Media Update: Major Shifts in Podcast Growth, Social Media Innovations, and Search Dynamics

Key Highlights:

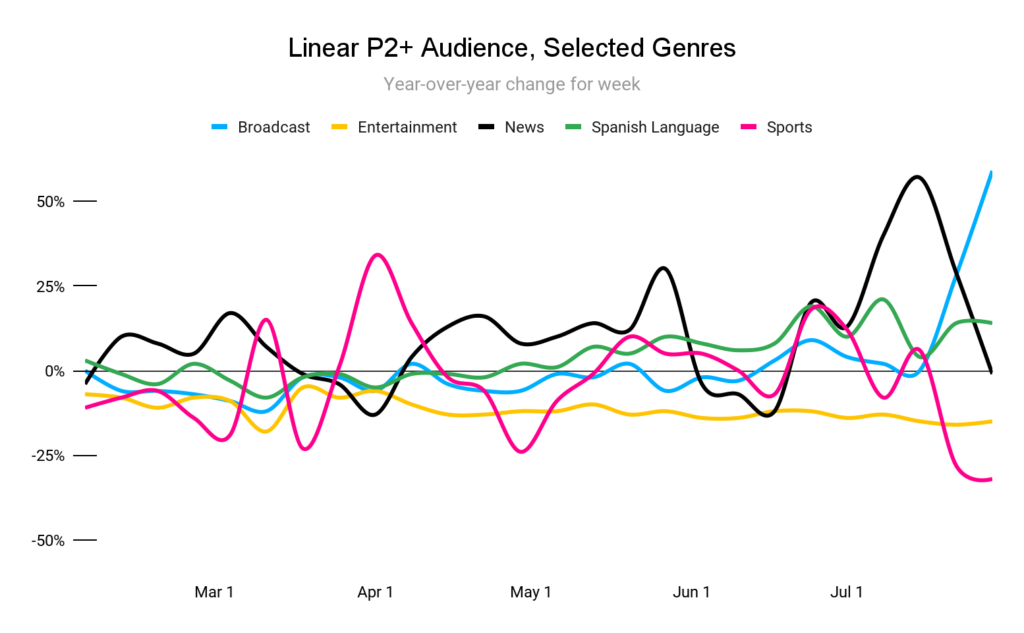

“Faster, higher, stronger” – broadcast TV has certainly leaned into the Olympic spirit, boasting record audience figures in recent weeks and pulling viewership in from other genres (especially other sports broadcasters). NBC reports average viewership of 32.6M, a 77% increase vs. the Tokyo games three years ago (with advertising revenue also coming in hot). Expect continued attention through the weekend before the closing ceremonies on Sunday, after which we can expect news viewership to bounce back strongly ahead of the Democratic National Convention, which kicks off on the 19th.

