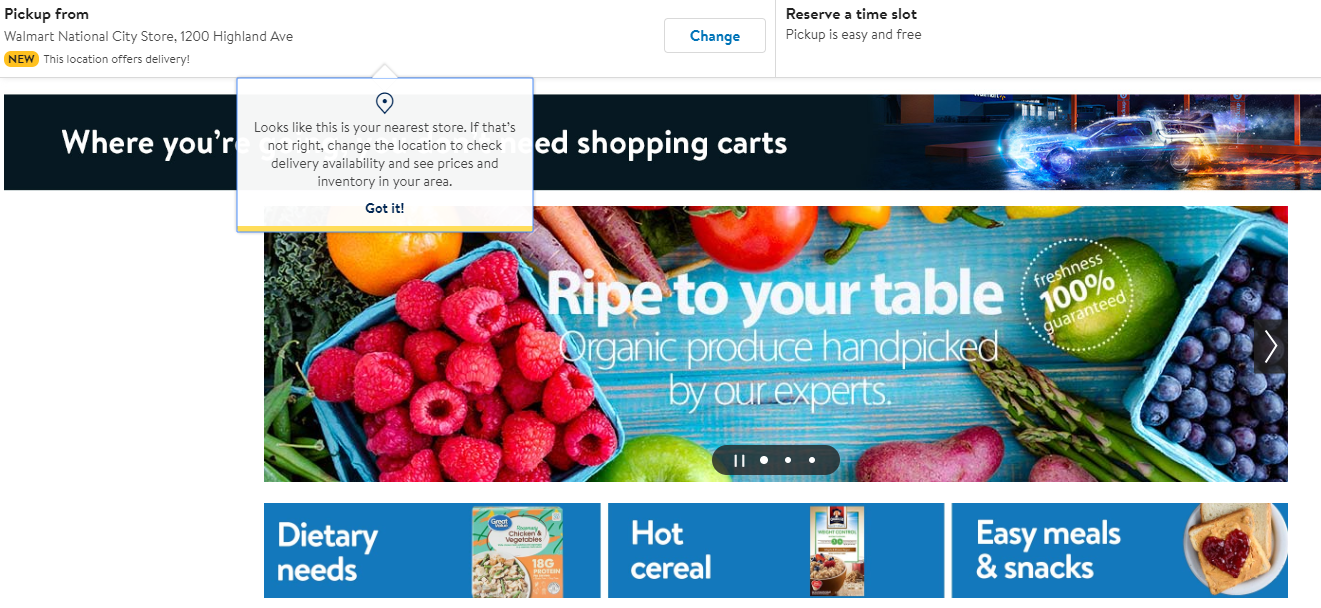

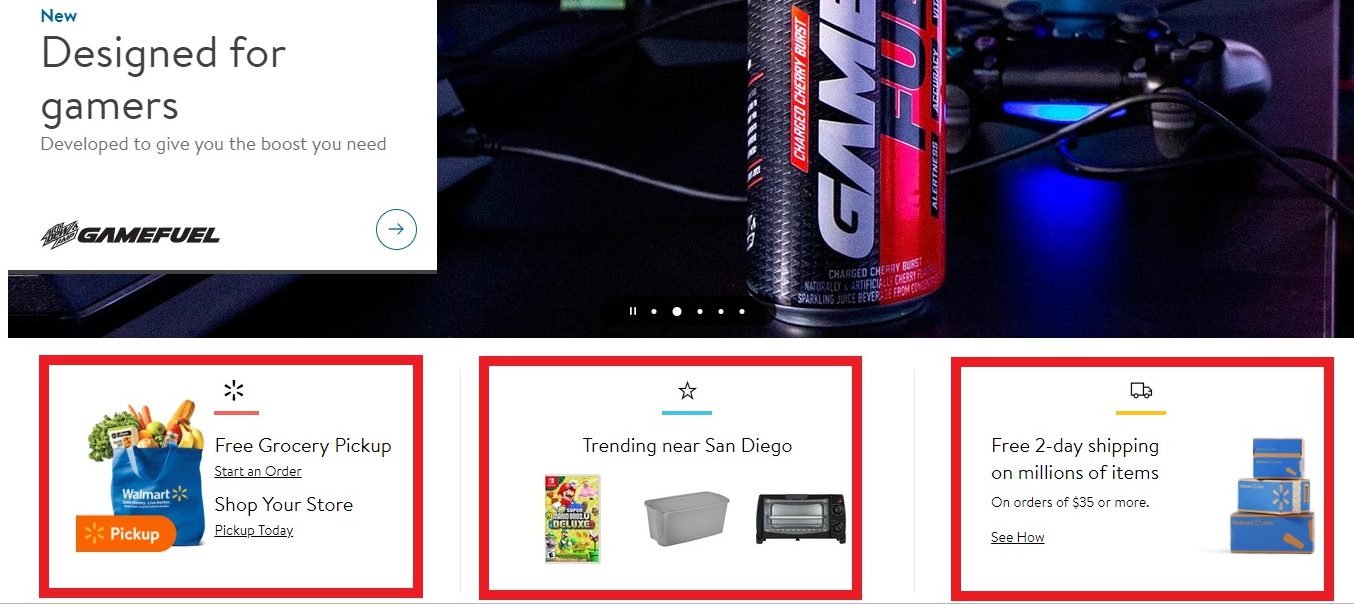

Walmart made two very important upgrades in 2018: it gave its website a modern redesign and improved its mobile app to make shopping easier and faster.

Walmart’s new website appears to have taken a few pages out of Amazon’s book: it features localized products and elements customized to the user.

Long gone is the warehouse feel of the old website, it is now replaced by a clean-looking interface that highlights the retailer’s omnichannel features:

- Products that are trending in your local area

- Nearest Grocery Pickup

- Free delivery (on orders $35 and up)

In addition to a revamped website, Walmart’s made some major improvements to its mobile app that allow customers to easily create shopping lists that calculate the customer’s order total before they arrive at the store.

Once they arrive, customers can use the app to access a virtual assistant and digital map routes the customer to their items so that they can complete their shopping as fast as possible.

The app also features weekly ads, baby and wedding registries, barcode scanners, and Mobile Express Returns — a feature that allows shoppers to return items to a nearby Walmart easily.

The upgrades speak to Walmart’s larger omnichannel strategy of integrating its digital platform with its enormous network of 4,700 stores.

Pay Attention To Walmart In 2019

Walmart’s string of strategic partnerships, brand acquisitions, and investments into its omnichannel model shows that the retail giant is reinventing itself to win in an Amazon-dominated ecommerce space.

The retail giant has shown its ability to leverage and integrate its massive network of 4,700+ physical stores into a working omnichannel model that is improving every year.

While the gap in total ecommerce retail between Walmart and Amazon remains enormous, the retail giant’s ability to accelerate its growth with new innovations to reach more customers is a testament to its commitment to fighting off Amazon in the long run.

Want to learn more?

Walmart vs. Amazon: The Race for Ecommerce Apparel Sales

What Can We Expect From the Google & Walmart Partnership?

The Complete Guide to Selling on the Walmart Marketplace | 2019

You Might Be Interested In