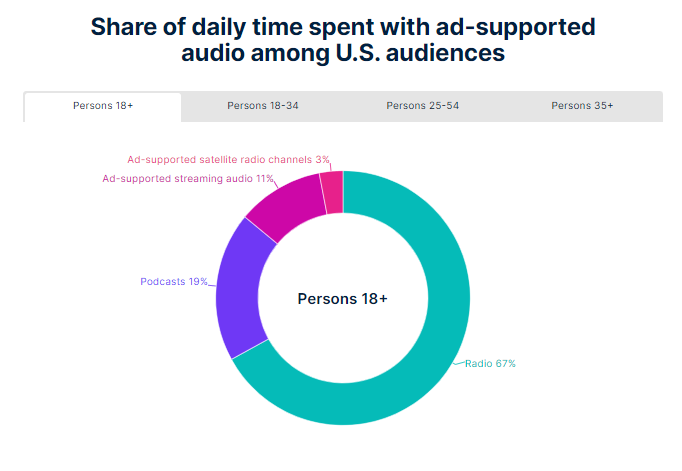

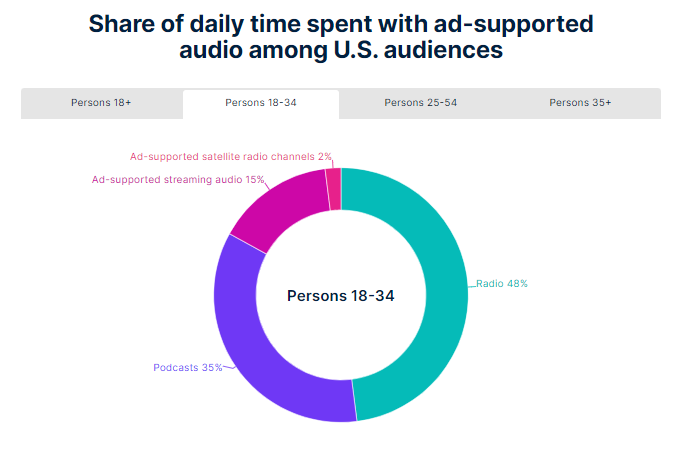

We often focus on TV in this space – the decline of linear, the fragmentation of streaming – given its premium position on the biggest screen in the house. However, as our advertiser partners know well, we should be careful not to ignore the power of audio. The latest figures from Nielsen show that the average American spends over 4 hours per day with audio, split between radio, podcasts, streaming music, and satellite.

For the majority of Americans, this time is heavily allocated towards radio, but among younger audiences, a full 50% of time is split between podcasts and ad-supported streaming audio.

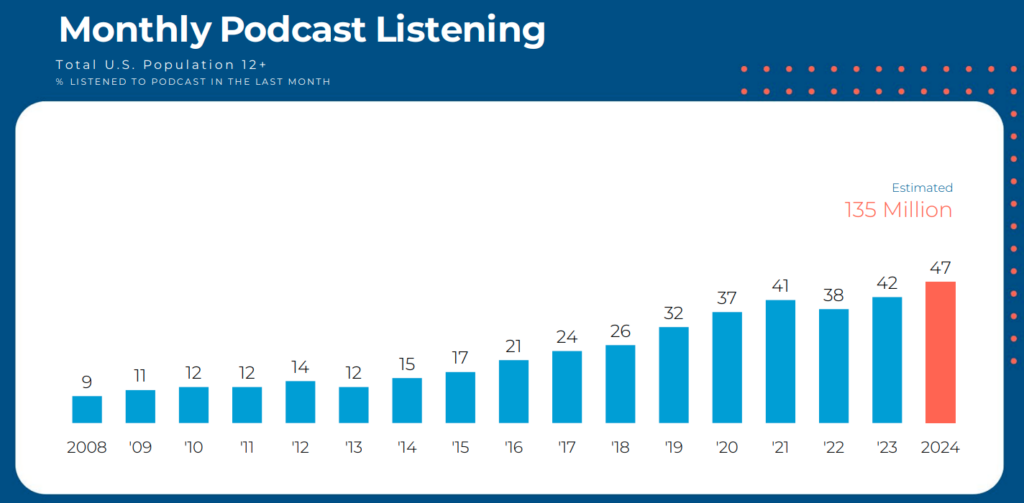

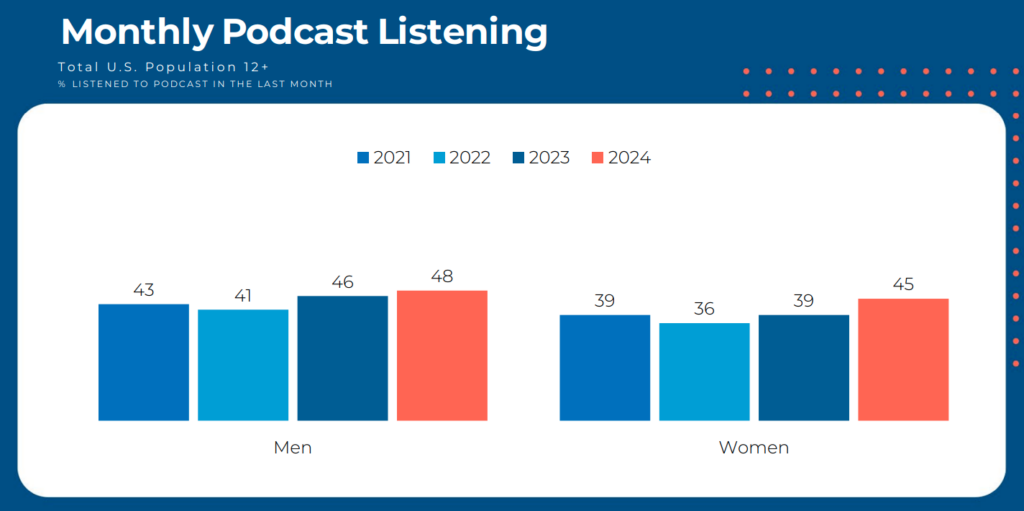

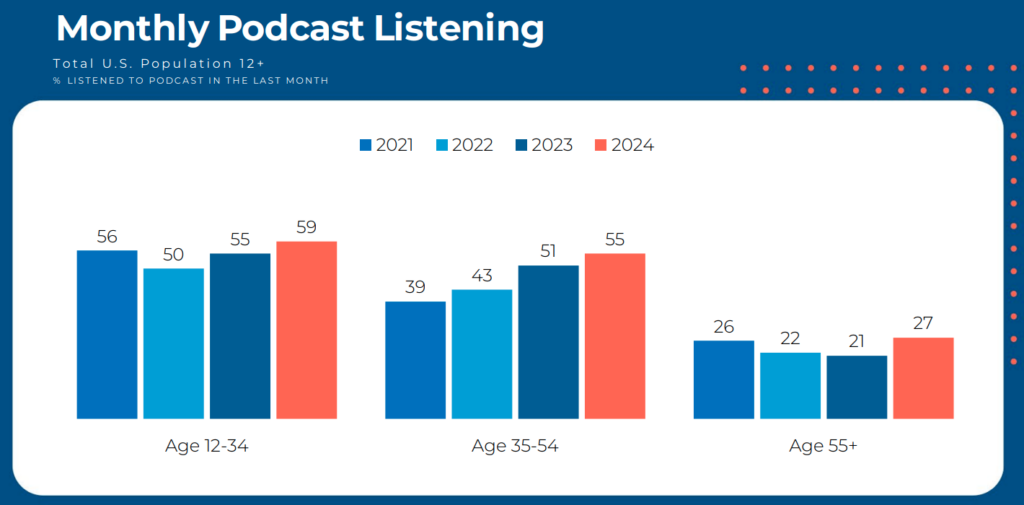

The growth of podcasts in particular is truly impressive, as it has occurred across genders and ages, with all groups reaching record highs in 2024, even accounting for COVID-era tailwinds.

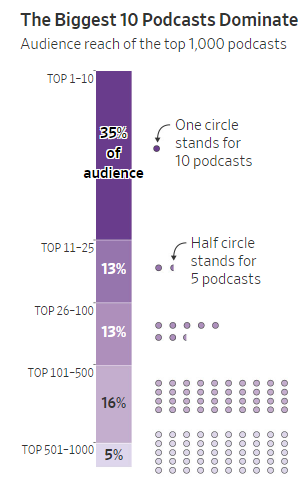

However, the growth of the medium overall masks an undercurrent of consolidation. Audiences are skewed heavily towards a small handful of podcasts, helping to drive some of the megadeals that have been recently reported, such as a $100M deal for Call Her Daddy host Alex Cooper and a similarly sized opportunity for the Kelce brothers. The stereotype that anyone with a microphone can start a podcast may persist (with over 400K podcasts currently active), but not everyone can get big enough to quit their day job, as just 25 podcasts reach 48% of the US audiences.

For brands, this leaves a complicated landscape to navigate, as costs to advertise in the largest podcasts can be heavy and attract some of the biggest spenders, including auto manufacturers and leading names in CPG. The good news is that the landscape leaves ample opportunity for strategic investment. The long tail of smaller podcasts opens the door for targeted advertising, as brands can piggyback on a host’s credibility and self-selected audience to reach engaged listeners who may already be primed to convert (and with dynamic ad insertion technology, advertisers can directly measure the impact of their placements on a 1:1 basis, enabling true performance advertising). When breadth is necessary, advertisers can also consider run-of-network placements across publishers like Audacy, C13, Wondery, and more, allowing for broad reach with efficient costs and measurability. As podcast listenership shows no signs of slowing, advertisers at all stages of the funnel should be actively considering an investment strategy. | WSJ, Nielsen, Edison Research

Two weeks ago, we noted that WarnerBros Discovery could pursue legal action against the NBA for rejecting its offer to match Amazon’s media rights bid. Soon after, WBD did just that, filing suit for breach of contract in the New York State Supreme Court. The league responded that because Amazon’s offer is to stream games, it is not obligated to accept WBD’s match. Further developments will now play out in courtrooms and legal offices, though WBD faces an uphill battle. Regardless, it may be a battle WBD needs to fight, as the increasingly competitive streaming landscape pressures David Zaslav’s organization. On the heels of its ~$10B quarterly loss, recent reporting suggests that WBD may be considering a breakup or beginning to offload smaller pieces of the conglomerate’s puzzle. As we’ve often said, streaming’s consolidation era is upon us and is picking up pace. | WSJ, Yahoo, ESPN

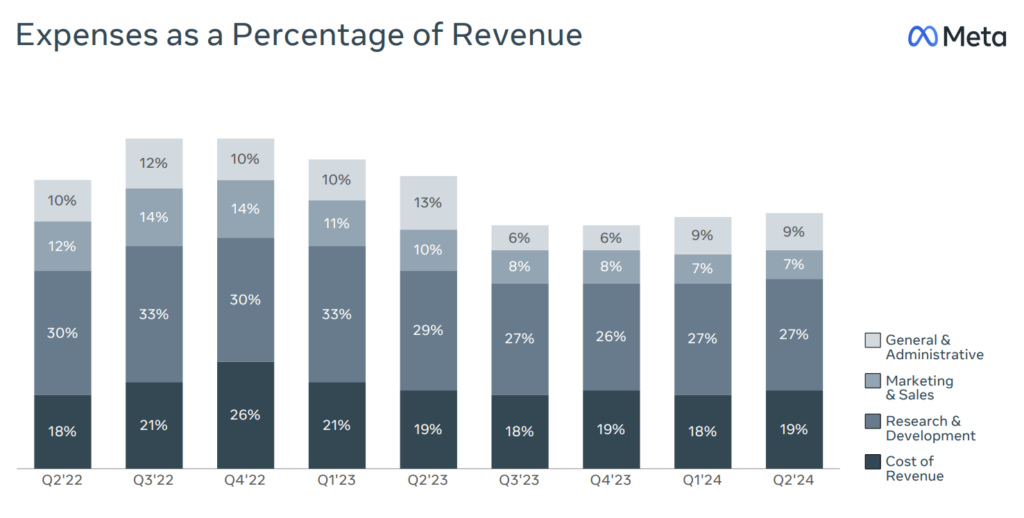

Meta reported another quarter of strong earnings last week, up 23% YoY. If you recall from their last earnings report back in April, AI was a large focus: Mark Zuckerberg doubled down on Meta’s AI growth, the early success of their LLM Llama 3, and how AI will be a core growth area for the company into the future. In last week’s call, that focus remained, with Zuckerberg quoted as saying that Meta’s AI is “on track to be the most used AI assistant in the world by the end of the year.”

While their research and development investment has remained steady, Meta’s Reality Labs, the development epicenter of AI for Meta, is slated to be a continued focus in future quarters and years. Meta plans to continue significantly investing into AI solutions to make both user and advertiser experiences more seamless. For brands that have already begun leaning into Meta’s advancements in the AI space, this is an exciting outlook. For brands that have been skeptical of some of the GenAI tools or automated features such as ASC, Meta’s future is still bright as they further refine their solutions and seek user and brand feedback to make their tools as beneficial as possible. | The Wrap, Meta Investors

X CEO Linda Yaccarino shared an open letter on X this week stating that X has filed an antitrust lawsuit against the Global Alliance for Responsible Media (GARM), the World Federation of Advertisers (WFA), and some of the members brands including Mars, Unilever, CVS Health, and Orsted. X reports that the basis of the action comes out of the U.S. House of Representatives Judiciary Committee’s report, disclosing that their investigation had found evidence of an illegal boycott against many companies, including X.

X has been the center of many brand safety concerns from brands, as well as brands seeking to avoid alignment with X’s outspoken owner, Elon Musk. For background, GARM is viewed as the gold standard for brand safety around the world, and in January 2023, Twitter (now X) announced that all US content adheres to GARM standards. This was followed by an announcement in August 2023 that global markets would meet GARM standards as well. X has sought out various third party tools and organizations to audit and validate the platform, with GARM just being one of those groups. While X has historically touted each accreditation, like the TAG Certification from June of this year, they have also been quick to back pedal when unfavorable reports come out, like this year’s snafu with DoubleVerify’s report.

For advertisers, while the legal action is meant to highlight illegal group boycotting and bring advertisers back to the platform, it is being received by some brands as yet another signal to steer clear. Former Assistant Attorney General Bill Baer highlighted that a politically motivated boycott is not an antitrust violation, and even if the case succeeds, X cannot force companies to buy ads on its platform. | X for Business, BBC, Linda Yaccarino

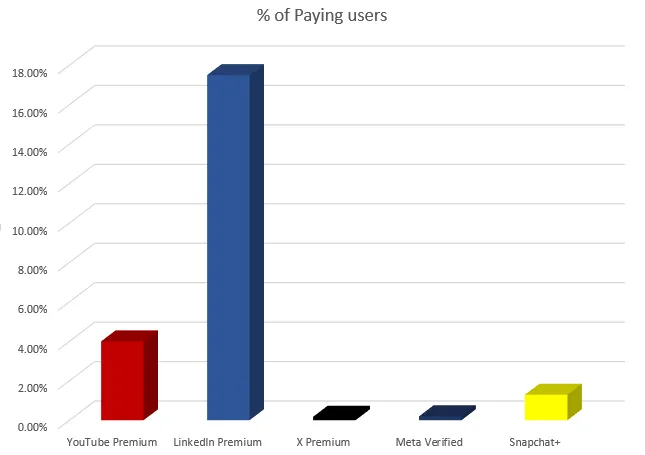

Closing out the social update this week, Snap reported a very interesting milestone during its Q2 earnings call with the revelation that Snapchat+ paid subscriptions have now exceeded 11M. While most other social platforms have shifted away from subscription and towards verification, Snap has been able to prove out a winning model. That model, as Snap reports, is “providing add-on features that users actually want.”

While Snapchat+ is not the leader compared to the more established and leaned-in offerings of YouTube Premium and LinkedIn Premium, it is rapidly growing, and it’s rooted in the user-first mindset that has historically set the platform apart. For advertisers, this signals that Snap may roll out new ways for brands to advertise and new ways for consumers to engage with their favorite brands in the future. Today, Snapchat+ includes features such as chat wallpapers, AI Bitmoji pets, and AI chatbots, all of which could lend themselves to branded opportunities in the future. While no official announcement has been made on monetizing some of these features, the growth of leaned-in users on the platform is a positive sign for Snap, and one that advertisers should keep in mind when thinking about their overall media mix. | SocialMediaToday, Snap Inc. Earnings

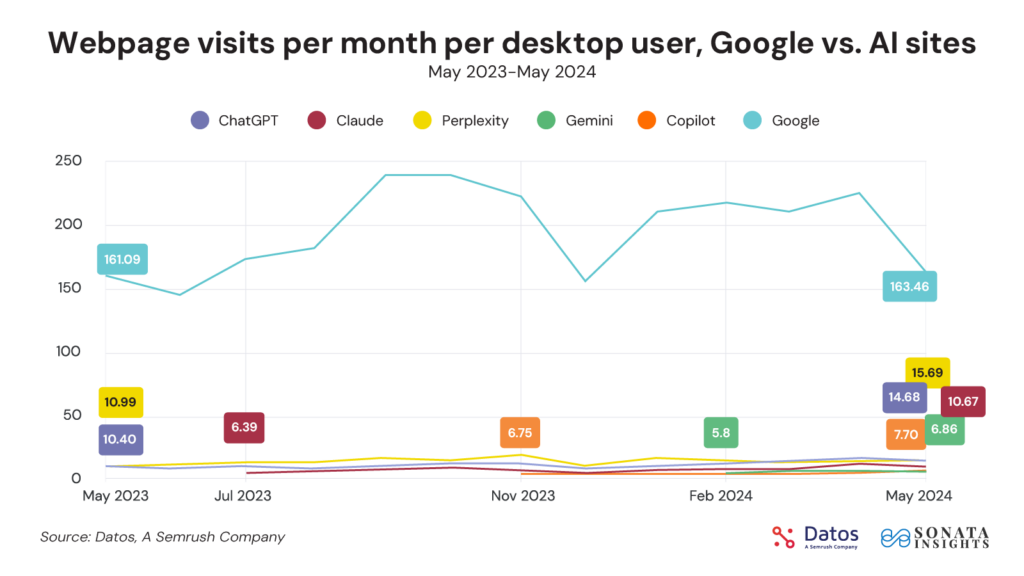

Recently it feels like nearly every day we’re seeing new developments from AI-powered chatbots and engines that are expected to disrupt the search landscape. But so far research suggests Google has maintained its significant market share, with Google traffic not diminishing even as AI competitors grow.

However, given the news about a federal judge ruling that Google violated antitrust law, we may start to see SEOs and paid search advertisers further diversify their toolkits and expand into more nascent search opportunities. Two of the most recent developments are SearchGPT and Perplexity’s new Publisher Program. | Search Engine Land, NY Times

First announced on July 25, OpenAI’s popular ChatGPT is testing AI-powered search results with its new product, SearchGPT. SearchGPT is being framed as “a temporary prototype of new AI search features that give you fast and timely answers with clear and relevant sources.” The prototype is currently only available to ~10,000 users, though anyone can request to join the waitlist from a personal ChatGPT account.

Early testers are indicating that SearchGPT is different from Google Search results in a few key areas:

Another AI-powered “answer engine”, Perplexity, recently announced that it is rolling out a Publisher Program where it will share ad revenue with media partners whose content is featured in its search results. Advertisers can purchase “related follow-up questions” that will appear below search results, and like most other search ad platforms, these ads will be labeled as sponsored. The company’s chief business officer, Dmitry Shevelenko, mentioned his goal is to “break the search engine model.” Perplexity could grow and evolve into an alternative paid search channel for publishers, both large and small. | Perplexity

Apple recently announced a partnership with Taboola to serve native ad inventory within the Apple News & Stocks ecosystem. While this announcement alone didn’t necessarily generate a lightning bolt of interest across the industry, as with all things Apple there are other angles in play. Similar to the self-serving nature of ATT providing a boon to App Store advertising revenue, we may be seeing the foundations laid for a similar play with Apple’s new “Distraction Control” feature currently available in iOS 18 beta 5, iPadOS 18 beta 5, and macOS Sequoia beta 5.

While Made For Advertising websites with their overlapping and cycling banner ad placements have drawn the ire of advertisers and users alike, the release of Distraction Control may well be a broad stroke that will aid and abet in content theft. A cynic may assume that Apple will use this to push publishers deeper into the Apple News ecosystem for content monetization.

Apple is aware of this concern regarding content demonetization and has proactively noted that “This feature is not meant to serve as an ad blocker. While a user can technically use Distraction Control to hide an ad on a website temporarily, that ad will reappear when the page is refreshed or otherwise reloaded. In fact, the first time a user activates Distraction Control, Safari will display a pop-up that emphasizes the feature will not permanently remove ads or other areas of a website that frequently change.” But actions speak louder than words, so while the ad removal will not persist to future sessions (initially), we’ll see how this initiative comes to life as Apple seeks to maintain the fragile balance between user centricity and growing its own share of the advertising revenue pie. | Axios, The Register, 9to5Mac

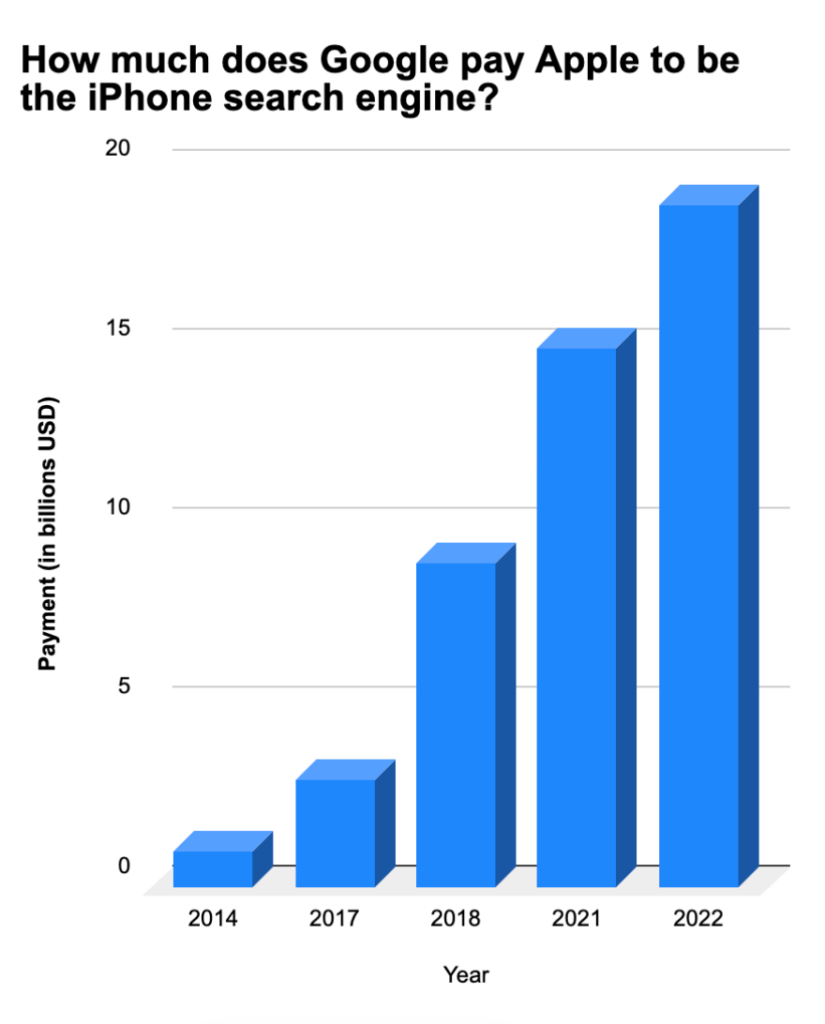

A federal judge has ruled in U.S. et al. v. Google that Google has acted illegally to maintain a monopoly in online search. Following the presentation of evidence, Judge Mehta found Google to be in violation of section 2 of the Sherman Antitrust Act. While this ruling is significant, it is critical to note that no remediation measures were referenced pertaining to penalties or changes that may be required for Google’s business operations.

At nearly 300 pages, the decision provided by Judge Mehta focused on:

While this ruling makes for a compelling headline and narrative, the ‘so what?’ at this point remains unclear. Given there have been no penalties imposed nor proposed remediation requirements provided at this time, one can only speculate as to how exactly the complex elements of Google’s business may be impacted. Of course, there will likely be challenges issued and this may take years to play out given the complexity of Google’s business operations.

Assuming the ruling stands as issued, some of the potential remediations may include:

Even with these remediations, the reality is that Google has become a synonym for search. Ultimately the consumer will decide whether to seek out Google over other search engines in scenarios where it is not immediately available. It may well be that Microsoft & Meta are the victors in this decision as they both present viable search alternatives, especially as we cross into the era of AI-enabled search where LLMs seek to change the fundamental nature of traditional search through the lens of agent-aided content discovery. Whatever happens, it will likely be a long road ahead before any significant impact is realized. | DOJ, DOJ Ruling, Fortune

The principal macroeconomic concern in the U.S. for the past three years has been inflation – the monetary and fiscal policies pursued by the U.S. government in response to the COVID-19 pandemic unleashed an increase in the price level that many Americans have not experienced in their lifetimes. The consequent interest rate policy of the Fed has made everything financed by debt – homes, automobiles, businesses, the U.S. government itself! – significantly more expensive. Taming inflation has been not only the central focus of the Fed, but of many other constituencies as well.

July brought the latest print of the Fed’s preferred inflation gauge (the PCE), which showed YoY price increases of 2.5% in June, down from May’s 2.6% and broadly consistent with expectations for an interest rate reduction in the fall. The “core” measure of PCE, which strips out volatile food and energy prices, rose 2.6% in June.

At this point, market expectations for a rate cut in September are that it’s a near certainty; the big question at this point is whether the latest employment figures (see below) will prompt a more aggressive half-point cut. | NYT, FRED

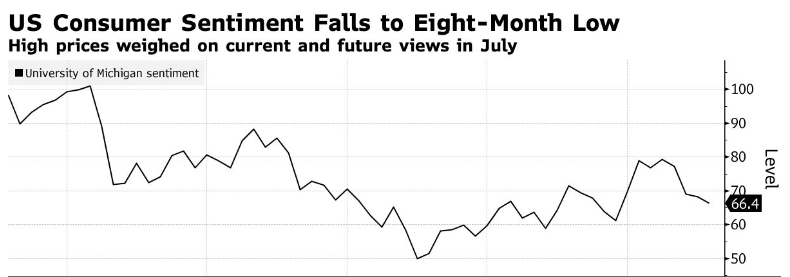

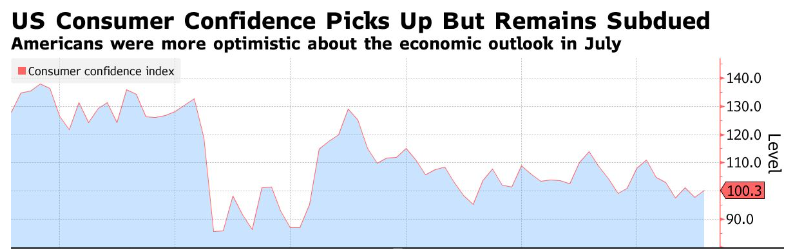

We have some conflicting signals regarding consumers’ mood. Consumer sentiment fell to an eight-month low in July, while consumer confidence rose slightly. While perplexing on the surface, the pictures they paint are not so different. Here is consumer sentiment, which comes from a survey conducted by the University of Michigan:

While they differ in details, both tell us the story “consumers began to feel much worse about the economy in the wake of the pandemic, and while the mood has improved somewhat from its nadir, it’s still much gloomier than pre-pandemic.” And as we’ve noted in other contexts, it’s probably wise to avoid killing too many brain cells trying to reconcile anomalies in high-frequency data sets like these, where measurement error is likely to swamp the movements of interest. | Bloomberg, Bloomberg

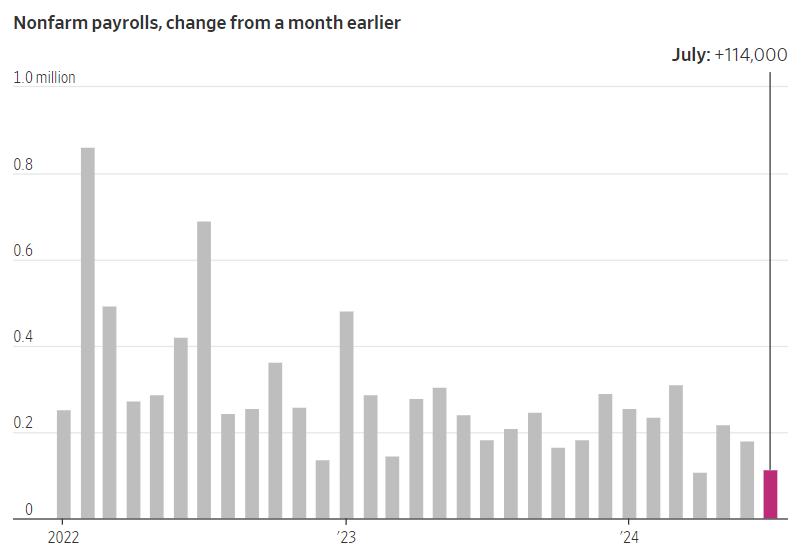

In the wake of June’s cool(er) inflation print (see above), the next major macroeconomic data point to drop was the July jobs report. As we’ve discussed at length here, the U.S. labor market has displayed remarkable resilience over the last several years, more or less shrugging off shocks like a global pandemic(!), a burst of inflation, and rapidly rising interest rates. But as we’ve been telling you in recent months, cracks are beginning to appear in the facade; July’s jobs report continues that trend, with U.S. employers adding just 114k jobs last month, which was well below expectations, and the unemployment rising to 4.3%, its highest level in nearly three years. Stocks fell sharply after the data came out, reflecting investors’ renewed worries about an economic slowdown.

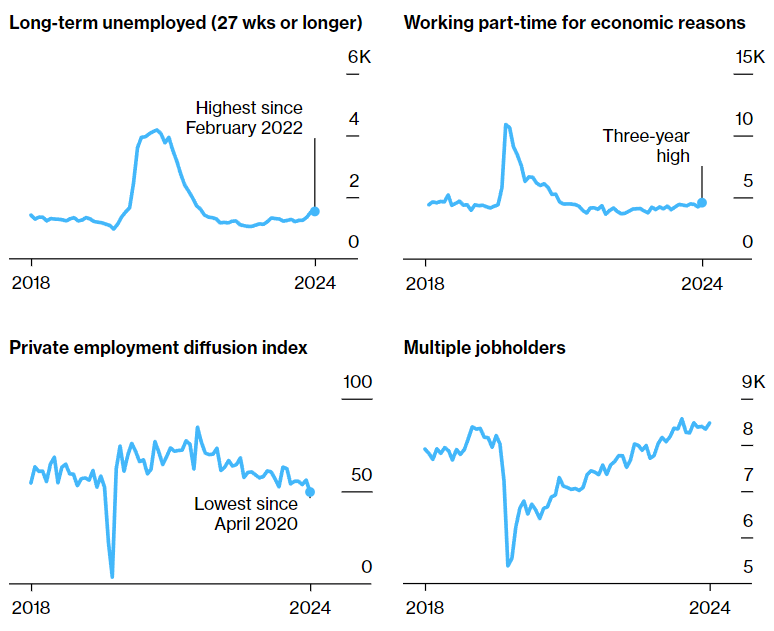

Beyond the July jobs figures, multiple indicators are showing labor market slackening:

As noted above, the question seems no longer whether the Fed will cut its benchmark interest rate in September, but by how much. In the wake of the jobs report, futures prices implied a 70.5% likelihood of a half-point cut, up from a 28% probability prior to the report’s release and an 11.5% probability a week prior. | WSJ, Bloomberg